Dairy Division Is Actually Doing Quite Well

Author: Icon8888 | Publish date: Sat, 6 Jun 2015, 09:57 AM

1. Introduction

Johotin has an eventful year in 2014. For the first time in many years, it reported a loss in the June 2014 quarter due to quality issue. In the subsequent quarters, its revenue jumped substantially as it pushed into new markets. While benefiting from lower raw material cost, it was adversely affected by forex losses. The group ended the year with net profit of RM13.0 mil, representing a decline of closed to 35% as compared to previous two years.

Its roller coaster performance over the past few quarters gave rise to many questions. How have its various divisions performed ? Beyond all those exceptional items, is the group's business fundamentals still intact ? What are the things to look out for in the coming quarters ? What kind of earnings should we be expecting ?

Before we proceed to answer the above questions, it is important for us to get to know a new member of the Johotin family - Able Food Sdn Bhd ("Able Food"). This new subsidiary has had a material impact on the group's profitability in FY2014. How the Johotin Group will perform in the future will to a large extent be determined by the profitability of Able Food.

2. Able Food

Able Food is not to be confused with Able Dairies Sdn Bhd ("Able Dairies"), which was acquired by Johotin in 2011 and produces creamer, evaporated milk, condensed milk, etc.

Able Dairies is fully owned by Johotin. It has been the major contributor to group earnings. Out of average group profit of approximately RM21 mil per annum (FY2012 and FY2013), approximately RM15 mil was from Able Dairies.

Able Food is a relatively new entity. It was acquired by Johotin through subscription of 80% equity interest on 2 December 2013 for cash consideration of approximately RM0.8 million.

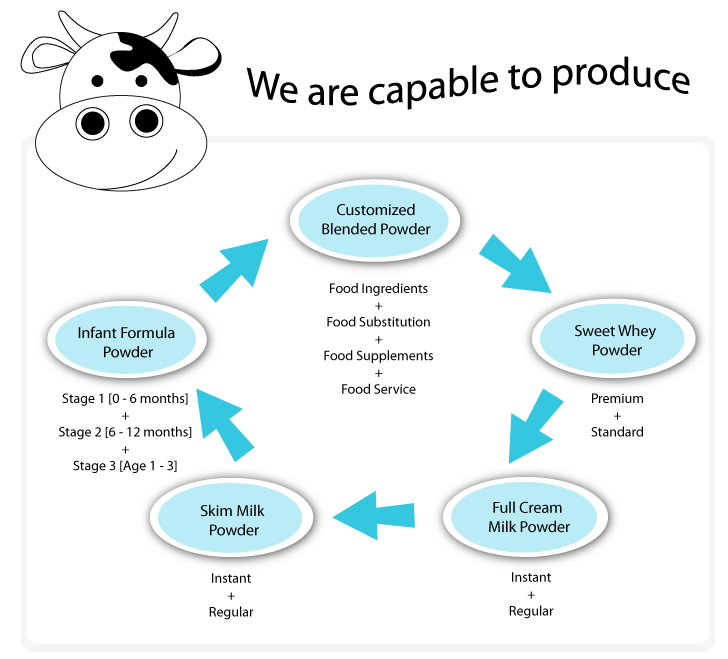

According to its website, Able Food is a milk powder manufacturer and packer. It imports milk power from overseas, mix it with supplements and ingredients before shipping the end products to mostly overseas customers.

Subject to further investigation, it seemed that Able Food commenced operation in the middle of 2014 (after being acquired by Johotin as a shell company in December 2013).

It is very likely the main reason for the spike in overall group revenue during the September and December 2014 quarters (from RM60 mil to RM90 mil per quarter).

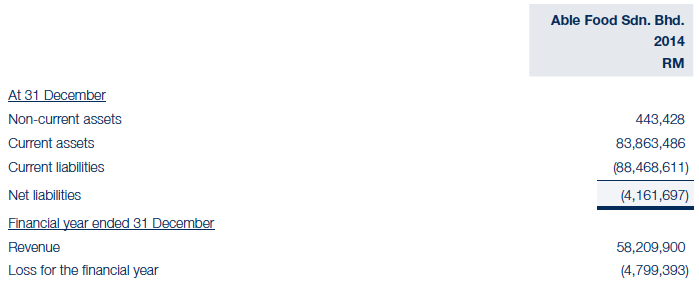

According to FY2014 annual report, Able Food reported net loss of RM4.8 mil in FY2014. Its losses was the main reason why Johotin Group's FY2014 profitability declined substantially.

3. Johotin Group's Historical Performance

The table below sets out Johotin Group's P&L over past 3 years. Please read the notes below the table for further details. For example : if you see "(a)" in the FY2012 table, please scroll down the article to read the explanation (a).

| (RM mil) | Tin | Able Dairies | Able Food | Consolidated | |

| FY2012 | Division | Sd Bhd | Sd Bhd | Others | P&L |

| Revenue | 82.0 | 164.3 | 0.0 | 0.0 | 246.3 |

| PAT | 7.9 | 17.2 | 0.0 | (2.2) | 22.9 |

| MI | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Net profit | 7.9 (a) | 17.2 (b) | 0.0 | (2.2) | 22.9 |

| Net margin (%) | 9.7 | 10.5 | 9.3 | ||

| (RM mil) | Tin | Able Dairies | Able Food | Consolidated | |

| FY2013 | Division | Sd Bhd | Sd Bhd | Others | P&L |

| Revenue | 83.1 | 158.3 | 0.0 | 0.0 | 241.4 |

| PAT | 8.5 | 13.5 | 0.0 | (1.5) | 20.5 |

| MI | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Net profit | 8.5 (a) | 13.5 (b) | 0.0 | (1.5) | 20.5 |

| Net margin (%) | 10.2 | 8.5 | 8.5 | ||

| (RM mil) | Tin | Able Dairies | Able Food | Consolidated | |

| FY2014 | Division | Sd Bhd | Sd Bhd | Others | P&L |

| Revenue | 88.9 | 169.7 | 58.2 | 0.0 | 316.8 |

| PAT | 9.1 | 9.6 | (4.8) | (1.9) | 12.0 |

| MI | 0.0 | 0.0 | 1.0 | 0.0 | 1.0 |

| Net profit | 9.1 (a) | 9.6 (c) | (3.8) (d) | (1.9) | 13.0 |

| Net margin (%) | 10.2 | 5.7 | (6.6) | 4.1 |

| Tin | Able Dairies | Able Food | Consolidated | ||

| Q1 of 2015 ^ | Division | Sd Bhd | Sd Bhd | Others | Figures |

| Revenue | 20.9 | 42.4 | 27.5 | 0.0 | 90.8 |

| PBT b4 EI | 1.3 | 3.2 | 3.9 | (0.4) | 7.9 |

| EI | 0.0 | (2.7) | 0.9 | 0.0 | (1.8) |

| PBT | 1.3 | 0.4 | 4.8 | (0.4) | 6.1 |

| Tax | (0.3) | (0.20) | (0.9) | 0.0 | (1.391) |

| PAT | 1.0 | 0.2 | 3.7 (e) | (0.2) | 4.725 |

| MI | 0.0 | 0.0 | (0.7) | 0.0 | (0.743) |

| Net profit | 1.0 | 0.2 | 3.0 | (0.2) | 3.982 |

| Net margin (%) | 4.8 | 0.5 | 10.8 | 4.4 |

^ estimated figures arrived at by making various guesses, assumptions and working backwards

Some key observations :-

(a) Tin manufacturing division's revenue and profitability has been flattish. Over past three years, they generated average revenue and net profit of RM85 mil and RM8.5 mil per annum respectively. Average net margin has been approximately 10% per annum.

(b) In FY2013, Able Dairies' revenue dropped from RM164.3 mil to RM158.3 mil (a decline of 3.7%). However, its net profit dropped from RM17.2 mil to RM13.5 mil (a decline of 22%).

The drastic drop in net profit was due to lower net margin (8.5% in FY2013 vs 10.5% in FY2012), which was very likely caused by higher milk powder cost (and other raw material).

FY2012 milk powder price of USD3,108 per MT (estimate) was 27% lower than FY2013 milk powder price of USD4,267 per MT (estimate).

(c) Able Dairies reported net profit of only RM9.6 mil in FY2014. That was because it paid compensation of RM8 mil (estimate) for quality related problems. If the RM8 mil is added back (and adjust for 23% tax), net profit would be RM15.7 mil. Net margin would be 9.2%. This is consistent with net margin of 10.5% and 8.5% in FY2012 and FY2013 respectively.

FY2014 milk powder price of USD2,625 per MT was 38% lower than FY2013 milk powder price of USD4,267 per MT.

(d) Able Food commenced operation in mid 2014. It reported a loss of RM4.8 mil in FY2014, of which RM3.8 mil attributable to Johotin (pursuant to its 80% stakes).

According to FY2014 annual report, Able Food has low fixed assets. This implies that it does not have its own manufacturing facility.

This is consistent with what Johotin MD told The Edge in the October 2014 interview :-

"Currently Able Food is engaging third party packers to pack the retail packs. Once the factory is ready in the second / third quarter of next year, it will do most of the packing in house. Hopefully, we can rake in revenue of USD4 mil and USD5 mil a month once it is fully functional."

Based on exchange rate of lets' say 3.3 during the time of interview, USD4 mil is equivalent to RM13.2 mil. This translates into quarterly revenue of closed to RM40 mil. For comparison purpose, Able Food reported revenue of RM58 mil in second half of FY2014. This works out to be RM29 mil per quarter.

Able Food is currently building a new manufacturing facility in Selangor (next to Able Diaries) for a cost of RM18 mil. The group targets completion by Q3 2015. This new manufacturing facility is expected to improve Able Food's profit margin as it will no more outsource the packaging operation to outsiders.

That is why in the FY2014 annual report, the company made the following bold statement :-

"Upon completion of F&B segment's manufacturing capacity by Q3 of 2015, production efficiency and pricing competitivenss will be increased and improved significantly."

(e) The company did not explain why Able Food reported such a huge loss of RM4.8 mil upon commencement of operation in H2 FY2014. One possible reason is that it needs to undertake promotional activities to create brand awareness.

In any event, it seemed that Able Food made a decisiive turnaround in the latest quarter ended March 2015 by reporting PAT of RM3.7 mil (I arrived at the figure by dividing MI of RM0.743 mil by 0.2, which represents the 20% minority stakes in Able Food not held by Johotin).

In my opinion, in the absence of promotions and discounts, it is only natural that Able Food will be doing well. Milk powder price is currently at 5 year low of USD2,500 per MT (vs peak of USD5,000 per MT in 2013). As Able Food's business model involves buying bulk (at low international price) and resells to consumers in package form, the profit margin should be quite attractive.

4. Concluding Remarks

(i) I am pleasantly surprised by the outcome of the analysis as it churns out more useful insights than I originally expected. This allows me to have better understanding of the Group.

(ii) For the tin manufacturing division, I would be happy if it can produce annual net profit of approximately RM8 mil regularly. All evidences point to a matured market with intense competition. This division has recently commissioned a RM15 mil new printing line. The company hopes to offer the services to Middle Eastern and African customers. Lets see whether they can execute as planned.

(iii) The dairy division traditionally reports net profit ranging from RM12 mil to RM17 mil (depends on amongst others, raw material price).

This division has actually done quite well in latest quarter with PBT of RM7 mil (excluding net forex loss of RM1.8 mil). Based on 24% tax rate, net profit would have been approxmiately RM5 mil. If annualised, it would be the highest ever recorded (at RM20 mil).

Of course, it is too early to celebrate. The strong result in March 2015 was primarily due to Able Food's contribution. Too little is known about this new entity. We need to monitor next few quarters performance to see whether earnings momentum can be sustained.

(iv) One of the most frequently heard complains is the group's failure to hedge its forex exposure. A few million Ringgit here and there can add up to a lot of money. And it is also irritating as earnings would have been stronger, share price higher and my wallet fatter, if they have managed it properly : )

No comments:

Post a Comment