An Undervalued Stock About To Get Even More Undervalued

Author: Icon8888 | Publish date: Fri, 18 Sep 2015, 08:56 AM

Executive Summary

(1) AWC is principally involved in facilities management (part of it backed by Government concession), enviromental and engineering services

(2) It has consistent profit track record and strong balance sheet (net cash per share of 23 sen, while share price is only 34 sen)

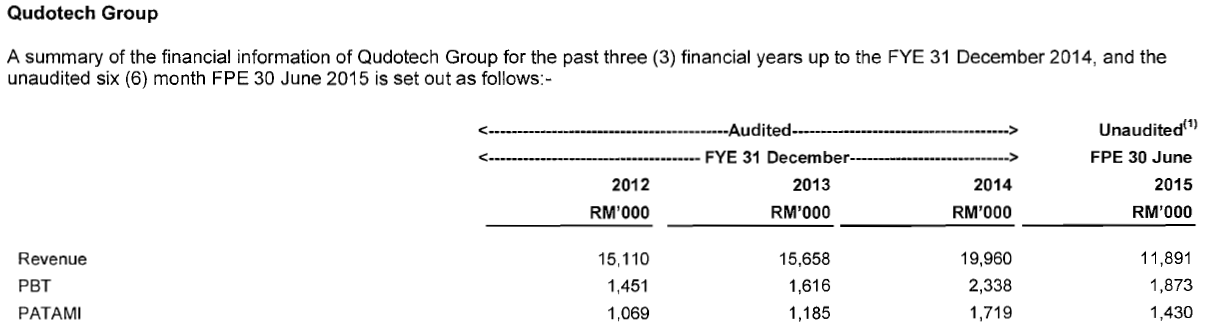

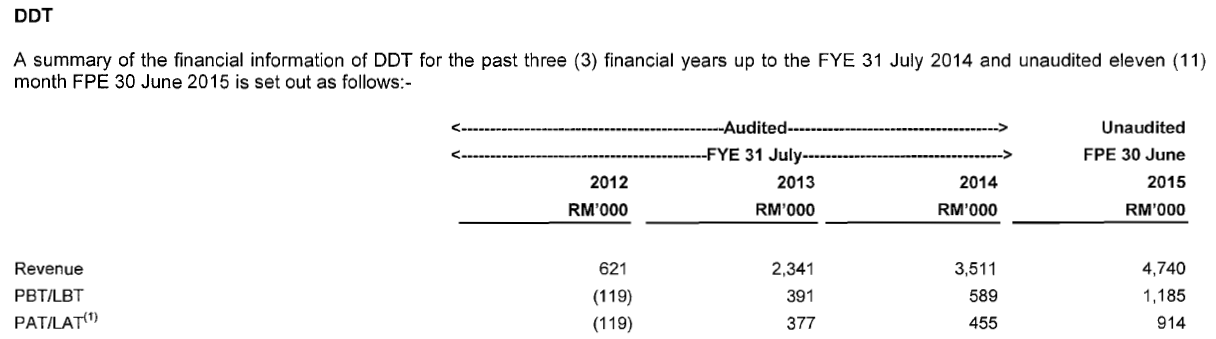

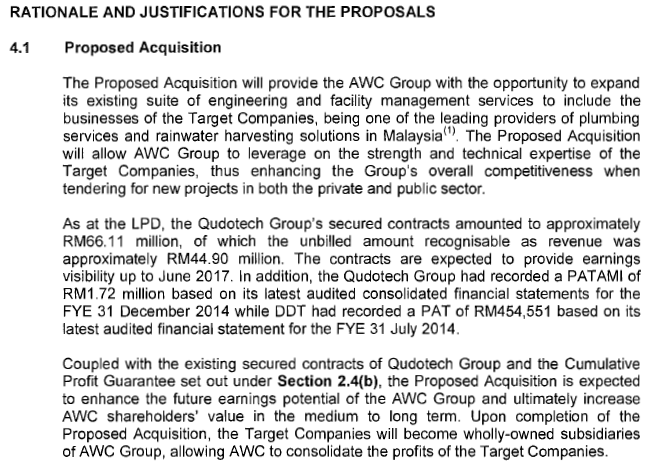

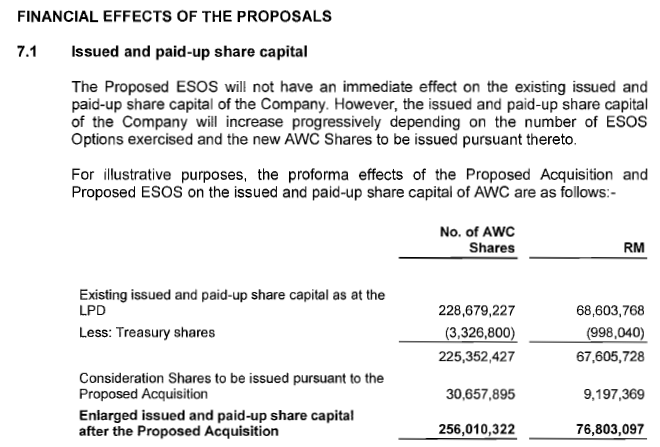

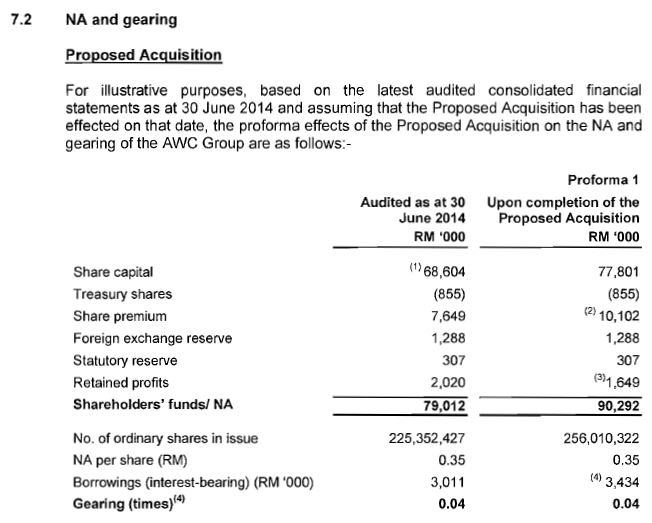

(3) Few months ago, it announced the proposed acquisition of Qudo Tech Sdn Bhd and DD Technique Sdn Bhd for purchase consideration of RM26.5 mil to be satisfied by issuance of 31 mil new AWC shares at 38 sen and cash of RM14.8 mil.

(4) Qudo is principally involved in Mechanical and Electrical Engineering, with specialty in plumbing services. DD's specialty is in design and installation of rain water harvesting systems.

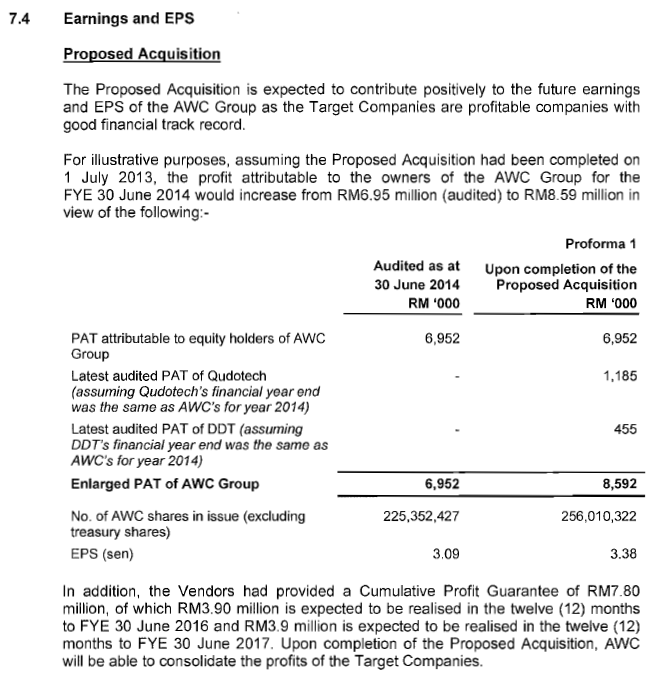

(5) The vendors of Qudo and DD have agreed to provide a profit guarantee of RM3.9 mil each for FYE June 2016 and 2017 respectively. The amount is considered quite substantial as AWC reported net profi of RM7.8 mil in FYE June 2015.

(6) Circular to shareholders was issued on 8 September 2015. EGM will be held at 10 am, 1 October 2015 at Bukit Kiara Equestrian and Country Resort, Jalan Bukit Kiara, Off Jalan Damansara.

Awc Berhad (AWCF) Snapshot

Open

0.33

|

Previous Close

0.33

| |

Day High

0.34

|

Day Low

0.33

| |

52 Week High

04/13/15 - 0.50

|

52 Week Low

12/15/14 - 0.27

| |

Market Cap

76.6M

|

Average Volume 10 Days

1.8M

| |

EPS TTM

0.03

|

Shares Outstanding

225.4M

| |

EX-Date

03/19/13

|

P/E TM

9.8x

| |

Dividend

--

|

Dividend Yield

--

|

1. Principal Business Activities

AWC provides integrated facilities management, environmental and engineering services.

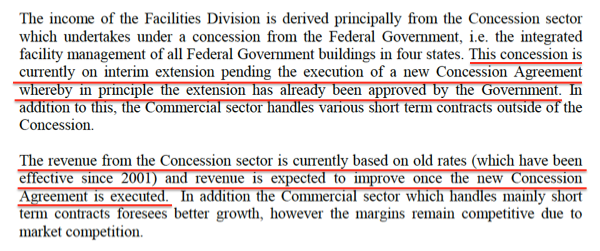

AWC's facilities management services is mainly from the government concessions on the maintenance of the federal government buildings. Previously, AWC had a 9 year concession to provide management and maintenance services of the federal government building in the southern zone and Sarawak.

AWC is handling 23 building complexes in Sarawak alone, which includes the Bintulu Port Authority building.

Other leading corporation and clients of AWC includes OCBC Bank, Telekom Malaysia, Bangunan KWSP, KLCC, KL Tower and PPB Harta Bina. AWC services also extends to the public sector such as Ministry of Works, Public Works Department, Prime Minister's Office, and Bank Negara Malaysia.

With the plans to expand their services to penetrate more into the private sector, AWC had seen breakthrough with the cornerstone foray into the healthcare sub-segment involving provision of biomedical and facilities engineering maintenance services in Hospital Rehabilitasi Cheras, and also secured new contracts to extend integrated facilities management services to telco stores and outlets of Celcom Axiata and the new Heriot-Watt University Malaysia campus in Putrajaya.

Another boost came for the group as AWC had secured a new 10 year concession with higher revised prices from the federal government in providing their facilities management and maintenance services in southern zone and Sarawak.

The follwoing is extracted from its latest quarterly report :-

2. Consistent Profit Track Record

The Group has consistent profit track record.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | NAPS |

|---|---|---|---|---|---|

| 2015-06-30 | 127,642 | 7,778 | 3.45 | 10.44 | 0.4030 |

| 2014-06-30 | 119,506 | 6,952 | 3.09 | 8.58 | 0.3510 |

| 2013-06-30 | 145,000 | 4,555 | 2.00 | 12.00 | 0.3200 |

| 2012-06-30 | 111,225 | 4,128 | 1.80 | 13.89 | 0.3200 |

3. The Proposed Acquisitions

As mentioned in executive summary, Qudo and DD are principally involved in plumbing and installation of rainwater harvesting systems.

No comments:

Post a Comment