New Hoong Fatt, Niche Capital, Ni Hsin, NTPM

Author: Icon8888 | Publish date: Sat, 7 Feb 2015, 04:18 PM

New Hoong Fatt

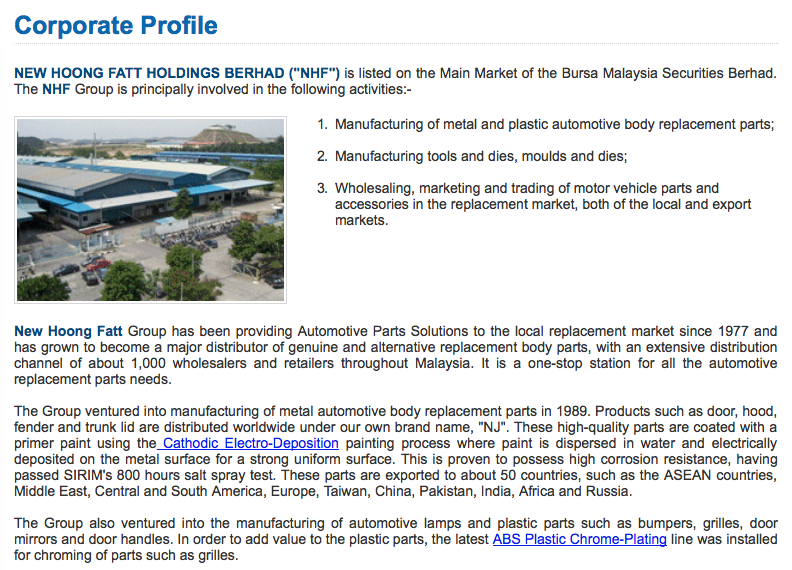

New Hoong Fatt Holdings Bhd (NHF) Snapshot

Open

2.50

|

Previous Close

2.50

| |

Day High

2.50

|

Day Low

2.50

| |

52 Week High

07/23/14 - 2.92

|

52 Week Low

12/16/14 - 2.26

| |

Market Cap

187.9M

|

Average Volume 10 Days

18.0K

| |

EPS TTM

0.14

|

Shares Outstanding

75.2M

| |

EX-Date

12/5/14

|

P/E TM

17.9x

| |

Dividend

0.11

|

Dividend Yield

4.80%

|

Consistent protiability over the years :-

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| TTM | 202,767 | 10,492 | 13.95 | 17.93 | 12.00 | 4.80 | 4.1700 | 3.35 |

| 2013-12-31 | 210,604 | 20,149 | 26.81 | 10.75 | 12.00 | 4.17 | 4.1700 | 6.43 |

| 2012-12-31 | 217,467 | 22,763 | 30.29 | 7.73 | 13.00 | 5.56 | 4.0300 | 7.52 |

| 2011-12-31 | 215,570 | 19,805 | 26.35 | 8.73 | 12.00 | 5.22 | 3.8500 | 6.84 |

| 2010-12-31 | 222,473 | 27,254 | 36.26 | 6.35 | 13.00 | 5.65 | 3.3200 | 10.92 |

| 2009-12-31 | 203,315 | 21,973 | 29.24 | 7.70 | 12.00 | 5.33 | 3.0800 | 9.49 |

| 2008-12-31 | 168,902 | 18,281 | 24.32 | 6.58 | 11.00 | 6.88 | 2.9000 | 8.39 |

| 2007-12-31 | 156,757 | 23,003 | 30.61 | 5.89 | 11.00 | 6.11 | 2.7600 | 11.09 |

| 2006-12-31 | 156,904 | 26,900 | 35.79 | 5.23 | 14.00 | 7.49 | 2.5600 | 13.98 |

| 2005-12-31 | 154,157 | 20,785 | 27.73 | 6.82 | 11.00 | 5.82 | 2.2200 | 12.49 |

However, the group saw reduced profitability in 2014. For the first nine months of 2013, the group reported net profit of RM20 mil. However, in first nine months of 2014, total net profit was RM10.6 mil only, a decline of 50%.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 50,249 | 4,293 | 2,589 | 3.44 | 3.00 | 4.1700 |

| 2014-12-31 | 2014-06-30 | 56,806 | 6,109 | 5,472 | 7.28 | - | 4.2300 |

| 2014-12-31 | 2014-03-31 | 45,951 | 3,492 | 2,480 | 3.30 | - | 4.1900 |

| 2013-12-31 | 2013-12-31 | 49,761 | 2,101 | -49 | -0.07 | 9.00 | 4.1700 |

| 2013-12-31 | 2013-09-30 | 51,592 | 7,427 | 5,505 | 7.32 | 3.00 | 4.2000 |

| 2013-12-31 | 2013-06-30 | 54,937 | 9,783 | 7,938 | 10.56 | - | 4.2300 |

| 2013-12-31 | 2013-03-31 | 54,313 | 8,047 | 6,755 | 8.99 | - | 4.1200 |

| 2012-12-31 | 2012-12-31 | 54,963 | 3,327 | 1,589 | 2.11 | 10.00 | - |

| 2012-12-31 | 2012-09-30 | 53,864 | 8,837 | 7,622 | 10.14 | 3.00 | 4.0400 |

| 2012-12-31 | 2012-06-30 | 54,622 | 9,835 | 9,457 | 12.58 | - | 4.0300 |

| 2012-12-31 | 2012-03-31 | 54,018 | 5,670 | 4,095 | 5.45 | - | 3.9000 |

Has been paying out dividend per share of 12 to 13 sen per annum over the years. This translates into yield of approximately 4.8%. With this years' lower profitability, can dividend payment be sustained ?

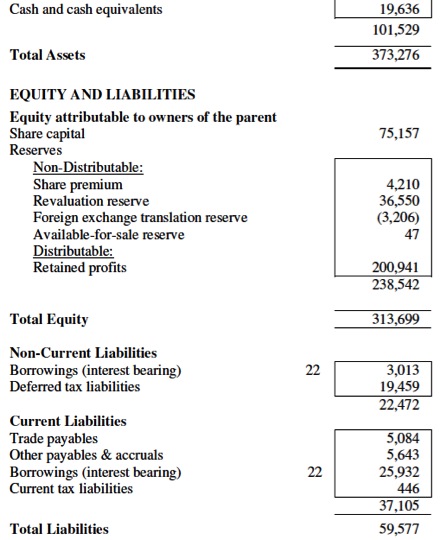

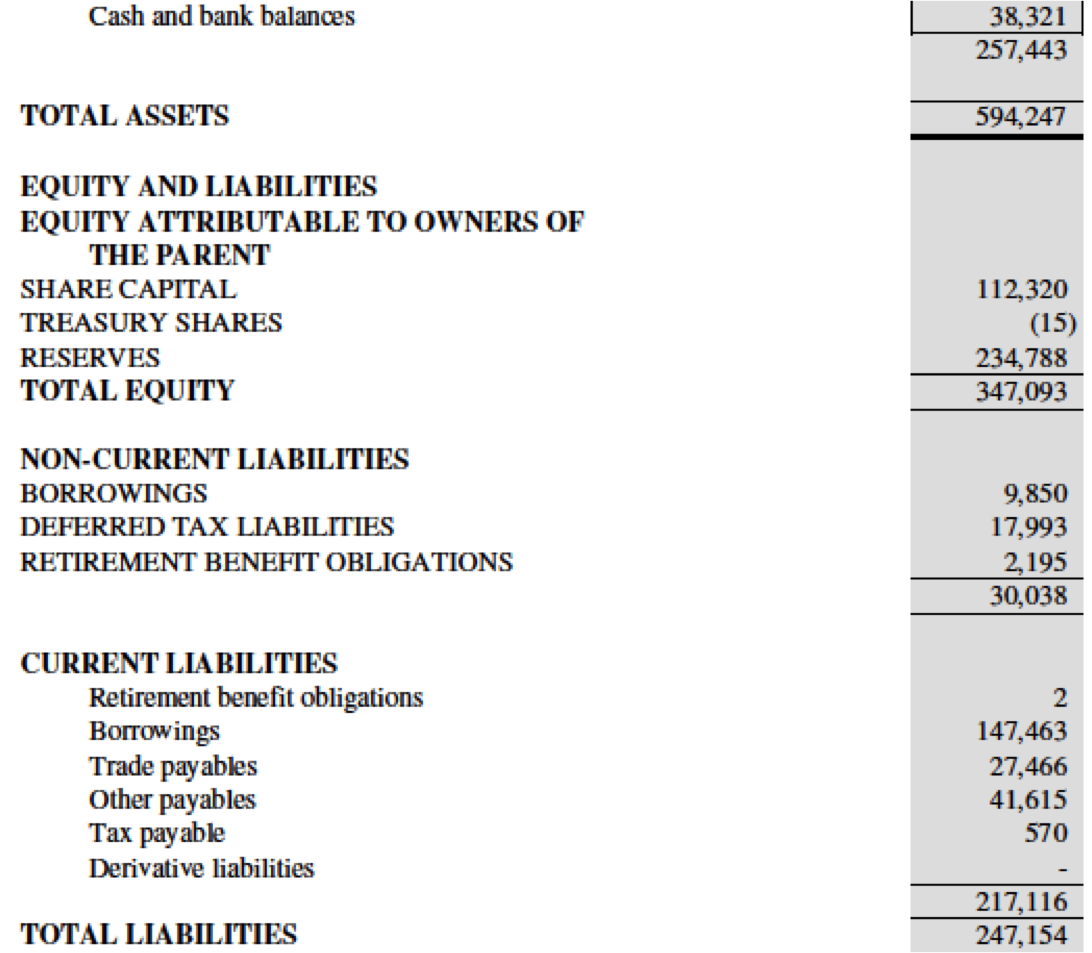

Strong balance sheets :-

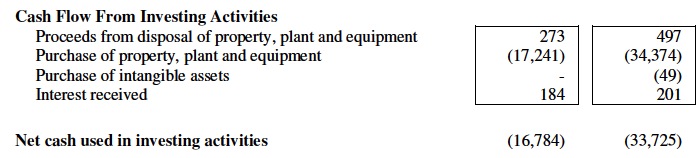

Occsaionally does need to invest in plants and machineries :-

Exports closed to 40% of its products :-

Comments

(a) Well managed replacement parts manufacturer with many years of proven track record.

(b) Strong balance sheets.

(c) 40% of products exported. The weak Ringgit should boost earnings in coming quarters.

(d) Lower oil price should benefit the group as it uses plastic resins as raw materials.

(e) First nine months of 2014 saw earnings dropped by closed to 50%. Does this spell troubles for longer term prospects ? At current price, PER is more than 17 times (unless earnings can catch up).

(f) High dividend yield of 4.8%. But sustainability depends on future profitability.

====================================================================================

Niche Capital Emas Holding

Niche Capital Emas Holding (NCHB) Snapshot

Open

0.14

|

Previous Close

0.14

| |

Day High

0.14

|

Day Low

0.14

| |

52 Week High

06/6/14 - 0.19

|

52 Week Low

12/15/14 - 0.10

| |

Market Cap

31.5M

|

Average Volume 10 Days

188.7K

| |

EPS TTM

-0.01

|

Shares Outstanding

233.1M

| |

EX-Date

05/6/04

|

P/E TM

--

| |

Dividend

--

|

Dividend Yield

--

|

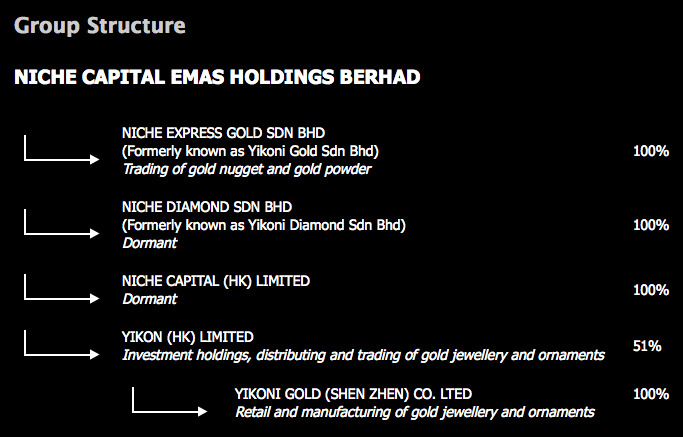

Niche Capital Emas Holdings Berhad, an investment holding company, manufactures and sells gold jewelry and ornaments.The company has operations in Malaysia, the People's Republic of China, and Hong Kong. Niche Capital Emas Holdings Berhad is based in Penang, Malaysia.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 3,467 | -1,656 | -1,004 | -0.85 | - | 0.1000 |

| 2014-12-31 | 2014-06-30 | 4,427 | 5,891 | 6,129 | 5.19 | - | 0.1100 |

| 2014-12-31 | 2014-03-31 | 9,054 | -674 | -468 | -0.40 | - | 0.0600 |

| 2013-12-31 | 2013-12-31 | 5,190 | -6,940 | -6,283 | -5.32 | - | 0.0800 |

| 2013-12-31 | 2013-09-30 | 9,488 | -1,197 | -823 | -0.70 | - | 0.1300 |

| 2013-12-31 | 2013-06-30 | 12,344 | -1,066 | -774 | -0.66 | - | 0.1300 |

| 2013-12-31 | 2013-03-31 | 8,982 | -611 | -536 | -0.45 | - | 0.1300 |

| 2012-12-31 | 2012-12-31 | - | - | - | - | - | - |

| 2012-12-31 | 2012-09-30 | 3,929 | -1,497 | -1,272 | -1.45 | - | 0.1500 |

| 2012-12-31 | 2012-06-30 | 6,897 | -590 | -296 | -0.68 | - | 0.2600 |

| 2012-06-30 | 2012-03-31 | 7,248 | -280 | -237 | -0.55 | - | 0.2600 |

Comments

I didn't do a detailed study of this group as I am not really interested in the industry and business they are in.

============================================================================================

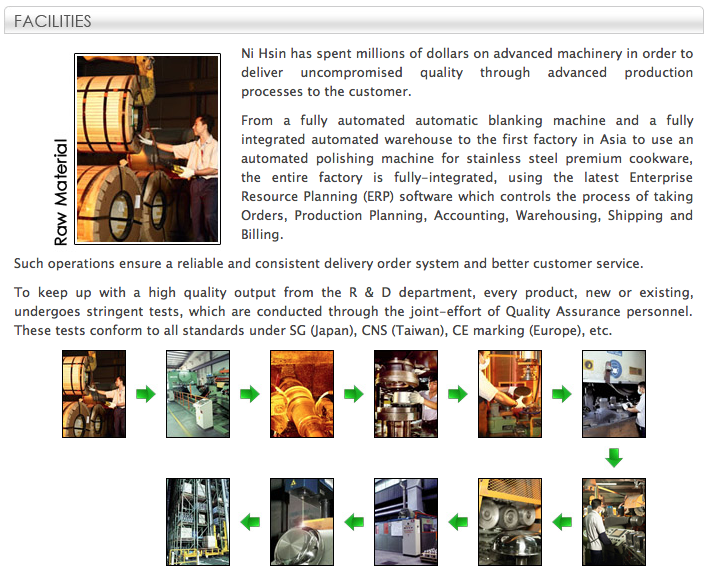

Ni Hsin Resources

Ni Hsin Resources Bhd (NHR) Snapshot

Open

0.36

|

Previous Close

0.44

| |

Day High

0.39

|

Day Low

0.35

| |

52 Week High

10/30/14 - 0.55

|

52 Week Low

03/25/14 - 0.17

| |

Market Cap

85.5M

|

Average Volume 10 Days

11.4M

| |

EPS TTM

0.0008

|

Shares Outstanding

231.0M

| |

EX-Date

10/16/14

|

P/E TM

462.5x

| |

Dividend

0.0050

|

Dividend Yield

1.35%

|

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 10,246 | 1 | -159 | -0.07 | - | 0.2600 |

| 2014-12-31 | 2014-06-30 | 9,529 | 317 | 224 | 0.07 | 0.01 | 0.2600 |

| 2014-12-31 | 2014-03-31 | 10,364 | -366 | -547 | -0.24 | - | 0.2600 |

| 2013-12-31 | 2013-12-31 | 14,422 | 1,375 | 749 | 0.32 | - | 0.2600 |

| 2013-12-31 | 2013-09-30 | 13,310 | 1,074 | 791 | 0.34 | - | 0.2600 |

| 2013-12-31 | 2013-06-30 | 12,780 | 849 | 612 | 0.26 | 0.01 | 0.2600 |

| 2013-12-31 | 2013-03-31 | 14,638 | 340 | 127 | 0.05 | - | 0.2600 |

| 2012-12-31 | 2012-12-31 | 15,779 | 731 | 877 | 0.38 | - | - |

| 2012-12-31 | 2012-09-30 | 12,034 | 282 | 10 | - | - | 0.2600 |

| 2012-12-31 | 2012-06-30 | 10,377 | -205 | -408 | -0.18 | - | 0.2600 |

| 2012-12-31 | 2012-03-31 | 11,745 | 680 | 426 | 0.18 | - | 0.2600 |

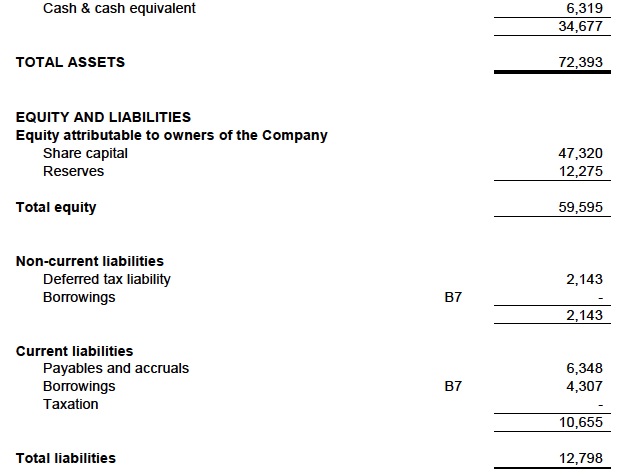

Healthy balance sheets :

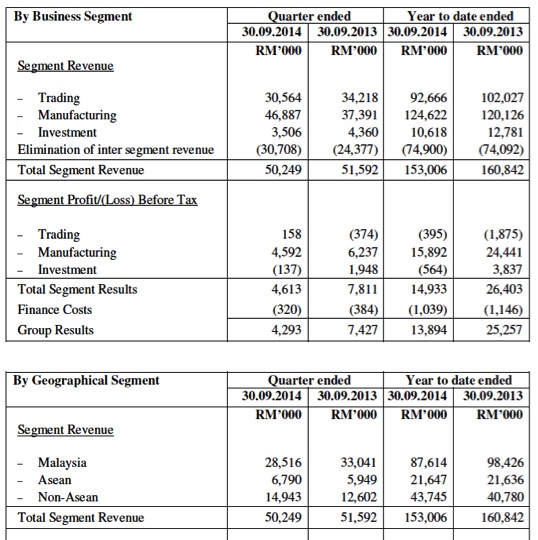

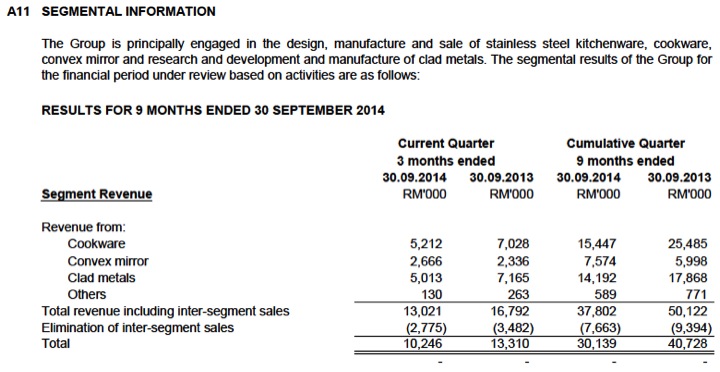

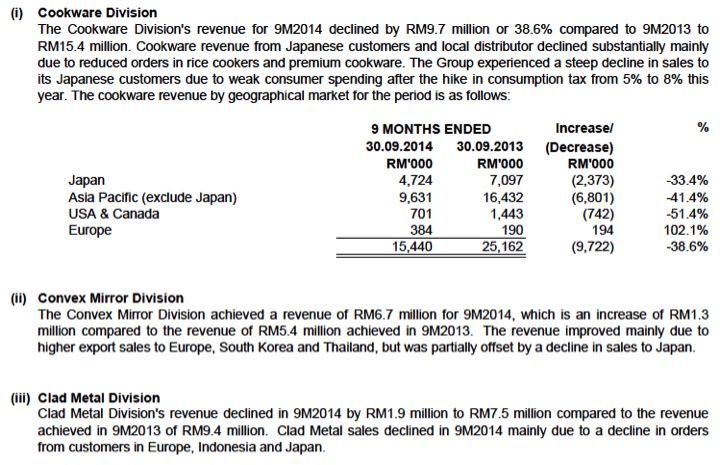

Segmental breakdown by revenue :

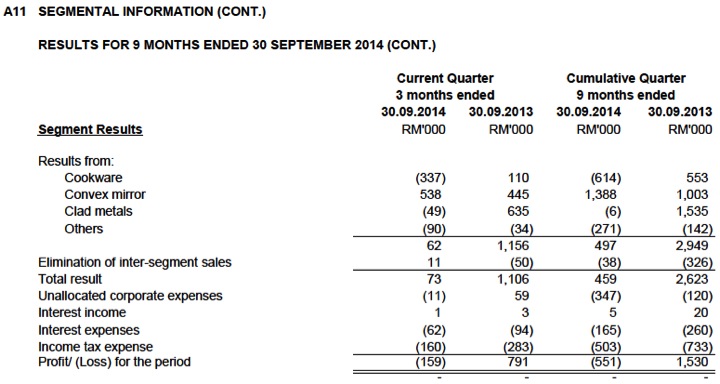

Segmental breakdown by profit :

Segmental btreakdown by geographical region. It seemed that the bulk of the group's products are exported.

Comments

(a) Small market cap of RM85 mil. Strong balance sheets.

(b) All this while, has been operating at breakeven level. However, as most of its products are exported, earnings should improve in coming quarters as Ringgit has weakended substantially. Nevertheless, this has more or less been priced in as share price has rallied from 25 sen to 45 sen over past few months.

(c) Despite better prospects, I am cautious about investing in this group. If a group has to rely purely on weak currency to boost its competitivenss, what will happen if the Ringgit return to normal ?

============================================================================

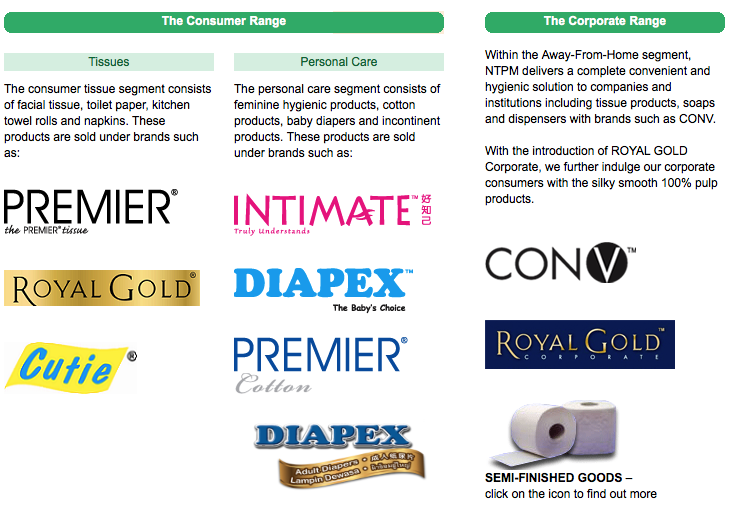

NTPM

Ntpm Holdings Bhd (NTPM) Snapshot

Open

0.65

|

Previous Close

0.65

| |

Day High

0.65

|

Day Low

0.64

| |

52 Week High

06/4/14 - 0.90

|

52 Week Low

12/24/14 - 0.60

| |

Market Cap

724.4M

|

Average Volume 10 Days

504.5K

| |

EPS TTM

0.04

|

Shares Outstanding

1.1B

| |

EX-Date

09/9/14

|

P/E TM

17.4x

| |

Dividend

0.03

|

Dividend Yield

4.50%

|

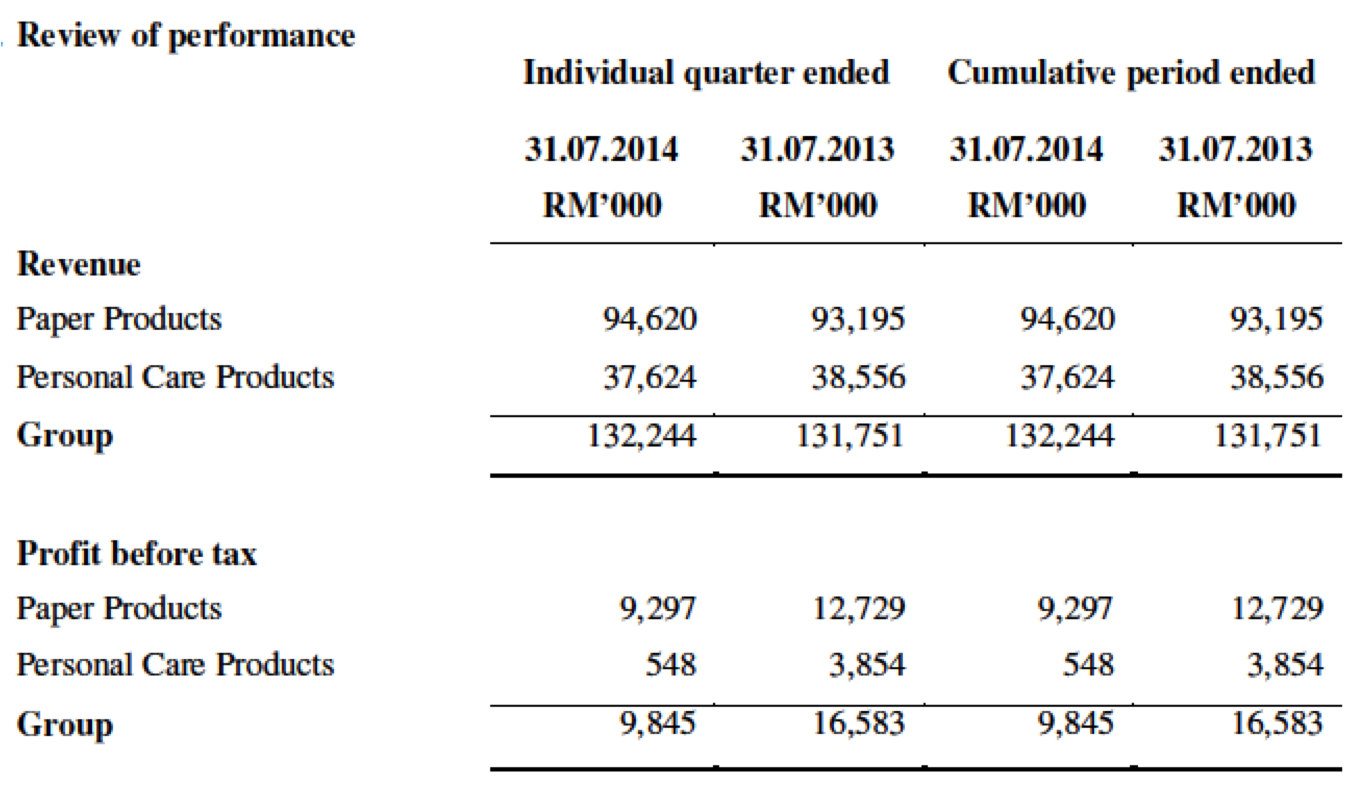

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-04-30 | 2014-10-31 | 138,091 | 12,557 | 9,198 | 0.80 | - | 0.3000 |

| 2015-04-30 | 2014-07-31 | 132,244 | 9,845 | 7,002 | 0.60 | - | 0.3100 |

| 2014-04-30 | 2014-04-30 | 135,964 | 13,814 | 11,703 | 1.00 | 1.45 | 0.3000 |

| 2014-04-30 | 2014-01-31 | 132,854 | 18,847 | 14,193 | 1.30 | 1.45 | 0.3100 |

| 2014-04-30 | 2013-10-31 | 126,872 | 20,636 | 16,021 | 1.40 | - | 0.3000 |

| 2014-04-30 | 2013-07-31 | 124,757 | 16,583 | 11,975 | 1.10 | - | 0.2900 |

| 2013-04-30 | 2013-04-30 | 126,352 | 17,077 | 12,827 | 1.20 | 1.45 | - |

| 2013-04-30 | 2013-01-31 | 127,521 | 18,819 | 13,827 | 1.20 | 1.45 | 0.2800 |

| 2013-04-30 | 2012-10-31 | 118,524 | 16,953 | 12,265 | 1.10 | - | 0.2700 |

| 2013-04-30 | 2012-07-31 | 114,861 | 14,515 | 10,213 | 0.90 | - | 0.2600 |

| 2012-04-30 | 2012-04-30 | 115,625 | 16,166 | 11,814 | 1.10 | 1.45 | - |

| 2012-04-30 | 2012-01-31 | 116,304 | 18,063 | 14,384 | 1.30 | 1.45 | 0.2400 |

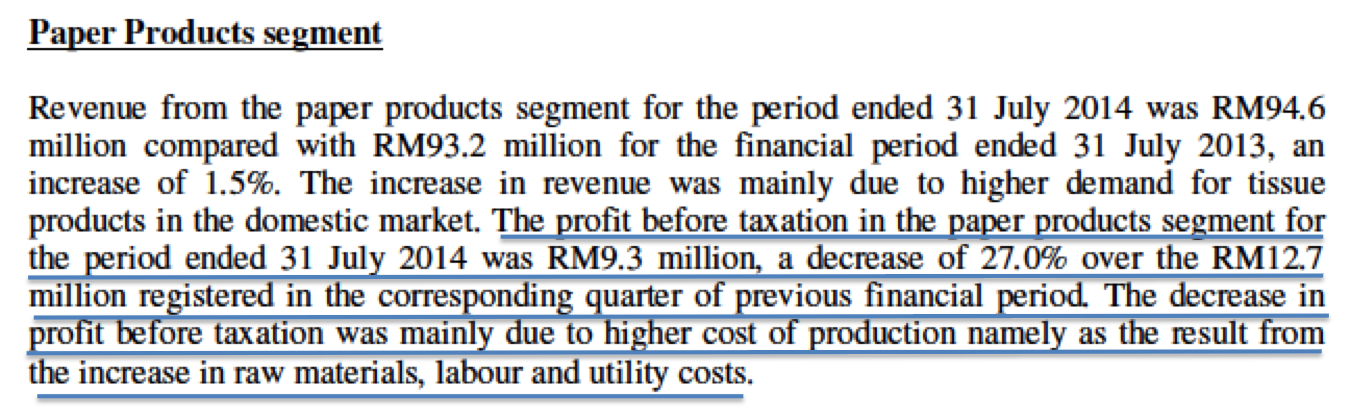

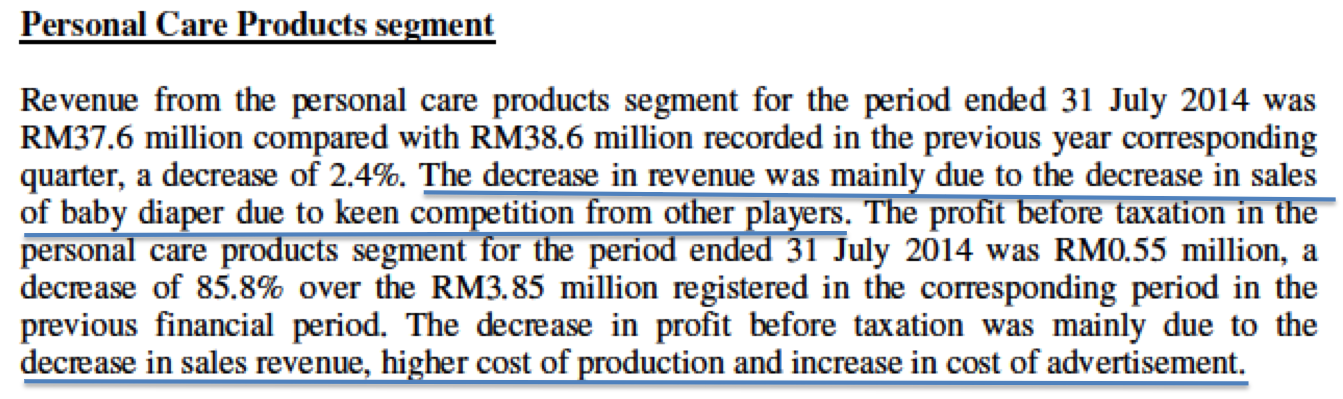

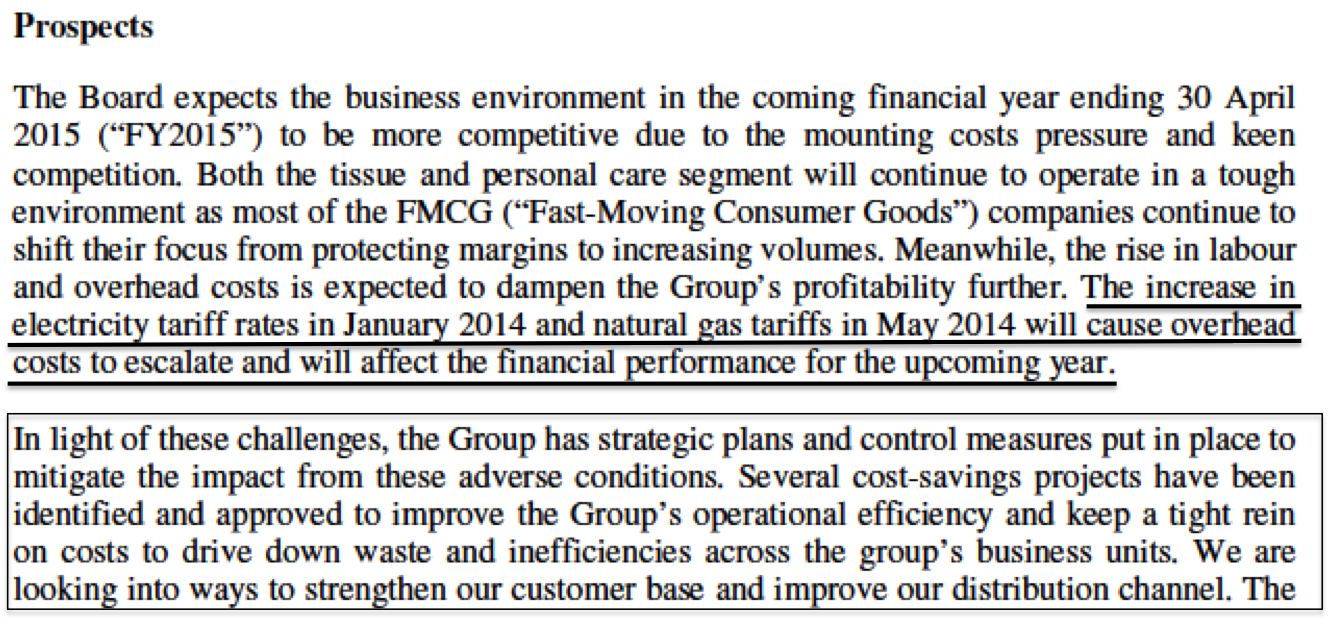

NTPM reported lower earnings in July and October 2014 quarters. As a result, share price declined from 80 sen range to 60 sen range. Managment explained that the decline was due to higher utility and labour cost as well as competition.

Surprisingly, the group has quite a fair bit of borrowings, with net gearing at 0.32 times.

Comments

The company has put in place cost cutting measures to restore profitability. We will have to wait for next few quarters to see whether performance will improve.

No comments:

Post a Comment