Smallish Plastic Parts Manufacturer Expects Better Year Ahead

Author: Icon8888 | Publish date: Thu, 16 Jul 2015, 11:52 AM

Denko Industrial Corp Bhd (DEN) Snapshot

Open

0.30

|

Previous Close

0.28

| |

Day High

0.32

|

Day Low

0.30

| |

52 Week High

06/1/15 - 0.38

|

52 Week Low

12/15/14 - 0.18

| |

Market Cap

32.9M

|

Average Volume 10 Days

98.0K

| |

EPS TTM

0.03

|

Shares Outstanding

104.5M

| |

EX-Date

07/24/92

|

P/E TM

10.6x

| |

Dividend

--

|

Dividend Yield

--

|

1. Introduction

Denko is a plastic parts manufacturer based in Tampoi, Johor.

It caught my attention as it is in same industry as LCTH and Geshen and these two companies' share price has recently performed quite well (probably due to anticipated long term weakness of Ringgit pursuant to Iran nuclear deal).

Denko has very small market cap of RM33 mil (105 mil shares x RM0.31).

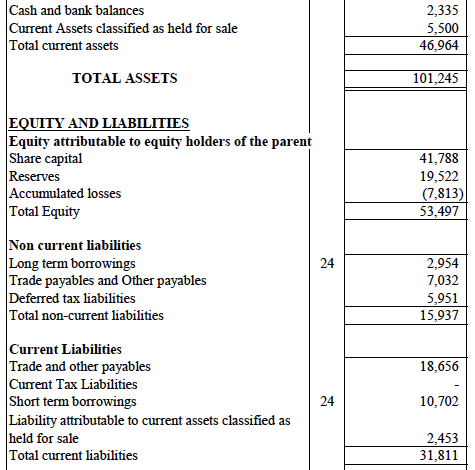

With shareholders' funds of RM54 mil, loans of RM13.7 mil and cash of RM2.3 mil, net gearing is 0.21 times. The bulk of the borrowings are bankers' acceptances (about RM9 mil), a type of short term borrowings usually used for working capital purpose.

The group has just announced proposed disposal of a piece of industrial land for RM7.5 mil. Part of the proceeds will be used to reduce gearing. Please refer to Section 3 below.

2. Historical Profitability

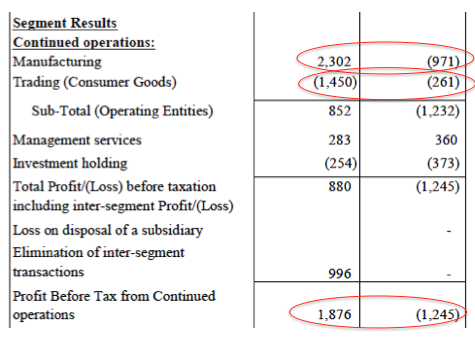

Denko has not been very profitable in the past but turned around in the latest quarter with EPS of 2.7 sen.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) |

|---|---|---|---|---|---|

| 2015-03-31 | 2015-03-31 | 22,758 | 1,876 | 2,826 | 2.71 |

| 2015-03-31 | 2014-12-31 | 18,794 | 194 | -51 | -0.05 |

| 2015-03-31 | 2014-09-30 | 19,001 | -101 | -101 | -0.10 |

| 2015-03-31 | 2014-06-30 | 19,525 | 376 | 428 | 0.41 |

| 2014-03-31 | 2014-03-31 | 16,887 | -1,245 | -143 | -0.14 |

| 2014-03-31 | 2013-12-31 | 20,145 | -564 | -676 | -0.65 |

| 2014-03-31 | 2013-09-30 | 18,911 | -2,425 | -2,389 | -2.29 |

| 2014-03-31 | 2013-06-30 | 21,356 | 291 | 173 | 0.17 |

| 2013-03-31 | 2013-03-31 | 21,557 | 1,354 | 120 | 0.11 |

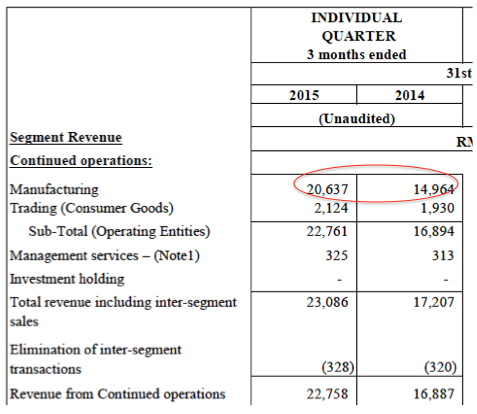

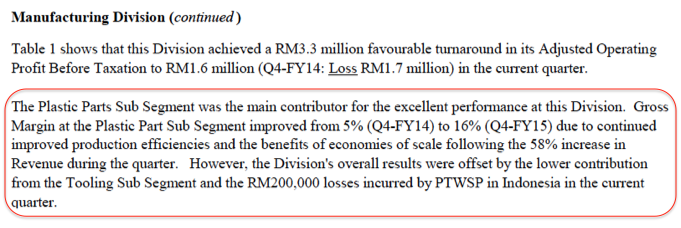

The improvement of profitability was due to higher revenue of its plastic parts manufacturing division.

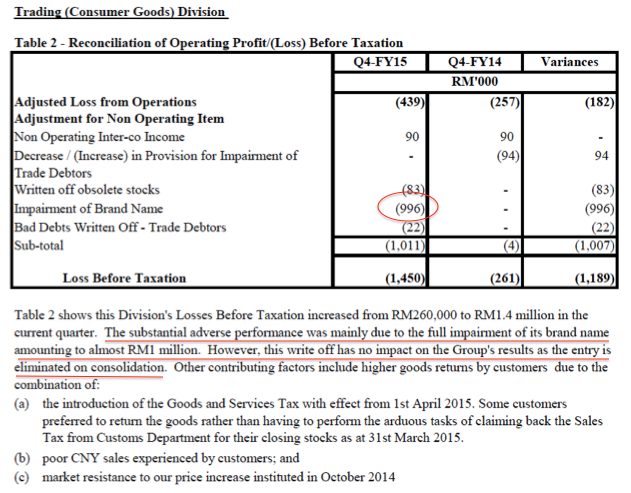

The trading division is principally involved in distribution of food items. It is a new set up and is relatively small. As shown in table above, this division reported operating loss of RM1.45 mil in lastest quarter, mostly due to impairment of brand name amountg to approximately RM1 mil. However, the actual impact to the group is very small after intra group elimination.

The company is upbeat about its current year prospects, expecting the latest quarter revenue and profitability to sustain going forward.

3. Disposal of Land

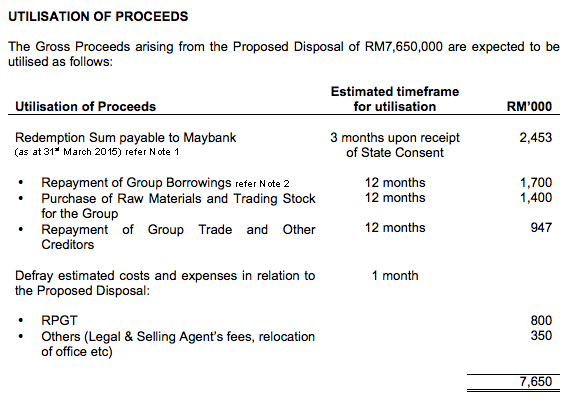

On 4 June 2015, the company announced the proposed disposal of a piece of industrial land in Bukit Mertajam, Penang for cash consideration of RM7.65 mil.

The land is currently being used by the group's trading division (not a core business) for warehouse. Following the disposal, warehousing will be outsourced to external parties.

The land was first acquired in 2011 for RM2.5 mil. The disposal will result in gain before tax of RM2.2 mil.

Most importantly, the disposal will allow the group to cut its borrowings by RM4.15 mil, reducing total borrowings from RM13.7 mil to RM9.55 mil.

The rest of the RM3.5 mil will be used for working capital, etc.

The land disposal is targeted to be completed within 9 months of SPA.

===================

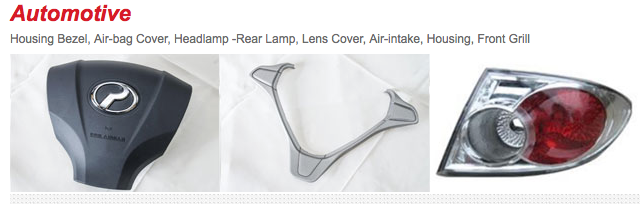

Appendix - Products Manufactured by The Group

No comments:

Post a Comment