Explosive Earnings Growth Ahead (Easily 200%)

Author: Icon8888 | Publish date: Fri, 27 Mar 2015, 07:46 AM

Executive Summary

(a) PRG Holdings Bhd (formerly known as Furniweb Industrial Products Bhd) was traditionally involved in manufacturing of furniture webbing, etc.

(b) In September 2014, Datuk Seri Yeoh Soo Ann emerged as the dominant shareholder after acquiring 25% stake in Furniweb. The company changed its name to PRG Holdings Bhd.

Yeoh is a turnaround expert. Please refer to picture below for further details.

(c) With new major shareholder and management team in place, PRG diversified into property development in 2014 by entering into a joint venture to develop a small parcel of land at Jalan Jelatek, near Jalan Ampang.

The project is called Picasso Residence, comprises 2 blocks of condominiums with 472 units. It has GDV of RM600 mil and expects to generate net profit of RM100 mil when completed in 2017 / 2018.

PRG owns 60% of the JV and is entitled to RM60 mil net profit. This works out to be approximately RM15 mil net profit per annum over the next 4 years. The company expects the project to start contributing to group profit by end 2015.

The profit from the project is very substantial. PRG's furniture webbing business generates about RM5 mil net profit per annum. With the additional earnings from Picasso Residence, net profit will grow by 300% to RM20 mil.

(d) Due to its strategic location (10 minutes walk from Jelatek LRT station and few kilometers from KLCC), Picasso Residence has been very well received. During soft launch in Feb 2015, the company managed to sell 276 units, representing closed to 60% of the total units for sale.

Official launch will be on coming Saturday, 28 March 2015.

(e) In the meantime, the furniture webbing business is expected to do well in the immediate future as 80% of its products are exported.

(Datuk Seri Yeoh Soo Ann, major shareholder of PRG. An accountant by training, Yeoh is a turnaround expert.

In 2012, he nurtured loss-making GW Plastic back to health before selling it to Scientex Packaging for RM283 mil.

In July 2013, he acquired 30.5% equity interest in Encorp from Datuk Seri Effendi. Once again, he managed to turn the company around within short period of time. He sold his stake to Felda Investment Corp in May 2014 at a price almost double his original cost of investment.

Upon exiting Encorp, Yeoh cast his sight on PRG. In September 2014, he took control of the group by acquiring a 25% stake. He is now the CEO and is involved in day to day operation of PRG Group.

Don't you want to ride with him ?)

Prg Holdings Bhd (PRG) Snapshot

Open

0.66

|

Previous Close

0.66

| |

Day High

0.68

|

Day Low

0.63

| |

52 Week High

08/25/14 - 0.94

|

52 Week Low

12/16/14 - 0.57

| |

Market Cap

91.3M

|

Average Volume 10 Days

17.8K

| |

EPS TTM

0.02

|

Shares Outstanding

144.9M

| |

EX-Date

09/4/14

|

P/E TM

39.6x

| |

Dividend

0.02

|

Dividend Yield

2.36%

|

PRG Holdings Berhad (formerly known as Furniweb Industrial Products Berhad) manufactures and sells upholstery webbings, covered elastic yarns and metal components for use in the furniture industry.

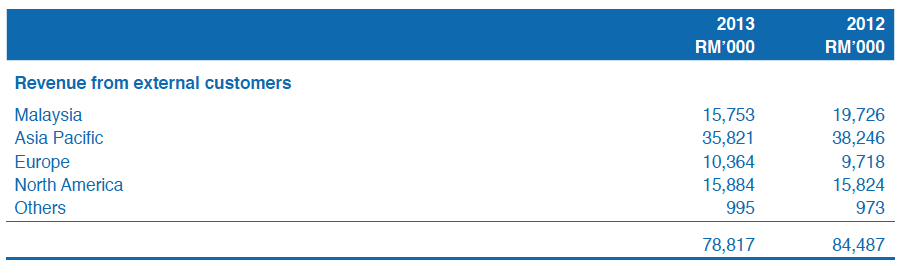

PRG Holdings Berhad sells its products primarily in Malaysia, the Asia Pacific, Europe, and North America. PRG Holdings Berhad was founded in 1983 and is headquartered in Seri Kembangan, Malaysia.

(Furniture webbing)

As at 31 December 2014, the group has net asets of RM108 mil, cash of RM16 mil and loans of RM65.8 mil. This translates into net gearing of 0.46 times.

The gearing looked high. However, the bulk of the long term borrowings of RM58.8 mil are property development related project debts (before venturing into property development, the group's borrowings was very low at less than RM10 mil as at 31 December 2013).

These borrowings are likely housed under its 60% owned subsidiary, which is the JV vehicle for the development project.

In my opinion, there is no need to be unduly worried about the gearing. Those debt will be extinguished following the completion of the development project. The question to be asked is whether the project will be a success ? As explained below, the development project has been very well received. During soft launch in February 2015, the group has managed to sell closed to 60% of the units.

Over the past few years, the group reported net profit of approximately RM5 mil per annum. Those profits were purely from manufacturing and sales of furniture webbing, etc. The group only ventured into property development in 2014.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) | |

|---|---|---|---|---|---|---|---|---|---|

| TTM | 92,295 | 2,374 | 1.98 | 33.84 | - | - | 0.7476 | 2.65 | |

| 2014-12-31 | 92,295 | 2,374 | 1.98 | 32.83 | - | - | 0.7476 | 2.65 | |

| 2013-12-31 | 78,817 | 4,746 | 4.89 | 18.00 | 1.50 | 1.70 | 0.8525 | 5.74 | |

| 2012-12-31 | 84,487 | 4,087 | 4.51 | 8.21 | - | - | 0.8138 | 5.54 |

In the latest financial quarter, the group reported substantial growth in net profit to RM2.12 mil.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 30,025 | 1,928 | 2,123 | 1.47 | - | 0.7476 |

| 2014-12-31 | 2014-09-30 | 22,681 | 1,373 | 1,470 | 1.38 | - | 0.7215 |

| 2014-12-31 | 2014-06-30 | 20,544 | -645 | -769 | -0.85 | - | 0.8304 |

| 2014-12-31 | 2014-03-31 | 19,045 | -268 | -451 | -0.50 | - | 0.8451 |

| 2013-12-31 | 2013-12-31 | 20,887 | 1,146 | 1,060 | 1.09 | - | - |

| 2013-12-31 | 2013-09-30 | 19,603 | 1,927 | 1,679 | 1.86 | - | 0.8397 |

| 2013-12-31 | 2013-06-30 | 19,145 | 2,079 | 1,567 | 1.73 | - | 0.8435 |

| 2013-12-31 | 2013-03-31 | 19,182 | 740 | 440 | 0.49 | - | 0.8212 |

Manufacturing of webbing, yarn, rubber strips, etc accounted for the bulk of the profit. Property division reported a loss due to start up costs.

The latest quarter results was boasted by forex gain of RM0.966 mil.

The strong US dollars augurs well for the group as it exports closed to 80% of its products (RM63 mil out of RM79 mil sales) :-

Management's comments on the company's prospects as per latest quarterly report :-

============================================

THE DEVELOPMENT PROJECT

Picasso Residence

(Picasso Residence, comprises 2 blocks of condominiums with 472 units. GDV of RM600 mil.

Launched in early 2015. Target completion by 2017 / 2018.

Mah Sing's M City is nearby.

The project is well received because it is priced at RM1,000 psf, lower than the RM1,200 psf market price at the surrounding area)

(Picasso Residence is within 10 minutes walking distance from Jelatek LRT Station at Ampang.

It is also closed to the various highways spanning the area)

(The Sun article dated 27 January 2015. According to management, the project should start contributing to group earnings by end 2015. Total net profit would be RM60 mil, to be booked in over four years)

(According to Picaso Residence's facebook posting, they managed to sell 276 units during soft launch in February 2015. This represents 60% of total units for sale. Official launch on this Saturday, 28 March 2015)

=================================================

Appendix 1 - PRG Holdings Bhd

Appendix 2 - Property Blogger's View on Picasso Residence

No comments:

Post a Comment