Use A Small Knife To Cut Big Tree

The theme over the past six months was currency play. Exporters had done very well.

Same as everybody, my portfolio is full of exporters. I have no idea when Ringgit will rebounce. But common sense tells me that I should diversify.

Banking stocks seemed to be a good choice. They are currency neutral. However, this industry is relatively matured and the stocks very well researched. In other words, they are not so exciting.

I scanned through several smaller banking groups like AFG, BIMB, MBSB, RHB Capital. But I just cannot convince myself that they are the right choices.

And then I bumped into BIMB-WA.

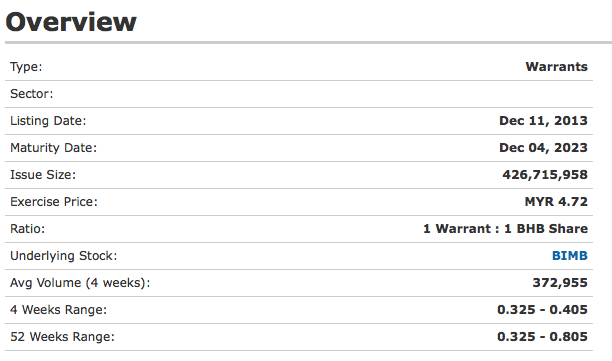

With market price of 40.5 sen and exercise price of RM4.72, BIMB-WA is currently trading at conversion premium of 25%, in line with market's average conversion premium for Warrants of approximately 30%.

It will expire in 8 years' time (December 2023).

Warrants that are out of money are to a large extent driven by emotion. They are notorious for their ability to shrink without good reason.

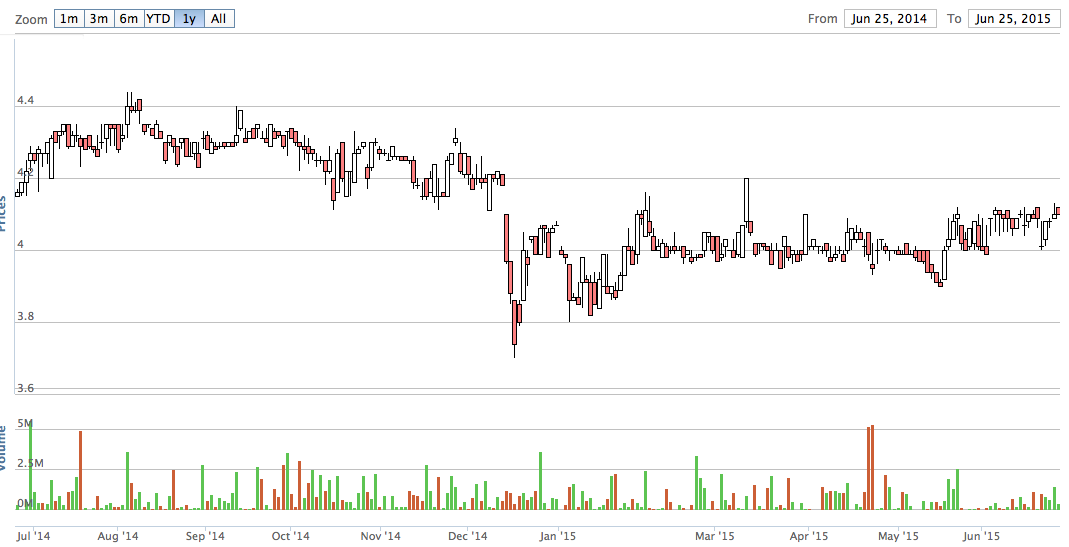

Even if mother share has not gone down much, Warrant's conversion premium could gradually disappear once the excitement / euphoria has died down. Please refer to the two charts below. BIMB mother shares had not gone down much, but BIMB-WA declined all the way from 90 sen to 40 sen.

(Historical share price of BIMB)

(Historcial price of BIMB-WA)

(BIMB-WA over past 6 months)

Is 40.5 sen a good price to enter ? This is a valid question as only not too long ago, BIMB-WA touched all time low of 32.5 sen.

To be honest, I don't have the answer. But I hope that it not only goes down to 32.5 sen, but to 30 sen, 25 sen, 20 sen, 15 sen, 10 sen, 5 sen..... Because I am very keen to add more at those levels.

=======================================

Appendix - BIMB Historical Performance

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-12-31 | 2015-03-31 | 809,082 | 220,296 | 135,699 | 8.84 | - | 2.1300 |

| 2014-12-31 | 2014-12-31 | 761,496 | 219,851 | 153,905 | 10.30 | - | 1.9700 |

| 2014-12-31 | 2014-09-30 | 744,485 | 194,464 | 125,297 | 8.39 | 14.70 | 2.0500 |

| 2014-12-31 | 2014-06-30 | 734,597 | 206,682 | 129,672 | 8.68 | - | 1.9500 |

| 2014-12-31 | 2014-03-31 | 726,895 | 194,387 | 123,455 | 8.27 | - | 1.9500 |

| 2013-12-31 | 2013-12-31 | 729,075 | 220,704 | 60,145 | 5.56 | - | - |

| 2013-12-31 | 2013-09-30 | 696,026 | 196,693 | 75,459 | 7.07 | - | 2.0000 |

| 2013-12-31 | 2013-06-30 | 707,448 | 213,039 | 69,581 | 6.52 | 3.50 | 1.9700 |

| 2013-12-31 | 2013-03-31 | 655,279 | 188,991 | 74,142 | 6.95 | - | 1.9600 |

BIMB has done well over past one to two years. Wih its small size, hopefully it can grow at above average rate.

No comments:

Post a Comment