Sai Lang This Cash Cow

Author: Icon8888 | Publish date: Wed, 30 Sep 2015, 09:24 PM

1. Introduction

On 17 September 2015, I wrote about PBA's quantum leap in earnings due to water tariff hike.

In today's article, I will discuss the tariff hike's positive impact on PBA's cashflow.

2. Cashflow Deficit Before Tariff Hike

The following table sets out PBA group's cashflow over past three and a half years :-

Key observations :-

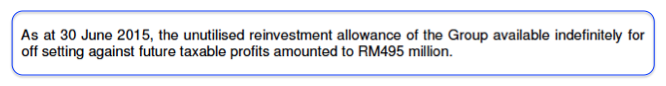

(a) Over the past three years, PBA generated average PBT of RM25.6 mil. The group has very low effective tax rate due to huge reinvestment allowance arising from heavy capex over the years (please refer to details below, extracted from June 2015 quarterly report) :-

After adding in huge depreciation charges of approximately RM48.8 mil (average), the group generated net operating cash flow of approximately RM68.4 mil per annum before working capital changes.

(b) Very little of the group's cash flow is tied down in working capital. On average, approximately RM3.2 mil per annum was due to changes in inventories, receivables and payables.

(c) After factoring in the above items, the group generated average net operating cash flow of approximately RM65.1 mil per annum.

(d) Being a utility, the group is required to regularly invest in plant, machinery and equipment. On average, capital expenditure was approixmately RM81.4 mil per annum. After factoring in dividend and interest income, average net investing cashflow was approximately RM73.2 mil per annum.

(e) After dividend payment, the group experienced average cashflow deficit of RM18.3 mil per annum. To bridge the gap, the group has been tapping into its cash reserve as well as drawing down interest free loans from the State Government. As a result, group cash has been gradually reduced from RM78.1 mil to RM35.9 mil, while loans had increased to RM18.4 mil.

3. Cashflow Surplus After Tariff Hike

It is clear from the above analysis that the group will not be able to operate on sustainable basis. Fortunately, the Group managed to secure a tariff hike from the Ministry of Energy, Green Technology and Water which took effect from 1 April 2015 onwards.

In the June 2015 quarter, the tariff hike caused revenue to increase by RM8 mil without any corresponding increase in operating expenses.

As the group will be mostly tax free going forward (due to presence of huge reinvestment allowance), the additional RM32 mil (being RM8 mil annualised) could potentially flow directly to bottom line, resulting in significant increase in net profit and cash flow.

I have discussed the positive impact of the tariff hike on net profit in my 17 September 2015 article. The following is a simplistic financial model for the group's cash flow :-

As shown in table above, the tariff hike could potentially result in almost 50% increase in net operating cash flow, resulting in surplus of closed to RM23.9 mil per annum after capital expenditure.

This will put the group in a position to declare higher dividend. Without even tapping into its existing cash reserve of RM35.8 mil or new borrowings, the group can comfortably declare Dividend per Share of 7.2 sen per annum.

Based on latest share price of RM1.11, potential dividend yield of 6.5%.

With strong earnings visibility and potentially high dividend yield, PBA is a good stock to park your money in this time of uncertainty.

Sai Lang.

No comments:

Post a Comment