Additional Information

Author: Icon8888 | Publish date: Sat, 21 Mar 2015, 02:17 PM

Introduction

After publishing the Jaycorp article on Friday, 20 March 2015, I carried out further study and noticed that there are certain information that could help readers to have better understanding of the group.

Instead of amending the original article, I decided to introduce the new information by writing Part 2.

Historical Profitability

(RM mil) Oct13 Jan14 Apr14 Jul14 FY2014 Oct14 Revenue 57.8 63.8 54.8 59.9 178.5 64.3 Investment hldg 0.0 0.0 0.0 0.0 0.0 0.0 Furniture 46.4 49.1 42.8 47.9 186.2 48.9 Packaging 5.0 5.0 4.7 5.1 19.8 5.2 Rubber wood 6.3 9.8 6.9 6.0 29.0 8.8 Renewable 0.0 0.0 0.3 0.9 1.2 1.3 others 0.0 0.0 0.1 0.1 0.2 0.0 PBT 3.6 3.6 3.0 3.4 13.6 3.5 Investment hldg 0.4 6.6 0.6 0.3 7.9 (0.7) Furniture (a) 2.7 4.9 3.3 2.0 12.9 3.2 Packaging (b) 0.6 0.6 0.4 0.4 2.0 0.5 Rubber wood (c) 0.7 (0.9) (0.1) 2.1 1.8 1.2 Renewable (d) 0.2 (0.8) (0.4) (0.8) (1.8) (1.1) others 0.3 0.2 0.3 0.2 1.0 0.2 Inter co elimination 0.0 (8.3) (1.3) (0.6) (10.2) 0.0 Taxation (0.9) (0.9) (0.5) (0.8) (3.1) (1.4) PAT 2.7 2.7 2.5 2.6 10.5 2.2 MI (e) (0.6) (0.2) (0.3) (0.9) (1.9) (1.0) Net profit 2.2 2.5 2.2 1.7 8.6 1.2

Comments :-

(a) On average, the furniture division reported PBT of RM3.2 mil per quarter.

(b) On average, the packaging division reported PBT of RM0.5 mil per quarter.

(c) The rubber wood division's performance was erratic. Profitability fluctuated between loss of RM0.9 mil and PBT of RM2.1 mil in FY2014.

(d) The renewable energy division (acquired in 2012) dragged down the group' overall performance with total loss before tax of RM1.8 mil in FY2014 and LBT of RM1.1 mil in Q1 of FY2015.

(e) It is likely that high minority interest (for example July and October 2014 quarter MI of RM0.9 mil and RM1.0 mil respectively) was due to strong performance of the rubber wood processing division. Jaycorp only owns 51% of the Indonesia based rubber wood manufactruing subsidiary.

Growing Through Mergers & Acquisitions

The Jaycorp group has a tradition of inorganic growth by taking over industry peers.

In 2000, the group acquired Winshine Industries Sdn Bhd, a rubber wood furniture manufacturer. They successfully turned Winshine around to become an exporter of dining sets to North America. Winshine was given an award by Walmart in 2005 for its good performance.

In 2007, Jaycorp acquired 60% equity interest in Digital Furniture Sdn Bhd which manufactures dining sets and bedroom sets. Post acquisition, Digital Furniture has contributed to group turnover and profitability.

On 12 February 2015, Jaycorp announced that it had entered into a Subscription Agreement to subscribe for 51% equity interest in Instyle Sofa Sdn Bhd (“ISSB”) for RM4.2 mil. Subsequent to the Subscription, ISSB becomes a 51%-owned subsidiary of Jaycorp.

ISSB is principally engaged in manufacturing of sofa sets, bed sets, chairs and upholstery works.

Rationale given by the company is as follows :-

"The Subscription will be strategic and beneficial to Jaycorp Group's furniture division as it provides an opportunity for Jaycorp Group to tap onto ISSB’s expertise and diversify into new export market segments such as sofa and non rubberwood furniture products.

The company believes that the prospect of the furniture industry is bright and still growing. The Malaysia furniture export for the nine months from January 2014 to September 2014 was RM5,904.8 million, a 11.9% growth compared to the same period last year. Increased demand from major export destinations such as the US, Japan and Australia for Malaysian-made furniture contributed to higher output.

Therefore, the investment in ISSB provides an opportunity for Jaycorp Group to seek out new markets in the furniture industry to maintain financial growth. "

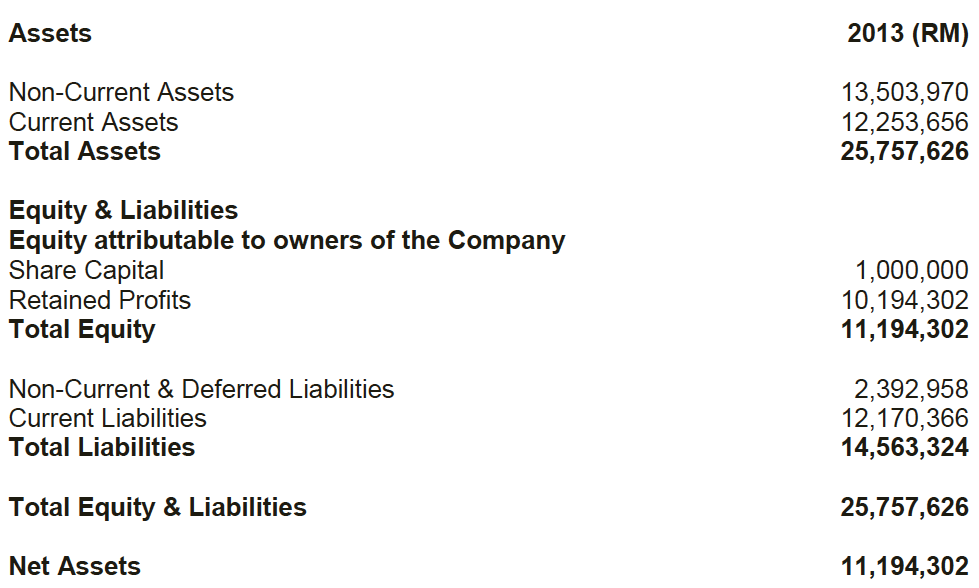

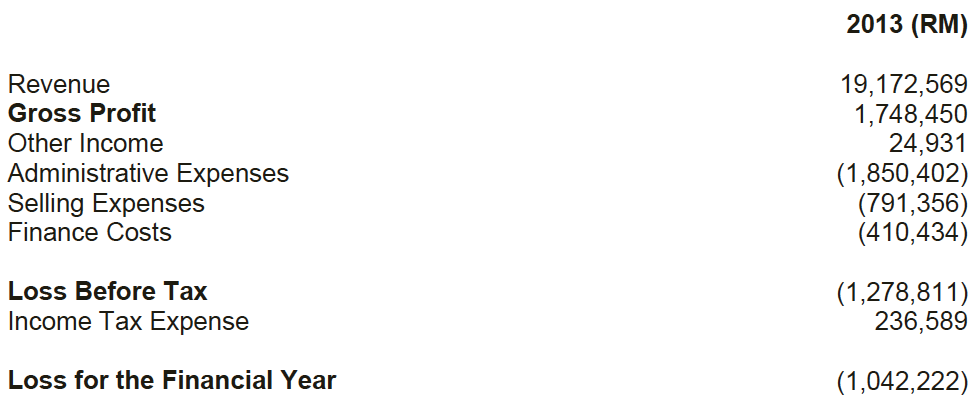

ISSB has a respectable size of operation with total assets of RM25.8 mil.

In 2013, ISSB reported revenue of RM19.2 mil and loss of RM1.0 mil.

In my opinion, we should not be unduly worried about Jaycorp buying into a loss making entity. The merger should create a lot of synergy for both parties. ISSB could tap into Jaycorp group's resources, financial strength, marketing network, etc to enhance its performance. I anticipate ISSB to turn around quickly after being incorporated into the Jaycorp group.

Concluding Remarks

(1) Anybody who buys into Jaycorp probably likes its high dividend yield of 4.8% (3 years in a row). PE wise, the stock doesn't look undervalued (approximately 12 times).

(2) However, upon closer inspection, the group's profitability has been dragged down by the renewable energy division. Improvement of this division's performance will quickly increase the group's overall profit.

(3) The company has just acquired 51% equity interest in a sofa manufacturing company (ISSB) through subscription of new shares.

I am positive about the transaction. ISSB's size of operation is quite respectable. Instead of starting from scratch, the acquisition will allow Jaycorp to scale up its operation quickly to take advantage of business opportunities presented by the existing favorable operating environment.

By leveraging on its resources, expertise and marketing network, Jaycorp should be able to turn ISSB around pretty quickly. This new asset could be a material source of growth for the coming few quarters.

(4) Last but not least, the Ringgit is now at 3.73 vs the US dollars. The coming quarter results (to be released over next two weeks) should reflect the positive impact of the strong US dollars.

Introduction

After publishing the Jaycorp article on Friday, 20 March 2015, I carried out further study and noticed that there are certain information that could help readers to have better understanding of the group.

Instead of amending the original article, I decided to introduce the new information by writing Part 2.

Historical Profitability

| (RM mil) | Oct13 | Jan14 | Apr14 | Jul14 | FY2014 | Oct14 |

| Revenue | 57.8 | 63.8 | 54.8 | 59.9 | 178.5 | 64.3 |

| Investment hldg | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Furniture | 46.4 | 49.1 | 42.8 | 47.9 | 186.2 | 48.9 |

| Packaging | 5.0 | 5.0 | 4.7 | 5.1 | 19.8 | 5.2 |

| Rubber wood | 6.3 | 9.8 | 6.9 | 6.0 | 29.0 | 8.8 |

| Renewable | 0.0 | 0.0 | 0.3 | 0.9 | 1.2 | 1.3 |

| others | 0.0 | 0.0 | 0.1 | 0.1 | 0.2 | 0.0 |

| PBT | 3.6 | 3.6 | 3.0 | 3.4 | 13.6 | 3.5 |

| Investment hldg | 0.4 | 6.6 | 0.6 | 0.3 | 7.9 | (0.7) |

| Furniture (a) | 2.7 | 4.9 | 3.3 | 2.0 | 12.9 | 3.2 |

| Packaging (b) | 0.6 | 0.6 | 0.4 | 0.4 | 2.0 | 0.5 |

| Rubber wood (c) | 0.7 | (0.9) | (0.1) | 2.1 | 1.8 | 1.2 |

| Renewable (d) | 0.2 | (0.8) | (0.4) | (0.8) | (1.8) | (1.1) |

| others | 0.3 | 0.2 | 0.3 | 0.2 | 1.0 | 0.2 |

| Inter co elimination | 0.0 | (8.3) | (1.3) | (0.6) | (10.2) | 0.0 |

| Taxation | (0.9) | (0.9) | (0.5) | (0.8) | (3.1) | (1.4) |

| PAT | 2.7 | 2.7 | 2.5 | 2.6 | 10.5 | 2.2 |

| MI (e) | (0.6) | (0.2) | (0.3) | (0.9) | (1.9) | (1.0) |

| Net profit | 2.2 | 2.5 | 2.2 | 1.7 | 8.6 | 1.2 |

Comments :-

(a) On average, the furniture division reported PBT of RM3.2 mil per quarter.

(b) On average, the packaging division reported PBT of RM0.5 mil per quarter.

(c) The rubber wood division's performance was erratic. Profitability fluctuated between loss of RM0.9 mil and PBT of RM2.1 mil in FY2014.

(d) The renewable energy division (acquired in 2012) dragged down the group' overall performance with total loss before tax of RM1.8 mil in FY2014 and LBT of RM1.1 mil in Q1 of FY2015.

(e) It is likely that high minority interest (for example July and October 2014 quarter MI of RM0.9 mil and RM1.0 mil respectively) was due to strong performance of the rubber wood processing division. Jaycorp only owns 51% of the Indonesia based rubber wood manufactruing subsidiary.

Growing Through Mergers & Acquisitions

The Jaycorp group has a tradition of inorganic growth by taking over industry peers.

In 2000, the group acquired Winshine Industries Sdn Bhd, a rubber wood furniture manufacturer. They successfully turned Winshine around to become an exporter of dining sets to North America. Winshine was given an award by Walmart in 2005 for its good performance.

In 2007, Jaycorp acquired 60% equity interest in Digital Furniture Sdn Bhd which manufactures dining sets and bedroom sets. Post acquisition, Digital Furniture has contributed to group turnover and profitability.

On 12 February 2015, Jaycorp announced that it had entered into a Subscription Agreement to subscribe for 51% equity interest in Instyle Sofa Sdn Bhd (“ISSB”) for RM4.2 mil. Subsequent to the Subscription, ISSB becomes a 51%-owned subsidiary of Jaycorp.

ISSB is principally engaged in manufacturing of sofa sets, bed sets, chairs and upholstery works.

Rationale given by the company is as follows :-

"The Subscription will be strategic and beneficial to Jaycorp Group's furniture division as it provides an opportunity for Jaycorp Group to tap onto ISSB’s expertise and diversify into new export market segments such as sofa and non rubberwood furniture products.

The company believes that the prospect of the furniture industry is bright and still growing. The Malaysia furniture export for the nine months from January 2014 to September 2014 was RM5,904.8 million, a 11.9% growth compared to the same period last year. Increased demand from major export destinations such as the US, Japan and Australia for Malaysian-made furniture contributed to higher output.

Therefore, the investment in ISSB provides an opportunity for Jaycorp Group to seek out new markets in the furniture industry to maintain financial growth. "

ISSB has a respectable size of operation with total assets of RM25.8 mil.

In 2013, ISSB reported revenue of RM19.2 mil and loss of RM1.0 mil.

In my opinion, we should not be unduly worried about Jaycorp buying into a loss making entity. The merger should create a lot of synergy for both parties. ISSB could tap into Jaycorp group's resources, financial strength, marketing network, etc to enhance its performance. I anticipate ISSB to turn around quickly after being incorporated into the Jaycorp group.

Concluding Remarks

(1) Anybody who buys into Jaycorp probably likes its high dividend yield of 4.8% (3 years in a row). PE wise, the stock doesn't look undervalued (approximately 12 times).

(2) However, upon closer inspection, the group's profitability has been dragged down by the renewable energy division. Improvement of this division's performance will quickly increase the group's overall profit.

(3) The company has just acquired 51% equity interest in a sofa manufacturing company (ISSB) through subscription of new shares.

I am positive about the transaction. ISSB's size of operation is quite respectable. Instead of starting from scratch, the acquisition will allow Jaycorp to scale up its operation quickly to take advantage of business opportunities presented by the existing favorable operating environment.

By leveraging on its resources, expertise and marketing network, Jaycorp should be able to turn ISSB around pretty quickly. This new asset could be a material source of growth for the coming few quarters.

(4) Last but not least, the Ringgit is now at 3.73 vs the US dollars. The coming quarter results (to be released over next two weeks) should reflect the positive impact of the strong US dollars.

No comments:

Post a Comment