New Lease of Life From Electric Vehicle Venture

Author: Icon8888 | Publish date: Thu, 19 Mar 2015, 04:20 PM

Executive Summary

(a) Boon Koon's expertise is in reconditoning of used commercial vehicles. It used to do well back in 2004 until 2008. However, due to changes in business environment, profitability declined substantially from 2009 onwards.

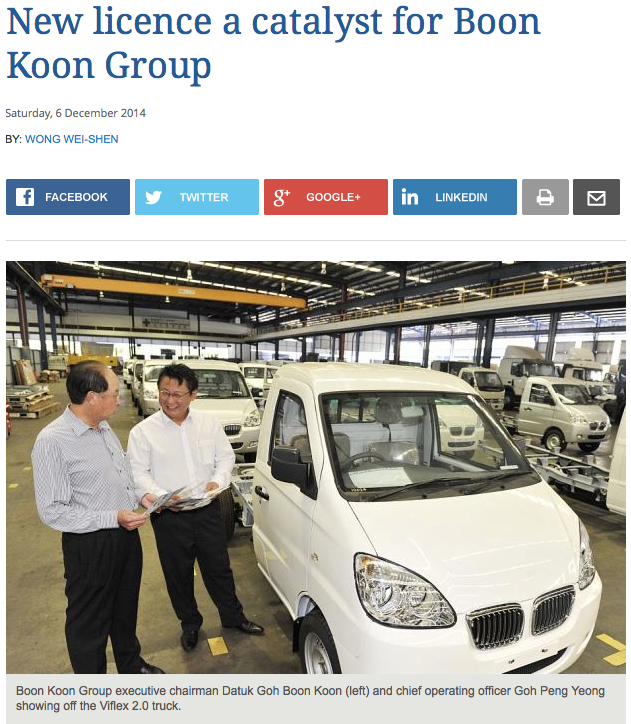

(b) Recently, Boon Koon obtained a license from the Malaysian government to assemble electric / hybrid commercial and passenger vehicles.

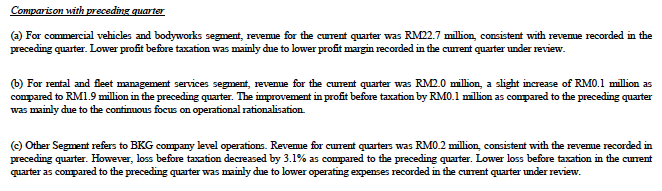

Boon Koon has teamed up with a China based car manufacturer to produce a commercial truck called Viflex 2.0. Viflex 2.0 is aimed at the small and medium enterprise and is priced at RM40,000.

Boon Koon originally plans to sell 300, 600 and 1,000 units in 2015, 2016 and 2017 respectively (translates into revenue of RM12 mil, RM24 mil and RM40 mil respectively). However, the vehicles turned out to be surprisingly popular (probably due to favorable economics). Within a short period of time, the entire 300 units had been taken up. In view of the favorable response, Boon Koon has now decided to bring forward the targeted 1,000 units from 2017 to 2016.

(c) A casual inspection of Boon Koon's price chart shows that the stock has more or less reached rock bottom at current level.

While this company does not really score well in terms of fundamentals, I feel that there is no harm taking a small position to try out my luck (a bit of speculation adds thrill to life).

Open

0.13

|

Previous Close

0.12

| |

Day High

0.13

|

Day Low

0.12

| |

52 Week High

07/17/14 - 0.16

|

52 Week Low

12/11/14 - 0.11

| |

Market Cap

33.2M

|

Average Volume 10 Days

1.3M

| |

EPS TTM

-0.0071

|

Shares Outstanding

276.8M

| |

EX-Date

05/29/06

|

P/E TM

--

| |

Dividend

--

|

Dividend Yield

--

|

Boon Koon Group is principally involved in the manufacture and trade of rebuilt commercial vehicles, reconditioned forklifts, etc.

It is also involved in the rental of commercial vehicles, forklift and equipment, etc.

Boon Koon Group is based in Seberang Perai Selatan, Malaysia.

Gearing is quite high. With net assets of RM71.8 mil, cash of RM3.7 mil and loans of RM44.7 mil, net gearing is 0.57 times.

The group used to be profitable back in 2004 to 2008. However, due to changes in business environment, the group's profitability declined substantially from 2009 onwards. In recent few years, the group is operating at break even level with minimal profit.

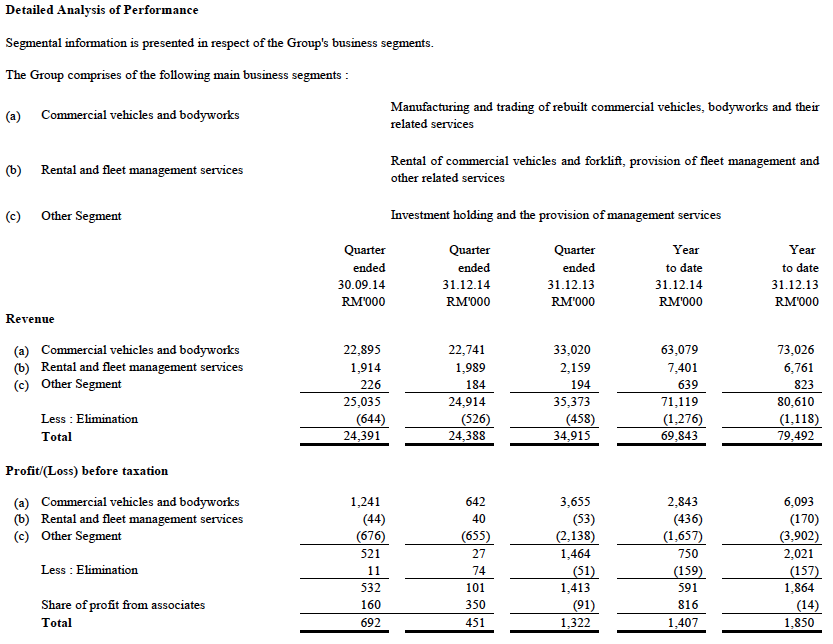

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|

| TTM | 94,890 | -1,982 | -0.71 | 0.2600 |

| 2014-03-31 | 104,539 | -988 | -0.36 | 0.2600 |

| 2013-03-31 | 144,191 | -6,881 | -4.97 | 0.3200 |

| 2012-03-31 | 153,862 | 5,341 | 3.86 | 0.3700 |

| 2011-03-31 | 158,342 | 2,229 | 1.61 | 0.3300 |

| 2010-03-31 | 153,998 | -413 | -0.30 | 0.3200 |

| 2009-03-31 | 188,200 | -60,974 | -43.87 | 0.3200 |

| 2008-03-31 | 204,567 | 18,533 | 12.30 | 0.7500 |

| 2007-12-31 | 213,886 | 16,665 | 12.00 | 0.7500 |

| 2006-12-31 | 169,671 | 16,869 | 14.00 | 0.7100 |

| 2005-12-31 | 158,435 | 13,893 | 11.00 | 0.6100 |

| 2004-12-31 | 93,622 | 15,671 | 14.00 | 0.7869 |

In the latest quarter, the group reported net profit of RM0.2 mil.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2015-03-31 | 2014-12-31 | 24,388 | 451 | 211 | 0.08 | 0.2600 |

| 2015-03-31 | 2014-09-30 | 24,391 | 692 | 359 | 0.13 | 0.2600 |

| 2015-03-31 | 2014-06-30 | 21,064 | 264 | 29 | 0.01 | 0.2600 |

| 2014-03-31 | 2014-03-31 | 25,047 | -2,798 | -2,581 | -0.93 | 0.2600 |

| 2014-03-31 | 2013-12-31 | 34,915 | 1,322 | 1,128 | 0.41 | 0.2700 |

| 2014-03-31 | 2013-09-30 | 25,092 | 819 | 771 | 0.28 | 0.2600 |

| 2014-03-31 | 2013-06-30 | 19,485 | -291 | -306 | -0.22 | 0.3200 |

| 2013-03-31 | 2013-03-31 | 25,416 | -9,106 | -8,036 | -5.81 | - |

| 2013-03-31 | 2012-12-31 | 36,450 | 483 | 437 | 0.32 | 0.3800 |

| 2013-03-31 | 2012-09-30 | 41,826 | 345 | 230 | 0.17 | 0.3800 |

| 2013-03-31 | 2012-06-30 | 40,499 | 381 | 488 | 0.35 | 0.3800 |

| 2012-03-31 | 2012-03-31 | 31,303 | -2,086 | -338 | -0.24 | - |

Appendix - Article By The Star

No comments:

Post a Comment