Export Oriented Oil & Gas Play

Author: Icon8888 | Publish date: Wed, 25 Feb 2015, 09:02 PM

Executive Summary

(a) When I first started writing about TAS Offshore, my intention is to write about an oil and gas play (Oil price is kind of recovering. Maybe one day will spike again ?).

However, as I dug deeper, I discovered that this company is actually an export play. The group sold almost 95% of its vessels to overseas customers.

(b) According to the Company's website, approximately 53% sale is to oil and gas customers while the remaining 47% is to non oil and gas sectors (note : not sure how updated these figures are).

The recent decline in oil price reduces demand for oil and gas related suppot vessels. However, the Ringgit has weakened substantially. This gives the company advantage when come to pricing.

Is the weak oil price a blessing in disguise for the group ?

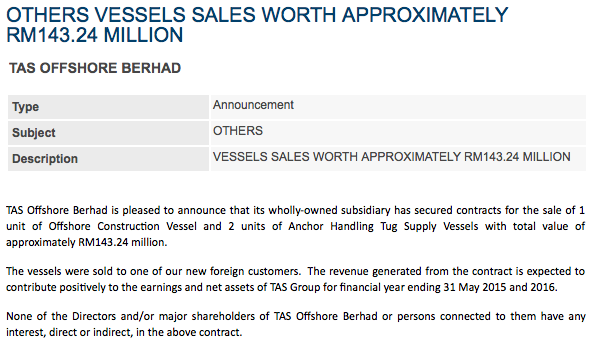

As if to confirm the above theory, the company announced on 27 January 2015 that they have secured a RM143 mil contract to construct new vessels for overseas customer.

Tas Offshore Bhd (TOB) Snapshot

Open

0.76

|

Previous Close

0.77

| |

Day High

0.77

|

Day Low

0.76

| |

52 Week High

07/16/14 - 1.65

|

52 Week Low

12/16/14 - 0.63

| |

Market Cap

135.4M

|

Average Volume 10 Days

754.2K

| |

EPS TTM

0.13

|

Shares Outstanding

175.8M

| |

EX-Date

05/12/14

|

P/E TM

6.0x

| |

Dividend

0.02

|

Dividend Yield

2.60%

|

TAS Offshore Berhad, an investment holding company, engages in the shipbuilding and ship repairing activities in Malaysia.

The company constructs a range of vessels, including tugboats, harbour tugs, anchor handling tugs, anchor handling tug supply vessels, landing craft, utility/support vessels, barges, ferries, and workboats, as well as pusher tugs and container carriers.

Its ship repair services comprise routine marine engine, machinery, and equipment inspection and maintenance, etc.

The company also operates in the United Arab Emirates, Indonesia, Singapore, Saint Vincent Island, Papua New Guinea, and Panama. TAS Offshore Berhad was incorporated in 2008 and is headquartered in Sibu, Malaysia.

-----------------------------------------------------------------------------------------------------------------------------

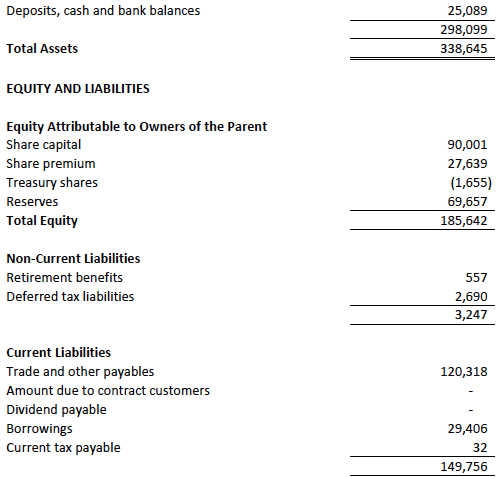

The group has strong balance sheets. With net assets of RM186 mil, loans of RM29 mil and cash of RM25 mil, net gearing is 2% only.

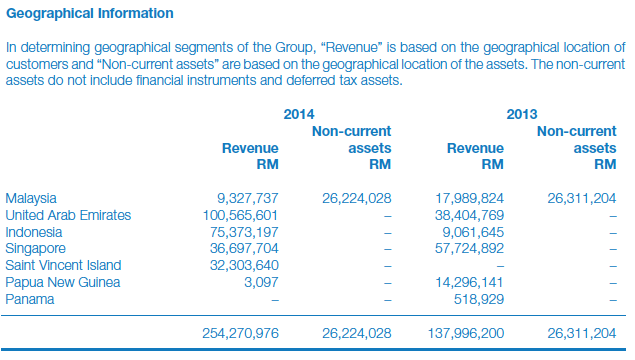

For the financial year ended 31 May 2014, only 3.7% of the group's revenue was from Malaysia. The remaining was from overseas.

For the 6 months ended 30 November 2014, only 5% of revenue is from Malaysia while the remaining 95% from overseas.

Annual Result:

Quarter Result:| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| TTM | 303,184 | 22,589 | 12.85 | 6.00 | 2.00 | 2.60 | 1.0313 | 12.46 |

| 2014-05-31 | 254,271 | 28,785 | 16.37 | 8.25 | 2.00 | 1.48 | 0.9705 | 16.87 |

| 2013-05-31 | 137,996 | 13,455 | 7.65 | 6.54 | 2.00 | 4.00 | 0.8458 | 9.04 |

| 2012-05-31 | 101,573 | 11,332 | 6.40 | 5.63 | 1.50 | 4.17 | 0.7850 | 8.15 |

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-05-31 | 2014-11-30 | 51,281 | 4,223 | 4,151 | 2.36 | - | 1.0313 |

| 2015-05-31 | 2014-08-31 | 76,318 | 6,507 | 5,451 | 3.10 | - | 0.9997 |

| 2014-05-31 | 2014-05-31 | 61,295 | 2,342 | 2,532 | 1.44 | - | 0.9705 |

| 2014-05-31 | 2014-02-28 | 114,290 | 12,280 | 10,455 | 5.95 | 2.00 | 0.9764 |

| 2014-05-31 | 2013-11-30 | 49,042 | 9,463 | 7,265 | 4.13 | - | 0.9167 |

| 2014-05-31 | 2013-08-31 | 29,644 | 10,218 | 8,532 | 4.85 | - | 0.8968 |

| 2013-05-31 | 2013-05-31 | 48,385 | 3,279 | 3,080 | 1.75 | 2.00 | - |

| 2013-05-31 | 2013-02-28 | 41,120 | 6,114 | 5,250 | 2.98 | - | 0.8292 |

| 2013-05-31 | 2012-11-30 | 30,719 | 3,593 | 2,420 | 1.38 | - | 0.8001 |

| 2013-05-31 | 2012-08-31 | 17,772 | 3,720 | 2,705 | 1.54 | - | 0.8002 |

As shown in tables above, the group has done well in past few years.

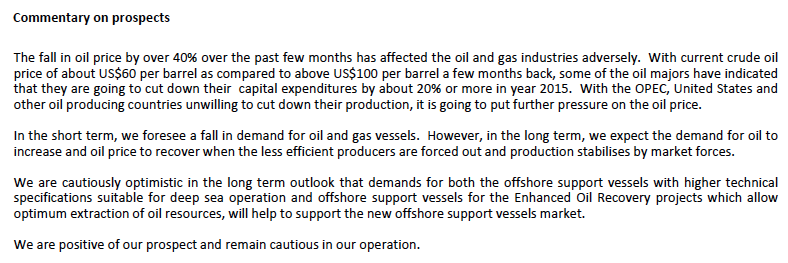

Management's comments on the group's prospects as set out in November 2014 quarterly report :-

On 27 January 2015, the company announced that they have secured RM143 mil contract from an overseas customer for new vessels :-

The new contract of RM143 mil represents 56% of FY2014 revenue of RM254 mil. Together with other already secured contracts, the group should have sufficient work to keep it busy over next one to two years while waiting for industry demand to pick up again.

The following is an article dated 29 January 2015 regarding TAS Offshore :-

No comments:

Post a Comment