CCK Consolidated, CCM Duopharma, Chee Wah Corp

Author: Icon8888 | Publish date: Mon, 9 Feb 2015, 10:19 AM

CCK Consolidated

Cck Consolidated Holdings Bh (CCK) Snapshot

Open

0.87

|

Previous Close

0.87

| |

Day High

0.87

|

Day Low

0.87

| |

52 Week High

08/20/14 - 1.06

|

52 Week Low

12/26/14 - 0.80

| |

Market Cap

135.1M

|

Average Volume 10 Days

46.4K

| |

EPS TTM

0.06

|

Shares Outstanding

155.3M

| |

EX-Date

05/28/14

|

P/E TM

14.7x

| |

Dividend

0.02

|

Dividend Yield

1.72%

|

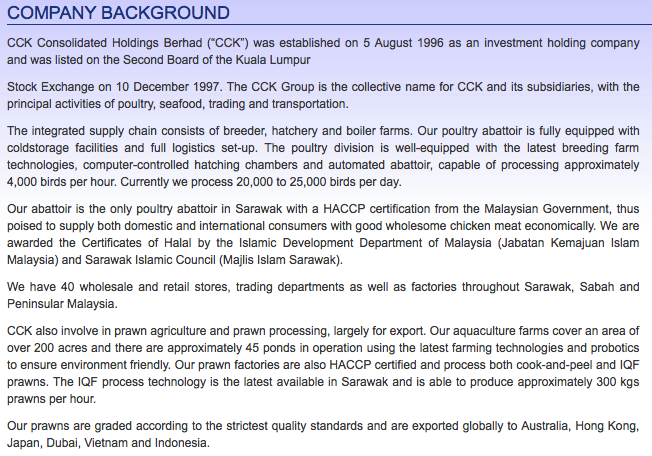

Sarawak based poultry company. Also owns 200 acres of fresh water prawn farm, with products mostly exported.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 122,805 | 3,127 | 2,343 | 1.51 | - | 0.9800 |

| 2014-12-31 | 2014-06-30 | 114,862 | 3,017 | 2,037 | 1.32 | - | 0.9600 |

| 2014-12-31 | 2014-03-31 | 117,335 | 4,162 | 3,107 | 2.01 | - | 0.9700 |

| 2013-12-31 | 2013-12-31 | 127,175 | 6,061 | 4,719 | 3.05 | - | 0.9500 |

| 2013-12-31 | 2013-09-30 | 119,772 | 6,410 | 4,553 | 2.94 | - | 0.9400 |

| 2013-06-30 | 2013-06-30 | 94,192 | 2,730 | 1,659 | 1.07 | - | 0.9100 |

| 2013-06-30 | 2013-03-31 | 94,583 | 2,402 | 1,475 | 0.95 | - | 0.9100 |

| 2013-06-30 | 2012-12-31 | 109,326 | 4,856 | 3,498 | 2.24 | - | - |

| 2013-06-30 | 2012-09-30 | 110,669 | 6,121 | 4,421 | 2.82 | - | 0.9200 |

| 2012-06-30 | 2012-06-30 | 96,221 | 6,405 | 4,573 | 2.90 | - | - |

| 2012-06-30 | 2012-03-31 | 98,710 | 6,392 | 4,638 | 2.94 | - | 0.8900 |

| 2012-06-30 | 2011-12-31 | 101,135 | 8,220 | 5,789 | 3.67 | - | 0.8700 |

| 2012-06-30 | 2011-09-30 | 114,832 | 8,179 | 5,544 | 3.52 | - | 0.8700 |

| 2011-06-30 | 2011-06-30 | 93,690 | 4,760 | 3,713 | 2.35 | - | - |

| 2011-06-30 | 2011-03-31 | 94,831 | 5,060 | 3,701 | 2.35 | - | 0.8500 |

| 2011-06-30 | 2010-12-31 | 98,719 | 6,974 | 4,926 | 3.13 | - | 0.8300 |

| 2011-06-30 | 2010-09-30 | 104,739 | 8,745 | 6,048 | 3.84 | - | 0.8100 |

| 2010-06-30 | 2010-06-30 | 77,871 | 5,782 | 4,036 | 2.56 | - | - |

| 2010-06-30 | 2010-03-31 | 88,127 | 5,081 | 3,707 | 2.35 | - | 0.7600 |

| 2010-06-30 | 2009-12-31 | 89,877 | 6,089 | 2,598 | 1.65 | - | 0.7600 |

| 2010-06-30 | 2009-09-30 | 95,336 | 7,406 | 5,034 | 3.19 | - | 0.7900 |

| 2009-06-30 | 2009-06-30 | 78,103 | 4,260 | 3,127 | 1.98 | - | - |

| 2009-06-30 | 2009-03-31 | 80,765 | 4,954 | 3,471 | 2.20 | - | 0.7500 |

One thing that struck me immediately is how the group managed to report consistent earnings over the past. This is quite unusual for a poultry company.

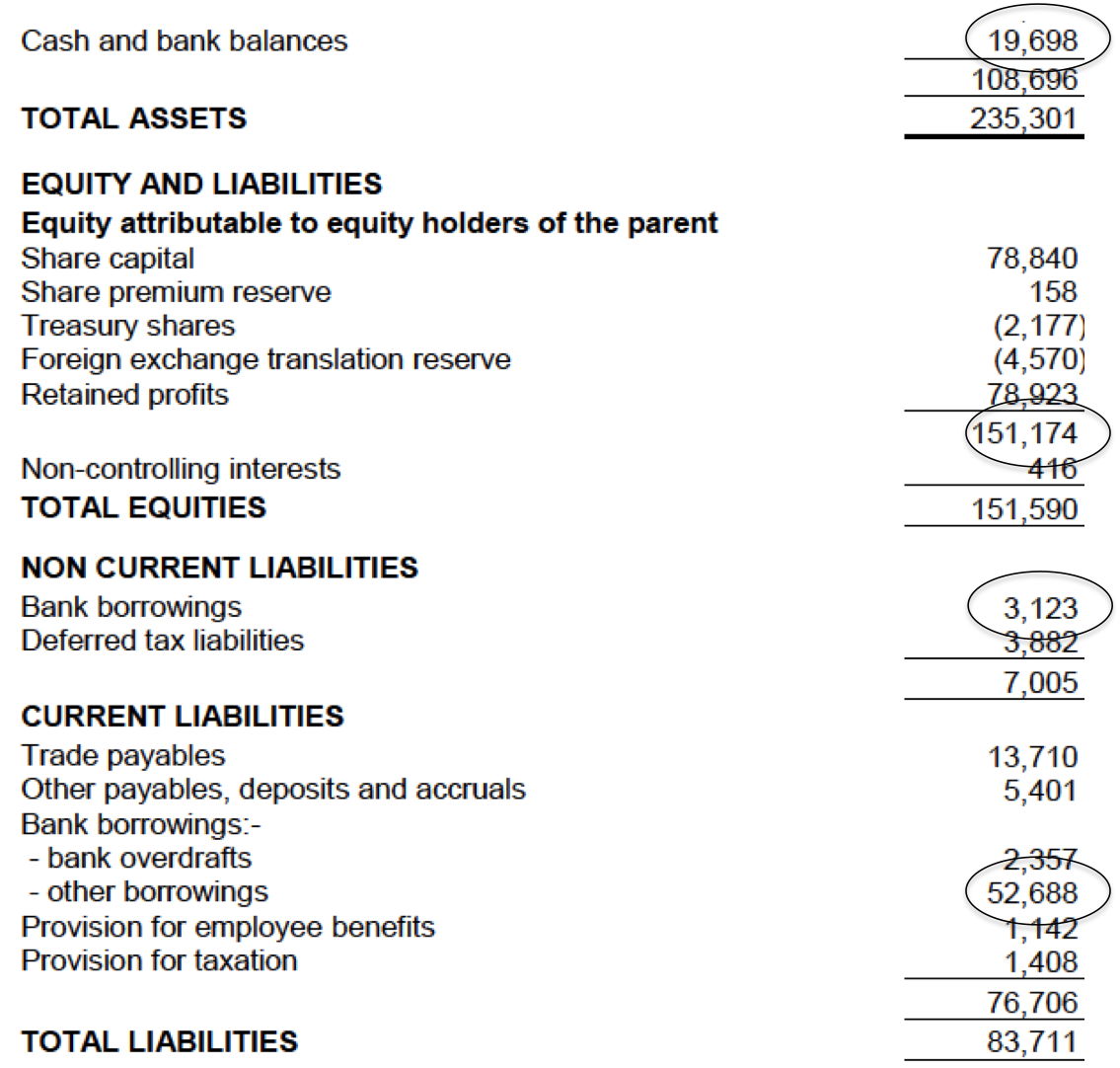

The group has strong balance sheets with net gearing of 0.23 times only.

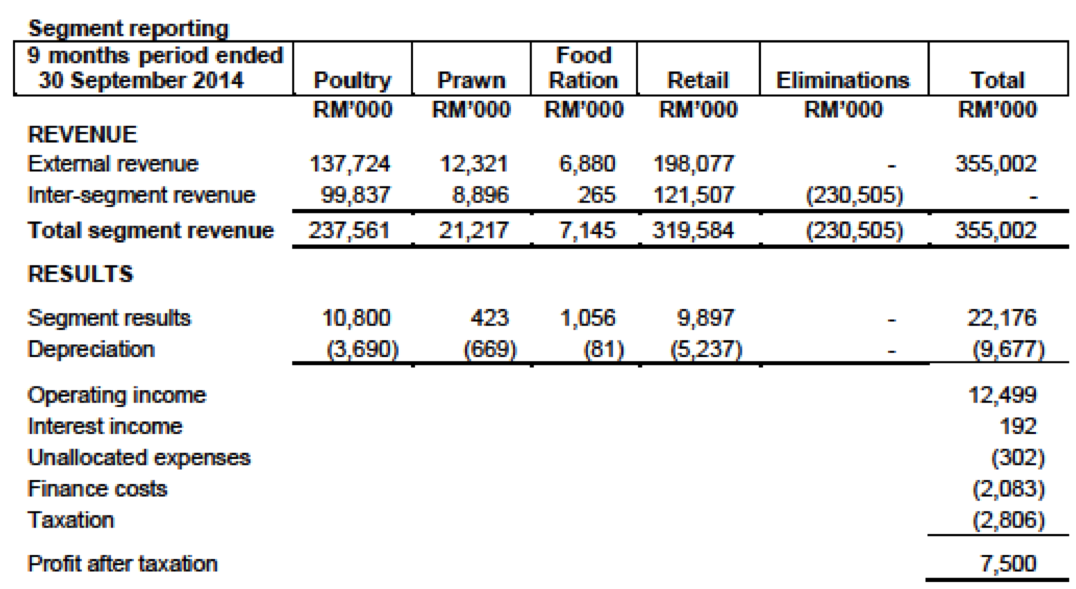

It seemed that apart from poultry farming, the retail division is also a major earning contributor (is this the reason behind the consistent earnings as mentioned above ?).

Prawn farming is not really profitable.

The group sells most of its products in Malaysia (Sarawak) but is expanding into Indonesia.

Comments

Good company. Consistent earnings but slow growth. At 14.7 times PER, fairly valued.

===========================================================================

CCM Duopharma Biotech

Ccm Duopharma Biotech Bhd (CCMD) Snapshot

Open

2.78

|

Previous Close

2.78

| |

Day High

2.78

|

Day Low

2.78

| |

52 Week High

08/26/14 - 3.37

|

52 Week Low

12/31/14 - 2.40

| |

Market Cap

385.9M

|

Average Volume 10 Days

11.2K

| |

EPS TTM

0.24

|

Shares Outstanding

138.8M

| |

EX-Date

10/15/14

|

P/E TM

11.4x

| |

Dividend

0.18

|

Dividend Yield

6.29%

|

CCM Duopharma Biotech Berhad, an investment holding company, manufactures, distributes, imports, and exports pharmaceutical products and medicines in Malaysia.

Despite its name of "Biotech", it seemed that the group's products are quite basic (mouthwash, vitamin, eye drops, etc). However, this is not necessarily a bad thing. If the company is given preferential access by government hospitals, the supply of these basic items can provide a steady source of income.

CCM group is owned by PNB.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

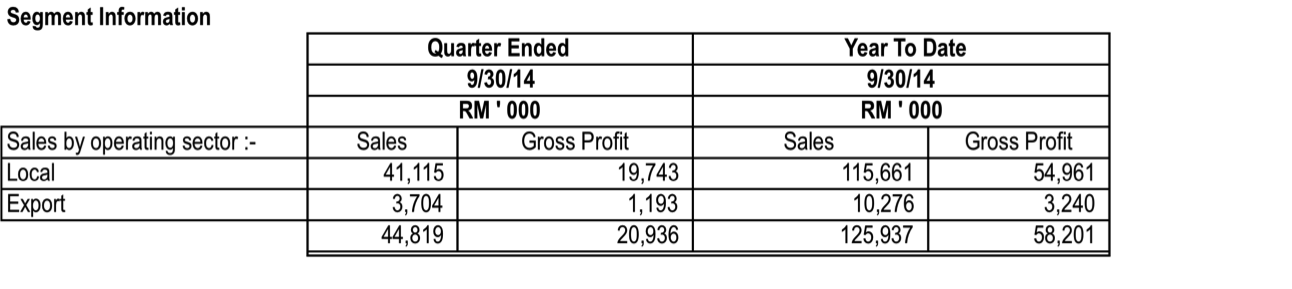

| 2014-12-31 | 2014-09-30 | 44,819 | 11,287 | 8,682 | 6.25 | - | 1.3500 |

| 2014-12-31 | 2014-06-30 | 40,623 | 10,107 | 7,513 | 5.41 | 4.00 | 1.2900 |

| 2014-12-31 | 2014-03-31 | 40,495 | 11,175 | 8,365 | 6.03 | - | 1.3700 |

| 2013-12-31 | 2013-12-31 | 45,734 | 9,160 | 9,313 | 6.71 | 13.50 | 1.3100 |

| 2013-12-31 | 2013-09-30 | 40,845 | 9,054 | 6,786 | 4.89 | - | 1.2900 |

| 2013-12-31 | 2013-06-30 | 37,988 | 13,007 | 10,689 | 7.70 | 4.00 | 1.3500 |

| 2013-12-31 | 2013-03-31 | 37,837 | 8,956 | 6,699 | 4.83 | - | 1.2700 |

| 2012-12-31 | 2012-12-31 | 35,378 | 9,000 | 5,998 | 4.32 | 10.50 | - |

| 2012-12-31 | 2012-09-30 | 29,521 | 8,392 | 6,442 | 4.64 | - | 1.2100 |

| 2012-12-31 | 2012-06-30 | 34,355 | 9,037 | 6,867 | 4.95 | 3.50 | 1.1700 |

| 2012-12-31 | 2012-03-31 | 36,057 | 8,869 | 6,708 | 4.83 | - | 1.2300 |

As shown in table above, earnings are very consistent. Strong dividend yield of more than 6%. However, this is about to end soon....(please refer to details below regarding their corporate proposals)

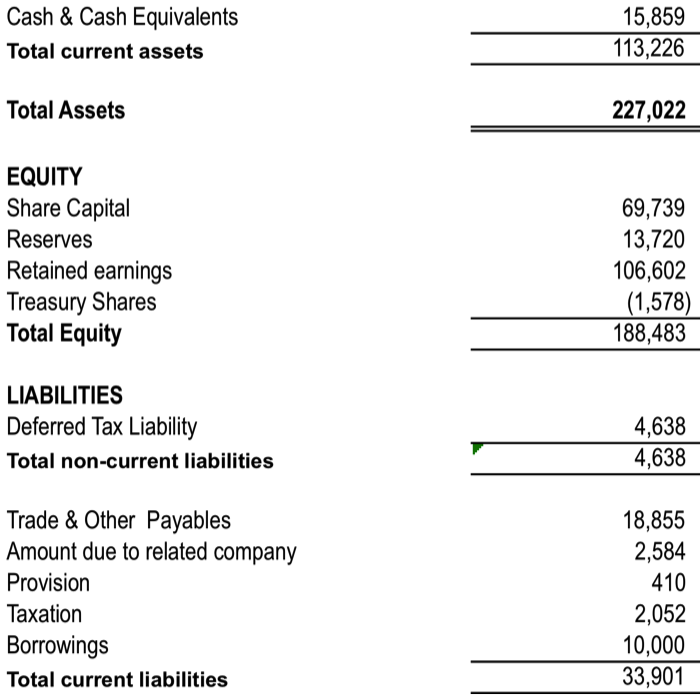

Strong balance sheets with limited borrowings :-

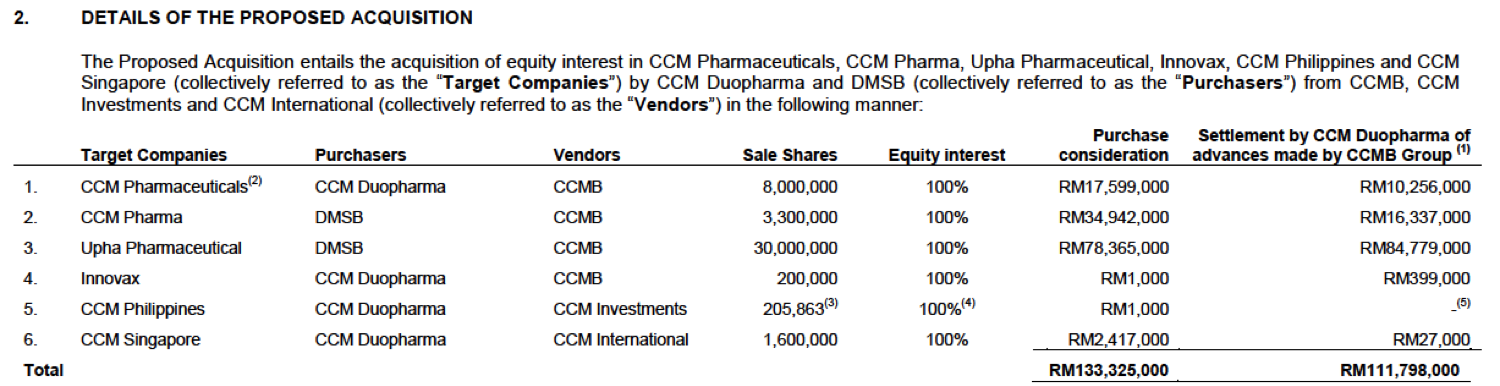

In November 2014, the company announced that it has entered into agreements to acquire several companies from its parent company for cash consideration of RM133 mil and settlement of debt of RM118 mil.

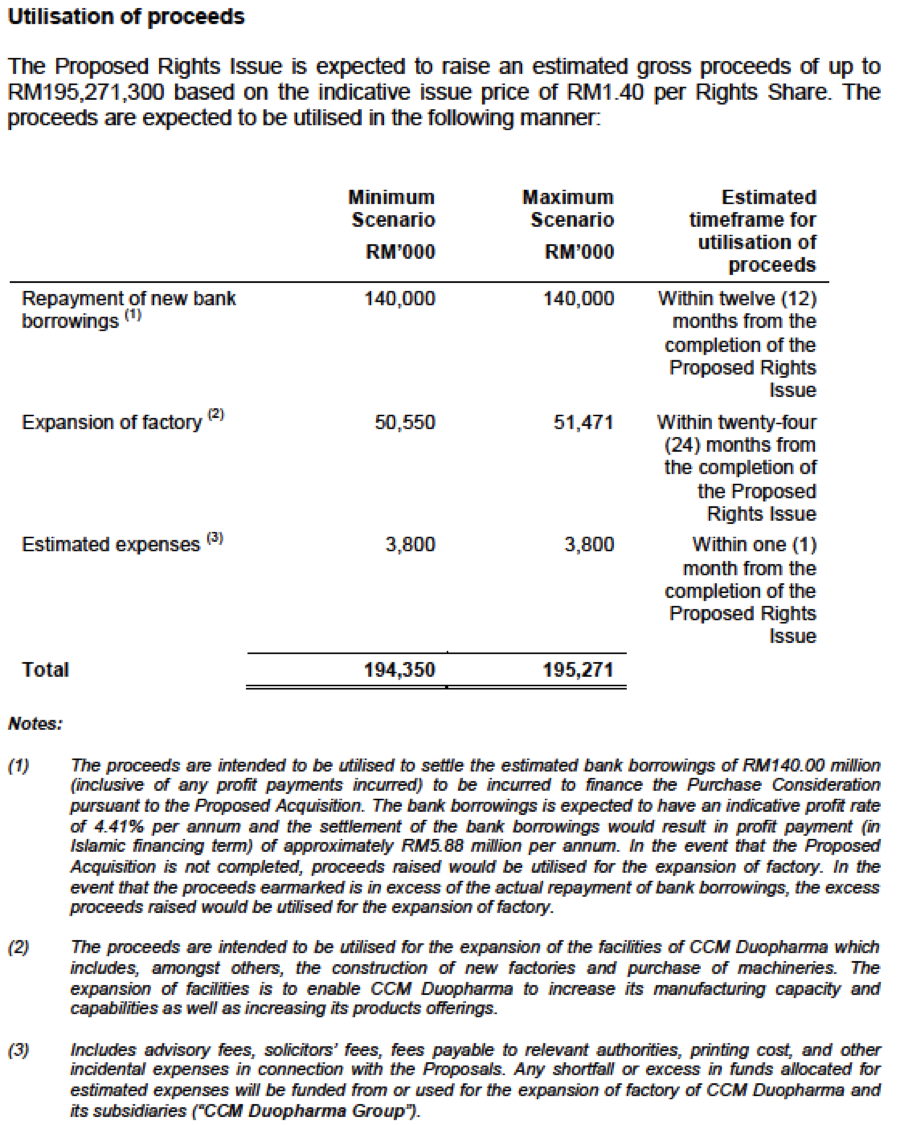

The cash consideration is to be funded by a rights issue on the basis of 1 rights share for every share held. Share cap will increase by 100% post rights issue. Rights price yet to be fixed.

The settlement of RM118 mil debts will be funded by way of borrowings.

The acquiree companies are not profitable (collectively have net profit of RM1 mil only) but have manufacturing facilities that have spare capacity. The plan is for CCM Duopharma to make use of the facilities to increase its drugs production capacity (the company is also investing to expand existing capacity).

This is to capitalise on the impending "Patents Cliff" whereby many of the world's pahrmaceutical patents will expire over next few years and pharmaceutical companies can start producing generic version. The company expects government hospitals to start sourcing more from domestically produced drugs (following expiry of patents) and there will be higher demand for their products.

Comments

(a) Used to be a company with consistent earnings and high dividend yield.

(b) Recently announced acquisition of companies from parent company will result in significant dilution in EPS (as proceeds will be funded by rights issue and the target companies only generate agggregate net profit of RM1 mil, despite purchase price of RM133 mil).

(c) Long term prospects is good as additional capacity will drive growth in the future especially with the expiry of patents.

(d) For a normal company, this exercise shopuld have caused a massive derating of share price as the exercise will create an overhang. However, CCM Duopharma is tightly held and owned by powerful shareholders with abundant financial resources (to support share price, if necessary). So it is difficult to predict how the shares will perform in the short term and when is the best time to gain exposure.

(d) If you like the long term story, maybe the best timing to buy is now.

=================================================================================

Chee Wah

Chee Wah Corp Bhd (CWAH) Snapshot

Open

0.40

|

Previous Close

0.40

| |

Day High

0.40

|

Day Low

0.40

| |

52 Week High

08/19/14 - 0.65

|

52 Week Low

03/13/14 - 0.38

| |

Market Cap

16.8M

|

Average Volume 10 Days

2.5K

| |

EPS TTM

0.0061

|

Shares Outstanding

42.1M

| |

EX-Date

12/29/03

|

P/E TM

65.6x

| |

Dividend

--

|

Dividend Yield

--

|

The company only has market cap of RM16.8 mil. I believe this could be one of the smallest in Bursa.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

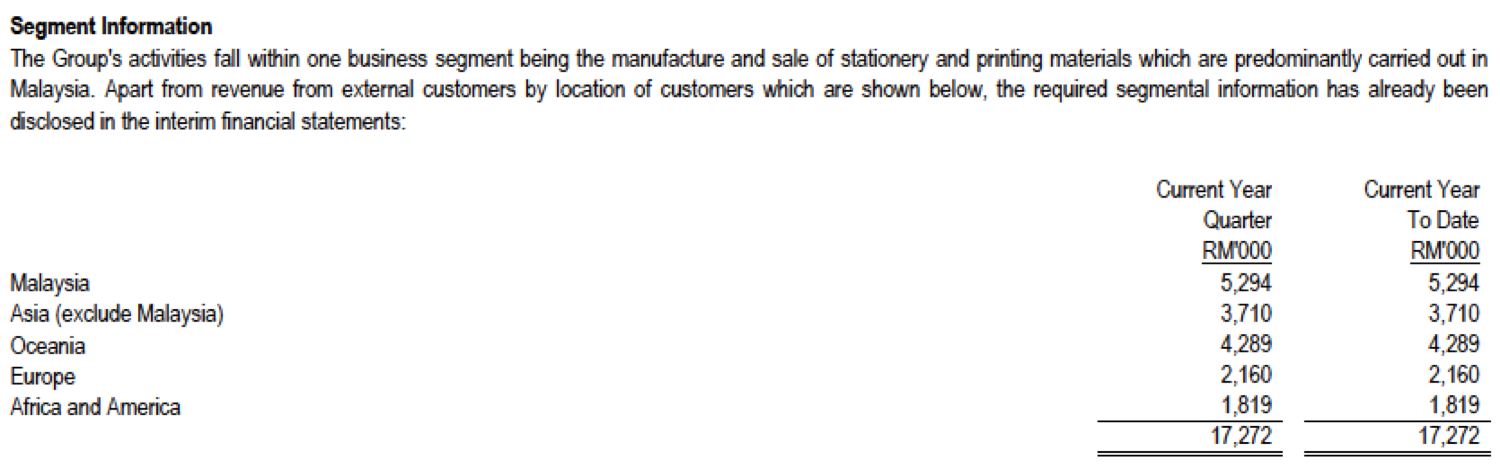

| 2015-06-30 | 2014-09-30 | 17,272 | -450 | -365 | -0.87 | - | 0.9900 |

| 2014-06-30 | 2014-06-30 | 27,387 | 1,011 | 653 | 1.55 | - | 1.0000 |

| 2014-06-30 | 2014-03-31 | 15,570 | -967 | -854 | -2.03 | - | 0.9900 |

| 2014-06-30 | 2013-12-31 | 27,110 | 921 | 827 | 1.96 | - | 1.0100 |

| 2014-06-30 | 2013-09-30 | 18,838 | -599 | -491 | -1.17 | - | 0.9900 |

| 2013-06-30 | 2013-06-30 | 25,102 | -177 | -53 | -0.13 | - | - |

| 2013-06-30 | 2013-03-31 | 19,146 | -884 | -569 | -1.35 | - | 1.0000 |

| 2013-06-30 | 2012-12-31 | 26,980 | 984 | 870 | 2.07 | - | 1.0100 |

| 2013-06-30 | 2012-09-30 | 14,966 | -760 | -599 | -1.42 | - | 0.9900 |

| 2012-06-30 | 2012-06-30 | 24,760 | -5,348 | -6,001 | -14.26 | - | - |

| 2012-06-30 | 2012-03-31 | 16,299 | -1,059 | -837 | -1.99 | - | 1.0200 |

The group has been loss making almost every quarter. However, this coming quarter result should show an improvement in earnings as the group exports 70% of its products :-

The group's gearing is quite high at 0.60 times. This is actually quite worrying as the group has not been very profitable. It will be difficult to pare down your borrowings when your operation is not generating surplus.

Comments

I am excited to discover Chee Wah as a currency play. However, the illiquidity of the shares made it very difficult to accumulate. The illiquidity could be dangerous in the event that the Ringgit starts strengthening as it will be difficult to exit. Will give it a pass.

Furthermore, weak currency is not a permanent feature. The group needs to be more efficient and not purely relies on weak currency to survive.

No comments:

Post a Comment