A New Beginning

Author: Icon8888 | Publish date: Tue, 10 Feb 2015, 09:12 PM

CI Holdings

C.i. Holdings Berhad (CIH) Snapshot

Open

1.01

|

Previous Close

1.01

| |

Day High

1.01

|

Day Low

1.01

| |

52 Week High

04/1/14 - 1.27

|

52 Week Low

10/16/14 - 0.98

| |

Market Cap

163.6M

|

Average Volume 10 Days

12.4K

| |

EPS TTM

-0.01

|

Shares Outstanding

162.0M

| |

EX-Date

03/16/12

|

P/E TM

--

| |

Dividend

--

|

Dividend Yield

--

|

Strong balance sheets. The group has net assets of RM136 mil, cash of RM74 mil (almost 50 sen per share) and borrowings of RM12 mil :-

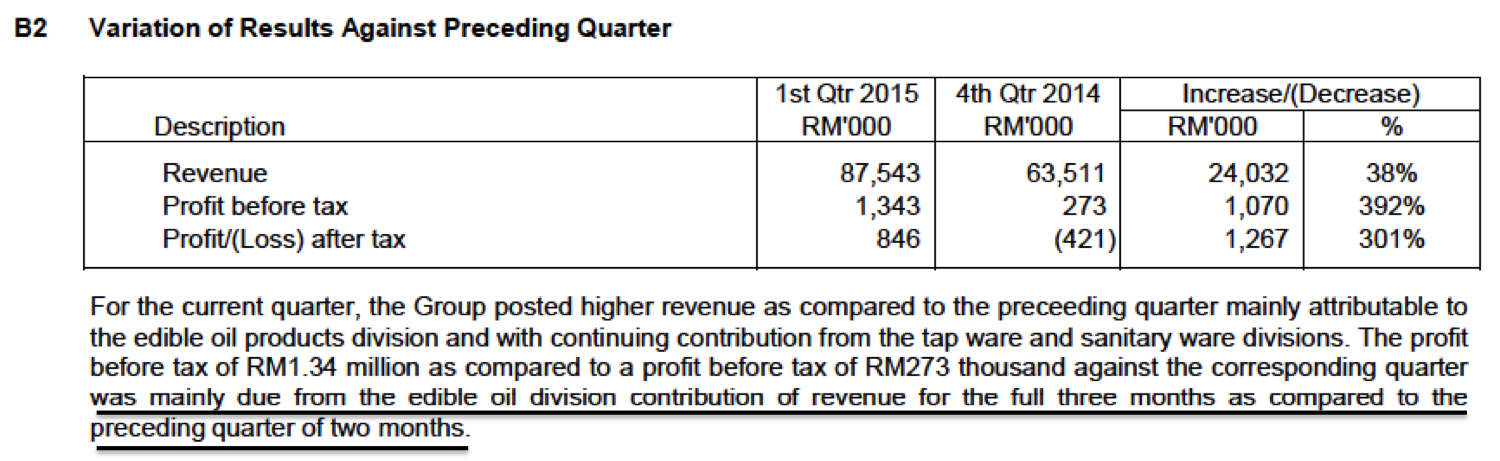

The group sold off its core business of soft drink distribution in 2012 and made a huge cash distribution back to shareholders. With the remaining cash (and through issuance of new shares), the group acquired Continental Resources Sdn Bhd (packaging of edible oil) in 2014. This new division started contributing to revenue and earnings in the recent two quarters.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-06-30 | 2014-09-30 | 87,543 | 1,343 | 846 | 0.52 | - | 0.8400 |

| 2014-06-30 | 2014-06-30 | 63,511 | 273 | -698 | -0.48 | - | 0.8300 |

| 2014-06-30 | 2014-03-31 | 9,593 | -2,105 | -2,145 | -1.51 | - | 0.8000 |

| 2014-06-30 | 2013-12-31 | 9,200 | 129 | 65 | 0.05 | - | 0.8200 |

| 2014-06-30 | 2013-09-30 | 9,953 | 327 | 216 | 0.15 | - | 0.8200 |

| 2013-06-30 | 2013-06-30 | 10,888 | 67 | -129 | -0.09 | - | - |

| 2013-06-30 | 2013-03-31 | 8,909 | -31 | -53 | -0.04 | - | 0.8200 |

| 2013-06-30 | 2012-12-31 | 9,789 | 99 | -47 | -0.03 | - | 0.8200 |

| 2013-06-30 | 2012-09-30 | 9,787 | -64 | -299 | -0.21 | - | 0.8200 |

| 2012-06-30 | 2012-06-30 | 10,019 | -688 | -260 | -0.18 | - | - |

| 2012-06-30 | 2012-03-31 | 10,396 | 1,410 | 1,172 | 0.83 | - | 1.3200 |

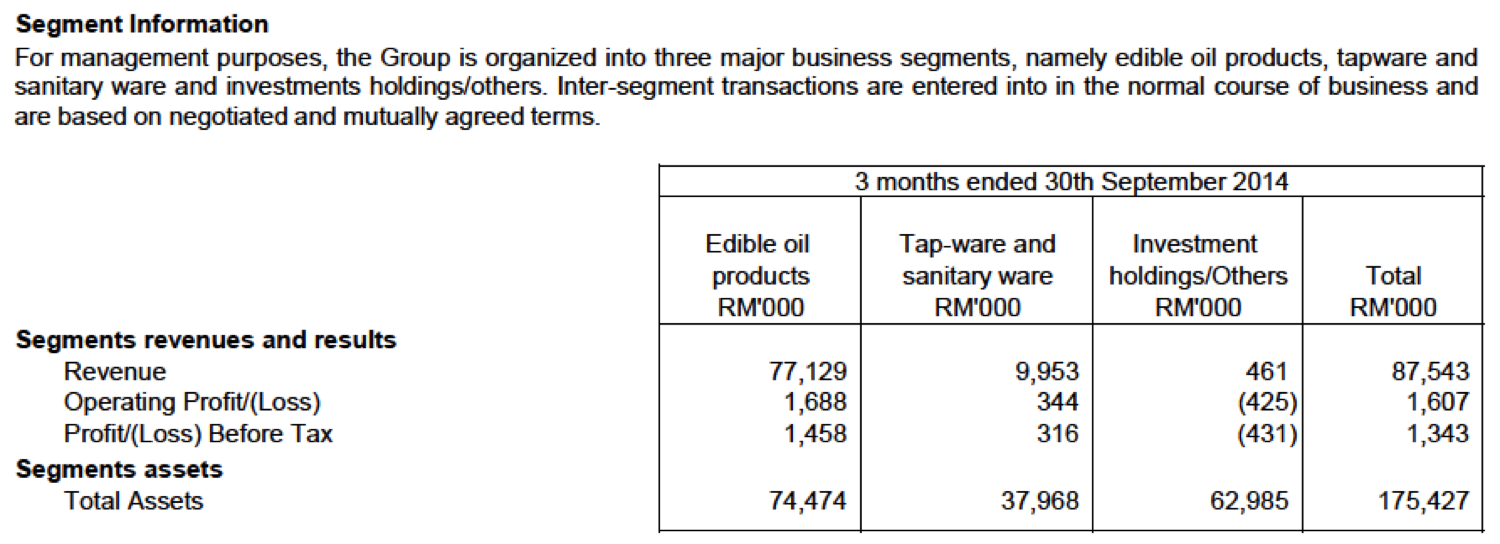

As shown above, the tapware and sanitary ware business is not really profotable. Earnings growth is driven by the edible oil packaging business.

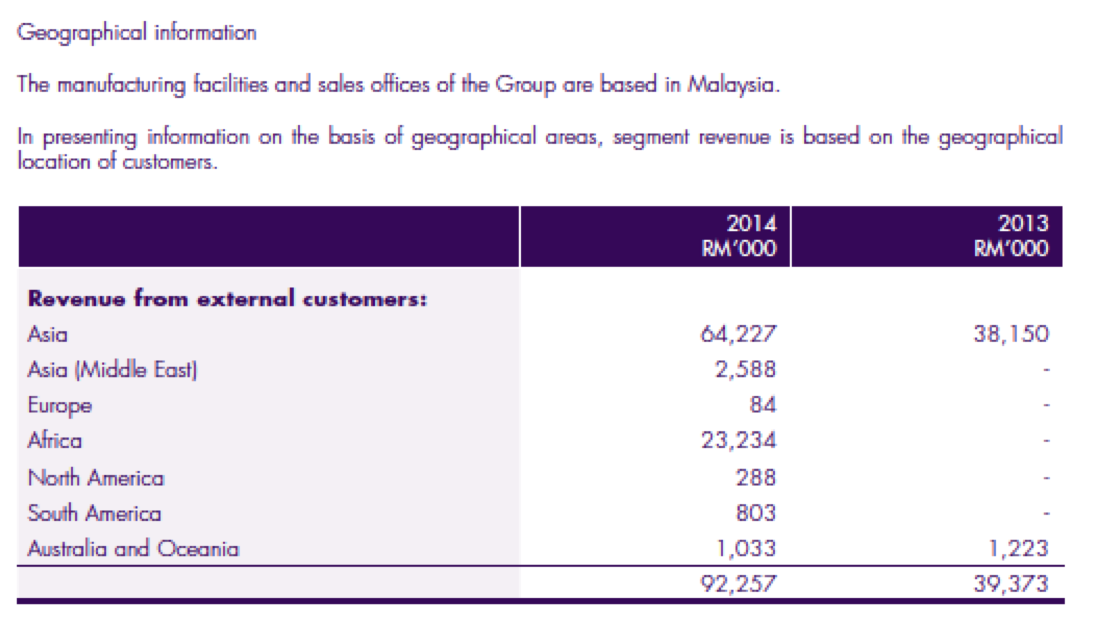

Continental Resources Sdn Bhd exports 85% of its products. It should benefit from recent weakening of Ringgit.

Comments

(a) Post disposal of Permanis and cash distribution, CI Holdings has acquired, inter-alia, Continental Resources Sdn Bhd as its new core business.

(b) The purchase consideration of RM42 mil (out of which RM20 mil was satisfied by issuance of new CI Holdings shares) represents PE multiple of 7 times (based on Continental net profit of RM6 mil).

(c) Continental exports 85% of its products, mainly to Middle East and Africa. CI Holdings will leverage on its marketing nertwork from the Permanis years to scale up the business.

(d) The recent weakening of Ringgit vs US Dollars augurs well for the group.

(e) I found Continental's business very interesting because it caters for the international market. As such, if managed properly, the scope for further growth is much larger than a company that sells only to domestic market.

CI's management team are specialists in consumer products manufacturing and distribution. They are now making use of those expertise to gradually build up the edible oil business.

(f) I don't mind having a small exposure to grow together with the company.

No comments:

Post a Comment