Two Consecutive Quarters of Super Profit

Author: Icon8888 | Publish date: Fri, 31 Jul 2015, 02:47 PM

1. Introduction

I first wrote about Luxchem on 4 January 2015.

http://klse.i3investor.com/blogs/icon8888/67652.jsp

Just to recap, Luxchem is involved in manufacturing and trading of Unsaturated Polyester Resin("UPR"), synthetic rubber and other industrial chemicals.

The group's customers use its products to manufacture a wide variety of plastic products such as waterproof materials, bath tub, automotive components, table top, boats, etc.

Open

1.08

|

Previous Close

1.03

| |

Day High

1.12

|

Day Low

1.08

| |

52 Week High

04/14/15 - 1.31

|

52 Week Low

10/16/14 - 0.67

| |

Market Cap

289.8M

|

Average Volume 10 Days

127.9K

| |

EPS TTM

0.09

|

Shares Outstanding

263.5M

| |

EX-Date

09/11/15

|

P/E TM

12.0x

| |

Dividend

0.05

|

Dividend Yield

4.09

|

2. March 2015 Earnings Disappointing And Yet Exciting

At the beginning of 2015, I was very concerned about Malaysia's economic outlook and was only interested in export oriented companies. Since the bulk of Luxchem's products are sold in Malaysia, I was lukewarm about the stock in my January 2015 article.

However, contrary to my view, Luxchem share price rallied over the subsequent few months. Due to lack of analyst coverage and publicly available information, I was not sure what was the reason. But I am sure whoever chasing up the share price must have done his homework and discovered that Luxchem will do well in low oil price environment.

The rally didn't last long. Share price succumbed to consistent selling, retracing from RM1.30 all the way to around RM1.10.

We soon found out why the insiders were busy selling down. On 8 May 2015, Luxchem announced a very weak set of result. Net profit declined by closed to 75% from RM6.2 mil to RM1.5 mil. This shocked many investors and triggered another round of selling, causing share price to declined to RM1.00.

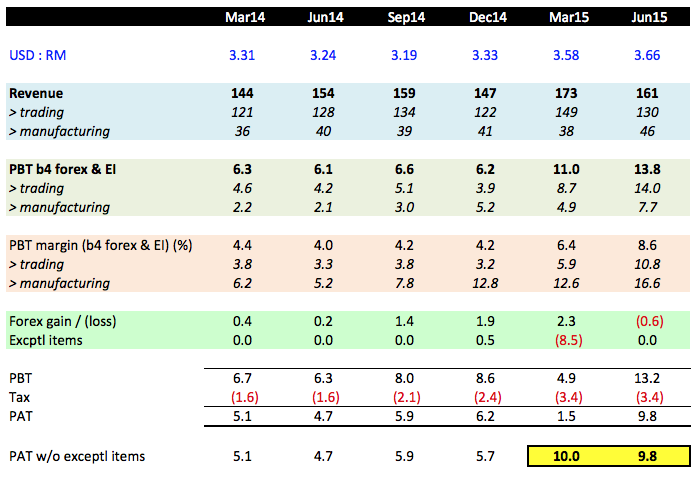

However, upon closer inspection, I found out that Luxchem has actually done very well in the March 2015 quarter. Its net profit was actually as high as RM10 mil, 61% higher than the RM6.2 mil in previous quarter. The reason its result was so weak was because of ESOS related expenses.

According to the company's explanation, during that quarter, they granted 32 mil ESOS to employees. The ESOS options were essentially Warrants, as it gives the holders the right to subscribe for new shares at a pre determined price. Based on Trinomial Option pricing model, each ESOS option has fair value of RM0.26. With 32 mil options given out, the total amount was RM8.5 mil.

It was this exceptional item that dragged down its Q1 2015 earnings.

In that quarter, the group actually saw improvement in operational parameters across the board. Not only turnover increased substantially, profit margin also experienced significant expansion, resulted in robust bottomline growth (please refer to table below).

I was excited about its performance but decided not to write about it. The main reason was because I was afraid that the strong result was due to stockpiling by customers ahead of GST and that future quarters might not be able to repeat the same performance.

3. Robust June 2015 Earnings

Yesterday, Luxchem reported excellent results for the quarter ended June 2015.

Despite slight dip in turnover, net profit came in at RM9.8 mil, tanslating into quarterly EPS of 3.75 sen. The strong earnings was achieved without any exceptional gain. As a matter of fact, there was a small forex loss of RM0.6 mil.

As usual, lack of information in the quarterly report made it difficult to explain how the sterling performnce was achieved. My guess is that they are related to lower raw material cost (low oil price) as well as strong US Dollars (which benefited the export segment).

If the group can sustain the recent two quarter's strong performance, we are potentially looking at net profit of RM40 mil for the full year, which translates into EPS of 15.2 sen based on 263 mil shares. At current price of RM1.10, prospective PER is 7.3 times.

4. Other Information

Luxchem has strong balance sheets. With net assets of RM171 mil, cash of RM87 mil and borrowings of RM61 mil, net cash is RM26 mil.

Together with the June 2015 results, the company declared dividend of 2 sen per share. In the past, they declare DPS of 6 to 8 sen per annum. This translates into dividend yield of at least 5.5%.

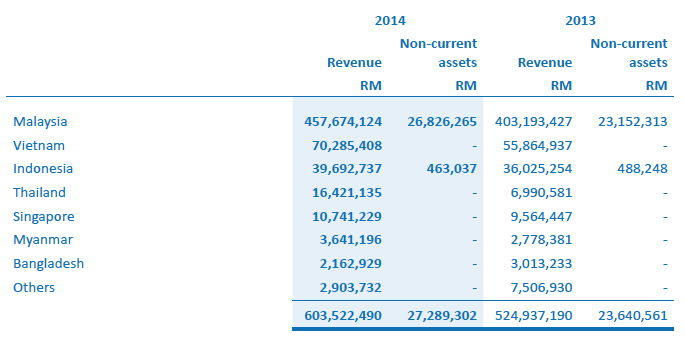

The group exports approximately 25% of its products.

No comments:

Post a Comment