With Multiple Assets Maturing, Risk Is On The Upside

Author: Icon8888 | Publish date: Mon, 28 Dec 2015, 05:16 PM

1. Introduction

I first wrote about Mudajaya (Part 1) on 6 March 2014. However, I suggest you ignore that article as the information was quite outdated.

http://klse.i3investor.com/blogs/icon8888/47896.jsp

When I wrote that article, Mudajaya was trading at RM2.70. Now it is trading at RM1.14.

The collapse of Mudajaya's market capitalization over past 18 months was caused by delayed commissioning of its power plant in India (still not fully resolved) as well as a series of quarterly losses.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) |

|---|---|---|---|---|---|---|

| 2015-12-31 | 2015-09-30 | 108,151 | 16,789 | 14,336 | 2.66 | - |

| 2015-12-31 | 2015-06-30 | 105,566 | -10,358 | -12,272 | -2.28 | - |

| 2015-12-31 | 2015-03-31 | 165,226 | -18,440 | -19,661 | -3.65 | - |

| 2014-12-31 | 2014-12-31 | 188,745 | -109,379 | -99,709 | -18.48 | - |

| 2014-12-31 | 2014-09-30 | 208,657 | 7,969 | 1,074 | 0.20 | - |

| 2014-12-31 | 2014-06-30 | 278,997 | 6,913 | 3,346 | 0.62 | 3.00 |

| 2014-12-31 | 2014-03-31 | 366,406 | 31,763 | 25,055 | 4.61 | 3.00 |

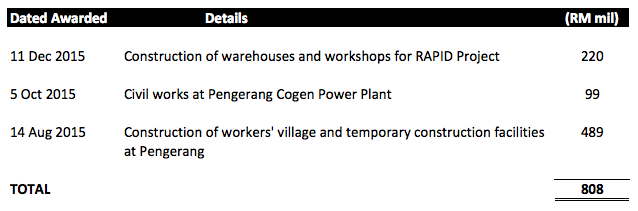

On 22 December 2015, Mudajaya announced that it has secured RM220 mil contract from Petronas. This is the third job win in a matter of 3 months.

That aroused my interest. After undertaking a quick study of the group, I decided to add it to my portfolio.

2. Balance Sheets

Based on net assets of RM1,092 mil, interest bearing debts of RM600 mil and cash of RM106 mil, net gearing is 0.45 times.

Strictly speaking, Mudajaya's gearing is not low. The bulk of it is the RM360 mil Medium Term Notes issued in first quarter of 2014.

As shown in table above, Mudajaya was in net cash position back in December 2013. What caused interest bearing debts to balloon to RM600 mil ? Should we be concerned ?

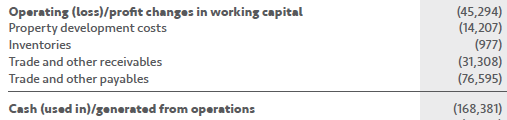

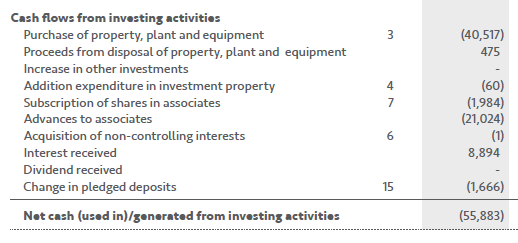

In order to understand the origin of these debts, I studied the Group's historical cashflow. The following is extracted from the Group's FY2014 cashflow statement. It seemed that a total of RM123 mil was tied down in working capital (-RM14.2 mil - RM0.98 mil - RM31.3 mil - RM76.6 mil).

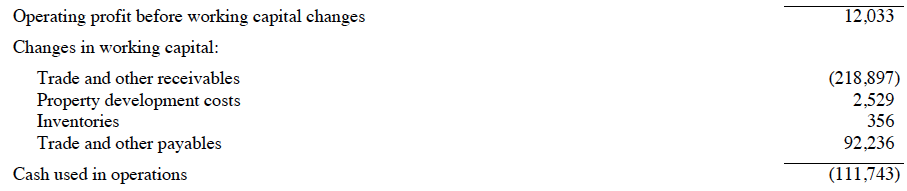

The 9 months ended September 2015 was not any better. As shown below, approximately RM123.8 mil was tied down in working capital (-RM218.9 mil + RM2.53 mil + RM0.36 mil + RM92.24 mil).

These two periods alone, working capital tied down approximately RM246.8 mil of the Group's cashflow. No wonder they need to draw down borrowings to plug the gap.

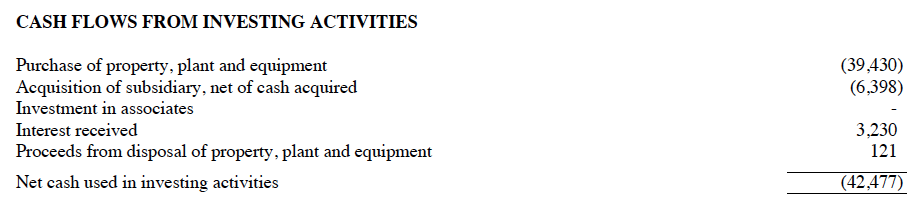

In contrast, capex did not take up a lot of cash. In FY2014, net amount spent was RM56 mil.

During the 9 months ended September 2015, net amount spent was RM42.4 mil.

Now that we have figured out how the debts arise, the question to be ask is "what is the potential source of repayment ? "

According to September 2015 quarterly report, the group has receivables of RM446 mil and "other current assets" of RM527 mil.

These items are huge. What are they ? How should we view them ?

When come to receivables, the major issue is whether they will turn bad. In my opinion, it is unlikely. The following are some of the reasons :-

(a) Almost all of Mudajaya's projects are in Malaysia. According to my experience, overseas customers carry higher credit risk (disputes, government intervention, etc). Local debtors are usually easier to manage.

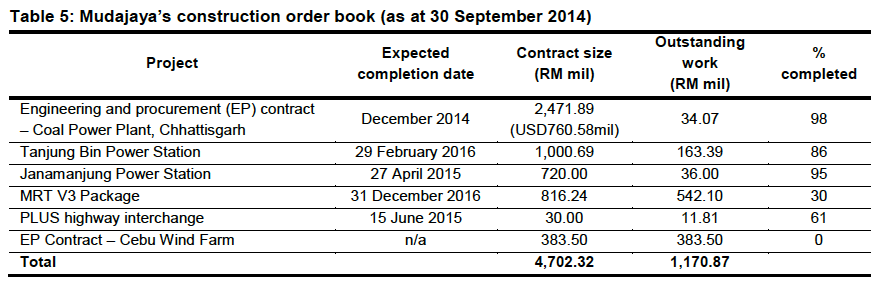

(b) Mudajaya's clients are reputable and established entities. So far, there are no news of them getting into financial troubles. Please refer to table below.

(c) In FY2013 and FY2014, Mudajaya's bad debts was RM0.597 mil and RM0.607 mil respectively. For the first 9 months of FY2015, the amount is zero. The low level of bad debts is indication that there is proper risk management mechanism in place.

What about "other current assets" of RM527 mil ? What are these items ? The September 2015 quarterly report did not provide details. However, according to FY2014 annual report, approximately RM234 mil are amount due from contract customers, which are essentially receivables. I have addressed this issue above.

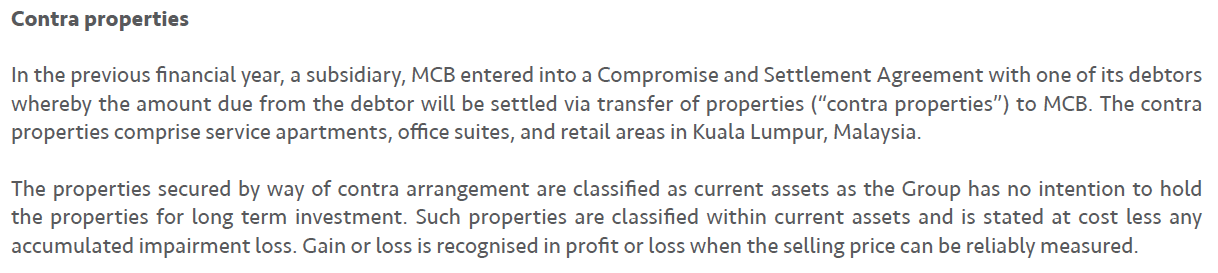

Another RM168 mil (FY2014) are contra properties. According to the company, those are payment in kind by a customer who has difficulty making payment.

I am comfortable with those properties. Since they were acquired through negotiations, I am sure they must be backed by proper valuations by professionals.

After digesting the above information, I have a better feel of the group's financial position. In my opinion, there is no need to be unduly worry about its gearing. High working capital requirement is a common feature of construction companies. Many of Mudajaya's debts will be extinguished when they sell off the contra properties and / or receive payment from customers.

3. Historical Profitability

Mudajaya used to eat shark fin soup and abalone everyday. However, since 2014, they can only afford peanut butter and white bread.

From net profit of RM151 mil in FY2013, the Group's performance nosedived to report losses of RM70 mil in FY2014. The losses continued in first half of FY2015. Construction division was the main culprit.

In September 2015 quarter, the Group finally turned around. Construction division's profitability improved to RM15.9 mil.

Is this one off or the beginning of a new chapter ? The sections below will take a closer look at the group's various divisions.

4. Construction Division

The losses of the construction division over past 3 quarters was due to :-

(a) cost overrun; and

(b) timing differences : cost has been incurred for Variation of Order but unable to bill clients yet.

There is no excuse for the poor performance, but I am not complaining though. Without those losses dragging down earnings, I would not have the chance to buy at current price. In any event, the worst seemed to be over already as the division has returned to the black.

Apart from the losses, one of the main reasons Mudajaya spooked analysts and investors was its inability to secure any contract for the most part of 2015.

The dry spell finally ended in September 2015.

According to Hong Leong Investment Bank, its outstanding order book should be approximately RM1.6 billion. That should be sufficient to last the group 1.5 years (based on FY2014 construction revenue of approximately RM1 billion).

In FY2013, the group's construction division reported net margin of closed to 10%. However, that was mostly due to the IPP project in India, which was a concession project.

For contracts secured through competitive bidding, net margin of 5% is more realistic. For the purpose of modelling, let's assume RM50 mil net profit from this division in FY2016 (being RM1 billion x 5%).

5. Chhattisgarh IPP Project

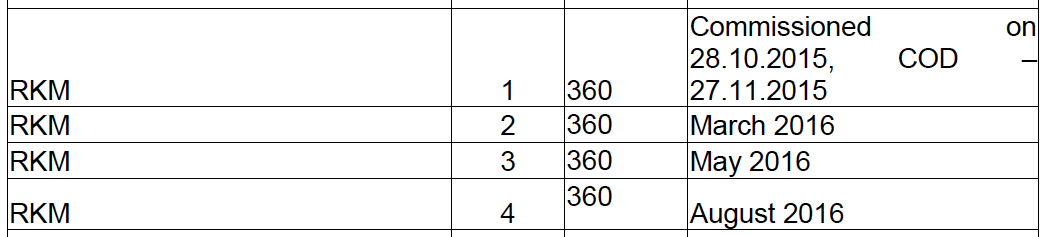

Mudajaya holds 26% equity interest RKM Powergen Pte Ltd, which has been building a 1,440 MW coal-fired power project in Chhattisgarh, India. The project comprises four generating units with a nominal capacity of 360 MW each.

Chhattisgarh is a state in central India. It is the 10th largest state in India, with an area of 135,194 km2. With a population of 25.5 million, Chhattisgarh is the 16th most-populated state of the nation. It is a source of electricity and steel for India, accounting for 15% of the total steel produced in the country. Chhattisgarh is one of the fastest-developing states in India (Source : Wikipedia)

Mudajaya was accorded VIP treatment in India. They sang and danced until they forgot that shareholders were waiting for them in Malaysia to switch on the power plant. The following is a recording of one of the business trips to Chhattisgarh to negotiate with local authorities.https://www.youtube.com/watch?v=-ijfNEF7-JY

Supposed to be commissioned in 2013, the power plant has faced one delay after another. The last I heard, Mudajaya has been telling shareholders that the power plant is targeted to be commissioned by early 2016.

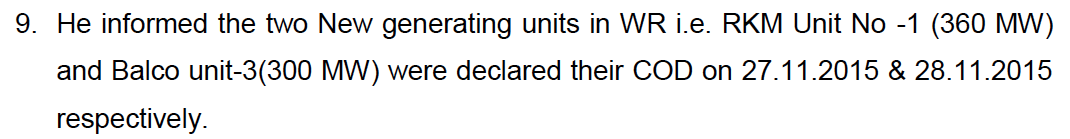

However, this round, it seemed that things are happening faster than expected. According to a document posted on the Mudajaya thread by forum member greddym3, Unit 1 of the plant achieved COD (Commercial Operation Date) in November 2015.

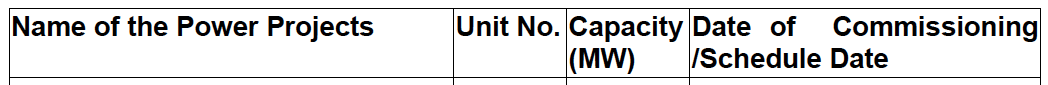

According to a separate table in the document, Unit 2, 3 and 4 are targeted to be commissioned by March, May and August 2016 respectively.

Now, we are finally seeing light at the end of the tunnel. But exactly how much profit can we expect from the IPP project ?

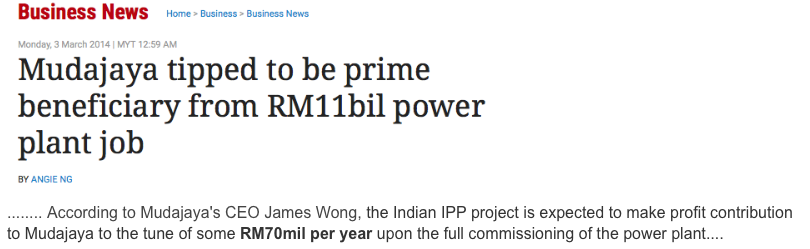

According to an article dated 3 March 2014 in The Star, Mudajaya's CEO expected the IPP project to contribute approximately RM70 mil to Group profit. Was he referring to EBITDA, PBT or net profit ? If I am not wrong, according to accounting standard, associate contribution is booked in at Net Profit level. As such, it is likely that the RM70 mil is referring to net profit (Accountants please chip in here).

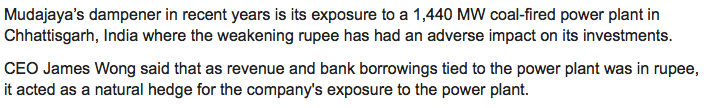

However, there is still one loose end to be tied up. Over the past 18 months, currencies have been on a roller coaster ride. How would that affect the IPP project's contribution to Mudajaya ? The 3 March 2014 article shedded some light on this issue as well.

First of all, let's have a feel of the movement of Rupee vs Ringgit. When James Wong mentioned that Rupee was weak, it was back in March 2014. During that time, one Rupee can get you 0.053805 Ringgit.

However, in 2015, Ringgit has depreciated substantially against the Rupee (Malaysia is a net oil exporter while India is a net oil importer). As at 24 December 2015, one Rupee can buy 0.064287 Ringgit, 19% more.

There is one more hurdle to clear. India does not have a strong power equipment manufacturing industry. As such, it is likely that the IPP needs to import the equipment and parts. We have all known by now that if you import anything, you need to pay US Dollars. Bearing in mind that the Rupee has depreciated against the US Dollars, how much USD debt does the IPP have ? Will all the advantge gained from strengthening of Rupee vs Ringgit be offset by the Rupee vs USD depreciation ?

Luckily, according to the 3 March 2014 article, both the IPP's revenue and debt are denominated in Rupee.

It seemed that we have a winner - no USD adverse impact, but strong Rupee will boost profit contribution to Mudajaya. Nice.

6. Other Power Projects

Apart from Chhattisgarh IPP project, Mudajaya has also invested in the following power projects :-

(a) Gebeng Solar Power

In 2014, Mudajaya acquired 60% equity interest in Special Universal Sdn Bhd ("SUSB"), which owns a 10 MW solar farm in Gebeng, Pahang. SUSB achieved Commercial Operation Date for 5 MW each in December 2013 and April 2014 respectively.

The investment allowed Mudajaya to gain exposure in renewable energy. However, profit contribution is not much. In the first 9 months of FY2015, operating profit was approximately RM4 mil. Based on annualised operating profit of RM5 mil and 25% tax rate, PAT should be approximately RM4 mil. 60% stake should result in net profit of RM2 mil.

(b) Sulawesi Coal Power

On 5 May 2014, Mudajaya anounced the proposed acquisition of 70% equity interest in PT Harmoni Energy Indonesia ("PT HEI") for cash consideration of RM18.5 mil. PT HEI was developing a 2 x 7 MW coal fired power plant in Sulawesi. The plant was backed by concession of 25 years with initial tariff of USD0.1185 / kWh.

Based on back of envelope calculation, annual revenue should be approximately RM50.9 mil (2 x 7,000 x 24 x 365 x 0.1185 x 3.5).

In March 2015, Mudajaya announced that it has completed the acquisition of 46% equity interest in PT HEI. The remaining 24% to be acquired at later date.

Recently, Mudajaya announced that PT HEI has achieved Commercial Operation Date on 29 October 2015. The COD of PT HEI qualifies Mudajaya to pursue opprtunity to develop a plant of larger capacity in the vicinity.

The Sulawesi project is not huge. For modelling purpose, let's assume net profit contribution of RM3 mil per annum (for the 70% stake).

(c) Cebu Wind Power

On 26 October 2013, Mudajaya acquired 40% equity interest in Amihan Energy Corporation ("AEC"). AEC has been given the right to make use of the wind power on 18,225 ha of land in Cebu, Philippines. The wind energy project has full capacity of 200 MW. However, only 50 MW will be developed in the first phase.

In August 2014, Mudajaya announced that it has secured USD119 mil EPC contract from AEC. According to terms of contract, works will commence by October 2014 and complete within 18 months. As such, targeted completion date should be April 2016.

There is no information available on how much profit Mudajaya's 40% stake in AEC will generate. However, based on Gebeng's case, my guess is that 50 MW should generate net profit of approximatey RM20 mil (for 100%).

For a 40% stake, net profit of RM8 mil ?

7. Property Development

Traditionally, property development did not contribute much to group revenue and profitability. The group's main project is in Kuching, which generated net profit of approximately RM5 mil to RM10 mil per annum.

In 2013, the group entered into a joint venture with sister company Mulpha Land Berhad (recently renamed Thriven Global Bhd). Mudajaya owns 49% of the JV entity. The JV entity owns a piece of land (6 acres) in PJ, which was acquired from Tropicana Corporation Bhd for RM115 mil.

The development project, Lumi Tropicana, was recently launched with GDV of RM700 mil. Due to its strategic location (next to LRT 3 train station), it received favorable response from potential buyers. For more information, please refer to the article below (The Star).

Due to the small size of the project, I do not want to spend too much time on profit projection. Based on Mah Sing's past three years' average net margin of 12.7% and GDV of RM700 mil, I arrived at total net profit of RM89 mil. Mudajaya's 49% share will give it RM43 mil. Spreading over a period of 4 years (target completion by 2019), annual profit contribution will be approximately RM10 mil.

Note : I choose Mah Sing as a proxy as that group's business model invovles buying development land from land owner at high cost (instead of relying on long held cheap land bank). The Lumi project shares this similarity.

8. Concluding Remarks

As most of my readers would have noticed, I rely heavily on prospective EPS to guard my investment decision. As such, to cut a long story short, I have put the various divisions' POTENTIAL earnings into a financial model :-

Can they deliver the profit as shown above ? I think the key is the Indian IPP. If the information of Chhattisgarh going COD turns out to be correct, Mudajaya should be able to report pretty good profit in FY2016.

With multiple assets maturing at more or less the same time, it seemed that the group is approaching inflection point.

With limited downside risk and good potential upside, I don't mind taking position now to wait for durians to drop.

As usual, before I end this article, I would like to qualify that as an armchair analyst, I have limitation on how accurate my earnings projection can be. I have disclosed in full details how I arrived at my projections, and I did that without manipulating the figures. If you make money in the future by investing in Mudajaya, there is no need to thank me. However, if you lose money, please don't blame me either.

You walk into the deal with your eyes wide open.