Acquisition Will Boast EPS By More Than 300%

Author: Icon8888 | Publish date: Mon, 16 Mar 2015, 11:36 AM

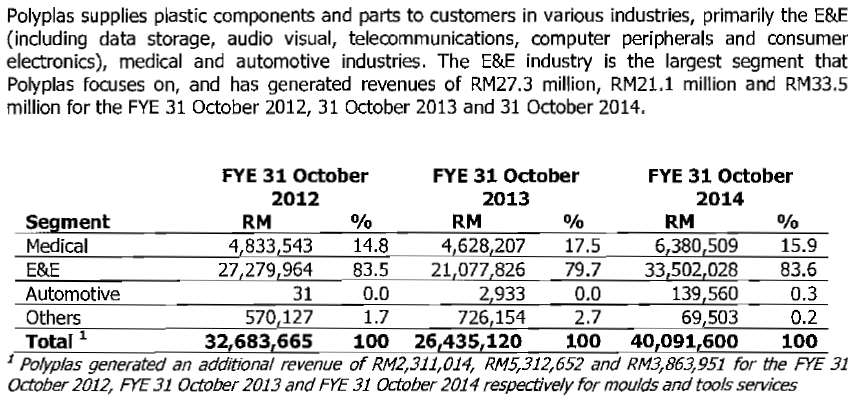

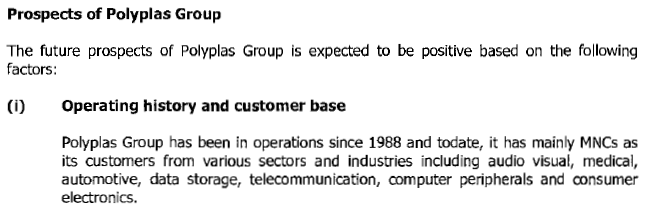

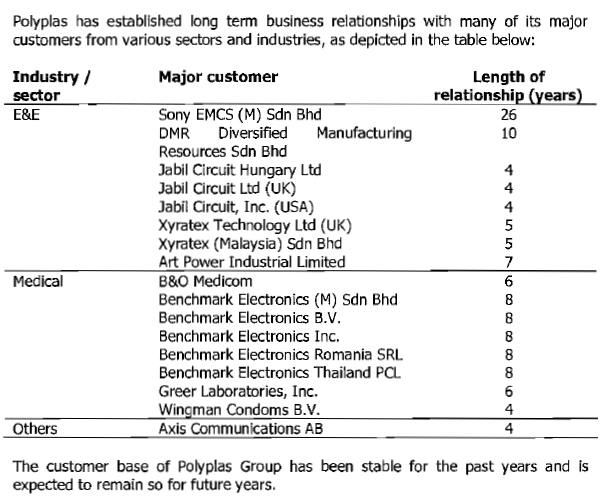

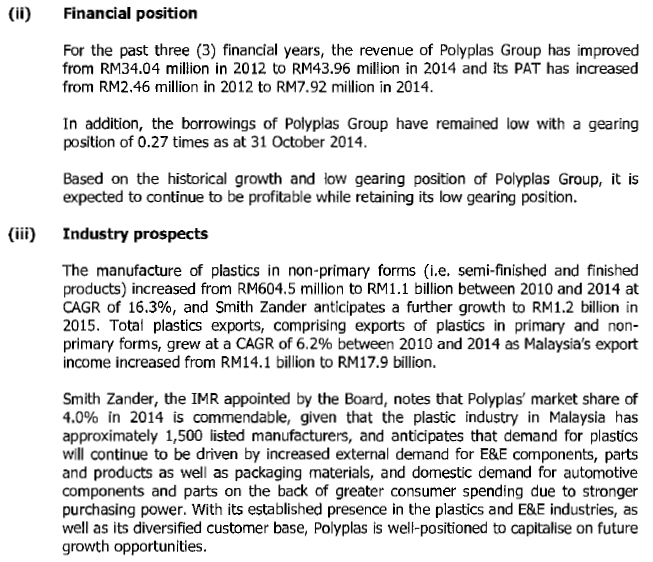

Executive Summary

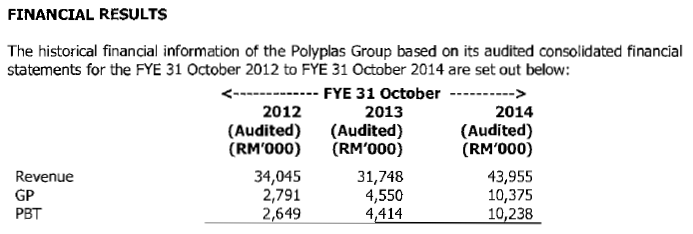

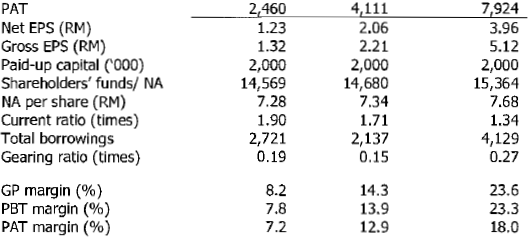

(a) Ge-Shen is principally involved in manufacturing of precision plastic parts. The group has not done well. Over the past few years, average net profit was only approximately RM2.18 mil.

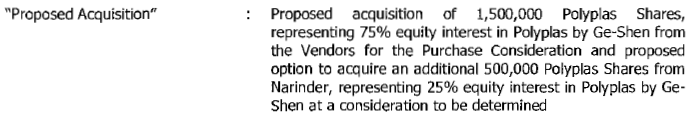

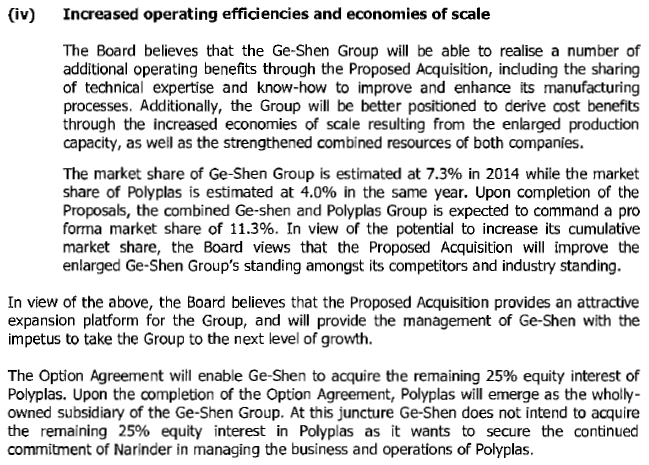

(b) However, the group is in the process of acquiring 75% equity interest in its industry peer Polyplas Sdn Bhd at attractive PER of 5.75 times. Circular to shareholders was issued on 13 March 2015. EGM will be held on 4 April 2015.

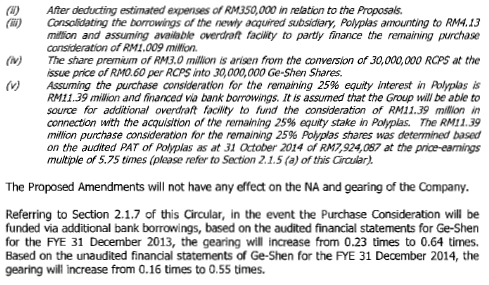

Polyplas is very profitable and reported net profit of RM7.83 mil in the financial year ended 30 October 2014. According to Ge-Shen's circular to shareholders, on pro forma basis, the acquisition will increase the group's net profit by 372% from RM2.13 mil (FY2013) to RM10.06 mil. EPS will increase from 2.78 sen to 13.08 sen (please scroll down to end of this article to check out the financial effects of the transaction).

(c) In addition to the above, on 2 March 2015, the group completed the disposal of two loss making subsidiaries. These two subsidiaries reported total losses of RM2.8 mil in FY2013 (latest available figures). With the de-consolidation of these two non-performing subsidiaries, overall net profit of the group should increase by the same amount accordingly.

(d) The acquisition of Polyplas is timely. Since locking in the deal in October 2014, the Ringgit has depreciated substantially against the US dollar, making Malaysia's manufacturing industry super competitive.

With all these favorable factors in play, the enlarged Ge-Shen group should do well in coming quarters.

Ge-Shen Corp Bhd (GSCB) Snapshot

Open

0.51

|

Previous Close

0.51

| |

Day High

0.51

|

Day Low

0.51

| |

52 Week High

09/30/14 - 0.62

|

52 Week Low

03/18/14 - 0.35

| |

Market Cap

38.8M

|

Average Volume 10 Days

14.0K

| |

EPS TTM

0.03

|

Shares Outstanding

76.9M

| |

EX-Date

08/6/07

|

P/E TM

14.9x

| |

Dividend

--

|

Dividend Yield

--

|

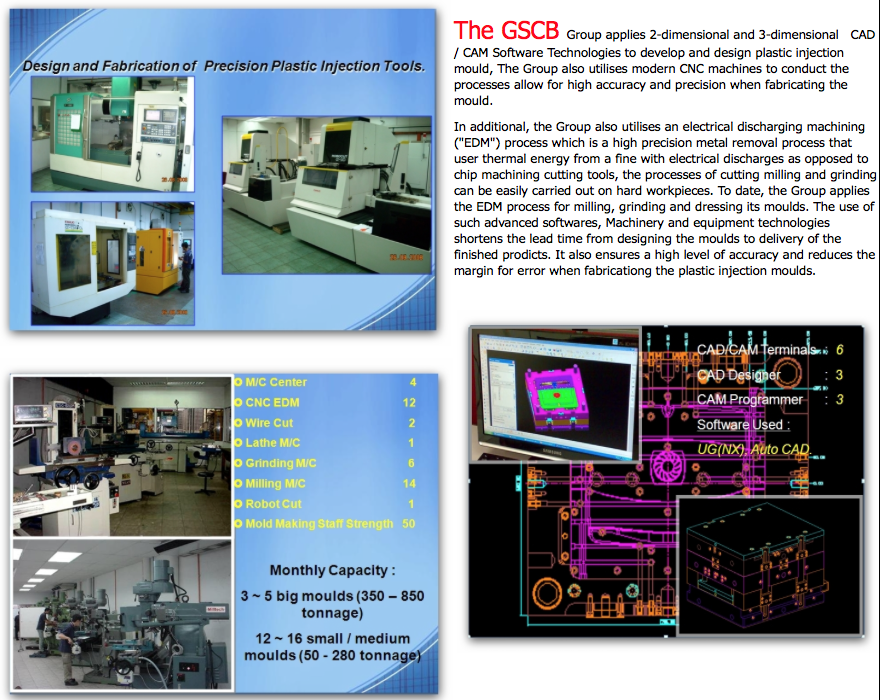

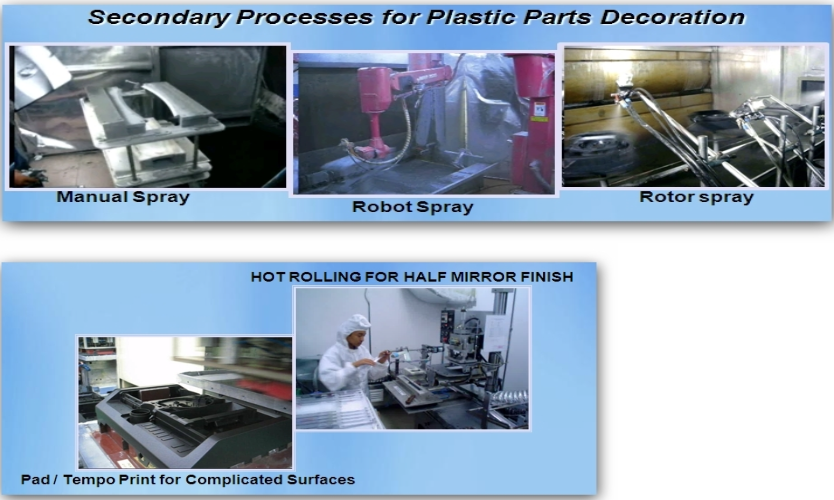

Ge-Shen Corporation Berhad manufactures plastic molded products and components. Its services include the design and fabrication of precision plastic injection tools; injection molding; secondary processes for plastic parts decoration; and assembly of semi-finished or completely finished products.

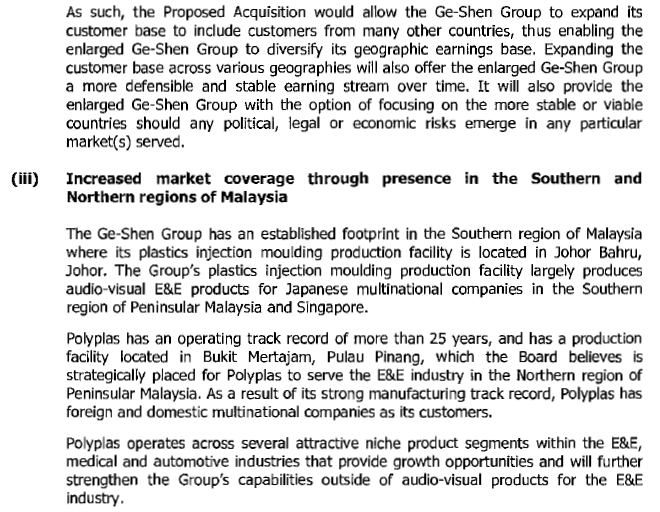

The company operates primarily in Malaysia, Vietnam, and Singapore. Ge-Shen Corporation Berhad was incorporated in 1995 and is based in Johor Bahru, Malaysia.

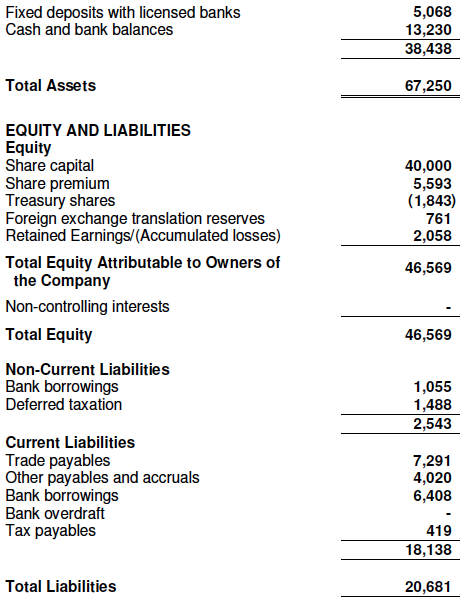

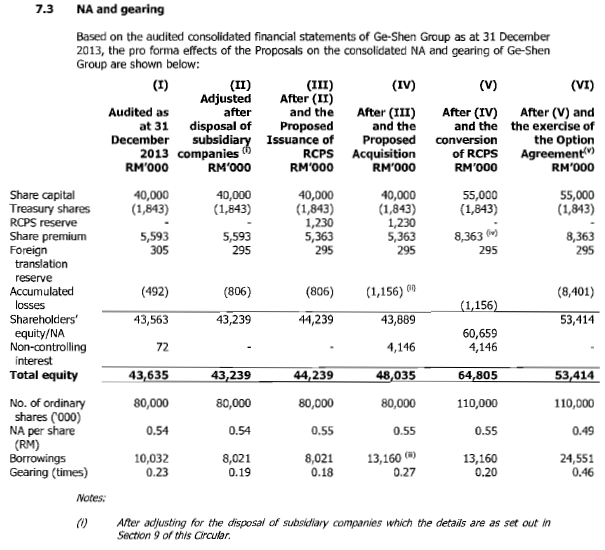

As shown above, the group is in net cash position with loans of RM7.4 mil and cash of RM18 mil. However, the cash will be used to part fund the acquisition.

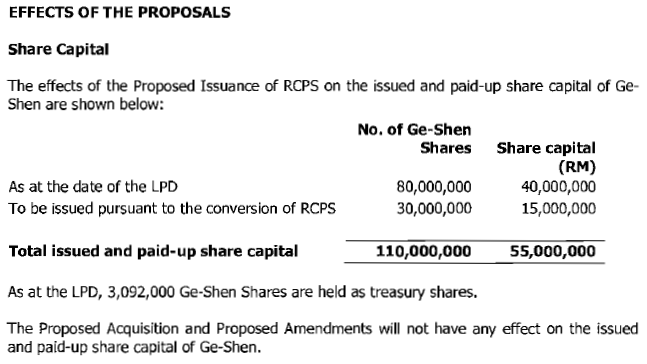

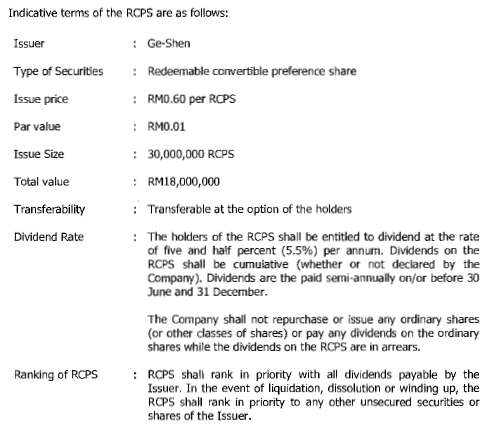

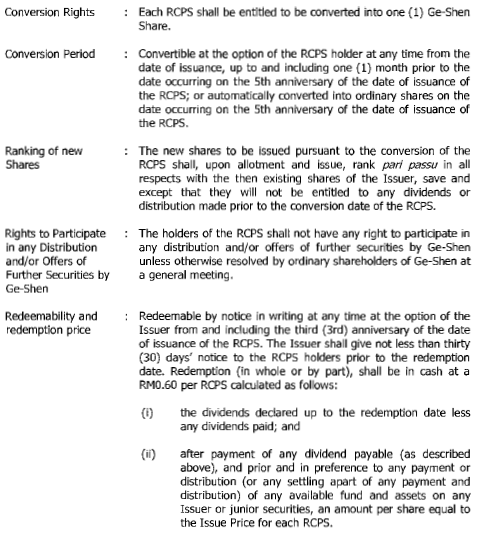

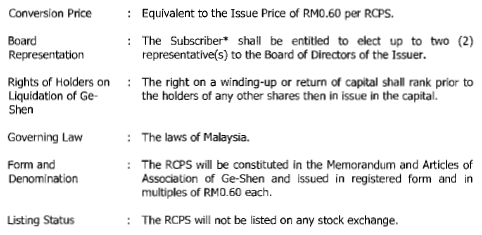

The company will issue RM18 mil RCPS to fund the remaining of the purchase consideration. The RCPS is NOT deemed a debt instrument as it is redeemable at the option of the Issuer (please refer to Appendix 3).

Upon completion of the acquisition, the group will have zero cash and loans of RM11.5 mil (being RM7.4 mil existing loans + RM4.1 mil Polyplas' borrowings).

Based on net assets of RM46.6 mil, net gearing will be at comfortable level of approximately 0.25 times post transaction.

Over past 3 years, the group reported average net profit of RM2.18 mil. Based on existing market cap of RM38.8 mil, historical PER is 17.8 times.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | NAPS | ROE (%) |

|---|---|---|---|---|---|---|

| TTM | 85,000 | 2,558 | 3.32 | 15.22 | 0.6100 | 5.44 |

| 2014-12-31 | 85,000 | 2,558 | 3.32 | 16.72 | 0.6100 | 5.44 |

| 2013-12-31 | 80,179 | 2,197 | 2.86 | 11.54 | 0.5700 | 5.02 |

| 2012-12-31 | 89,603 | 1,781 | 2.32 | 8.63 | 0.5300 | 4.38 |

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 16,534 | 1,209 | 1,284 | 1.67 | 0.6100 |

| 2014-12-31 | 2014-09-30 | 25,403 | 1,130 | 288 | 0.37 | 0.5800 |

| 2014-12-31 | 2014-06-30 | 24,475 | 969 | 399 | 0.52 | 0.5800 |

| 2014-12-31 | 2014-03-31 | 20,846 | 1,143 | 588 | 0.76 | 0.5700 |

| 2013-12-31 | 2013-12-31 | 21,118 | 750 | -23 | -0.03 | - |

| 2013-12-31 | 2013-09-30 | 23,524 | 1,800 | 1,026 | 1.33 | 0.5600 |

| 2013-12-31 | 2013-06-30 | 19,624 | 1,039 | 733 | 0.95 | 0.5500 |

| 2013-12-31 | 2013-03-31 | 18,502 | 622 | 461 | 0.60 | 0.5400 |

| 2012-12-31 | 2012-12-31 | 19,552 | -852 | -848 | -1.10 | - |

| 2012-12-31 | 2012-09-30 | 23,513 | 1,318 | 950 | 1.24 | 0.5500 |

| 2012-12-31 | 2012-06-30 | 23,432 | 1,433 | 1,148 | 1.49 | 0.5400 |

| 2012-12-31 | 2012-03-31 | 23,077 | 1,120 | 589 | 0.77 | 0.5300 |

In the latest quarter, the group reported net profit of RM1.28 mil. The net profit comprises gain on disposal of subsidiaries of RM1.19 mil and losses incurred by discontinued operation amounting to RM1.226 mil. Adjusted for those exceptional items, net profit in the latest quarter would be RM1.316 mil.

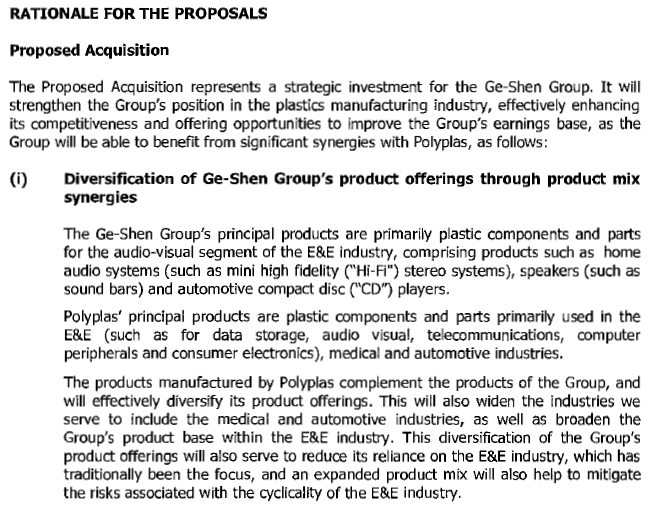

THE PROPOSED ACQUISITION

In October 2014, the company announced the proposed acquisition of 75% Polyplas for cash consideration of RM33.76 mil to be funded by :

(a) internal cash of RM15.76 mil; and

(b) issuance of RCPS of RM18 mil (30 mil x RM0.60).

On 13 March 2015, the company issued circular to seek shareholders approval for the proposed acquisition. Date of EGM is 4 April 2015.

The company targets to complete the acquisition by 2nd quarter of 2015.

========================================

Appendix 1 - The Ge-Shen Group

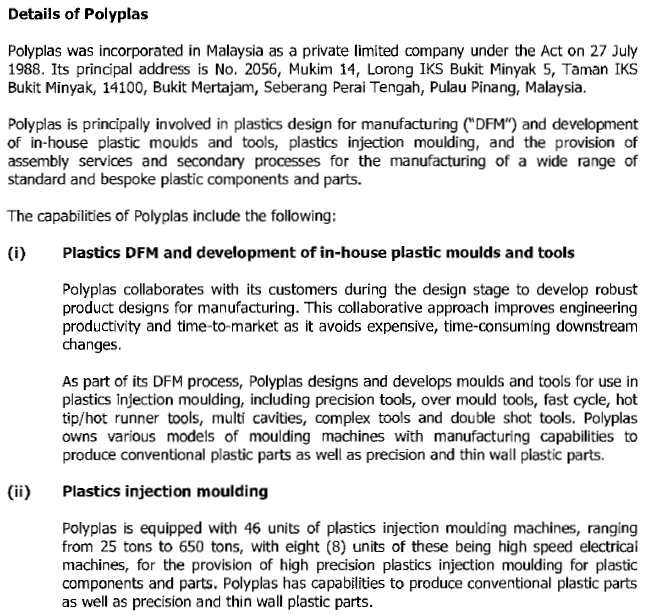

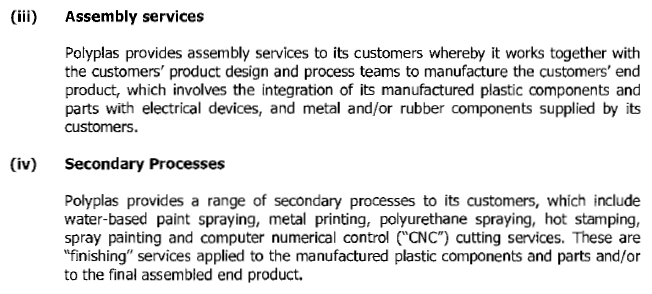

Appendix 2 - Polypas (The Acquiree Company)

Appendix 3 - Salient Terms of the RCPS

No comments:

Post a Comment