Author: Icon8888 | Publish date: Wed, 15 Jul 2015, 05:26 PM

Executive Summary

(1) MNRB is principally involved in reinsurance business. It is a subsidiary of PNB.

(2) Never loss money before. Trading at PER of 6.3 times only.

(3) Gearing of 0.24 times only.

(4) Dividend yield of 4.3%. Dividend expected to be announced in September.

(5) Regulated by Bank Negara Malaysia. No hanky panky.

(6) Plenty of room for growth

Mnrb Holdings Bhd (MNRB) Snapshot

Open

3.75

|

Previous Close

3.75

| |

Day High

3.76

|

Day Low

3.75

| |

52 Week High

07/16/14 - 4.86

|

52 Week Low

03/31/15 - 3.53

| |

Market Cap

799.0M

|

Average Volume 10 Days

128.0K

| |

EPS TTM

0.60

|

Shares Outstanding

213.1M

| |

EX-Date

09/26/14

|

P/E TM

6.3x

| |

Dividend

0.17

|

Dividend Yield

4.39%

|

1. Impeccable Profit Track Record

The Group has never lost money before, not even during 2008 Global Financial Crisis :-

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) |

|---|---|---|---|

| TTM | 2,384,975 | 127,569 | 59.90 |

| 2015-03-31 | 2,384,975 | 127,569 | 59.90 |

| 2014-03-31 | 2,386,177 | 155,986 | 73.20 |

| 2013-03-31 | 2,303,169 | 112,665 | 52.90 |

| 2012-03-31 | 2,018,043 | 87,187 | 40.90 |

| 2011-03-31 | 1,463,262 | 122,942 | 57.70 |

| 2010-03-31 | 1,345,183 | 48,167 | 22.60 |

| 2009-03-31 | 1,173,819 | 26,288 | 12.30 |

| 2008-03-31 | 978,555 | 170,441 | 80.30 |

| 2007-03-31 | 834,127 | 129,479 | 61.40 |

| 2006-03-31 | 751,400 | 115,183 | 57.50 |

| 2005-03-31 | 719,194 | 90,024 | 45.70 |

| 2004-03-31 | 670,730 | 88,581 | 45.48 |

| 2003-03-31 | 843,214 | 61,106 | 31.50 |

| 2002-03-31 | 733,369 | 57,407 | 29.56 |

| 2001-03-31 | 659,974 | 31,018 | 16.01 |

| 2000-03-31 | 363,310 | 85,963 | 45.01 |

| 1999-03-31 | 421,669 | 68,109 | 35.66 |

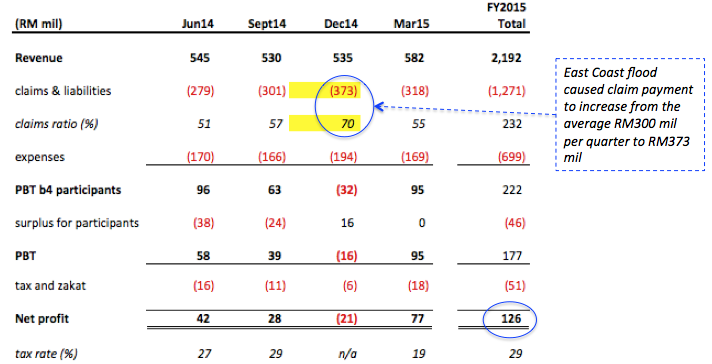

In December 2014 quarter, the group was adversely affected by East Coast flood, which caused its claim payment to increase by an estimated RM70 mil. Adjusted for that (based on conservative RM50 mil) and assume tax rate of 29%, FY2015 net profit should be RM163 mil instead of RM127.5 mil.

Based on existing market cap, PER will be 4.9 times only.

2. Business Model

The group's P&L statement looked complicated but is actually quite easy to understand :-

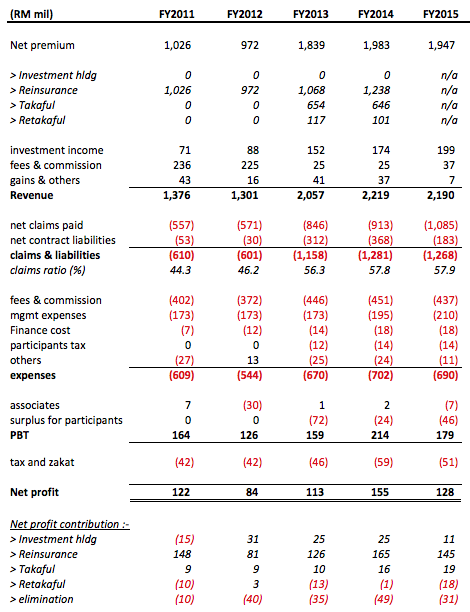

(a) Revenue comprises mostly premium collected from insurance buyers and investment income (cash from insurance buyers are invested in financial instruments).

(b) When an insurance buyer makes a claim, it become an expense item for the insurer. Over the past 5 years, this item on average is equals to 53% of premium collected (Claim Ratio of 53%).

(c) Other expenses are commission paid to agents, salary, admin and marketing expenses, etc. The amount is usually quite stable. In MNRB's case, the amount is approximately 30% of revenue.

(d) There is an item called "surplus for Participants Funds". This is related to MNRB's Takaful operation, which is relatively small compared to its reinsurance business. The surplus for Participants Funds is not a drag on MNRB as it is paid out of Takaful revenue. We can ignore this item as MNRB's core earnings is from reinsurance.

3. Risky Business ?

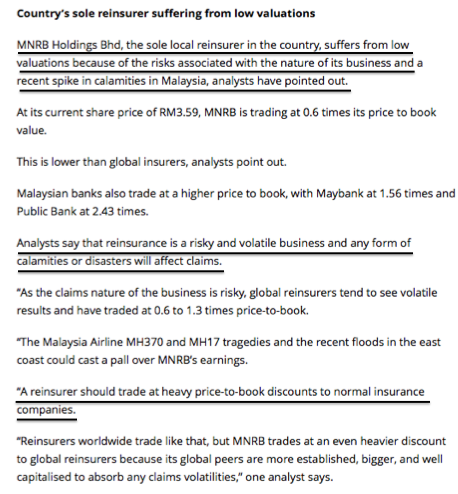

The article below by a reporter from The Star claimed that Reinsurance is a risky business.

According to the article, "Reinsurance is a risky and volatile business and any form of calamities or disasters will affect claims". It also stated that "A reinsurer should trade at heavy price to book discounts to normal insurance companies".

I am not an insurance expert. However, I don't think the reporter's view is logical or based on facts. MNRB has been consistently profitable at least since 1999. If you look at MNRB's historical earnings at Section 1 above, no matter how you look at it, it doesn't look like a "volatile business".

Of course, reinsurer will get hit when calamities happen (just like any insurance company). But according to preliminary research, systemic risk can be minimized by geographical diversification. Reinsurers also systematically 'reinsure" with other reinsurers, some of them overseas.

As such, in my opinion, the notion that reinsurers will be wiped out when a major calamity happen is an oversimplistic way of looking at things.

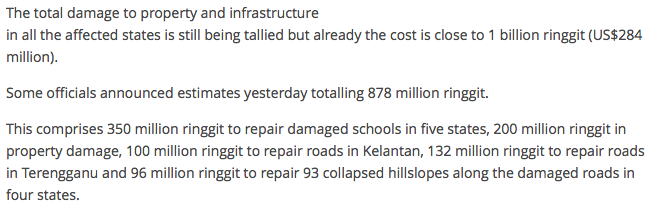

(according to the article above, damage caused by the East Coast flood at end of 2014 is estimated to be approximately RM1 billion. But MNRB only saw spike of RM70 mil in its claims during that quarter)

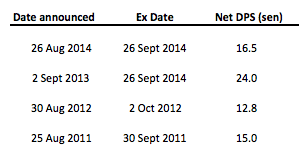

4. Dividend

Over the past 4 years, the group paid out average net DPS of 17 sen. Dividend is traditionally announced in the month of August / September.

5. A Low Beta Stock

MNRB has traditionally been trading at low PER and price-to-book ratio. I don't subscribe to the view that they deserve depressed valuation to justify the "riskiness" of their business. I don't think their business is any more risky than insurance companies (which have been trading at PER of more than 10 times).

In my opinion, MNRB has all the things that a good company should have :-

(1) viable business model that leads to sustainable profitability;

(2) healthy balance sheets;

(3) attractive dividend yield;

(4) good corporate governance, in no small part due to regulatory oversight by Bank Negara Malaysia; and

(5) abundant room for growth.

The depressed valuation is simply a case of mispricing.

However, this is a low Beta stock that can really test your patience. I intend to lock it up for long long time.

Nevermind if it doesn't go up by much over the next few years. As long as it generates good profit, pay me regular dividend and injects retained earnings into shareholders' funds year after year to inflate it like a balloon, it serves my investment objective.

Market will wake up one day to unlock its value.

I am very sure about that.

No comments:

Post a Comment