Author: icon8888 | Publish date: Mon, 14 Dec 2015, 01:03 PM

At the beginning of the year, certain sharp eye investors spotted Superlon when it was trading at approximately 70 sen.

In the subsequent few quarters, the Group came up to expectation and delivered a series of strong profitability. As a result, share price has been rising steadily.

On 10 December 2015, Superlon announced EPS of 6 sen for the quarter ended 30 September 2015. The company also announced second interim dividend of 3 sen per share. As a result, share price got a big boost and went up to all time high of RM2.40 on 11 December 2015.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2016-04-30 | 2015-10-31 | 22,357 | 5,850 | 4,798 | 6.04 | 3.00 | 1.0957 |

| 2016-04-30 | 2015-07-31 | 22,106 | 4,999 | 3,856 | 4.86 | 2.00 | 1.0553 |

| 2015-04-30 | 2015-04-30 | 20,872 | 4,152 | 3,241 | 4.08 | - | 1.0067 |

| 2015-04-30 | 2015-01-31 | 19,320 | 3,902 | 2,939 | 3.70 | - | 0.8002 |

| 2015-04-30 | 2014-10-31 | 17,109 | 2,965 | 2,081 | 2.62 | 6.00 | 0.7832 |

| 2015-04-30 | 2014-07-31 | 17,208 | 1,535 | 1,120 | 1.41 | 2.00 | 0.7570 |

However, the company's share price soon succumbed to profit taking and went down to as low as RM1.97 this morning.

As mentioned in my earlier article "Three Ways To Punt The Market", I recognised "Surf Riding" (buy high sell high) as a legitimate way of benefiting from an industry up cycle.

I am positive about Superlon's prospects. The group is a beneficiary of weak Ringgit as it exports most of its products. I am of the view that Ringgit will remain weak in 2016 due to :-

(1) US interest rate hike;

(2) low oil price; and

(2) weakening of Renminbi (which caps potential upside of Ringgit).

This morning, I decided to pick up some Superlon at RM2.00.

My decision to buy is guided by Superlon's PE multiple. I am not sure whether RM2.00 is the bottom. As such, I have made preparation to average down if necessary.

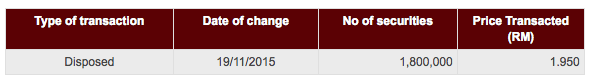

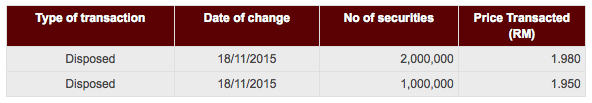

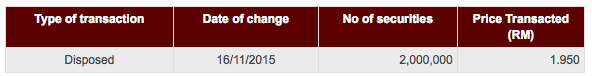

Before I end this article, I would like to bring to your attention Superlon director Mr. Yee Wei Ming's recent disposal of shares (before announcement of September 2015 result) :-

Only time will tell whether I will triump or get a nasty choke by sea water. Buy at own risk.

No comments:

Post a Comment