Semiconductor Division Doing Well

Author: Icon8888 | Publish date: Tue, 17 Feb 2015, 02:03 PM

Executive Summary

(a) Provides surface metamorphosis (meaning treatment of objects surface by specialised technology) and mechanical engineering services.

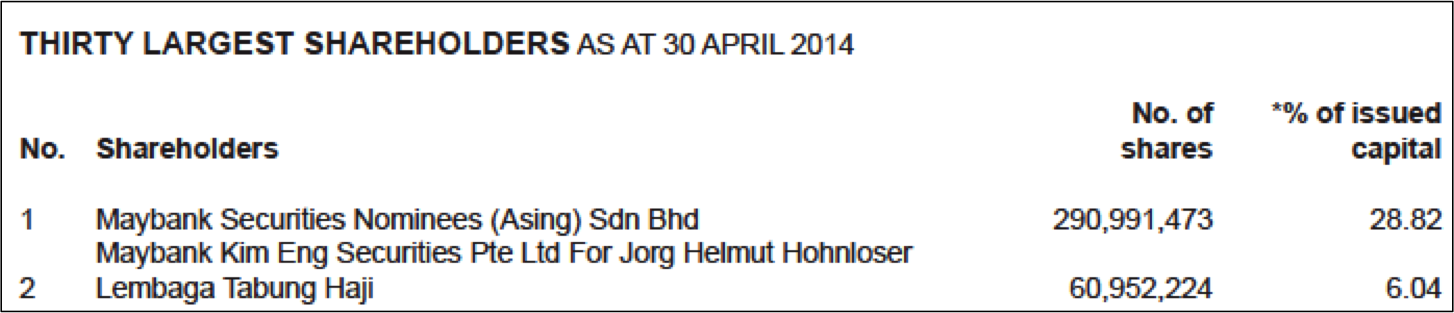

(b) Used to be loss making and mis-managed. The emergence of new major shareholder (Dr Jorg Helmut Hohnloser) from Germany helped cleaned up and turned the company around.

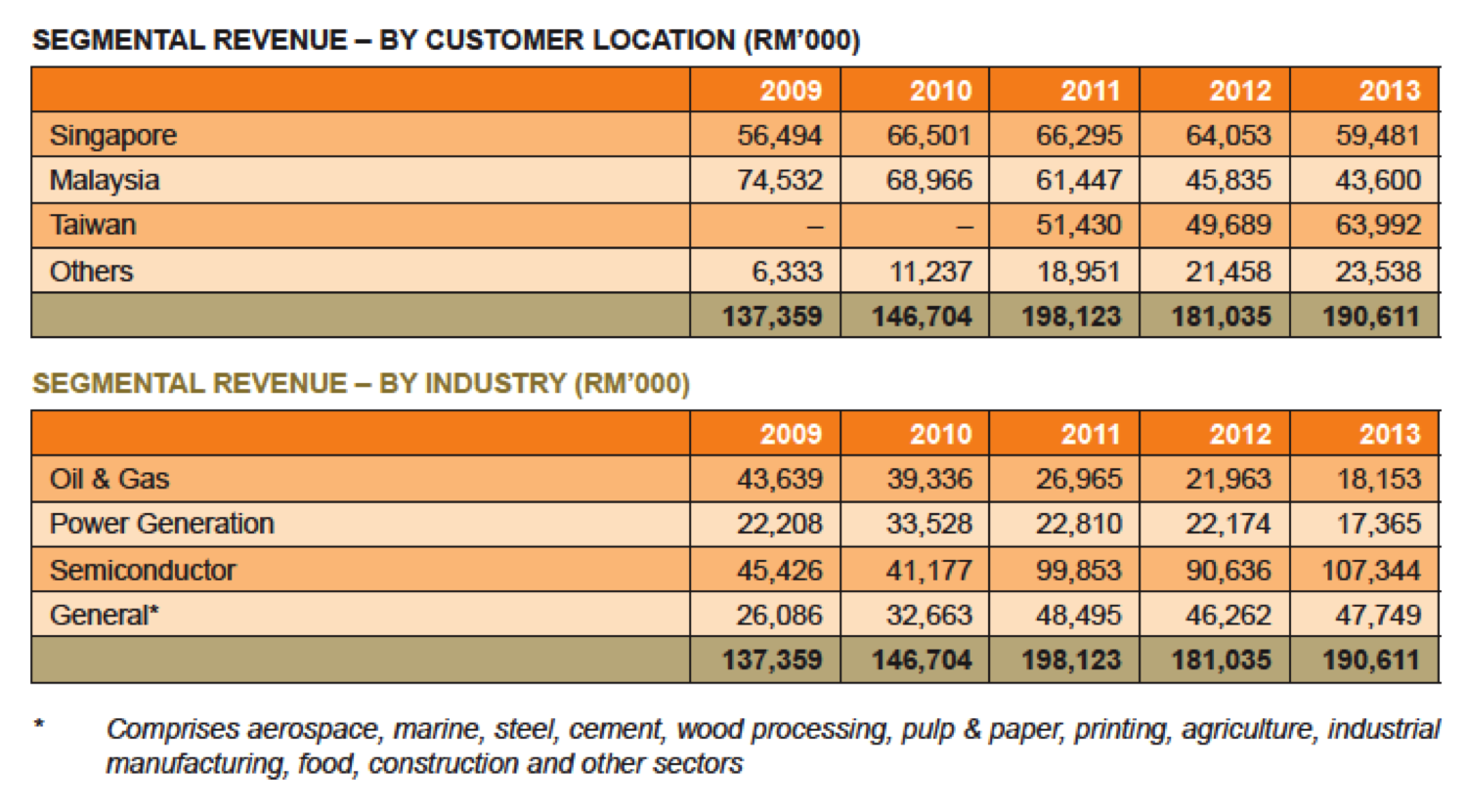

(c) It owns 57.9% equity interest in Ares Green Technology Corp which is listed on Taiwan Stock Exchange and provides cleaning services to electronic / semiconductor manufacturers. Ares Green Tech has performed well in recent months and is expected to boast the group's overall results.

(d) With the bulk of its sales from overseas operation, the group is a beneficiary of weak Ringgit.

Frontken Corp Bhd (FRCB) Snapshot

Open

0.17

|

Previous Close

0.17

| |

Day High

0.18

|

Day Low

0.17

| |

52 Week High

08/13/14 - 0.20

|

52 Week Low

03/3/14 - 0.09

| |

Market Cap

171.1M

|

Average Volume 10 Days

8.5M

| |

EPS TTM

0.0091

|

Shares Outstanding

1.0B

| |

EX-Date

06/9/11

|

P/E TM

18.7x

| |

Dividend

--

|

Dividend Yield

--

|

Frontken Corporation Berhad provides surface metamorphosis and mechanical engineering services.

The company offers industrial equipment services consisting of upgrade and maintenance services on stationary/rotating equipment and its components.

It also provides various specialized engineering services, such as thermal spray coating, cold build up coating, plating and conversion coating, specialized welding, etc.

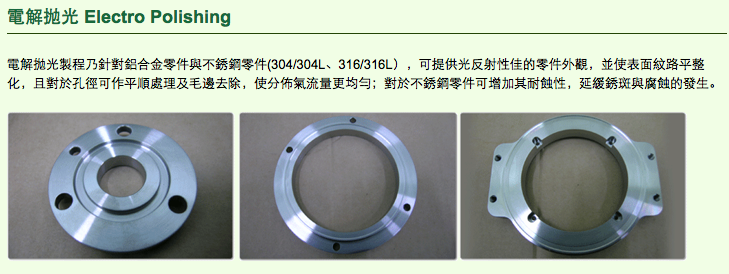

In addition, the company provides surface treatment and precision cleaning for the thin film transistor-liquid crystal display and semiconductor industries.

It serves oil and gas, petrochemical, power generation, semiconductor, aerospace, marine, electronics manufacturing, steel, cement, wood processing, etc.

It operates in Malaysia, Singapore, the Philippines, Taiwan, China, and Indonesia.

Strong balance sheets. Based on net assets of RM197 mil, cash of RM47 mil and loans of RM38 mil, the group is in net cash position.

The group reported EPS of 0.52 sen in latest quarter. If annualised, full year EPS would be 2.08 sen. Based on existing share price of 17 sen, prospective PER is 8.2 times.

(Of course, if based on 12 months cumulative EPS of 0.9 sen, historical PER would be 19 times)

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 83,554 | 8,816 | 5,258 | 0.52 | - | 0.2300 |

| 2014-12-31 | 2014-06-30 | 73,037 | 3,437 | 1,778 | 0.18 | - | 0.2200 |

| 2014-12-31 | 2014-03-31 | 48,202 | 5,971 | 4,582 | 0.45 | - | 0.2200 |

| 2013-12-31 | 2013-12-31 | 54,401 | 2,519 | -2,447 | - | - | 0.2100 |

| 2013-12-31 | 2013-09-30 | 50,539 | 2,355 | 1,566 | 0.16 | - | 0.2200 |

| 2013-12-31 | 2013-06-30 | 42,291 | 366 | -455 | - | - | 0.2100 |

| 2013-12-31 | 2013-03-31 | 43,380 | 671 | -984 | - | - | 0.2100 |

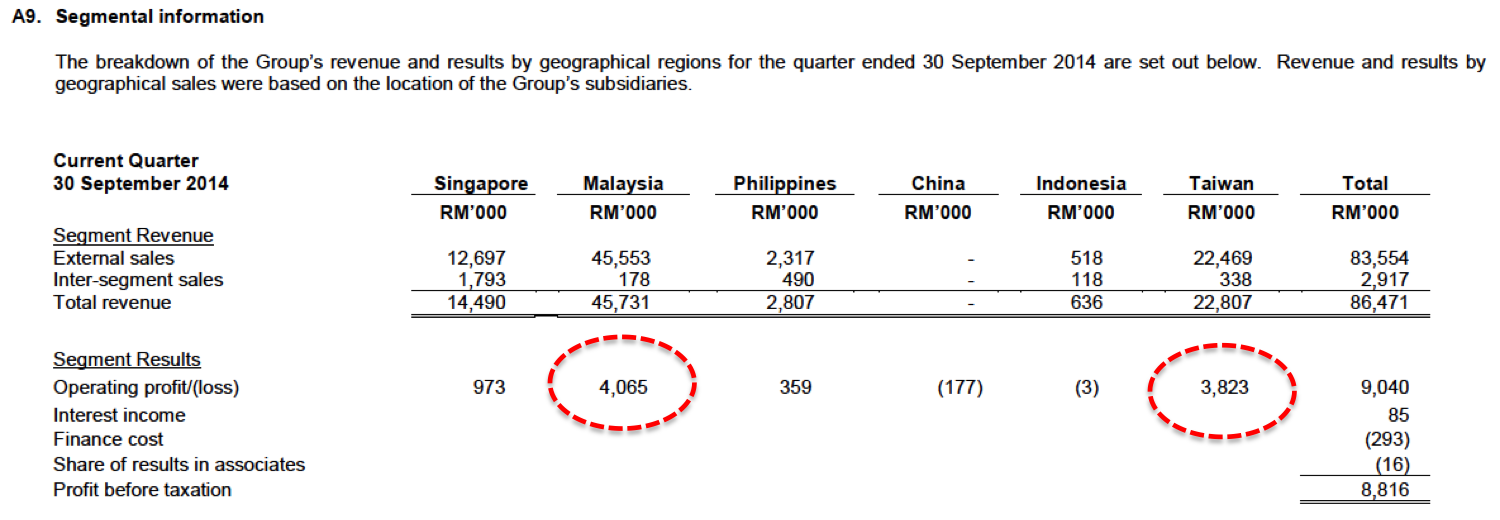

Malaysia and Taiwan operation are key earnings contributors :-

According to Taiwan listed Ares Green Technology Corp's recent announcement to stock exchange, its sales increased substantially in the months of October, November and December 2014 :-

(credit given to i3 member cpng for highlighting this piece of information)

Ares Green Technology's share price has almost doubled over past twelve months due to better financial performance :-

Appendix 1 - Frontken's principal business activities

Appendix 2 - Ares Green Technology Corp's principal business activities (a 57.92% owned subsidiary listed on Taiwan Stock Exchange)

No comments:

Post a Comment