Can High Dividend Yield Be The Norm ?

Author: Icon8888 | Publish date: Tue, 3 Mar 2015, 11:49 AM

Previously known as LKT Industrial Bhd, the company specialised in manufacturing of semiconductor related equipments. In 2012, it acquired from its major shareholder, Singapore Precision Engineering Ltd, its aeroplane parts manufacturing business. The company was subsequently renamed SAM Engineering & Equipment (M) Bhd.

SAM Engineering & Equipment (M) Berhad provides precision manufacturing solutions for aerospace, renewable energy, semiconductor, medical equipment, oil and gas, and related microelectronics industries worldwide.

Among all divisions, aerospace contributes most revenue and profitability. Despite its name "aerospace", the group mostly manufactures engine casing for Airbus and Boeing.

(Aeroplane engine casing. Precision tooling and machining required, which is the company's core expertise)

The company has 83.4 mil shares outstanding. After full conversion of ICULS, share cap will increase to 135 mil shares. Based on RM3.00, market cap is RM405 mil.

The group has strong balance sheets, with net assets of RM349 mil, zero loans and RM82.8 mil cash. Based on enlarged share capital of 135 mil shares, cash per share is RM0.61.

Over the years, the group has reported consistent earnings. Technological requirement forms an entry barrier that protects them from competition. It is more or less a captive market.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| TTM | 444,830 | 29,003 | 36.48 | 7.95 | 0.00 | - | 4.1300 | 8.83 |

| 2014-03-31 | 452,755 | 28,316 | 38.85 | 8.50 | - | - | 4.4800 | 8.67 |

| 2013-03-31 | 383,444 | 19,960 | 27.97 | 8.16 | - | - | 4.1300 | 6.77 |

| 2012-03-31 | 531,144 | 17,816 | 25.14 | 8.24 | - | - | 2.6200 | 9.60 |

| 2011-03-31 | 308,247 | 17,832 | 25.16 | 8.23 | - | - | 2.4200 | 10.40 |

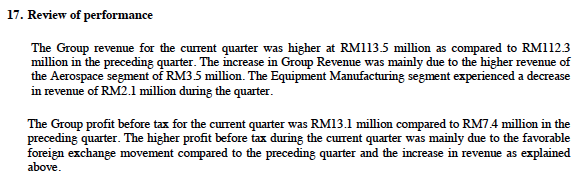

| 2010-03-31 | 302,531 | 25,984 | 36.66 | 5.65 | - | - | 2.1700 | 16.89 |

Almost the entire revenue is denominated in US Dollars :-

The group reported strong earnings of RM11.5 mil in December 2014 quarter. However, not all can be attributed to operational improvement. Depreciation of Ringgit over past few months resulted in forex gain.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2015-03-31 | 2014-12-31 | 113,542 | 13,086 | 11,545 | 13.70 ^ | 4.1300 |

| 2015-03-31 | 2014-09-30 | 112,328 | 7,358 | 6,129 | 7.39 | 3.8100 |

| 2015-03-31 | 2014-06-30 | 93,157 | 2,120 | 1,574 | 2.09 | 4.2400 |

| 2014-03-31 | 2014-03-31 | 125,803 | 9,842 | 9,755 | 13.30 | 4.4800 |

| 2014-03-31 | 2013-12-31 | 121,021 | 7,549 | 5,862 | 8.00 | 4.3200 |

| 2014-03-31 | 2013-09-30 | 111,188 | 12,220 | 10,262 | 14.08 | 4.3500 |

| 2014-03-31 | 2013-06-30 | 94,743 | 2,783 | 2,437 | 3.38 | 4.1100 |

| 2013-03-31 | 2013-03-31 | 109,802 | 5,237 | 6,328 | 8.80 | - |

| 2013-03-31 | 2012-12-31 | 102,641 | 4,994 | 3,764 | 5.25 | 4.2200 |

| 2013-03-31 | 2012-09-30 | 52,177 | 1,494 | 883 | 1.25 | 4.2200 |

| 2013-03-31 | 2012-06-30 | 118,824 | 9,938 | 9,017 | 12.72 | 2.7700 |

| 2012-03-31 | 2012-03-31 | 166,765 | 7,961 | 8,089 | 11.41 | - |

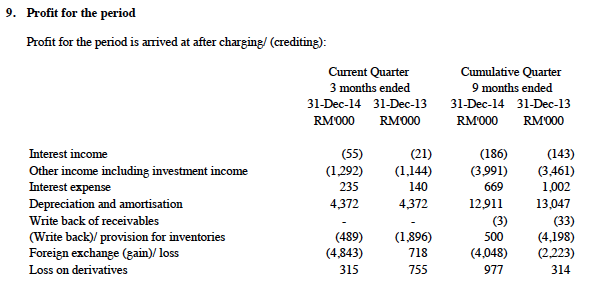

As shown below, out of RM11.55 mil net profit, RM4.8 mil is due to forex gain. Stripping off this item, adjusted net profit would be RM6.75 mil. Based on 135 mil shares, EPS in Q4 of 2014 is 5 sen.

Based on annualised EPS of 20 sen and market price of RM3.00, the stock is already trading at 15 times PER.

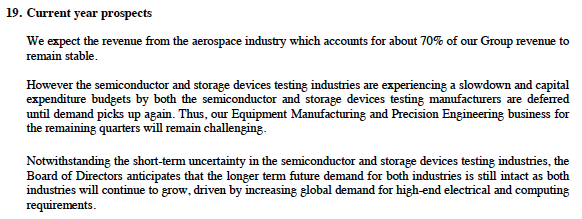

Management's comments on company's prospects :-

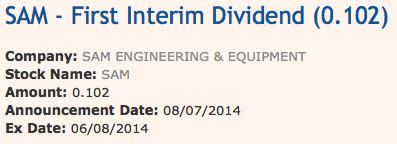

In July 2014, the company paid 17.25 sen dividend. This translates into dividend yield of 5.75% (based on existing price of RM3.00).

Based on 84.5 mil shares, total payout was RM14.5 mil.

Based on cumulative net profit (before July 2014) of RM27 mil, this represents payout ratio of approximately 50%.

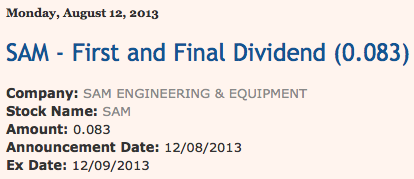

In 2013, the company paid 8.3 sen dividend.

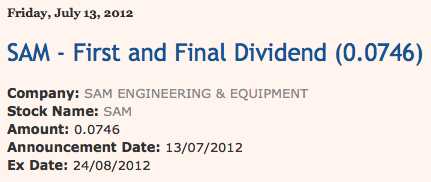

In 2012, the company paid 7.46 sen dividend.

If the company can sustain dividend yield of 5.75% going forward, the stock does still looked interesting. Otherwise, at 15 times PER, it is fairly valued.

No comments:

Post a Comment