Earnings Turbo Charged By Revenue Growth and Margin Expansion

Author: Icon8888 | Publish date: Thu, 3 Dec 2015, 02:50 PM

1. Introduction

On 25 November 2015, Ajinomoto announced a sterling set of results. Quarterly net profit increased by more than 60% y-o-y from RM7.6mil to RM12.4 mil.

The company attributed the improved performance to increase in export sales. In other words, Ajinomoto is a beneficiary of weak Ringgit (my favorite theme).

Surprisingly, the strong profitability was met with muted response from the investing community. Between the date of the announcement of the results and this article, the stock has only gone up by RM0.80 (from RM6.40 to RM7.20), an increase of 12.5%.

Based on my experience, a stock such as Ajinomoto doing so well should be worth much more than that. For me, it is a Screaming BUY.

2. Principal Business Activities

According to the company's website, Ajinomoto has sale branches in the following cities in Malaysia.

However, it seemed that Ajinomoto's Malaysian operation also sells its products to other countries.

According to quarterly report, during the 6 months ended 30 September 2015, the group derived 63% and 37% of its revenue from Malaysia and overseas markets respectively.

The group's products are separated into two broad categories - retail and industrial.

Retail products comprise the following :-

(a) Umami

The Group's flagship product. Commonly known as MSG (Monosodium Glutamate).

(b) Seasonings

Industrial products comprise the following :-

3. Pristine Balance Sheet

The group has net assets of RM290 mil, zero loan and cash of RM144.9 mil. Based on 60.8 mil shares, cash per share is RM2.38 (33% of share price of RM7.20).

4. Historical Profitability

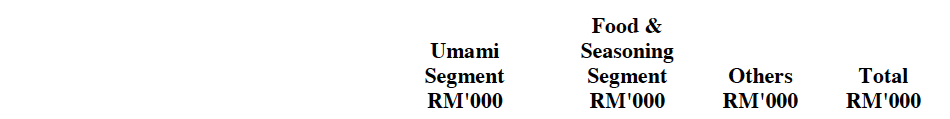

The table below sets out Ajinomoto's P&L over past few quarters :-

(note : please refer to the different colours for explanations)

Key observations :-

(a) Revenue

In June and September 2015 quarters, revenue grew substantially.

In the past, average revenue per quarter was RM85 mil. However, in the latest two quarters, average revenue per quarter has increased to RM94.7 mil.

Both domestic and export sales increased.

In the past, average domestic and oversea sales was RM55.1 mil and RM30 mil respectively. In latest two quarters, they increased to RM59.4 mil and RM35.4 mil respectively. Both divisions also experienced growth of about RM5 mil per quarter.

(b) Operating Profit

Operating profit has also grown substantially.

In the past, average operating profit was RM9.1 mil per quarter. In latest two quarters, average operating profit was RM13.4 mil per quarter.

Apart from revenue growth, higher operating profit was also caused by margin expansion.

In the past, average operating margin was 10.7%. In latest two quarters, average operating margin has increased to 14.2%.

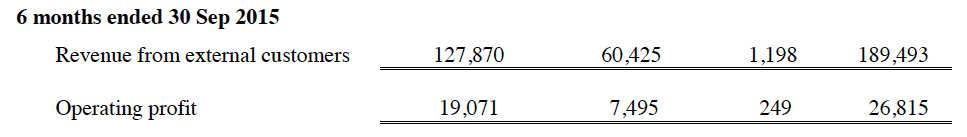

The biggest contributor to margin expansion was the Seasoning division.

As shown in table above, Umami's operating margin increased slightly from 12.8% to 15%. However, Seasoning's operating margin increased dramatically from 6% to 12.5%.

As Seasonings contribution to revenue is quite substantial (33% of revenue), aggrssive expansion in margin will have significant impact on bottomline.

Due to lack of information, it is not possible to ascertain what caused the margin expansion. My guess is that it is due to a combination of weak Ringgit and lower raw material costs.

5. Valuation

Based on 60.8 mil shares and RM7.20, Ajinomoto's market cap is RM438 mil. Based on past 12 months aggregate net profit of RM36.6 mil, historical PER is 12 times.

However, in my opinion, the latest two quarters of strong profit is more reflective of the group's earnings capacity in the latest operating environment. Based on annualised net profit of RM47.4 mil (being latest six months' net profit of RM23.7 mil x 2), PER is 9.2 times.

This has not factored in the group's surplus cash of RM2.38 per share. If you less out the cash, effective entry price will be RM4.82. This will result in market cap of RM293 mil. Based on annualised net profit of RM47.4 mil, effective PER will be 6.2 times, making it one of the cheapest food companies in Bursa.

6. Concluding Remarks

First of all, let me explain why I am putting my money in Ajinomoto.

I recently cashed out of some stocks that had gone up quite a bit. That landed me with a new set of problem - what should I do with the cash ?

Ajinomoto is suitable for me because it hasn't gone up by a lot. If you look at the chart, Ajinomoto has hardly gone up since June 2014 (at about RM6.00). It has also stubbornly stood at that level throughout 2015, despite the roller coaster Bursa went through.

I am not a TA expert, but it does look like there is a Support level at RM6.00.

From capital preservation point of view, Ajinomoto suits me.

As set out in previous section, Ajinomoto's prospective PER ranges from 6.2 times to 9.2 times, depends on whether you factor in its net cash.

My guess is that maybe half of the investing public will value the company without the cash while the other half will factor in the cash holding.

In this regard, the valuation could be somewhere in between. You have to make your own judgement.

No comments:

Post a Comment