Explosive Earnings Growth

Author: Icon8888 | Publish date: Thu, 12 Feb 2015, 11:11 AM

CIHB released Dec 2014 quarterly report yesterday, net profit grew by a massive 168% from RM0.846 mil to RM2.269 mil.

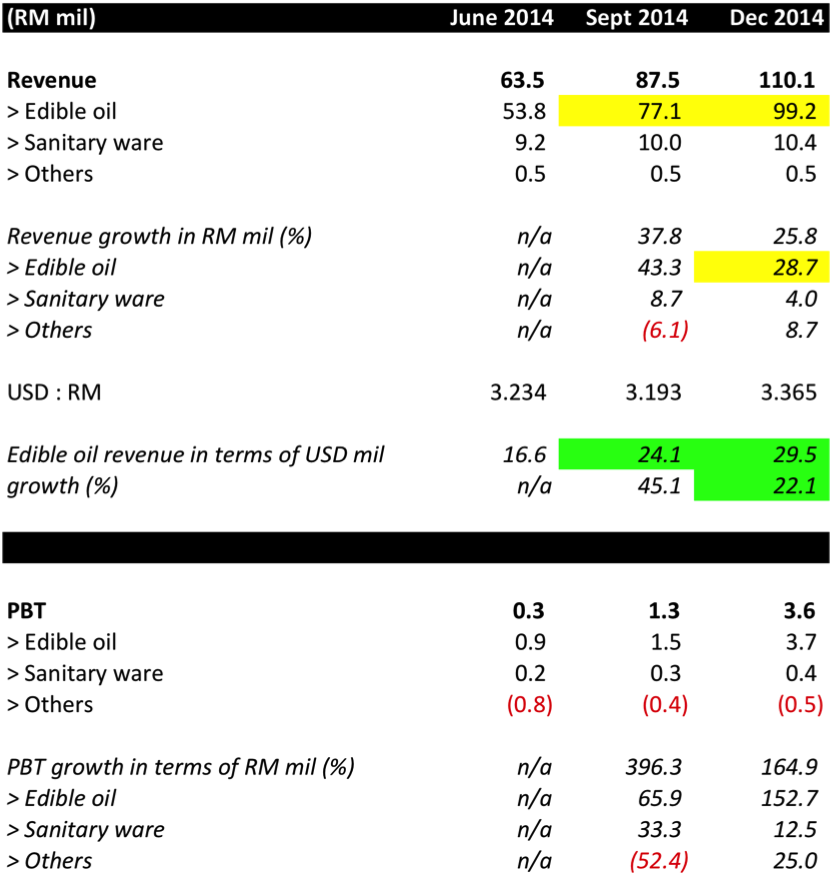

Quarter Result:

The driving force behind the growth is the edible oil packaging division. Its revenue grew by 28.7% q-o-q (from RM77.1 mil to RM99.2 mil).

However, the growth in revenue could be due to a combination of two factors :-

(a) volume growth; and

(b) weakening of RM against US dollar (every US dollar received by CIHB from oversea sales translates into more RM revenue).

In order to have a feel of the revenue growth without the effects of currency, I have divided the revenue by the average exchange rate during the relevant periods.

After making the adustments, it seemed that CIHB's edible oil packaging division grew its revenue from USD24.1 mil in September quarter to USD29.5 mil in December quarter.

The volume growth is a robust 22.1%.

Concluding Remarks

(a) After I first wrote about CIHB on 10 February 2015, I am pleasantly surprised one day later to see CIHB announced its quarterly result with robust growth in revenue and earnings.

(b) The revenue growth (and the correpsonding net profit growth) was mostly attributable to the edible oil packaging division, which sold 85% of its products overseas. Of course, the growth was aided by the stronger US dollar. However, upon closer inspection, it seemed that it is also successful in increasing its sales volume.

This is very important as the weak Ringgit will not be a permanent feature. The fact that the group is able to grow its sales volume is an indication of market acceptance of its products, which puts it in a position to further grow its business going forward.

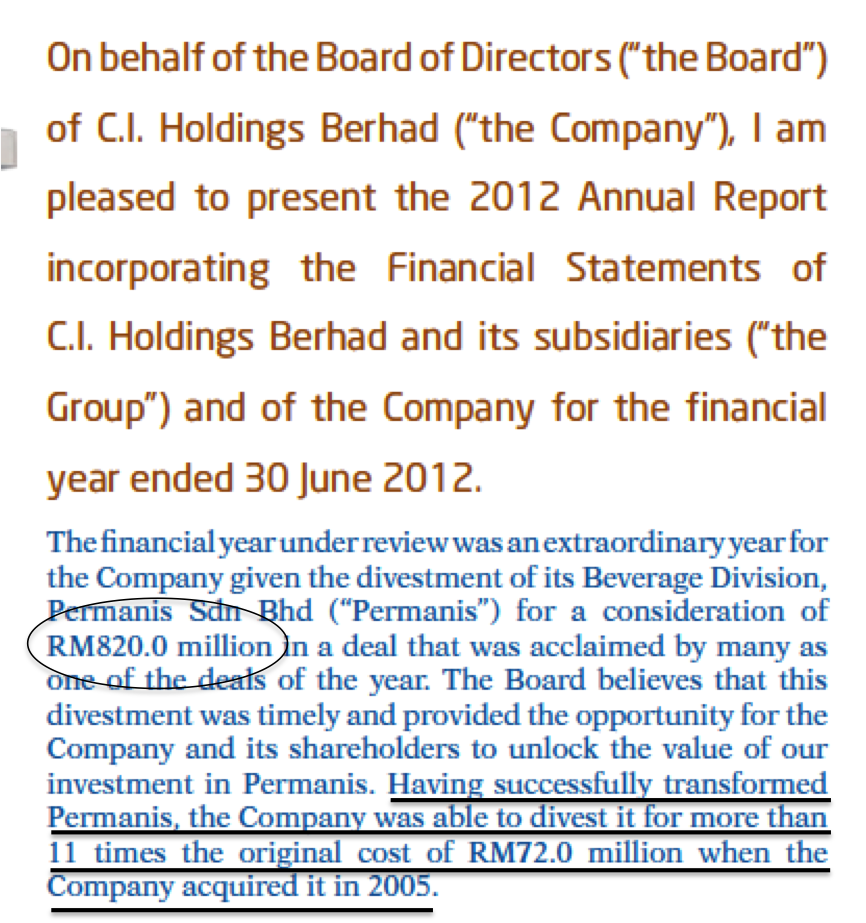

(c) As mentioned in Part 1, CIHB's management team are experts in consumer products business. After selling off KFC stakes, they focused on distributing Pepsi Cola (through Permanis).

The Permanis business was initially not profitable, with only RM0.766 mil net profit in 2005. However, over the years, the management team (led by the major shareholders) successfully grew the business to report RM40 mil net profit in 2011.

They subsequently sold off Permanis to Japanese buyer for an astounding RM820 mil. They distributed the bulk of the cash back to shareholders and utilised the remaining proceeds to acquire the current edible oil packaging business.

With such profit track record and tentative signs that it now posseses a new platform that can potentially repeat the same success story, it makes sense to buy into CIHB now despite its high historical PE multiple.

====================================================

Appendix 1 - The company's track record :-

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY |

|---|---|---|---|---|---|---|

| TTM | 270,778 | 272 | -0.07 | - | 0.00 | - |

| 2014-06-30 | 92,257 | -2,562 | -1.76 | - | - | - |

| 2013-06-30 | 39,373 | -529 | -0.37 | - | - | - |

| 2012-06-30 | 40,842 | 658,651 | 463.84 | 0.26 | 460.00 | 383.33 |

| 2011-06-30 | 43,800 | 40,094 | 28.24 | 11.66 | 12.00 | 3.65 |

| 2010-06-30 | 516,401 | 38,528 | 27.13 | 10.03 | 11.00 | 4.04 |

| 2009-06-30 | 362,981 | 20,975 | 16.15 | 6.57 | 7.00 | 6.60 |

| 2008-06-30 | 290,451 | 14,544 | 11.22 | 9.54 | 4.00 | 3.74 |

| 2007-06-30 | 265,775 | 7,868 | 6.07 | 14.50 | - | - |

| 2006-06-30 | 222,160 | -3,764 | -2.90 | - | - | - |

| 2005-06-30 | 267,975 | 766 | 0.59 | 101.70 | - | - |

Appendix 2 - Chairman's statement as set out in FY2012 annual report :-

No comments:

Post a Comment