Author: Icon8888 | Publish date: Fri, 3 Jul 2015, 11:06 PM

1. Introduction

Recently, there has been some trading interest in Engtex. Share price has gone up quite a bit over past few days. Most likely in anticipation of the resolution of the deadlock over water industry restructuring in the next few weeks.

I first wrote about Engtex in October and November 2014.

http://klse.i3investor.com/blogs/icon8888/62914.jsp

http://klse.i3investor.com/blogs/icon8888/63768.jsp

After that, I stopped writing about the company, despite its low PE multiple of 7 times (based on market cap of RM330 mil and past 12 months net profit of RM46.7 mil).

Why ? That is because Engtex violates almost every guiding principles that have nowadays become consensus regarding what constitute good companies.

According to those principles, good companies should be those that generate strong free cash flow, do not rely on debt to fund its growth, no incessant capex and most importantly, generous in paying dividend. I wholeheartedly embrace those principles and use them to guide my investment decisions (most of the time).

Engtex violates all of those principles.

Is Engtex to be avoided like plague ? Quite the contrary. I have invested in Engtex for quite some time. So far, my experience has been positive. It has given me satisfactory returns.

Of course, I am not trying to gloss over its weaknesses. If not for those shortcomings, maybe my return will be higher ?

Or maybe not ? Because without those shortcomings, my entry price would have been higher ?

The only thing I can say is that, it is complicated. I suggest we not get too academic about that. Like somebody once famously said, "Buying good stocks is not good enough. Buying at good price is also important".

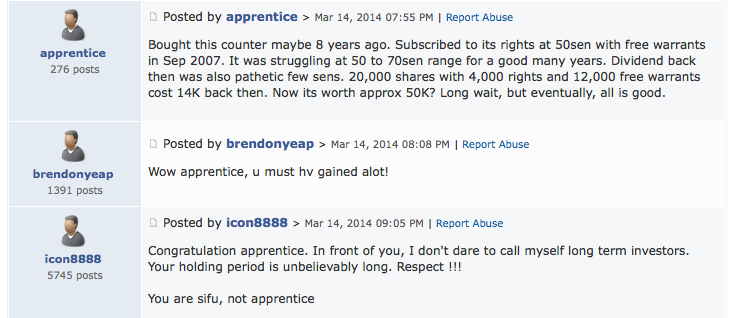

And I am not alone, there is at least one forum member, "Apprentice", who shared the same experience.

(note : when I have the conversation with Apprentice in March 2014, Engtex was trading before bonus at about RM1.80)

I dug out the above conversations not to justify investing in Engtex. But more to piggy back on this article to highlight how Apprentice has been holding on to a stock for 8 years !!! I consider myself to be an investor, but I have never held a share for that long.

For me, what Apprentice has done is worthy of respect - be patient, go through the ups and downs, and at the end, you will be rewarded. This should be the way we treat the stock market.

(showing respect to sifu)

(Don't speculate... speculators party when time is good...)

(but lost their pants when things get rough......)

2. Horror Stories ?

The followings are some of Engtex Group's relevant financial information over past 10 years :-

| FY2006 | FY2007 | FY2008 | FY2009 | FY2010 | FY2011 | FY2012 | FY2013 | FY2014 | Mar 2015 | |

| Revenue | 452.2 | 566.4 | 751.8 | 599.8 | 680.1 | 793.6 | 920.5 | 1,090.4 | 1,178.3 | 306.4 |

| EBITDA | 32.9 | 45.9 | 64.3 | 49.8 | 64.8 | 71.5 | 68.0 | 101.0 | 97.6 | 29.3 |

| > depreciation | (9.1) | (9.9) | (10.4) | (11.4) | (12.0) | (12.4) | (13.7) | (14.9) | (15.0) | (4.1) |

| > int exp | (7.8) | (10.6) | (12.2) | (7.2) | (7.8) | (10.9) | (12.3) | (14.8) | (18.4) | (5.0) |

| > excpt Items | 0.0 | 0.0 | (2.0) | (0.9) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| PBT | 16.0 | 25.4 | 39.7 | 30.3 | 45.0 | 48.2 | 42.0 | 71.3 | 64.2 | 20.2 |

| tax | (7.3) | (6.1) | (6.5) | (6.3) | (9.5) | (10.3) | (11.1) | (16.4) | (18.3) | (5.8) |

| PAT | 8.7 | 19.3 | 33.2 | 24.0 | 35.5 | 37.9 | 30.9 | 54.9 | 45.9 | 14.4 |

| MI | (0.4) | (0.9) | (2.7) | (1.2) | (1.4) | (3.1) | (1.7) | (3.8) | (2.3) | (1.0) |

| Net profit | 8.2 | 18.4 | 30.5 | 22.8 | 34.2 | 34.8 | 29.2 | 51.2 | 43.6 | 13.4 |

| EBITDA margin (%) | 7.3 | 8.1 | 8.6 | 8.3 | 9.5 | 9.0 | 7.4 | 9.3 | 8.3 | 9.6 |

| Tax rate (%) | 45.8 | 24.0 | 16.4 | 20.8 | 21.1 | 21.4 | 26.4 | 23.0 | 28.5 | 28.7 |

| inventories | 118.3 | 149.2 | 141.8 | 123.8 | 148.1 | 186.2 | 189.3 | 230.0 | 279.2 | 203.0 |

| receivables | 150.5 | 174.9 | 170.8 | 167.6 | 202.2 | 254.4 | 269.5 | 328.7 | 336.5 | 348.4 |

| payables | 55.1 | 77.3 | 51.7 | 52.6 | 69.9 | 103.7 | 120.4 | 157.3 | 158.4 | 149.4 |

| LT loans | 10.3 | 11.3 | 23.4 | 23.2 | 20.3 | 29.9 | 39.9 | 85.9 | 127.2 | 127.8 |

| ST loans | 167.2 | 192.6 | 200.4 | 161.6 | 182.7 | 269.9 | 276.5 | 300.7 | 362.4 | 342.5 |

| Total loans | 177.5 | 203.9 | 223.8 | 184.8 | 203.0 | 299.8 | 316.4 | 386.6 | 489.6 | 470.3 |

| cash | 6.5 | 17.5 | 17.8 | 19.0 | 26.7 | 39.8 | 34.3 | 32.1 | 54.6 | 47.9 |

| PPE | 91.7 | 98.1 | 108.1 | 110.8 | 128.4 | 150.7 | 185.2 | 229.4 | 286.7 | 335.1 |

| prop devp cost | 0.0 | 12.4 | 28.8 | 30.0 | 34.4 | 77.2 | 87.9 | 107.4 | 140.5 | 148.8 |

| optg Cflow b4 WC chg | 34.4 | 46.2 | 62.0 | 47.4 | 63.1 | 66.8 | 67.1 | 101.1 | 99.0 | 29.2 |

| acqn of land | 0.0 | 0.0 | 0.0 | 0.0 | 2.3 | 14.7 | 16.7 | 17.4 | 6.8 | 0.0 |

| acqn of PPE | 6.9 | 13.1 | 18.0 | 14.0 | 9.4 | 17.3 | 26.2 | 35.8 | 59.5 | 45.8 |

| capex | 6.9 | 13.1 | 18.0 | 14.0 | 11.7 | 32.0 | 42.9 | 53.2 | 66.3 | 45.8 |

| Net CFlow (Optg less invtg) | 27.6 | 33.1 | 44.0 | 33.4 | 51.4 | 34.8 | 24.2 | 47.9 | 32.7 | (16.6) |

Observation 1 - Consitent Profitability

The group has been consistently profitable throught the years, even during 2008. This was an amazing achievement. I am not able to figure out the reason.

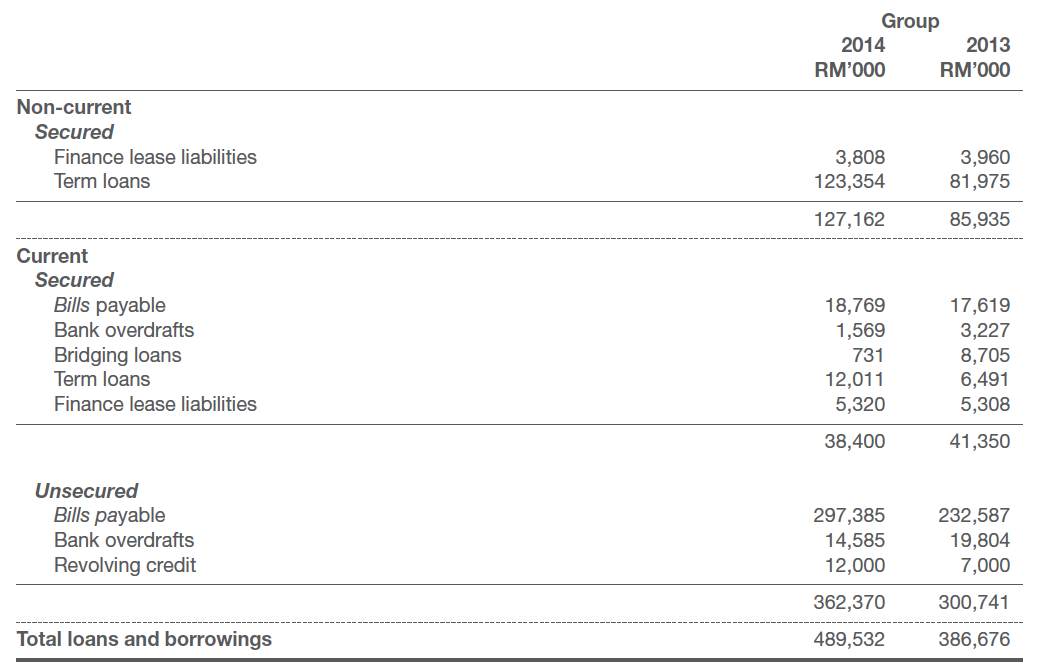

Observation 2 - "High" Gearing

The group has relatively high gearing. With net assets of RM435 mil, loans of RM492 mil, cash of RM48 mil, net gearing as at March 2015 is 1.02 times.

Annual interest expense is approximately RM20 mil, closed to 30% of PBT.

Q : What cause the group to have such high borrowings ?

In my opinion, one of the main reasons was their inability to rely on suppliers for credit terms. For a group with that size of turnover, trade payables are surprisingly low.

For example, in FY2014, with RM1.18 billion turnover, trade payables were only RM158 mil, 13% of turnover. At the same time, inventories and receivables was RM279 mil and RM337 mil respectively (added up to be RM616 mil, 52% of turnover).

To bridge the gap, the group has to rely extensively on trade facilities. In 2014, out of total loans of RM489.6 mil, RM297.4 mil were Bills Payable. These short term loans were to be repaid on rollover basis from cash payment by trade debtors.

After deducting the Bills Payable, RM192 mil were the actual loans. Still not a small number. What were the loans for ?

One possible contributing factor was the group's land banking activties. Apart from its manufacturing and trading operation, the group has a penchant for collecting small parcels of land.

Based on estimates, from 2010 until 2014, they spent approximately RM57.9 mil to acquire land bank for investment / future development purpose (please refer to table above). Without these acquisitions, non trade related loans would be RM134 mil instead of RM192 mil.

This amount is more manageable.

Q : Is it substainable ?

This answer is obvious : Yes, it is sustainable. Otherwise, they would have folded a long time ago.

As shown in table above, all this while, the group's gearing has never been low. For example, in FY2006, with net assets of RM145 mil, loans were RM177.5 mil. The same pattern was seen throughout the years.

However, the group seemed to be able to manage its financial risk comfortably. Even in 2008 and 2009, amid all the financial and economic turbulence, the group did not get into difficulties at all. It sailed through without a hitch.

Q : How did they manage their cashflow and debt servicing ?

If a group has strong balance sheet, naturally they won't get into financial trouble.

But for a group with gearing like Engtex, we need to better understand how they managed their cashflow.

It is actually not that complicated. Even by casual inspection, it is clear that the group's main source of cash inflow is payment by trade debtors (for example, RM337 mil in FY2014).

If I am the Chief Financial Officer of Engtex, I would focus on that area like a laser beam. Anything happens there, the group is doomed.

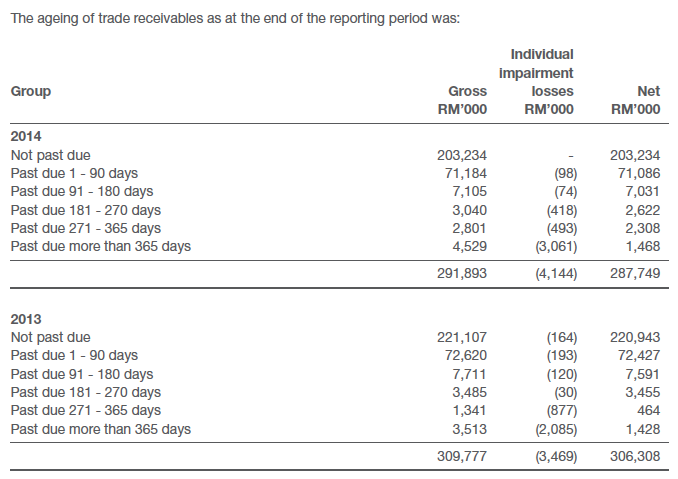

So, how well has Engtex been managing its debtors ? Pretty well, actually.

As shown below, the group has very little bad debt problem. In FY2014, out of RM292 mil trade debtors, only RM4.1 mil turned bad, equivalent to 1.4% of total amount. The same was true for FY2013, and the other years.

In my opinion, the group must have known that managing trade debtors is a matter of life and death. They must have put in place a mechanism and / or system that can ensure their interest is well protected. Otherwise, they wouldn't have been able to survive turbulent time like 2008 with minimal damage.

Observation 3 - Capex

Apart from high gearing, another thing that makes Engtex a horror story is its capex pattern.

As shown in table above, between FY2012 and March 2015 (3 years and a quarter), the group spent a total of RM167 mil on acquiring buidlings, plant and machinery.

Let's give them benefit of doubt that their mandatory capex is equal to their annual depreciation charges. With depreciation of approximately RM15 mil per annum, from FY2012 to March 2015, they need to invest RM49 mil to replace wear and tear.

This means that RM118 mil has been spent on establishing new capacity (being RM167 mil less RM49 mil). This is more or less consistent with the increase in plant and equipment of RM105 mil from FY2013 to March 2015.

Exactly what are these additional capacity for ? (Now you know why I named this article "Horror Story")

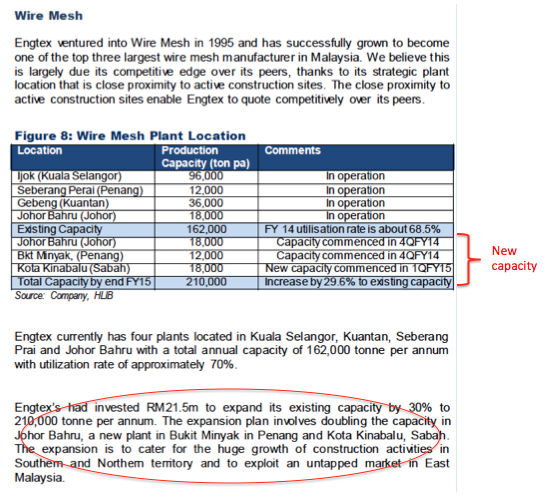

Fortunately, a March 2014 newspaper article and a recent analyst report by Hong Leong Investment Bank has shedded some light on this issue.

According to the newspaper article above, the group spent RM50 mil and RM70 mil in FY2013 and FY2014 respectively to construct factory and acquire machineries so as to tap into potential opportunities arising from Pengerang, RRIM, MRT projects, etc.

It is too early to say when those capex will bear fruits. But at least I know the money has not gone into some bank accounts in Middle East. So I am fine with that.

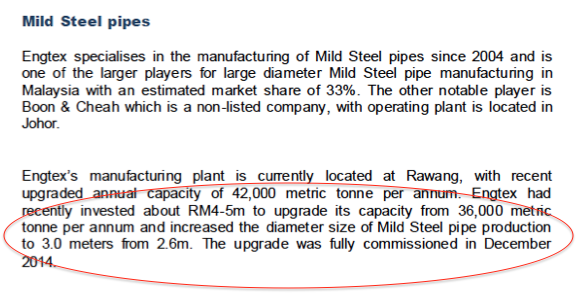

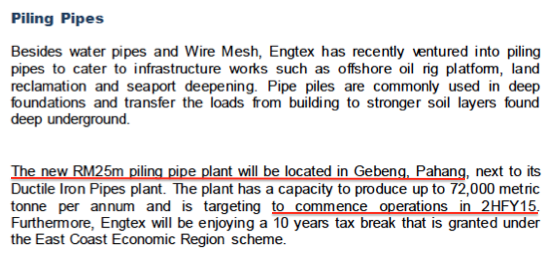

In the Hong Leong Investment Bank report, there were bits and pieces of information that further shed light on where the money has gone to.

With the surfacing of these details, I am a bit relieved. As long as the money is not spent on something fishy, I keep my mind open about the viability of these investment. Engtex has been in the relevant industries for many years. I will leave it to the management to decide what is best for the company. They should know better.

Now you know why I named this article "Horror Story With A Happy Ending" ? (not exactly a happy ending yet, but nevermind)

3. Re-Rating In The Offing ?

In my optinion, the main reason Engtex attracted trading interest these few days must have been due to news trickling out of government offices that the water restructuring scheme is closed to being finalised.

On top of that, Jaks' recent announcement that they are quiting the pipe industry must have been a positive development for Engtex. (One competitor less. But the timing for Jaks is horrible, isn't it ?)

(source : Oriental Daily 29 June 2015)

4. Concluding Remarks

(a) For many investors, Engtex is not a group that is easy to understand. High gearing and incessant capex, plus lack of explanation by management, must have turned many people off and contributed to its lackluster share price performance. Engtex's major shareholders and management have themselves to be blamed.

(b) In view of its less than pristine balance sheets (despite solid profit track record), is it worth the risk to invest in this counter ?

Apparently, for certain investors, the answer must have been a big "Yes", for they have been busily accumulating over the past few days.

They might not have been wrong afterall.

From risk management point of view, even though this company carries certain risks, there is a high probability that the industry is entering a golden age with potentially billions of contracts up for grabs.

Rising water lifts all boats. Maybe it is time to jump in and party, instead of worrying about losing your pants ?

No comments:

Post a Comment