Author: Icon8888 | Publish date: Thu, 17 Dec 2015, 07:54 AM

1. Introduction

I have been eyeing RGB for a long time, but only look see look see no action. Based on 1,312 mil shares and 18 sen per share, the company has market cap of RM236 mil.

The group has been doing well in the past few quarters. The reason I hesitated to jump in was because I was not sure about the sustainability of its earnings.

I know that RGB supplies gaming machines to Casinos. If that is the case, I expect them to be like contractors - there will be sales when new Casinos open or existing Casinos expand their business, right ?

Even though the gaming industry is booming in Philippine (their primary market), I just cannot imagine Casinos keep expanding and buying new machines from RGB. Sooner or later, the demand will dry up, right ?

However, as I undertook a more detailed study of the group recently, I realised that my perception of RGB was wrong. RGB is not only a toll road builder, it is also a toll road operator.

According to RGB's annual report, the group is principally involved in the followings :-

(a) sales and manufacturing of electronic gaming machines and other equipments ("SSM"); and

(b) technical support management and machines concession programme ("TSM").

SSM is straight forward and easy to understand - RGB supplies equipment to gaming operators, either for business expansion or for replacement purpose.

As for TSM, this is how RGB describes it in their website :-

Under a TSM arrangement, RGB is not only involved in maintenance of hardwares, it is also involved in operation of the machines, including marketing and business development. In return, RGB receives a fee or gets a cut of the profit.

The TSM business is the biggest contributor to group profitability. It provides the group with a recurrent stream of profit and cashflow.

More details below.

2. Historical Performance

The table below sets out RGB's P&L from FY2013 until September 2015 :-

Key observations :-

(a) SSM is the key revenue contributor. However, TSM commands better margin and contributed more to earnings. For the 9 months ended 30 September 2015, TSM accounted for 57% of operating profit. As mentioned above, TSM's revenue, profit and cashflow is recurrent in nature. As such, their heavy weightage enhances the visibility of the group's earnings.

(b) Due to consistent strong operating cash flow, the group has been able to slowly pare down its borrowings. Interest expenses had declined from RM8.2 mil in FY2013 to RM4.9 mil in FY2015 (estimate). In the next Section, I will provide more details of the group's cashflow and the degearing process.

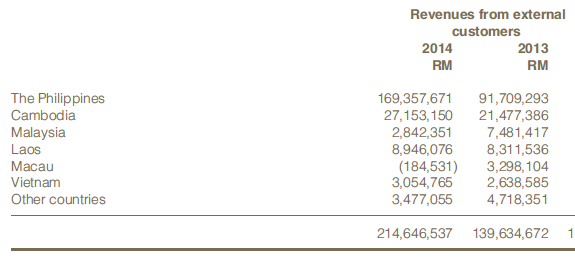

(c) The Group derives the bulk of its revenue from overseas :-

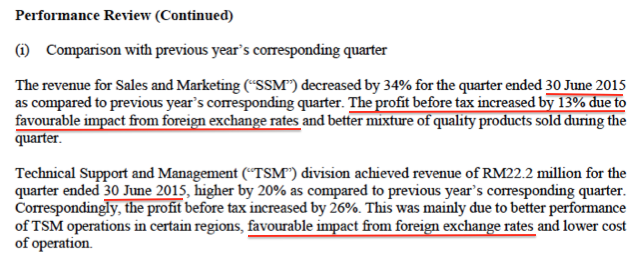

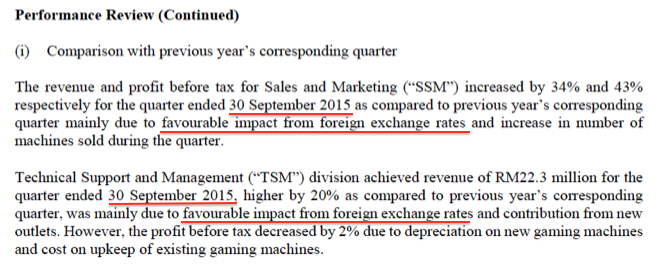

Weak Ringgit seemed to benefit the Group as it results in higher profit margin. The following paragraphs are extracted from the Company's June and September 2015 quarterly reports respectively :-

My guess is that the group is not exactly an exporter. I would treat it more like a Multinational Corporation with operation in various countries. In this regard, I believe the group's sales and expenses (apart from certain equipment that need to be imported) are mostly denominated in the currency of the host countries (instead of USD). As the bulk of the group's operation is based in Philippine, fluctuation of Philipine Peso should have a material impact on profitability.

The chart below shows Peso's movement vs Ringgit :-

As at 1 January 2015, one Peso can buy 0.078 Ringgit. However, on 30 September 2015 , one Peso can buy 0.094 Ringgit, 20% more than at the beginning of the year. As the bulk of RGB's expenses are denominated in Ringgit (employees' salary, electricity, depreciation, etc), the group benefits from expansion in profit margin.

(Just in case I am wrong with my assumption of Peso denominated revenue, you can replace the analysis with USD, and the positive effect would be more or less the same. The Peso devalued by approximately 6% against the USD in 2015)

Even though weak Ringgit benefits the group in the form of margin expansion, it adversely affected the part of the operation denominated in USD. Subject to further investigation, it seemed that RGB sources many of its electronic equpment from overseas (payable in USD, of course). The latest quarterly report does not provide detailed breakdown, so I have to rely on the annual report to have a feel of the group's exposure to USD liabilities.

According to FY2014 annual report, the group has net exposure of RM15.5 mil :-

During the period from January until September 2015, Ringgit depreciated by 25.6% against the USD (from 3.50 to 4.40).

Based on net exposure of RM15.5 mil, this would have resulted in net forex losses of RM4.0 mil (being 0.256 x RM15.5 mil). This back of the envelope calculation turned out to be a surprisingly good estimate as the group reported forex losses of RM4.6 mil during the 9 months ended 30 September 2015.

How will forex movement affect the group's profitability going forward ? In my opinion, the group should be able to avoid huge forex losses in the coming December 2015 quarter. Forex losses happen when currency moves from one level to another during the relevant reporting period (affecting value of assets and liabilities). On 1 October 2015, Ringgit vs USD was 4.43. On 14 December 2015 (the date of this article), the exchange rate is 4.37, a minor strengthening. If anything, there should be a small forex gain in the coming December 2015 quarter.

While forex losses can be avoided, the benefit of margin expansion remains. With that in mind, I am cautiously optimistic of the coming December quarter (to be announced by end February 2016).

On pro forma basis, assuming that everything else remains the same, by eliminating the RM3.2 mil forex losses from the September 2015 quarter, can the group unleash its full potential to deliver net profit of RM8.5 mil in the coming quarter (after making tax adjustment) ?

Based on 1,312 mil shares, EPS of 0.6 sen ?

If that happens, based on annualised EPS of 2.4 sen and PER of 10 times, should we argue for re-rating from the current 18 sen to 24 sen, an upside of 33% ?

Whether this will happen is not up to me to say. We will have to wait until next February to find out.

3. Breathtaking Degearing Process

As at 30 September 2015, RGB has net assets of RM177 mil, interest bearing debts of RM44 mil and cash of RM77 mil respectively. As such, it is in net cash position of RM33 mil.

The group is not always in such good shape. Their operation got into trouble in 2008 when the Cambodian government changed its mind about the gaming industry. The group reported huge losses and ended up with huge debts.

The group did not turn around until FY2012. As at January 2012, the group has cash of RM30 mil and loans of RM107 mil. Interest expenses amounted to RM9.4 mil per annum.

Over the subsequent few years, the group slowly nurtured its operation back to health and progressively pared down borrowings.

Details of the degearing process are as set out in the table below :-

Key observations :-

(a) Over the past 4 years, depreciation charges had been on declining trend. From RM43.7 mil in FY2012, it dropped to RM28.4 mil in FY2014, a decline of RM15.3 mil.

The decline of depreciation charges was the main reason for increase in group profitability. PBT increased from RM6.1 mil in FY2012 to RM19.7 mil in FY2014, an increase of RM13.6 mil (almost matching the RM15.3 mil decline).

The decline in depreciation charges is definitely a positive thing. However, I am not sure how they managed to pull it off (without affecting operation). Was that a result of finetuning of business model to become asset light, or was it due to some other reasons ?

I am very interested to find out. In the meantime, let's just be happy about it and wish that they could continue with the good job.

(b) After adding back depreciation charges, operating cash flow was surprisingly consistent at approximately RM50 mil per annum.

(c) It seemed that very little of the group's cashflow was tied down in working capital. In FY2012 and FY2013, an average of only approximately RM5.5 mil (being -RM9.2 mil + RM2.2 mil / 2) was tied down in working capital. This is definitely a positive point.

In FY2014, inventories and receivables tied down RM34 mil of the group's cashflow (RM13.3 mil and RM20.7 mil respectively). However, instead of raising borrowings, the group simply delay payment to creditors to plug the funding gap. I am very impressed by this flexibility. In my opinion, this is an indication of either the group's bargaining strength or trusting relationship with its suppliers.

In the first 9 months of FY2015, RM23.9 mil of the group's cash flow was tied down in working capital. Let's wait and see how the group will address this issue.

(d) The Group's spending on acquisition of properties, plants and equipment has been consistently below its depreciation charges. Of course, this is a positive thing (anything that preserve cash without affecting operation is good). However, I am curious how thay are able to do that on sustainable basis. Further research is required.

(e) Every year, the group made net repayment of loans of approximately RM20 mil per annum. Their ability to do so without relying on equity (apart from FY2015 that raised RM18.4 mil) was due to a combination of low working capital and capex requirement.

Over the past 4 years, the group managed to pare down RM62.8 mil loans. Quite an acheivement.

(f) Apart from aggressively paring down borrowings, the group at the same time managed to raise its cash holding by RM54.5 mil over the years (from RM22.5 mil to RM77 mil). The group is currently in net cash position. Due to strengthening of financial position, the company started paying dividend in FY2014.

4. Concluding Remarks

(a) Before I undertook indepth study of the group, I thought it was a marginal player that supplies equipment to gaming operators on adhoc basis.

However, now my perception has changed completely. I view RGB as an established player with the requisite skills and resources to compete regionally. It has a long history of operation, is well managed and has stable business operation.

(b) More and more East Asian countries are interested in developing gaming industry as a way to promote economic growth and create employment opportunities. Apart from its primary market in Philippine, RGB is actively working on new business opportunities in Nepal, Korea, Japan, Timor Leste, etc. There is plenty of room for growth. Prospect is exciting.

(c) As mentioned in Section 1 above, more than 50% of the group's profit is derived from Technical Support and Management. This division generates a steady stream of income and cashflow, which greatly enhances earnings quality and visibility.

(d) The group derives the bulk of its eanrings from overseas operation. As such, it is a beneficiary of weak Ringgit. There is a possibility that there will be no more forex losses in the coming quarter. Driven by expanded profit margin, I am hoping that the coming quarter results will be exciting.

(e) The Group managed to pare down the bulk of its borrowings over past few years. It is currently operating in a virtuous cycle - strong profit and cash flow quickly pares down borrowing and that in turn will have a positive impact on profitability, which facilitates further paring down of borrowings.

(f) With improved fundamentals boosted by cheap Ringgit, the group is fast approaching inflection point. From previously burdened by heavy debts, it will very soon be in a position to pay out generous dividend.

Once that happens, the stock will experience massive re-rating. Different people might have different opinion on how much a stock is worth from PE Multiple point of view. But once the company puts dividend money in your pocket, all resistence will melt away. That is when the stock will really shine and defy gravity.

I look forward to that day soon.

No comments:

Post a Comment