A Neglected Exporter Trading At 3.6 Times PER

Author: Icon8888 | Publish date: Thu, 8 Oct 2015, 11:47 AM

(Teck Guan is principally involved in production of palm kernel oil)

1. Introduction

On 25 September 2015, Teck Guan released its financial results for the quarter ended July 2015.

For two consecutive quarters, the group has been reporting spectacular profit growth.

Based on share price of 96 sen and 12 months EPS of 3.3 sen, the stock is trading at historical PER of 29 times.

However, based on annualised EPS of 27 sen (being 6 months EPS of 13.5 sen x 2), prospective PER is only 3.6 times.

(Note : I use the latest six months figure to calculate prospective earnings as I believe it is most reflective of the group's short term earnings capacity, which is boosted by strong USD)

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2016-01-31 | 2015-07-31 | 66,090 | 4,261 | 2,586 | 6.45 | 2.0082 |

| 2016-01-31 | 2015-04-30 | 54,205 | 4,074 | 2,842 | 7.09 | 1.9437 |

| 2015-01-31 | 2015-01-31 | 72,295 | 1,997 | 1,035 | 2.58 | 1.8688 |

| 2015-01-31 | 2014-10-31 | 63,838 | -5,724 | -5,157 | -12.86 | 1.8430 |

| 2015-01-31 | 2014-07-31 | 45,694 | -2,312 | -1,864 | -4.65 | 1.9716 |

| 2015-01-31 | 2014-04-30 | 82,225 | 5,330 | 3,771 | 9.40 | 2.0181 |

| 2014-01-31 | 2014-01-31 | 62,266 | 1,826 | 1,770 | 4.41 | - |

| 2014-01-31 | 2013-10-31 | 45,876 | 3,211 | 1,822 | 4.54 | 1.8799 |

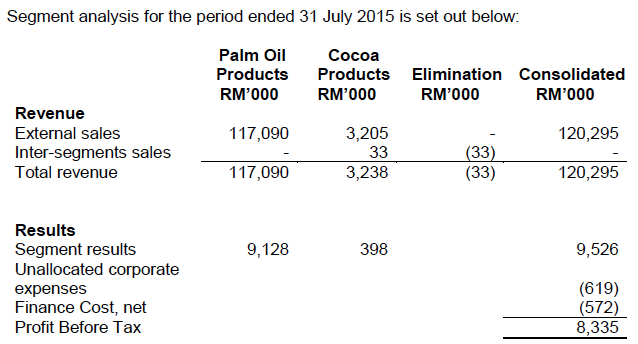

2. Principal Business Activities

Teck Guan derives the bulk of its revenue and earnings from production and sale of palm kernel oil and operation of oil palm plantations.

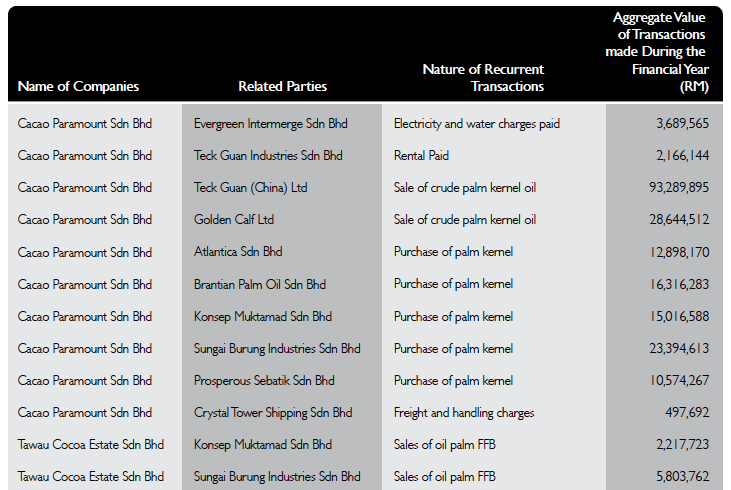

The group purchases palm kernels from its sister companies (non listed). The palm kernel oil produced is also sold to its sister company, Teck Guan (China) Ltd.

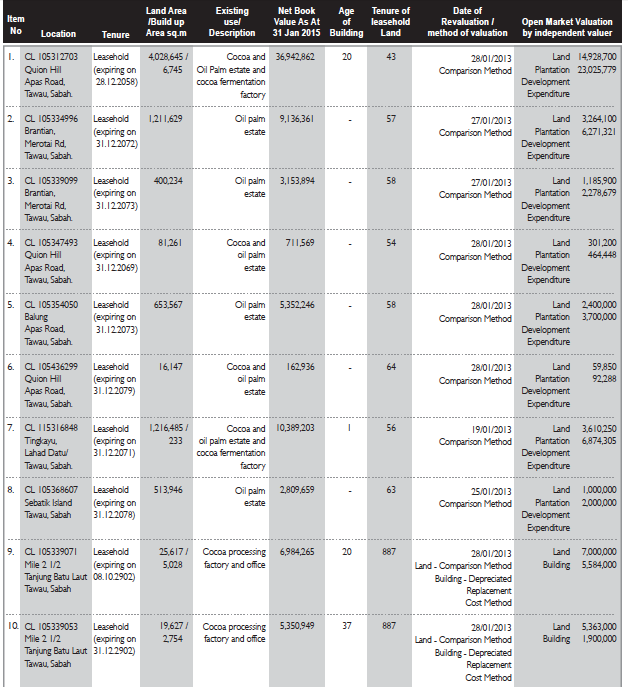

The group also owns approximately 2,000 acres of oil palm plantations in Tawau, Sabah with average age of 13 years.

The plantations has book value of RM38 mil. This works out to be RM19,000 per acre (RM47,000 per hectare).

The FFBs produced are sold to sister companies to be processed into CPO.

3. Balance Sheets

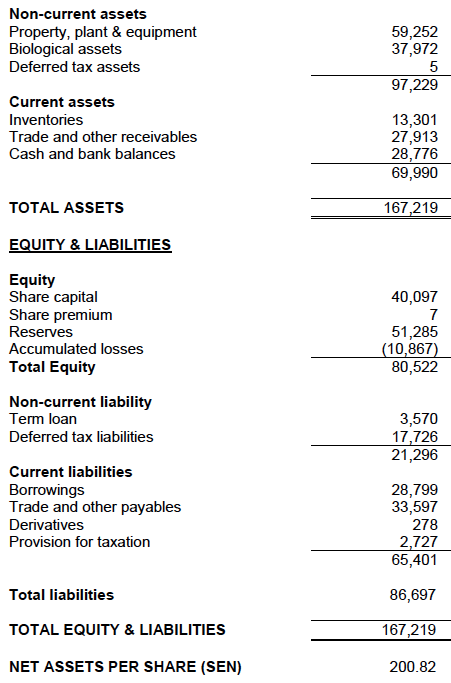

The group has strong balance sheets. As at 30 July 2015, the group has cash of RM28.8 mil and borrowings of RM32.4 mil. Based on net assets of RM81 mil, net gearing is 5% only.

4. Beneficiary of Strong US Dollars

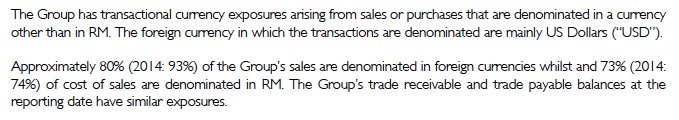

The group is a beneficiary of strong USD as the bulk of its revenue is in USD while its cost is mostly Ringgit denominated.

The following paragraphs are extracted from the company's FY2015 Annual Report :-

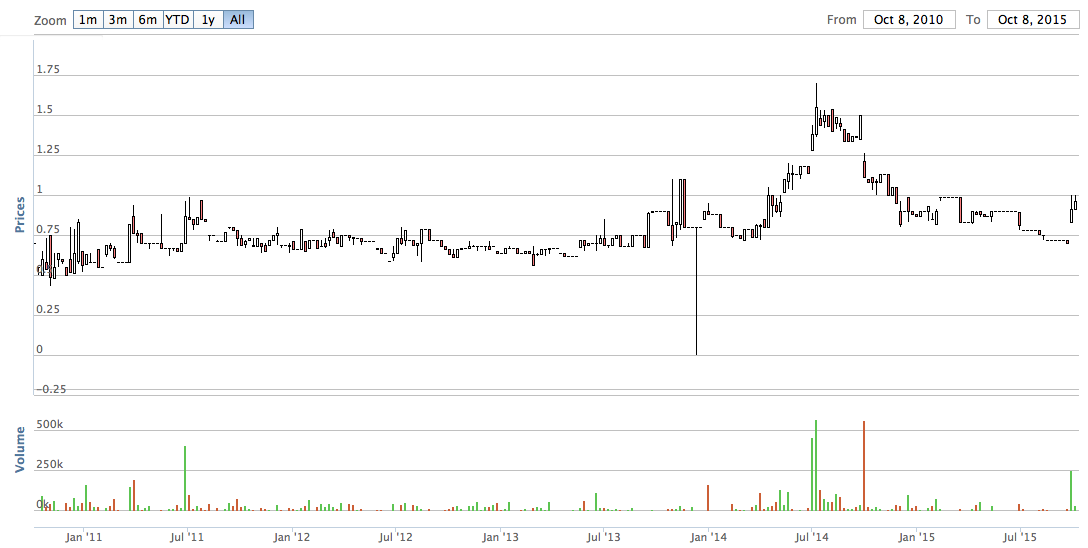

5. Illiquidity

The stock is extremely illiquid. This is mostly due to its small paid up capital of 40 mil shares. That is the main reason it is so undervalued.

Based on latest share price, market cap is only RM38 mil.

Hopefully a bonus issue or share split in the future will address the liquidity issue and unlock value.

No comments:

Post a Comment