Massive Push Overseas Beginning to Bear Fruits ?

Author: Icon8888 | Publish date: Tue, 2 Jun 2015, 01:14 PM

Johore Tin Bhd (JOHO) Snapshot

Open

1.54

|

Previous Close

1.55

| |

Day High

1.55

|

Day Low

1.53

| |

52 Week High

07/30/14 - 1.83

|

52 Week Low

12/11/14 - 1.30

| |

Market Cap

142.8M

|

Average Volume 10 Days

162.4K

| |

EPS TTM

0.13

|

Shares Outstanding

93.3M

| |

EX-Date

07/1/15

|

P/E TM

12.0x

| |

Dividend

0.04

|

Dividend Yield

1.31%

|

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-12-31 | 2015-03-31 | 90,778 | 6,115 | 3,981 | 4.27 | 3.50 | 1.9800 |

| 2014-12-31 | 2014-12-31 | 104,661 | 6,648 | 5,216 | 5.59 | - | 1.9400 |

| 2014-12-31 | 2014-09-30 | 90,661 | 3,996 | 2,962 | 3.15 | - | 1.8800 |

| 2014-12-31 | 2014-06-30 | 58,757 | -548 | -334 | -0.27 | - | 1.8700 |

| 2014-12-31 | 2014-03-31 | 61,454 | 7,625 | 5,132 | 5.44 | 2.00 | 1.8700 |

| 2013-12-31 | 2013-12-31 | 64,577 | 4,928 | 3,920 | 4.20 | - | - |

| 2013-12-31 | 2013-09-30 | 63,473 | 8,167 | 5,433 | 5.89 | 3.00 | 1.8100 |

| 2013-12-31 | 2013-06-30 | 61,540 | 7,764 | 5,660 | 6.06 | - | 1.7900 |

| 2013-12-31 | 2013-03-31 | 51,794 | 6,289 | 5,572 | 5.97 | 4.20 | 1.7300 |

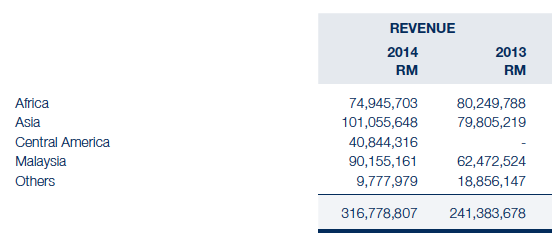

1. Massive Growth In Revenue

Johotin's revenue traditionally has been around RM60 mil per quarter. However, since September 2014, its revenue has increased by closed to 50% to RM90.7 mil per quarter. The massive growth was driven by the dairy products division which saw revenue jumped from RM37.3 mil to RM69.6 mil, an almost 100% increase.

According to the just released FY2014 annual report, the group's dairy division reported strong growth in Asia (27%) and Central America, a new market that previously did not exist.

(Sales to Africa has declined, which is unusual for a continent that is experiencing strong economic growth. My guess is that it was due to Ebola crisis, which affected West Africa, where Johotin ships most of its products)

2. Impact On Profitability

One thing that worried me in the September and December 2014 quarters was the lack of growth in dairy division's profitability despite masive revenue growth. However, in the latest March 2015 quarter. it seemed that the additional revenue has finally trickled down to bottomline, with dairy division's PBT increasing from the traditional RM4.5 mil to RM7 mil.

| (RM mil) | Mar14 | Jun14 | Sep14 | Dec14 | Mar15 |

| Revenue | 61.4 | 58.8 | 90.7 | 104.7 | 90.8 |

| > Tins & Cans | 21.5 | 21.5 | 21.1 | 24.7 | 20.9 |

| > Dairy Products | 39.9 | 37.3 | 69.6 | 80.0 | 69.9 |

| PBT | 7.63 | (0.55) | 4.0 | 6.7 | 6.1 |

| > others | (0.3) | (0.5) | (0.4) | (0.4) | (0.4) |

| > Tins & Cans | 3.4 | 3.3 | 1.3 | 4.1 | 1.3 |

| > Dairy Products | 4.5 | (3.4) | 3.0 | 3.0 | 5.2 |

| adjustments :- | |||||

| > Tins & Cans | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| > Dairy Products | 0.0 | (7.0) ** | (1.0) ** | (1.7) # | (1.8) # |

| adjusted PBT :- | |||||

| > Tins & Cans | 3.4 | 3.3 | 1.3 | 4.1 | 1.3 |

| > Dairy Products | 4.5 | 3.6 | 4.0 | 4.6 | 7.0 |

| adjusted PBT margin (%) | |||||

| > Tins & Cans | 15.8 | 15.4 | 6.3 | 16.6 | 6.3 |

| > Dairy Products | 11.3 | 9.7 | 5.8 | 5.8 | 10.1 |

** compensation due to quality issues

# forex losses

In the latest quarter, tins & cans division reported PBT of RM1.3 mil, a significant decline as compared to previous quarters. The company attributed that to lower sales of biscuits tins as well as higher raw material cost pursuant to strengthening of USD vs RM.

On the other hand, the dairy division reported PBT of RM5.2 mil, an increase of RM2.2 mil compared to previous quarter.

According to the company, this division benefited from lower raw material cost as well as more favorable foreign currency translation (every USD sales generates more RM).

The company also mentioned that the dairy division was affected by Realised Forex Loss. According to March 2015 quarterly report, realised forex loss was RM2.73 mil. However, there was also an unrealised forex gain of RM0.93 mil, which I suspect has already been factored into diary division's PBT. In order not to overstate dairy division's profitability, I have added back only the net amount of RM1.8 mil (being RM2.73 mil less RM0.93 mil) to diary division's PBT, thereby arriving at PBT of RM7 mil.

Jut to cross check, the PBT margin for the RM7 mil of 10.1% is consistent with previous margin of approximately 10% as per March and June 2014 quarters.

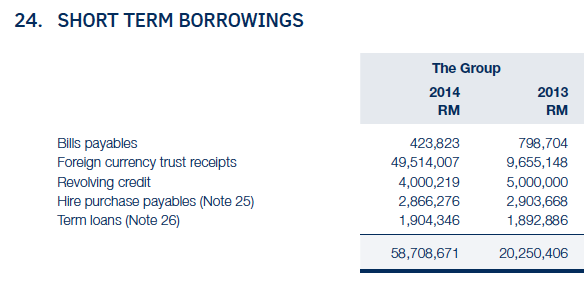

3. Impact On Balance Sheet

It is common sense that as size of business operation grows, one should expect funding needs to increase, in particular for working capital purpose. The same happens to Johotin. It saw a massive jump in short term borrowings in the latest two quarters from RM35.6 mil to RM95 mil, an increase of RM59.4 mil.

| (RM mil) | Mar14 | Jun14 | Sep14 | Dec14 | Mar15 |

| Revenue | 61.4 | 58.8 | 90.7 | 104.7 | 90.8 |

| > Tins & Cans | 21.5 | 21.5 | 21.1 | 24.7 | 20.9 |

| > Milk Products | 39.9 | 37.3 | 69.6 | 80.0 | 69.9 |

| cash | 40.5 | 38.7 | 31.1 | 25.5 | 28.9 |

| LT borrowings | 14.1 | 12.9 | 11.7 | 10.5 | 9.4 |

| ST borrowings | 20.2 | 32.9 | 35.6 | 58.8 | 95.0 |

| net borrowings | net cash | 7.0 | 16.1 | 43.7 | 75.5 |

| shareholders funds | 174.8 | 174.4 | 175.5 | 180.8 | 184.8 |

| net gearing (%) | net cah | 4.0 | 9.2 | 24.2 | 40.8 |

| inventories | 63.1 | 74.1 | 81.8 | 125.0 | 148.2 |

| receivables | 42.0 | 47.7 | 44.3 | 73.5 | 45.7 |

| payables | 19.1 | 26.8 | 24.7 | 65.9 | 30.2 |

Any spike in borrowings warrants attention. London Biscuits is a classic example of high borrowings went awry. The company gears up to spend on expensive plants and machinery, without corresponding increase in proftiability. The end results is disastrous, with significant destruction in shareholders value.

According to Johotin's FY2014 annual report, increase in short term borrowings was due to higher Foreign Currency Trust Receipts (increased from RM9.7 mil in FY2013 to RM49.5 mil in FY2014).

According to internet sources, a Trust Receipt is :

"A financing facility that allows the buyer to collect its purchases before making payment to suppliers, as payment to suppliers is advanced by the bank.

The bank remains the owner of the merchandise, but the buyer is allowed to hold the merchandise in trust for the bank, for manufacturing or sales purposes."

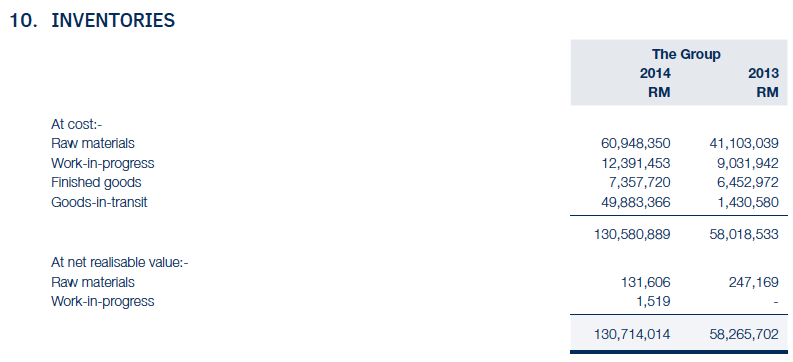

In my opinion, the increase in Foreign Currency Trust Receipt is related to increases of inventories by RM72.6 mil (from RM58 mil in FY2013 to RM130.6 mil in FY2014).

According to FY2014 annual report, the increase of inventories is due to stocking up of raw materials (instead of unsellable finished goods rottening away at warehouses).

The increase in inventories could be due to two reasons :-

(a) increases in scale of operations as the group penetrates into new markets in Asia and Central America; and

(b) to capitalise on recent weaknesses in raw material price such as skimmed milk powder, sugar, palm oil and butter fat.

4. Concluding Remarks

(a) Johotin attracted my attention primarily due to its ability to grow its overseas sales recently as well as softening of raw material cost.

(b) In the September and December 2014 quarters, dairy division's profitability has not grown much despite almost 100% jump in revenue. However, according to my analysis (which is undertaken by making various guesses and asumptions), this has begun to change. Dairy division's profitability seemed to have made a quantum leap from the previous RM4 mil plus to the RM7 mil level in latest quarter.

One possible reason for previous two quarters' PBT stagnation (despite higher revenue) was that the dairy division was promoting its products in new markets in Asia and Central America to create brand awareness. Build market share first, profit comes later ?

All eyes on next few quarters whether this division can repeat the March 2015 performance and propel group earnings to new height, which will be the catalyst for re-rating.

(c) Massive growth in revenue came with side effects - the group saw its short term borrowings increased quite substantially. However, the increase in borrowings was for the purpose of meeting working capital requirement, which is only natural when sales has expanded so dramatically. At least the borrowings is not used for funding massive capex that has long gestation period and tie down cash over a long period of time.

In my opinion, as long as the group can manage its receivables properly (namely, no spike in bad debts), these working capital related short terms borrowings should be manageable as receipt of payment from customers could be used to service debt obligation on rollover basis.

In addition, short term borrowings has lower funding cost. As such, the net effect to profitability should be positive (ie, interest expesnes won't overwhelm incremental profit arising from additional sales).

Having said so, I would be careful not to pretend that it is perfectly ok to have higher borrowings. It is definitely something that need to be monitored closely going forward. I also wonder whether there is a need for cash call to resolve this issue once and for all ? Maybe a rights issue or a placement in the near future ?

No comments:

Post a Comment