Target Price of RM3.50 According To Conspiracy Theory ?

Author: Icon8888 | Publish date: Mon, 27 Jul 2015, 03:21 PM

1. Conspiracy Theory

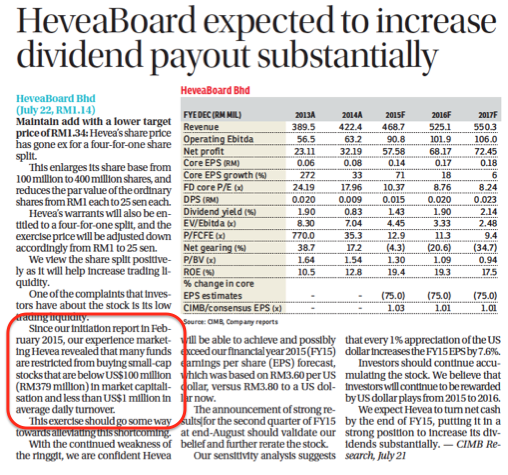

According to CIMB's analyst report dated 22 July 2015 for Hevea, a lot of funds cannot buy stocks with daily trading volume lower than RM1 mil (RM3.8 mil).

This could be one of the reason why recently some public listed companies, backed by strong earnings, decided to undertake bonus issue and / or share split. Far from a superficial exercise, this should lead to higher trading volume and put them in Fund Managers' radar.

Before the share split, Hevea has trading volume of approximately 0.8 mil shares. Based on share price of let's say, RM3.70, daily trading volume will be 0.8 m shares x RM3.7 = RM2.96 mil, less than RM3.8 mil.

However, after split, trading volume reached 8.72 mil shares in the first trading day. Based on RM1.00 then, trading volume was RM8.72 mil, above the RM3.8 mil threshold.

In addition, according to CIMB, a lot of funds also cannot buy stock with market cap less than USD100 mil (RM380 mil). Hevea has 100 mil shares before split. If they target to attract funds, share price has to be at least RM3.80.

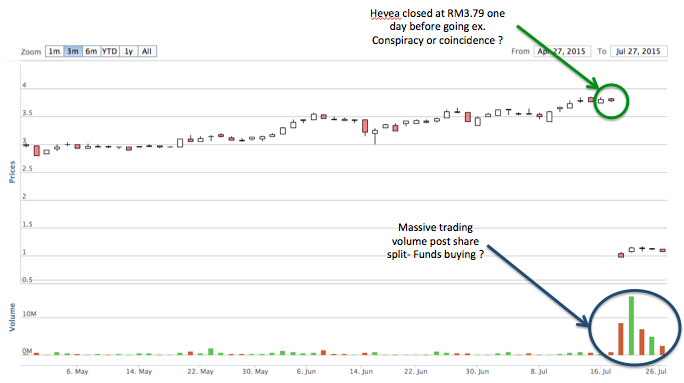

On 20 July 2015, one day before the share split went ex, Hevea closed at RM3.79 !!!!

Was that just a coincidence or due to support by invisible hands ? I think only those people behind it have the answer.

It seemed that the tricks worked. With RM380 mil market cap, the moment the stock went ex the next day, there was aggressive buying, pushing share price from RM0.95 to RM1.05. Since then, share price sustained at around RM1.10, equals to RM4.40 before split.

Funds buying ? As usual, I don't have the answer.

(Coincidence or conspiracy ?)

2. Poh Huat 's Rising Share Price

Recently, Poh Huat share price has performed very well, rising from RM2.18 on 10 July to RM2.80 on 27 July, a gain of 28% over 2 weeks.

This has sent tongues wagging on whether a bonus issue or share split is imminent.

With the Hevea conspiracy in mind, I decided to do a quick check on how things will pan out if the same plot is applied to Poh Huat.

Based on Poh Huat's 107 mil shares, share price of RM3.50 will result in RM380 mil market cap.

How will Poh Huat look like at RM3.50 ?

During the financial year ended October 2014, Poh Huat reported net profit of RM23.8 mil. However, as pointed out in my past articles, their July 2014 quarter was adversely affected by riot in Vietnam. Based on rough estimate, without that distorting effect, net profit could be approximately RM28.5 mil.

That was when USD / RM exchange rate was about RM3.20. The exchange rate now is RM3.80.

It is not inconceivable that Poh Huat can deliver RM35 mil net profit in the latest financial year, boosted by strong US dollar as well as better economic performance of Uncle Sam, its major customer.

At RM3.50, PER will be a comfortable 10 times.

3. Concluding Remarks

(a) First of all, I declare that I am a shareholder of Poh Huat. So I will be positively biased as far as its prospects is concerned. Please take whatever I said with a pinch of salt.

(b) I don't expect anybody to be so reckless / silly to rush in to buy Poh Huat at this price so as to benefit from "further upside" at RM3.50. Afterall, it is just a conspiracy theory.

(c) I wrote the article mostly for fun. At the end of the day, I expect share price to be driven by earnings and dividend, instead of corporate exercise like bonus issue / share split. Maybe Poh Huat will go RM3.50, maybe it won't. Please don't blame me if things don't work out as expected.

No comments:

Post a Comment