High Dividend Yield Manufacturer of Plastic Cans, Bottles, etc

Author: Icon8888 | Publish date: Wed, 25 Feb 2015, 12:00 PM

Cyl Corp Bhd (CYLC) Snapshot

Open

0.58

|

Previous Close

0.58

| |

Day High

0.58

|

Day Low

0.58

| |

52 Week High

07/25/14 - 0.65

|

52 Week Low

02/28/14 - 0.51

| |

Market Cap

58.0M

|

Average Volume 10 Days

1.6K

| |

EPS TTM

0.04

|

Shares Outstanding

100.0M

| |

EX-Date

01/22/15

|

P/E TM

15.6x

| |

Dividend

0.05

|

Dividend Yield

7.76%

|

CYL is based in Shah Alam.

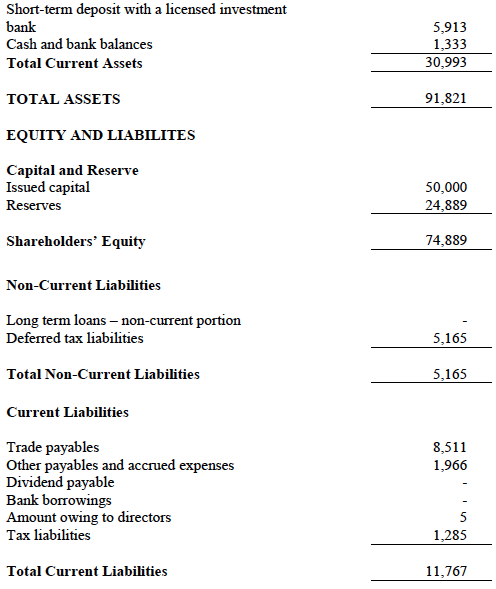

Strong balance sheets with limited borrowings :-

Over past few years, earnings has been quite consistent at about RM3 to 3.5 mil per annum.

Every year, the company paid out dividend of approximately 4 sen per share. Based on 58 sen, dividend yield is 6.9%.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) | |

|---|---|---|---|---|---|---|---|---|---|

| TTM | 72,133 | 3,715 | 3.71 | 15.64 | 4.00 | 6.90 | 0.7489 | 4.95 | |

| 2014-01-31 | 63,179 | 1,353 | 1.35 | 37.41 | 4.00 | 7.92 | 0.7315 | 1.85 | |

| 2013-01-31 | 63,306 | 3,489 | 3.49 | 13.76 | 4.50 | 9.38 | 0.7630 | 4.57 | |

| 2012-01-31 | 61,645 | 3,001 | 3.04 | 15.47 | 4.00 | 8.51 | 0.7881 | 3.86 | |

| 2011-01-31 | 64,778 | 3,719 | 3.72 | 13.98 | 4.00 | 7.69 | 0.7977 | 4.66 | |

| 2010-01-31 | 67,397 | 3,753 | 3.75 | 13.34 | 4.00 | 8.00 | 0.7305 | 5.13 |

Past three quarters saw material improvement in earnings. For the 9 months ended October 2014, total net profit was RM3.8 mil. If annualised, full year profit would be RM5 mil, 44% higher than the past years average of approximately RM3.5 mil.

What drove the improvement in performance ?

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-01-31 | 2014-10-31 | 19,927 | 1,693 | 1,193 | 1.19 | - | 0.7489 |

| 2015-01-31 | 2014-07-31 | 19,310 | 2,097 | 1,597 | 1.60 | - | 0.7370 |

| 2015-01-31 | 2014-04-30 | 17,823 | 1,287 | 1,002 | 1.00 | - | 0.7210 |

| 2014-01-31 | 2014-01-31 | 15,073 | -77 | -77 | -0.08 | 4.00 | 0.7315 |

| 2014-01-31 | 2013-10-31 | 15,564 | 521 | 271 | 0.27 | - | 0.7514 |

| 2014-01-31 | 2013-07-31 | 17,093 | 867 | 767 | 0.77 | - | 0.7487 |

| 2014-01-31 | 2013-04-30 | 15,449 | 404 | 304 | 0.30 | - | 0.7411 |

| 2013-01-31 | 2013-01-31 | 14,660 | 790 | 662 | 0.66 | 4.50 | - |

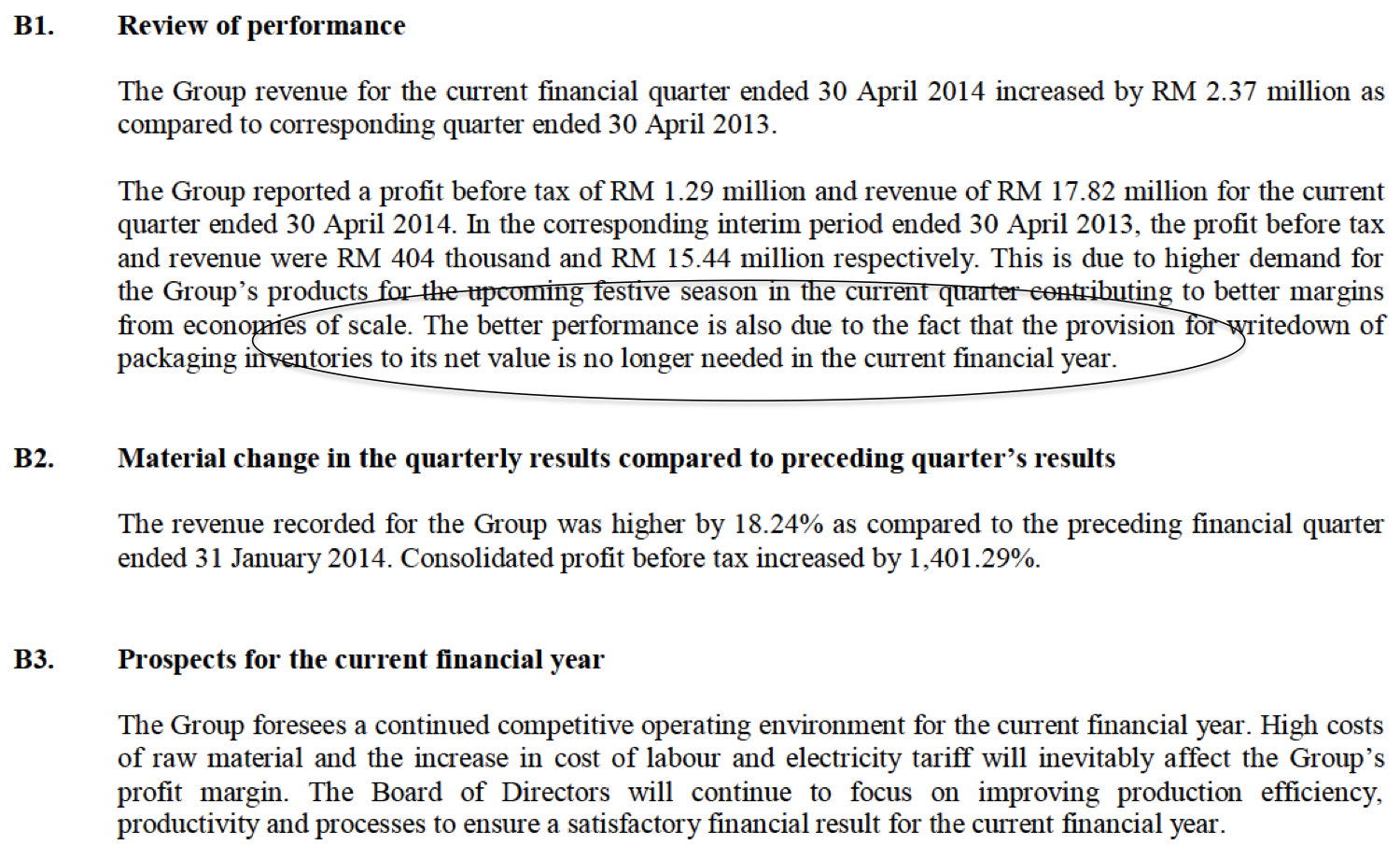

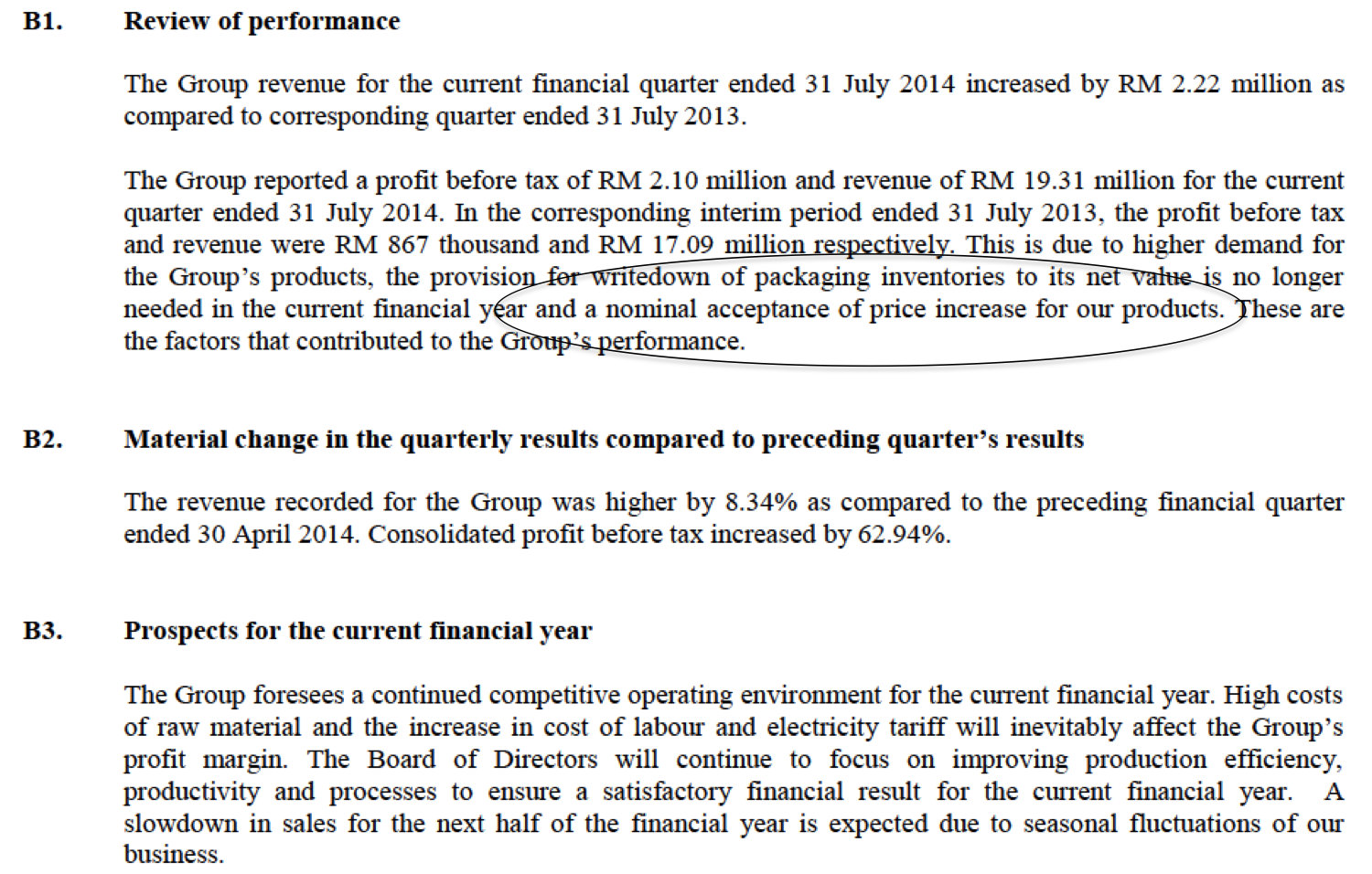

In April 2014 quarterly results (as set out below), management commented that better performance was partly due to lack of provision for writedown of investories. A quick check of January 2014 quarterly report showed that the total amount involved was only RM0.86 mil. In my opinion, that didn't really explain the big increase in earnings in subsequent quarters.

In July 2014 quarter, management attributed the better performance partly to "nominal acceptance of price increase". Not sure what "nominal" means ?

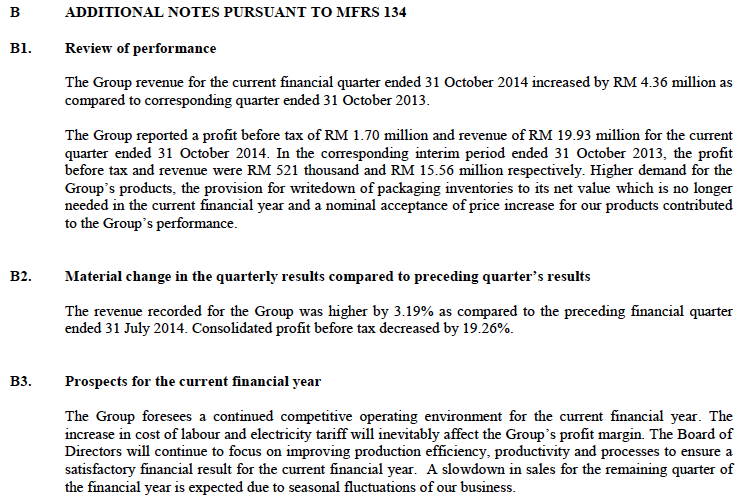

Management's comments for Oct 2014 quarterly results :-

Concluding Remarks

(a) After reviewing past 3 quarters' financial reports, I still cannot determine what is the main reason for earnings improvement. Sometime public listed companies are deliberately vagued in their commentaries so as not to give out too much details to customers about their profitability. My guess is that the higher profitability was due to the price increase which boost profit margin (rather than the absence of inventories writedown).

(b) Dividend yield is good. With consistent earnings and high dividend payout, the stock beats fixed deposit from yield point of view.

(c) All eyes on coming quarter results (to be announced by end March 2015) to see how recent decline in oil prices will benefit the group. Raw material cost will definitely go down. The question is whether customers will ask for price reduction.

(d) Resilient business as it supplies to consumer products manufacturers. Not so susceptible to economic downturn.

(e) Based on prospective eranings of RM5 mil (arrived at by annualising latest 9 months figures) and market cap of RM58 mil, PER is 11.6 times. I would rate it a BUY due to the consistent and high dividend payout.

No comments:

Post a Comment