Exports 84% of Its Products

Author: Icon8888 | Publish date: Mon, 16 Feb 2015, 02:24 PM

Wtk Holdings Berhad (WTKH) Snapshot

Open

1.21

|

Previous Close

1.21

| |

Day High

1.22

|

Day Low

1.20

| |

52 Week High

03/26/14 - 1.49

|

52 Week Low

12/15/14 - 0.95

| |

Market Cap

577.8M

|

Average Volume 10 Days

599.7K

| |

EPS TTM

0.13

|

Shares Outstanding

477.5M

| |

EX-Date

07/11/14

|

P/E TM

9.3x

| |

Dividend

0.03

|

Dividend Yield

2.08%

|

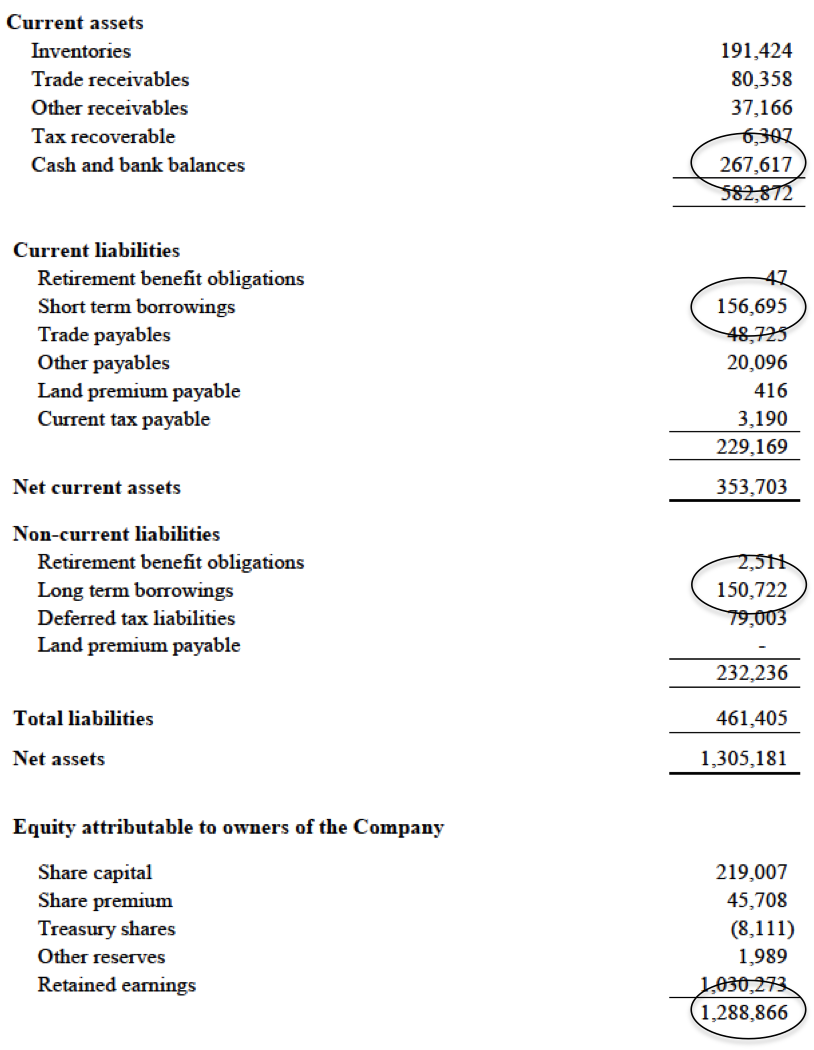

The group has strong balance sheets. With net assets of RM1.29 billion, lonas of RM308 mil and cash of RM268 mil, net gearing is 3% only.

The group reported net profit of RM55.8 mil over past twelve months. Based on existing market cap of RM578 mil, PER is 10.4 times.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 155,576 | 14,732 | 9,708 | 2.24 | - | 2.9700 |

| 2014-12-31 | 2014-06-30 | 180,976 | 15,017 | 10,913 | 2.51 | - | 2.9700 |

| 2014-12-31 | 2014-03-31 | 169,585 | 18,801 | 15,878 | 3.66 | - | 2.9400 |

| 2013-12-31 | 2013-12-31 | 197,802 | 15,869 | 19,348 | 4.46 | 2.52 | 2.9200 |

| 2013-12-31 | 2013-09-30 | 159,182 | 18,083 | 13,940 | 3.21 | - | 2.8700 |

| 2013-12-31 | 2013-06-30 | 184,078 | 14,962 | 11,668 | 2.69 | - | 2.8600 |

| 2013-12-31 | 2013-03-31 | 173,779 | 12,702 | 9,428 | 2.17 | - | 2.8300 |

| 2012-12-31 | 2012-12-31 | 195,624 | 11,090 | 9,611 | 2.21 | 2.80 | - |

| 2012-12-31 | 2012-09-30 | 199,314 | 21,102 | 17,239 | 3.97 | - | 2.7900 |

| 2012-12-31 | 2012-06-30 | 170,184 | 11,251 | 8,516 | 1.96 | - | 2.8100 |

| 2012-12-31 | 2012-03-31 | 203,553 | 11,025 | 9,304 | 2.14 | - | 2.7900 |

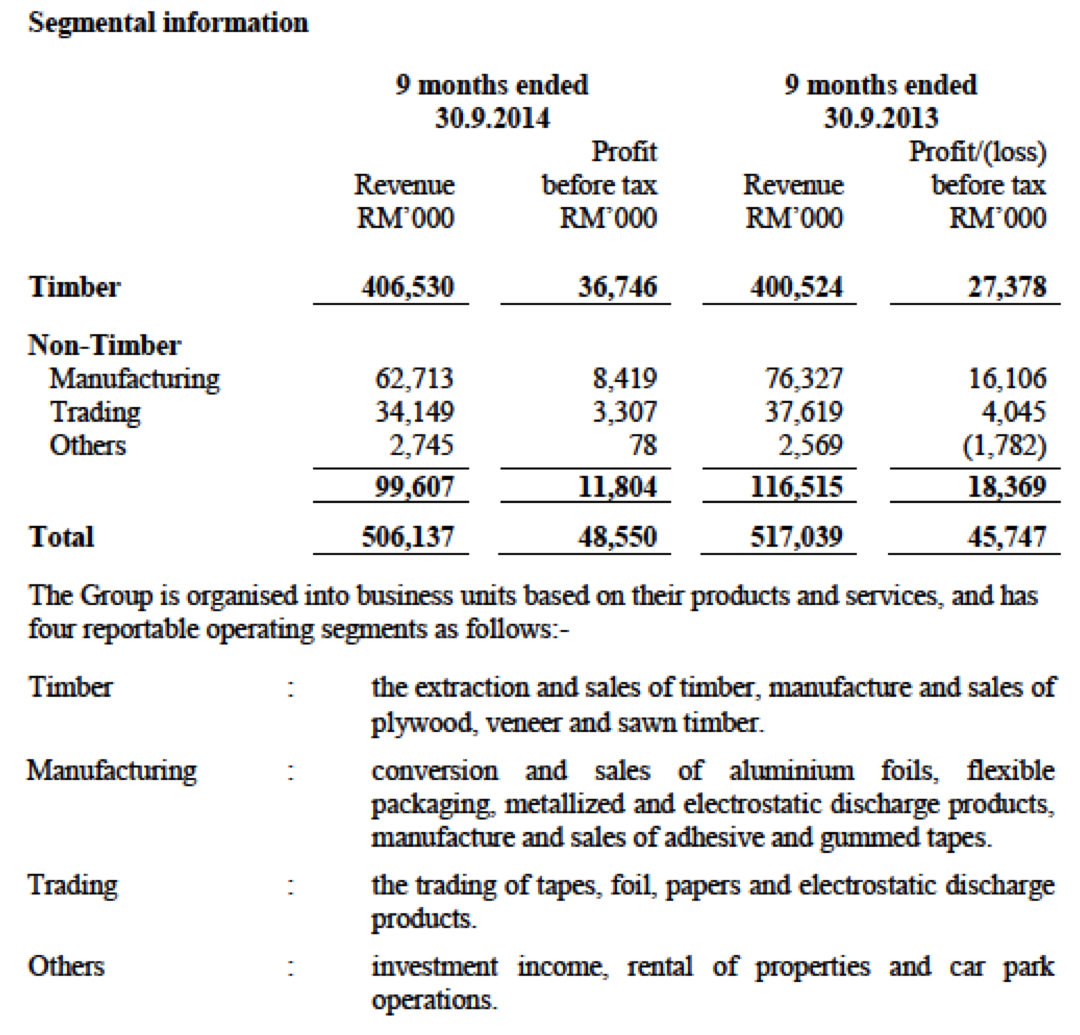

Timber operation accounted for the bulk of the revenue and earnings :-

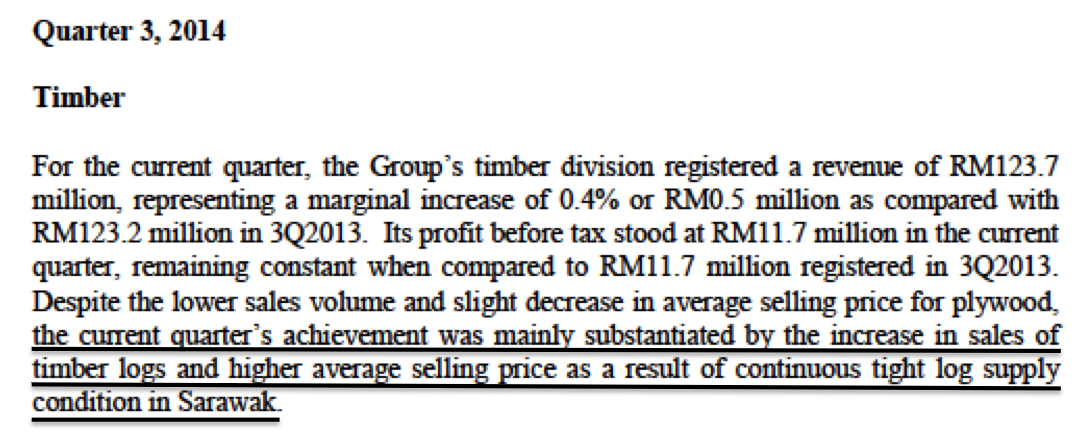

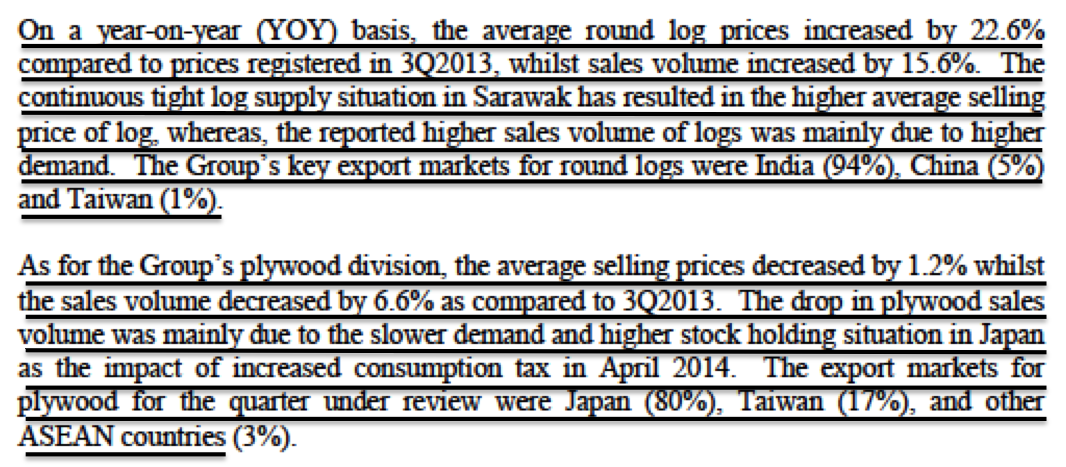

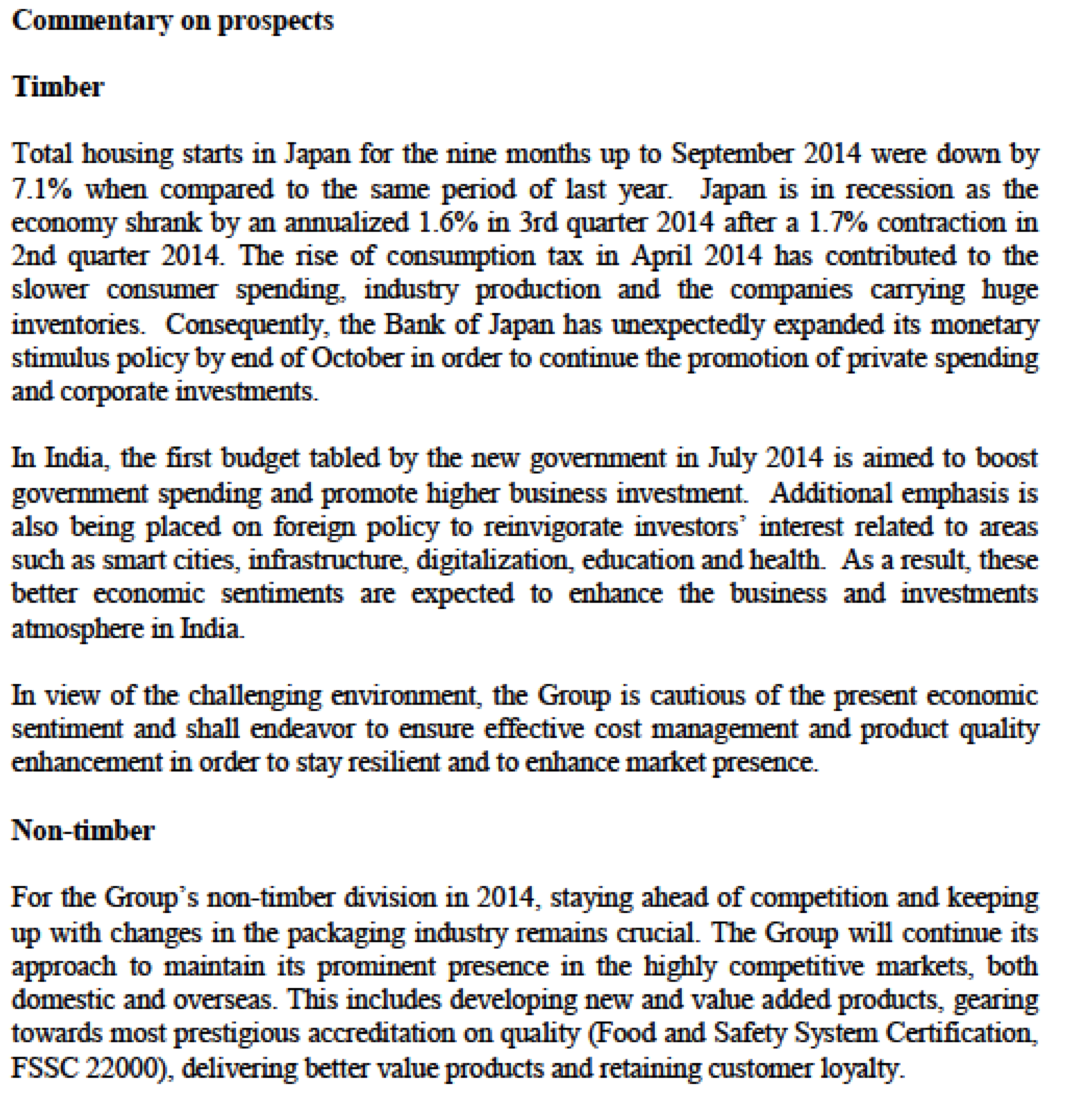

September 2014 quarterly performance review for the timber division :-

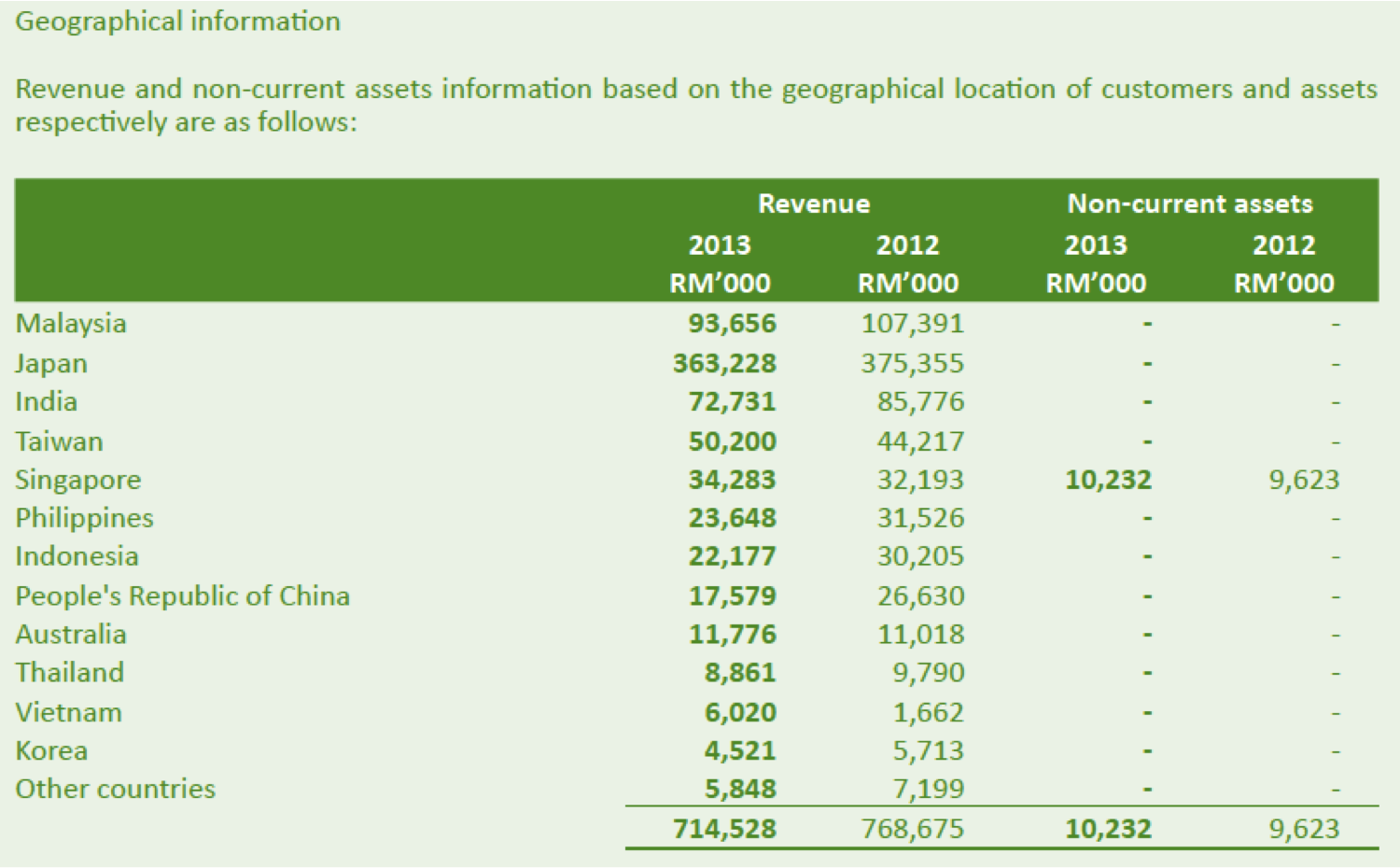

According to FY2013 annual report, WTK exports closed to 84% of its products (only RM93 mil out of RM714 mil is Malaysia sales)

The group also has about 11,000 hectares of planted oil palm plantations as at December 2013. The plantations do not contribute much yet. The group is planting another 1,000 hectares. Target to complete planting by 2018.

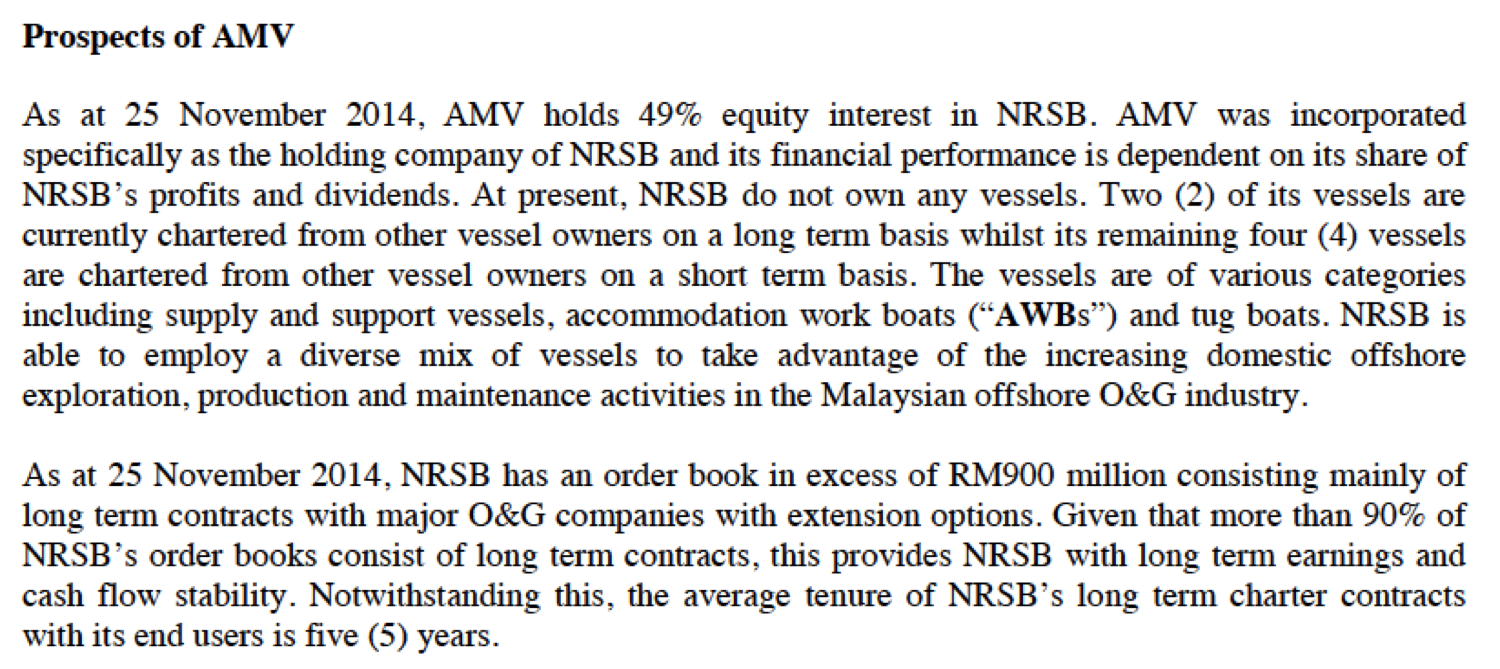

In December 2014, the company announced the proposed acquisition of Alanya Marine Ventures Sdn Bhd ("AMV") for purchase consideration of RM94.6 mil to be satisfied as follows :-

(a) cash consideration of RM38.3 mil; and

(b) share consideration of RM56.3 mil via issuance of 43 mil new WTK shares at RM1.30.

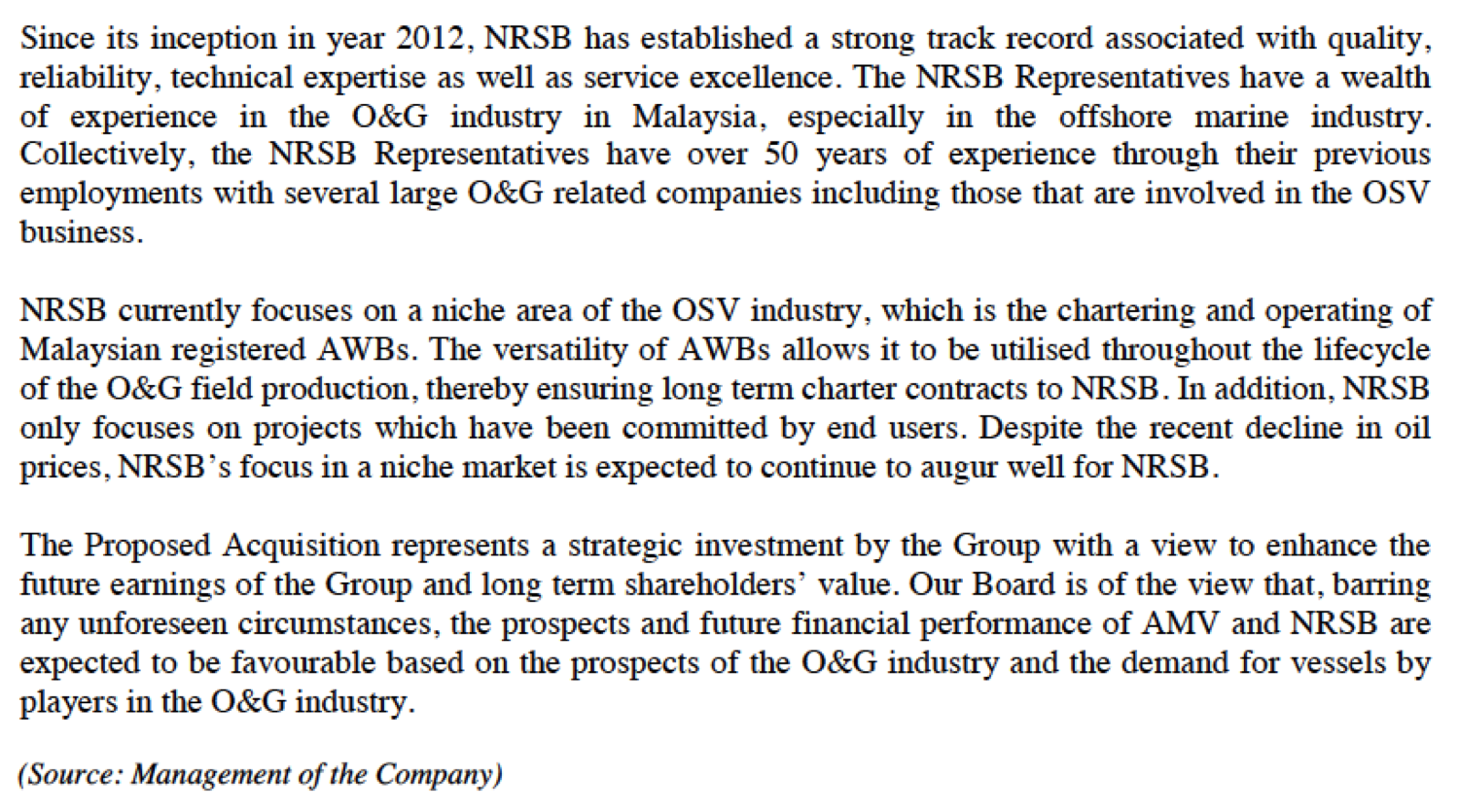

AMV holds 49% of Nautical Returns Sdn Bhd ("NRSB"). NRSB operates offshore support vessels and provides engineering and consuktancy services for oil and gas activities. NRSB is a licensed operator by Petronas.

NRSB is expected to registed net profit of RM10.9 mil and RM17.2 mil for FYE 31 December 2015 and 2016 respectively. NRSB has order book of RM900 mil over next five years,

Concluding Remarks

(a) WTK caught my attention (belatedly) due to 84% of its revenue are from oversea sales. The group is expected to benefit from the stong US dollars.

(b) The coming quarter will be released soon. Factors that could affect its peorformance are :-

(i) exchange rate - USD : RM exchange rate was 3.193 and 3.365 for Q3 and Q4 2014 respectively. The Q4 figure was 5.4% higher than that of Q3.

(ii) log harvested - as a timber company, WTK is required to announce monthly timber extraction volume. According to announcements, the group extracted 122,680 cubic meters in Q4 2014 vs 132,234 cubic meters in Q3 2014, a decline of 7.3% (probably due to rainy season).

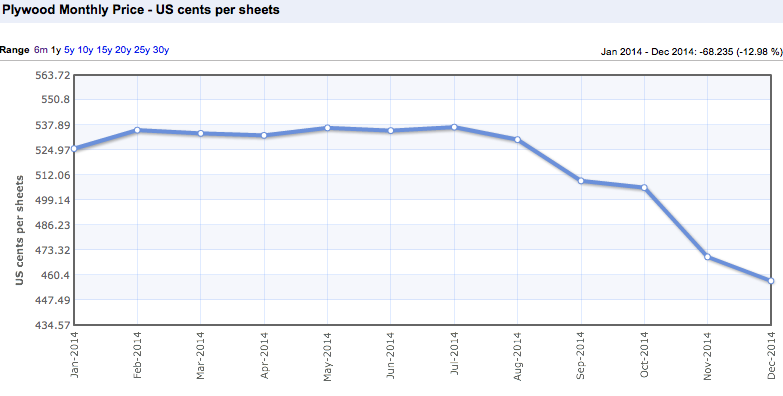

(iii) plywood prices - based on rough estimate, plywood prices averaged about USD5.25 per sheet and USD4.78 per sheet in Q3 and Q4 2014 respectively, down by 9%.

(iv) log prices - I dont have the relevant figures. But I understand that log prices has been firm due to curtailment of logging by Myanmar and increasing demand from India.

No comments:

Post a Comment