Windfall Gain If China Deal Materialises In March 2015

Author: Icon8888 | Publish date: Tue, 3 Mar 2015, 02:55 PM

Dkls Industries Berhad (DKLS) Snapshot

Open

1.80

|

Previous Close

1.80

| |

Day High

1.80

|

Day Low

1.78

| |

52 Week High

11/19/14 - 1.91

|

52 Week Low

03/24/14 - 1.50

| |

Market Cap

166.9M

|

Average Volume 10 Days

15.9K

| |

EPS TTM

0.24

|

Shares Outstanding

92.7M

| |

EX-Date

07/23/14

|

P/E TM

7.5x

| |

Dividend

0.03

|

Dividend Yield

1.67%

|

DKLS operates as a building and general contractor in Malaysia. The company is based in Ipoh, Perak.

Based on net assets of RM328 mil, loans of RM146 mil and cash of RM86 mil, the group has net gearing of 0.18 times.

Over the past 4 years, the group reported average net profit of RM21.5 mil. Based on market cap of RM167 mil, PER is 7.8 times.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|

| TTM | 210,981 | 22,121 | 23.86 | 7.55 | 3.00 | 1.67 | 3.5400 |

| 2014-12-31 | 210,981 | 22,121 | 23.86 | 7.42 | 3.00 | 1.69 | 3.5400 |

| 2013-12-31 | 226,988 | 24,240 | 26.15 | 5.82 | 3.00 | 1.97 | 3.3300 |

| 2012-12-31 | 213,813 | 20,304 | 21.90 | 5.03 | 3.00 | 2.73 | 3.0500 |

| 2011-12-31 | 183,865 | 19,247 | 20.76 | 5.01 | 3.00 | 2.88 | 2.8693 |

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 57,572 | 7,712 | 5,637 | 6.08 | 3.00 | 3.5400 |

| 2014-12-31 | 2014-09-30 | 59,682 | 13,808 | 9,734 | 10.50 | - | 3.4800 |

| 2014-12-31 | 2014-06-30 | 43,094 | 3,502 | 2,443 | 2.64 | - | 3.3900 |

| 2014-12-31 | 2014-03-31 | 50,633 | 5,237 | 4,307 | 4.65 | - | 3.3700 |

| 2013-12-31 | 2013-12-31 | 51,114 | 12,984 | 8,994 | 9.70 | 3.00 | - |

| 2013-12-31 | 2013-09-30 | 52,602 | 7,160 | 6,095 | 6.58 | - | 3.2000 |

| 2013-12-31 | 2013-06-30 | 65,551 | 6,891 | 5,620 | 6.06 | - | 3.1600 |

| 2013-12-31 | 2013-03-31 | 57,720 | 4,671 | 3,531 | 3.81 | - | 3.0900 |

| 2012-12-31 | 2012-12-31 | 70,511 | 7,062 | 5,677 | 6.12 | 3.00 | - |

| 2012-12-31 | 2012-09-30 | 54,674 | 5,779 | 5,549 | 5.99 | - | 2.9900 |

| 2012-12-31 | 2012-06-30 | 55,162 | 7,170 | 4,825 | 5.20 | - | 2.9600 |

| 2012-12-31 | 2012-03-31 | 33,466 | 4,309 | 4,253 | 4.59 | - | 2.9100 |

In the latest quarter, the group reported net profit of RM5.6 mil. Quarry and precast concrete is the biggest contributor.

The company paid dividend of 3 sen per annum. Based on RM1.80, yield is 1.67 %.

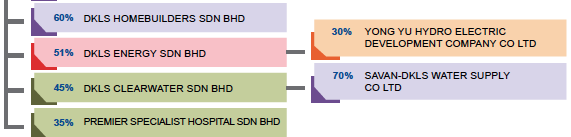

DKLS has 15.3% effective interest in Yong Yu Hydro Electric Development Company Ltd ("Yong Yu") (being 51% x 30%).

On 20 October 2014, DKLS announced that it and its partners had entered into Memorandum of Understanding with a Chinese buyer to dispose of their equity interest in Yong Yu for RM859 mil. Based on 15.3% effective interest, that works out to be approximately RM131 mil for DKLS. The MOU was subsequently extended and the relevant parties target to execute the SPA before 31 March 2015. Please refer to announcement below :-

The associate stake in Yong Yu only contributes approximately RM4 to 5 mil profit per annum to DKLS. The disposal will unlock significant value for the group.

Appendix - DKLS Group's Various Divisions

No comments:

Post a Comment