Bonanza From Export Business

Author: Icon8888 | Publish date: Thu, 26 Nov 2015, 12:09 PM

1. Introduction

You might not be familiar with the name Chee Wah. But you probably have seen their products before. Chee Wah is principally involved in manufacturing and sale of stationery products under the brand name Campap.

For many years, Chee Wah has not done well. This is understandable. Stationery business has low entry barrier and faces intense competition from low cost producers such as Vietnam and China. However, things changed for the better since devaluation of Ringgit this year. Chee Wah exports more than 70% of its products. These two quarters, they have been laughing to the bank.

It is time to take a closer look.

2. Background Financials

Based on net assets of RM48 mil and net loans of RM27 mil, the group's net gearing is approximately 0.56 times. The gearing is not considered low if the group is loss making.

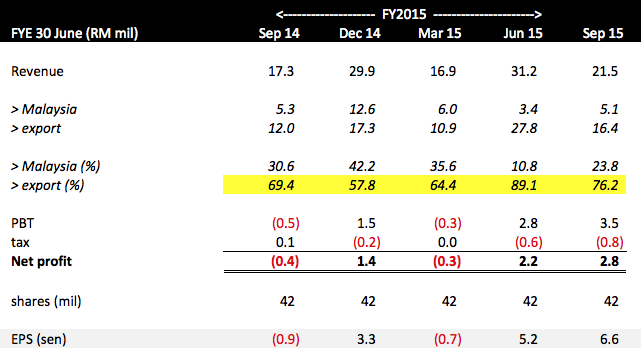

However, as shown in table below, the group exports closed to 70% of its products. Strong US Dollar has resulted in massive jump in earnings in latest two quarters.

With Ringgit expected to be weak for an extended period of time (the past two USD bull run lasted for 7 years each), persistent strong profitability will create a virtuous cycle whereby healthy operating cashflow slowly pares down borrowings, further boosting profitability as interest expenses decline.

We have seen how quickly Hevea degeared its balance sheets with few quarters of super profit. The same could happen to Chee Wah. As such, I am not so concerned about its balance sheets.

Based on 42 mil shares outstanding and market price of RM1.14, the company's market cap is RM48 mil.

Based on net profit of RM2.9 mil for FYE 30 June 2015 (FY2015), historical PER is 16.6 times. However, FY2015 reflected the "Old" Chee Wah, before the currency effect kicks in.

For the "New" Chee Wah, based on estimated net profit of RM10 mil for FYE 30 June 2016 (being past 6 months aggregate net profit of RM5 mil annualised), prospective PER will be a very attractive 4.8 times.

3. Concluding Remarks

With Ringgit strengthening slightly from RM4.40 to RM4.20 over past few days, sentiment quickly turned cautious and there was a mini sell down of export stocks yesterday. However, as Ringgit weakened again today, many export stocks are flashing green again.

I don't profess to be a currency expert. However, my bet is that Ringgit will remain weak over an extended period of time. I have previosuly written about this (please refer below).

There is no guarantee that Ringgit has not peaked at 4.40. However, even if it strengthens back to 4.00 or 3.90, exporters will still be able to make extremely good profit. In my opinion, export stocks are still good bet for at least 2016.

Chee Wah's business is a bit seasonal. It tradionally does well during December and June quarters while March and September quarters are a bit weak. As a result, I expect the coming December quarter (to be released by end February 2016) should be quite exciting. The following is the company's comments on prospects :-

Last but not least, I don't have insider information, my analysis is purely based on publicly available information. Please don't blame me if things don't work out well.

Buy at own risk.

No comments:

Post a Comment