Earning Spike Generates A Lot of Excitement

Author: Icon8888 | Publish date: Mon, 20 Jul 2015, 01:03 PM

(Japanese connection brings food to the table)

1. Background Information

Bintai Kinden Corporation (BKC) Snapshot

Open

0.33

|

Previous Close

0.32

| |

Day High

0.33

|

Day Low

0.32

| |

52 Week High

06/2/15 - 0.45

|

52 Week Low

05/22/15 - 0.21

| |

Market Cap

68.6M

|

Average Volume 10 Days

2.2M

| |

EPS TTM

0.05

|

Shares Outstanding

214.4M

| |

EX-Date

09/15/04

|

P/E TM

6.8x

| |

Dividend

--

|

Dividend Yield

--

|

Bintai Kinden Corporation Berhad is principally involved in provision of Mechanical and Electrical Engineering services ("M&E"). Basically, they are the contractor that installs the air conditioning system, lifts and escalators, lighting system, piping systems, etc in offices, high rise buildings, commercial properties, etc.

Bintai has been in the industry for a long time and is widely recognized as a strong and reputable player.

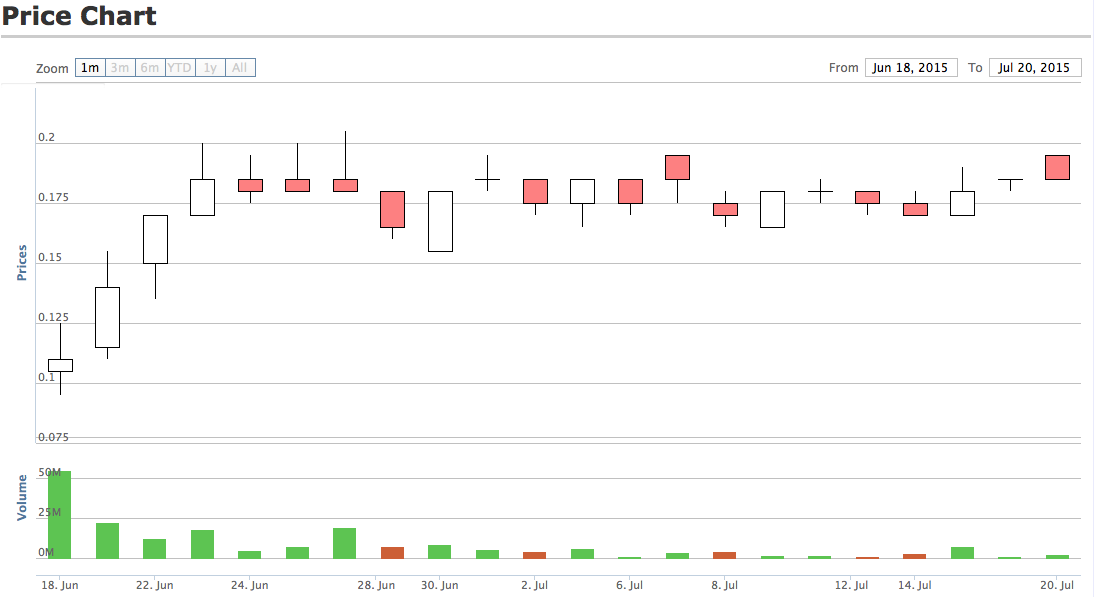

2. Recent Earning Spike

Bintai has not performed well in the past. But on 28 May 2015, it released its quarterly report for the 3 months ended 31 March 2015 with strong net profit of RM9.8 mil. As a result, share price saw a huge spike from approximately 25 sen to as high as 45 sen over subsequent few days.

Share price has since come down and is now trading at approximately 32 sen.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) |

|---|---|---|---|---|---|

| 2015-03-31 | 2015-03-31 | 158,885 | 13,021 | 9,784 | 9.60 |

| 2015-03-31 | 2014-12-31 | 136,859 | 4,447 | 6,087 | 5.97 |

| 2015-03-31 | 2014-09-30 | 111,664 | -6,191 | -5,074 | -4.98 |

| 2015-03-31 | 2014-06-30 | 66,458 | -5,672 | -4,762 | -4.67 |

| 2014-03-31 | 2014-03-31 | 80,213 | 2,954 | -1,732 | -1.70 |

| 2014-03-31 | 2013-12-31 | 82,235 | 2,093 | 1,037 | 1.02 |

| 2014-03-31 | 2013-09-30 | 116,953 | 4,247 | 3,149 | 3.09 |

| 2014-03-31 | 2013-06-30 | 119,401 | -3,253 | -3,960 | -3.89 |

| 2013-03-31 | 2013-03-31 | 142,897 | 4,295 | 1,285 | 1.26 |

The strong quarter fired investors' imagination. Due to lack of analyst coverage, there is not sufficient information to gauge how the group will perform going forward. However, it does have a healthy order book.

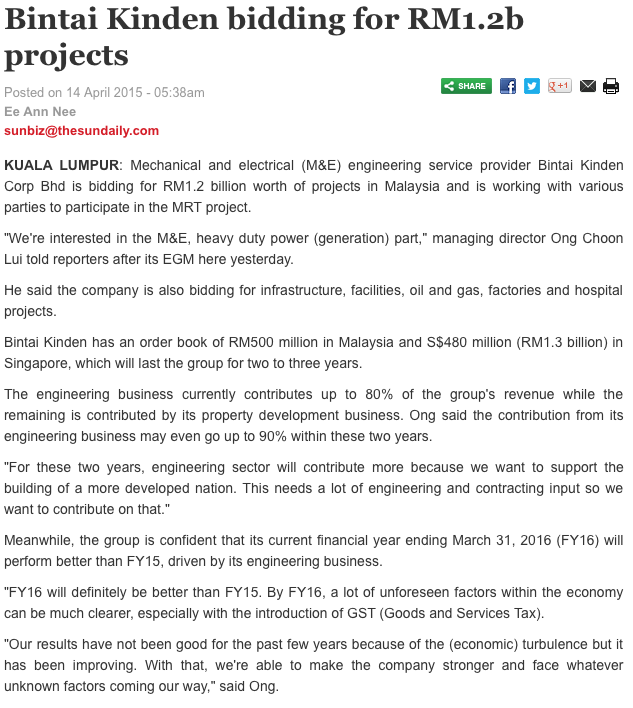

3. Order Book

According to The Sun's article above, Bintai has order book of RM500 mil and SGD480 mil (RM1.3 billion) respectively. However, I hesitate to assume that they have an order book of RM1.8 billion (being RM500 mil plus RM1.3 billion) due to the following two reasons :-

(a) Bintai's Singapore subsidiary is only 69.82% owned; and

(b) I am not sure whether the RM1.8 billion was the order book outstanding or the original vaue of the contracts secured.

Not withstanding the above, the article was very clear to mention that the group has sufficient works to last for two to three years. Over the past twelve months, the group recorded revenue of RM474 mil. However, RM60 mil was from property development. As such, construction revenue was approximately RM414 mil. If that is the case, is order book size at least RM800 mil ?

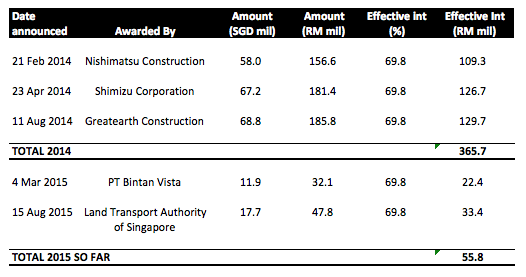

The following are details of Bintai's contract win from 2014 until mid 2015 :-

In 2014 alone, Bintai secured new contracts of RM366 mil (based on 69.82% equity interest in the relevant subsidiary). So far during the first 6 months of 2015, total contracts secured was RM56 mil. The group is currently bidding for RM1.2 billion contracts.

4. Gearing A Bit High

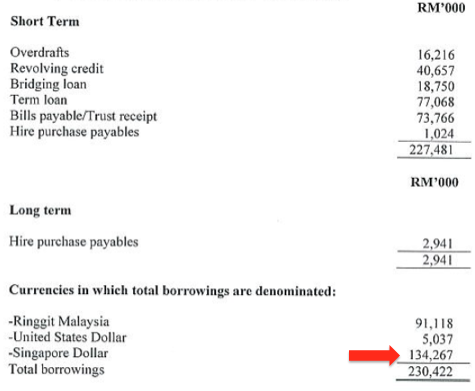

As at 31 March 2015, the group has borrowings of RM230 mil. Based on net assets of RM66 mil, gearing is 3.5 times.

By any measure, this level of gearing is considered high. However, in my opinion, its financial position is not as precarious as it looked.

This is because at least RM134 mil is housed under its 69.82% Singapore subsidiary, which has been doing very well and was responsible for securing the bulk of the group's contracts over past few years.

These borrowings are very likely (or should I use a stronger word, "definitely") bridging loans to finance the construction jobs. These loans will be extinguished upon completion of the projects.

4. Major Shareholder, Kinden Corp

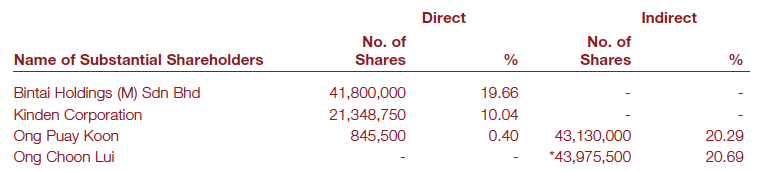

Kinden Corporation owns 10% equity interest in the company :-

Kinden is a world class Japanese M&E contractor with operation in many countries.

5. Bintai-WA

The company has 100.7 mil Warrants outstanding. The WA was issued on 15 June 2015 and will expire on 15 June 2020. Exercise price is RM0.20.

Based on latest price of RM0.19 and mother share price of RM0.32, conversion premium is 22%. This conversion premium is reasonable as it is within the range of 20% to 30% for Warrants trading in Bursa.

6. Concluding Remarks

(a) Bintai is not a new comer. It has been in the industry for a long time. However, since 2001, it has not done so well. This has led to a massive derating of its share price.

(b) However, its fortune started to improve in recent two years. It seemed that their decision to focus on the Singapore market has started to bear fruits, with its 69.82% owned Singapore subsidiary securing one contract after another.

(c) This subsidiary is expected to continue to do well going forward, aided by its Japanese connection. I can't help but to notice that out of RM366 mil contracts secured in 2014, RM235 mil were from Japanese clients (64% of total contract win). That is the reason why I dedicated a section in this article to highlight that Kinden Corp owns 10% in the company.

(d) Due to insufficient information, I am not able to pin down the exact order book outstanding. It is believed that the amount should be sufficient to last the company for at least another two years.

In any event, I don't think investors should be too fixated about the exact amount. The more important point is that Bintai seemed to have found a winning formula (through partnerships with Singaporean and Japanese parties) to secure construction contracts. Hopefully this positive momentum can be maintained.

============

Appendix - The Sun Article Dated 14 April 2015

No comments:

Post a Comment