1. Introduction

As many readers would have noticed, I seldom write about topics that are macro in nature. This is because topics like that usually generate a lot of controversies and heated arguments. The only time I undertook such a discussion was my April 2014 article to dispel the myth of "Buy In November, Sell In May and Go Away".

http://klse.i3investor.com/blogs/icon8888/50088.jsp

2. Nervous Newbie

Recently, I notice some nervous discussions about cashing out of export stocks.

(Nervous newbie advocates cashing out of Poh Huat at RM2.50)

3. US Dollar Bull Run

To find out whether Chicken Little is just being paranoid or the sky is indeed falling, I decided to take a closer look at past US Dollar movement.

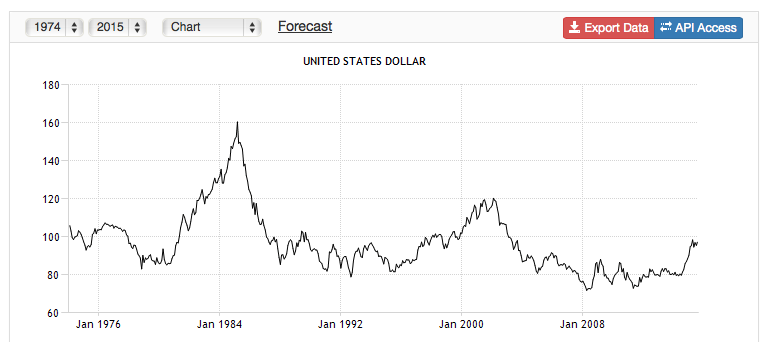

The following is a chart of US dollar vs a basket of currencies from 1974 to 2015 :-

(US dollars against a basket of currencies)

Some of the interesting information :-

(a) The US Dollar went up by 88% (from 85 to 160) during the period from 1978 to 1985. The bull run lasted for 7 years.

(b) The US Dollar went up by 50% (from 80 to 120) during the period from 1995 to 2002. The bull run also lasted for 7 years.

So far, the US Dollar has appreciated against the currency basket by 21% (from 80 to 97). The bull is one year old (July 2014 until July 2015)

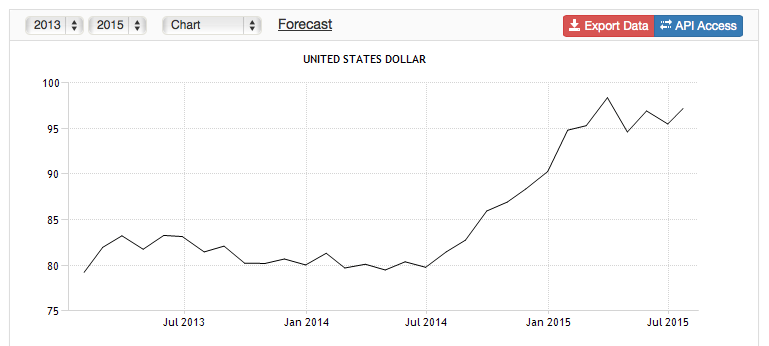

(US dollar movement July 2014 to July 2015)

Just to do a quick check, the US Dollar appreciated 22% against the Ringgit during the one year period from July 2014 to July 2015 :-

The 1978-1985 US Dollar bull run was due to a series of interest hike by the Federal Reserves to fend off inflation (sounds familiar ?).

The 1995-2002 US Dollar bull run was due to strong economic performance fueld by IT related productivity gain.

The latest bull run is of course due to shale oil boom which brings down oil prices, putting more money into US government and consumers pocket.

4. Concluding Remarks

The objective of this article is not for me to take a stance regarding the extent and duration of the US Dollar bull run. That topic is too huge and complicated for a layman like me to fully understand.

However, the little study did turn up some useful insights - a currency's upward / downward trend has its momentum, it doesn't reverse so easily and usually last for an extended period of time.

So far, the major factors that contributed to the Dollar bull run are still intact. In fact, as at the date of this article, some of those factors are showing signs of intensifying (oil price weakness, Malaysia political uncertainties, etc).

Of course, I was just joking when I teased the relevant forum member's assertion that export stocks have peaked. We shouldn't be complacent. Black swan events could happen anytime to change the macro environment overnight (for example : a war in the Middle East causes oil price to spike).

However, the study does have a profound impact on my view on export stocks. Before that, I was always nervously watching for signs of reversal.

But now, there is a new notion that the system has certain inherent stability and it will take more than a few oil rig counts to trigger a major reversal.

Maybe I should just hold on to my export stocks for a little longer.

(Phew ! The sky is not falling.....yet)

No comments:

Post a Comment