Better Prospects Post Restructuring ?

Author: Icon8888 | Publish date: Thu, 12 Feb 2015, 09:04 PM

Lcth Corp Bhd (LCTH) Snapshot

Open

0.32

|

Previous Close

0.32

| |

Day High

0.32

|

Day Low

0.32

| |

52 Week High

07/23/14 - 0.39

|

52 Week Low

03/7/14 - 0.20

| |

Market Cap

113.4M

|

Average Volume 10 Days

2.7M

| |

EPS TTM

0.02

|

Shares Outstanding

360.0M

| |

EX-Date

05/5/10

|

P/E TM

15.4x

| |

Dividend

--

|

Dividend Yield

--

|

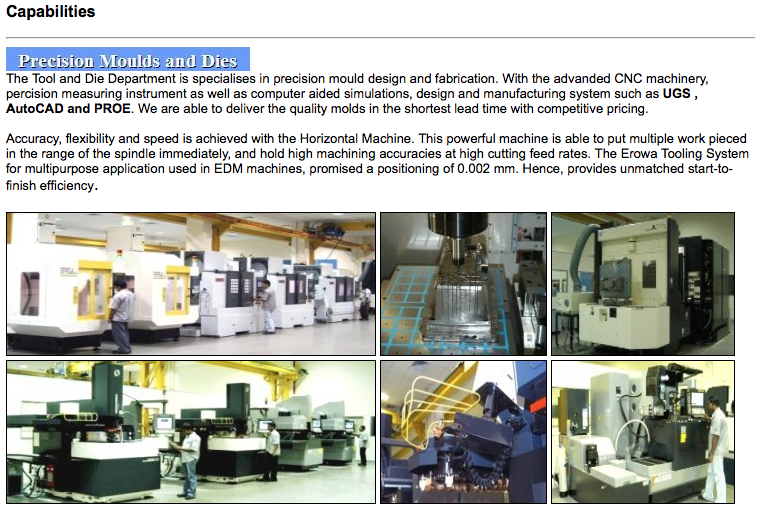

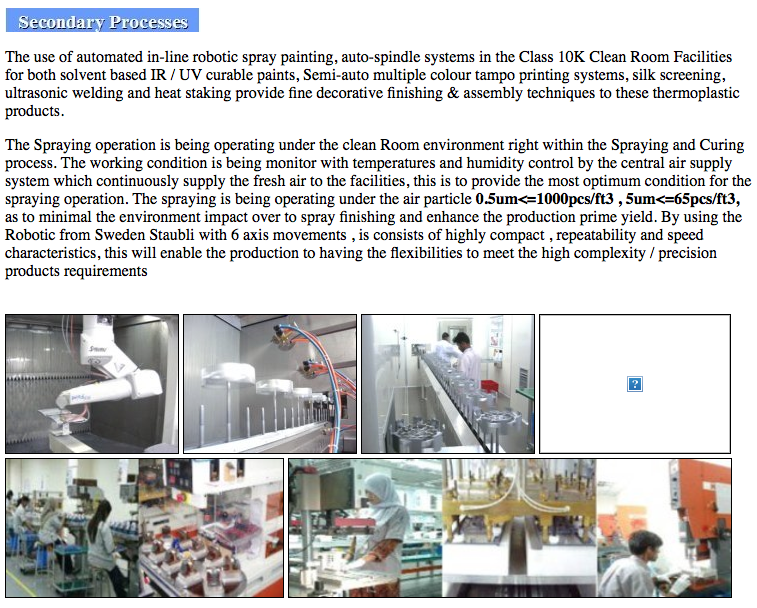

LCTH Corporation Berhad, an investment holding company, manufactures and sub-assembles precision plastic parts and components primarily in Malaysia. The company is also involved in the fabrication of precision moulds and dies. LCTH Corporation Berhad also exports its products to the United States, Hong Kong, Singapore, the United Kingdom, Singapore, China, Spain, Germany, Mexico, Hungary, and Thailand. The company is headquartered in Senai, Malaysia. LCTH Corporation Berhad is a subsidiary of Fu Yu Investment Pte. Ltd.

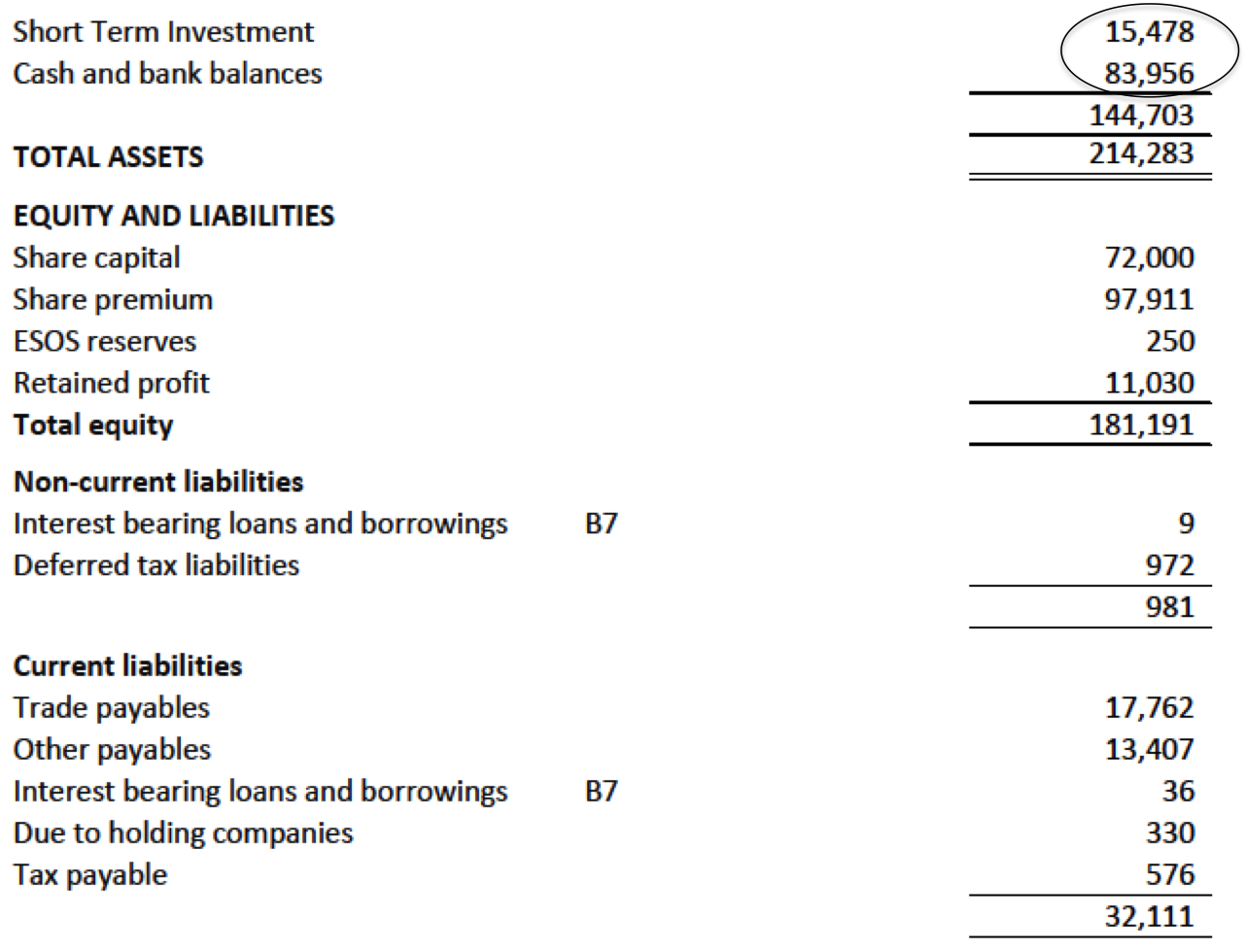

The group has strong balance sheets. It has RM99 mil cash, equivalent to 28 sen per share (share price now 32 sen) and almost zero borrowings. The cash is neither encumbered nor required for future capex. As such, the company is likely to declare dividend if earnings starts showing signs of stabilisation going forward.

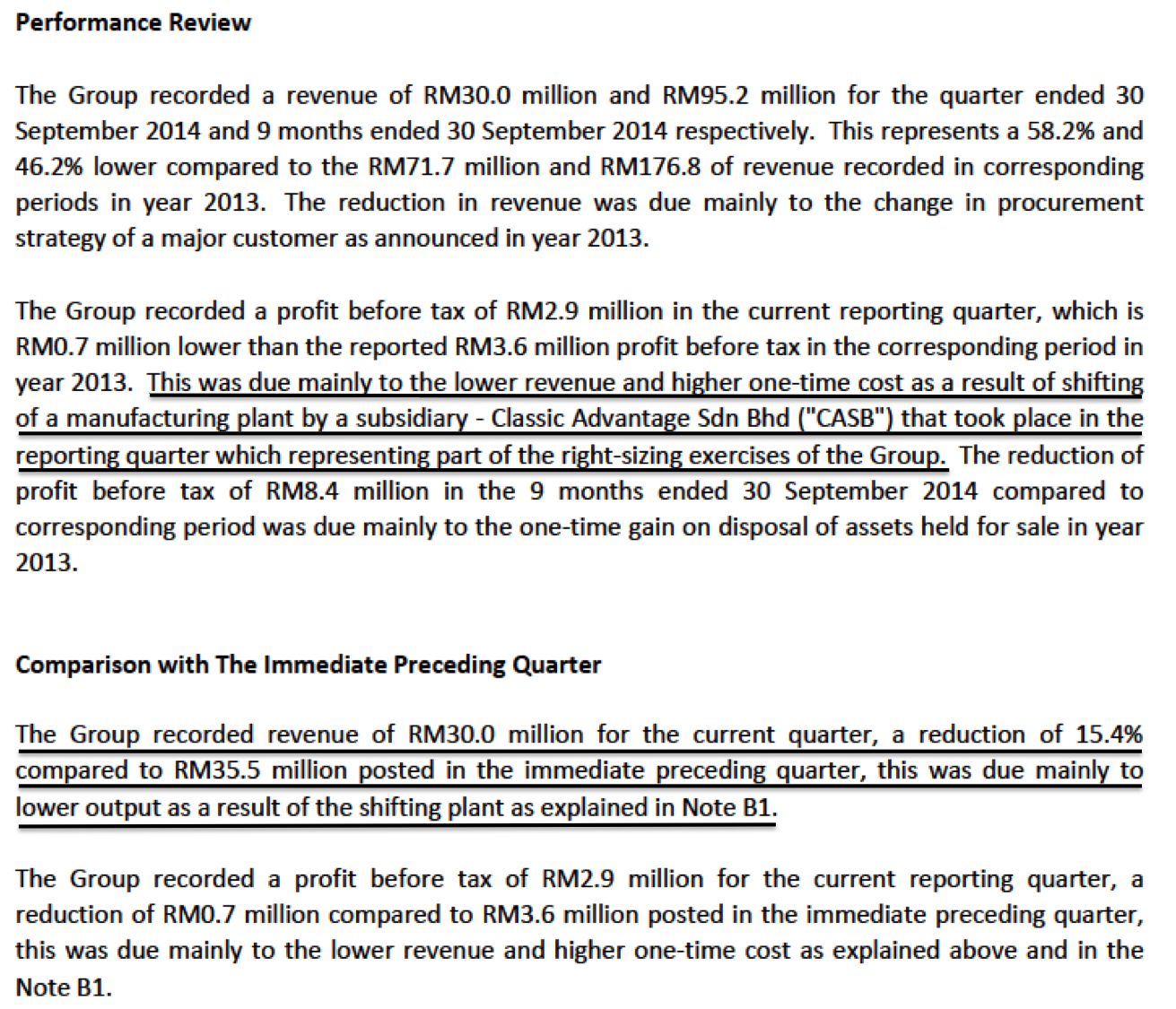

The group has been reporting losses in the past. However, in mid 2013, it disposed of the loss making subsidiary to Flextronics (Suiwah Group) for cash consideration of RM29.5 mil. Since the disposal, the group has returned to profitability.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 29,990 | 2,925 | 2,605 | 0.72 | - | 0.5033 |

| 2014-12-31 | 2014-06-30 | 35,450 | 3,599 | 3,329 | 0.90 | - | 0.5000 |

| 2014-12-31 | 2014-03-31 | 29,771 | 1,385 | 1,115 | 0.31 | - | 0.4900 |

| 2013-12-31 | 2013-12-31 | 29,759 | 588 | 438 | 0.12 | - | 0.4800 |

| 2013-12-31 | 2013-09-30 | 71,730 | 3,580 | 3,241 | 0.90 | - | 0.4800 |

| 2013-12-31 | 2013-06-30 | 56,909 | 14,194 | 13,877 | 3.85 | - | 0.4700 |

| 2013-12-31 | 2013-03-31 | 48,197 | -1,469 | -1,749 | -0.49 | - | 0.4352 |

| 2012-12-31 | 2012-12-31 | 46,082 | -5,367 | -5,476 | -1.52 | - | - |

| 2012-12-31 | 2012-09-30 | 60,506 | -6,365 | -2,252 | -0.63 | - | 0.4600 |

| 2012-12-31 | 2012-06-30 | 96,795 | -12,198 | -11,402 | -3.17 | - | 0.4600 |

| 2012-12-31 | 2012-03-31 | 84,055 | -3,995 | -4,346 | -1.20 | - | 0.4900 |

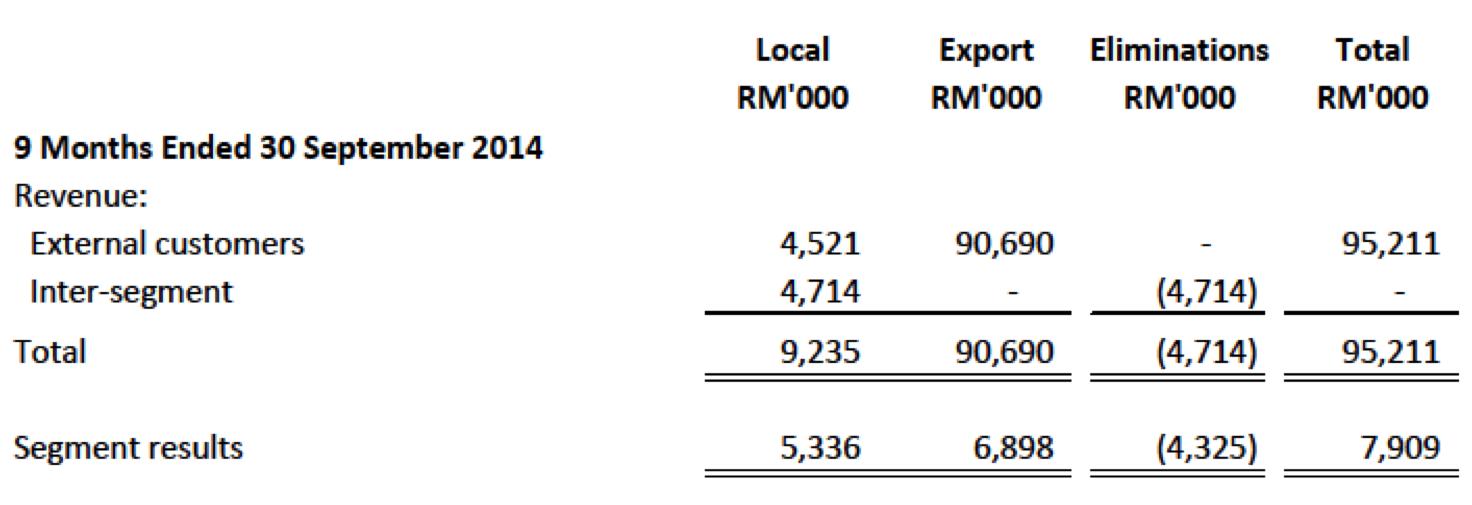

The group's operation is divided into local and export market. The local market relates to sales to customers within Malaysia who are non Licensed Manufacturing Warehouse ("LMW"). The export market relates to sales to LMW in Malaysia and overseas customers, with Hong Kong and China being the principal market segment.

The loss making subsidiary that was disposed of in mid 2013 caters mostly for the local market. This segment has been incurring losses for many years and dragged down the group's overall earnings.

In the September 2014 quarterly report, it was announced that the local market still contributed significant operating profit. However, at the same time, the revenue for local market is closed to zero. Based on preliminary information, it seemed that the group continues to service its local market customers, but meet their orders by using the manufactruing facilties of the export market subsidiary (there are eliminations between the two entities).

In the latest quarterly report, management commented that the reason the September 2014 quarter profit was lower than the June 2014 quarter profit was because of shifting of manufacturing plant which caused disruptions to operations.

Concluding Remarks

(a) The group disposed of loss making subsidiary in mid 2013. As a result, it returned to profitability since September 2013.

(b) The lower earnings in the latest quarter result (Septembr 2014) was due to shifting of manufacturing plant that disrupted operation. The coming quarter result should reflect full three months operation.

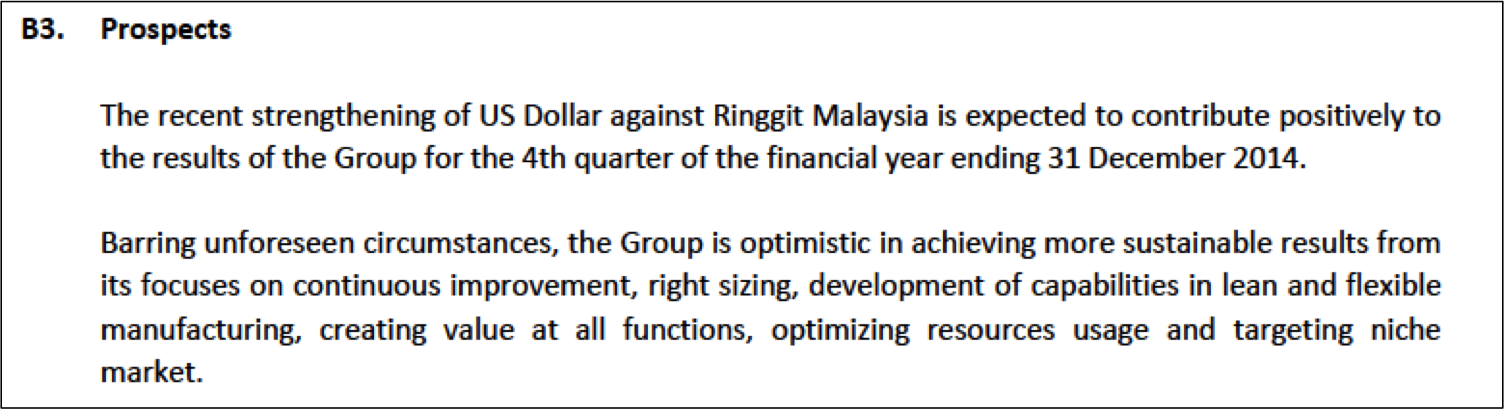

(c) With the disposal of the loss making local market subsidiary, the group currently derived ALMOST 100% of its sales from export market. In the September 2014 quarterly report, management mentioned that the strong US Dollars is beneficial to the group.

(d) In addition to the above, the electronic and semiconductor industry has been performing very well recently. This should benefit the group as the bulk of its products comprises high precision components mostly for uses by the electronic industry.

(e) By purely relying on publicly available informtaion, no amount of analysis can enable me to make an accurate prediction of coming quarter's results. However, with the convergence of the few positive factors as mentioned above, there is indeed grounds to be optimistic about the group's performance in the soon to be announced quarterly results.

No comments:

Post a Comment