Publish date:

1. Introduction

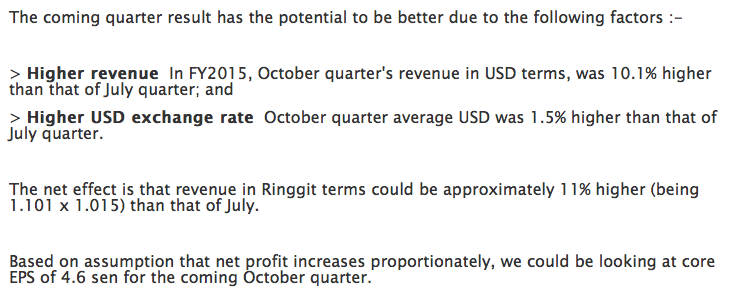

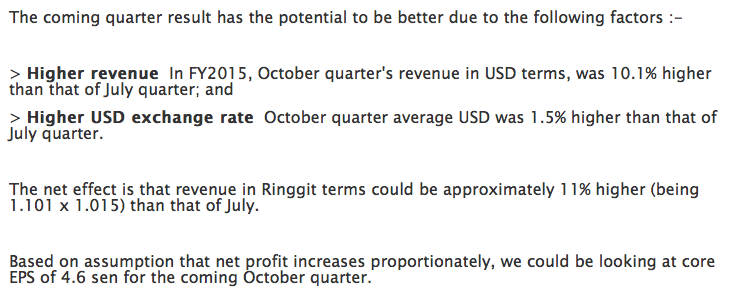

In my previous article dated 27 November 2016, I predicted EPS of 4.6 sen for Poh Huat's October quarter result.

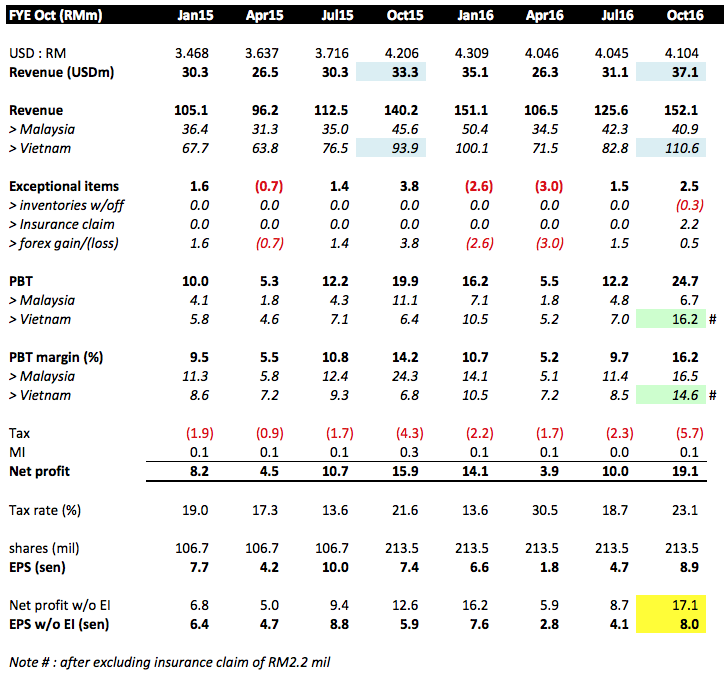

Poh Huat released its result today. EPS was 8.9 sen (!!!). After excluding insurance claim of RM2.2 mil, core EPS was still an extremely impressive 8.0 sen. This is 74% higher than the 4.6 sen I expected.

2. Earning Review

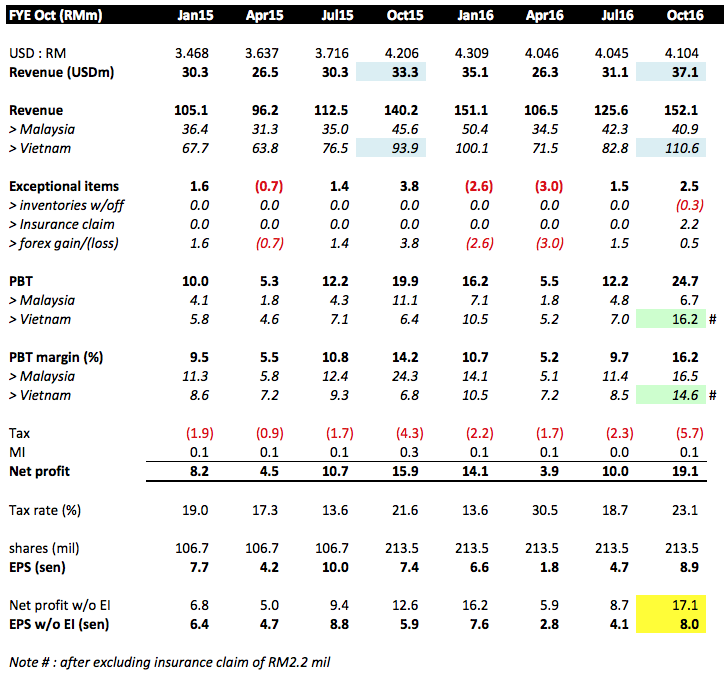

Key observations :-

(a) Malaysia operation's performance was reasonable. Its revenue, PBT and profit margin were more or less the same as previous quarters.

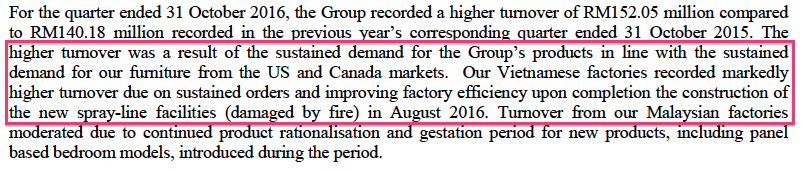

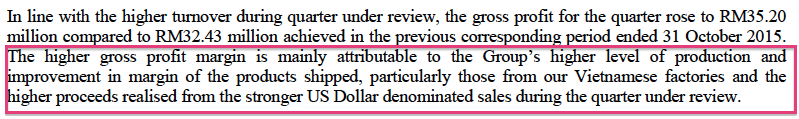

(b) Vietname operation sprang a HUGE positive surprise. Revenue increased by more than 17% Y-o-Y, while PBT increased by 153% from RM6.4 mil to RM16.2 mil (after excluding RM2.2 mil insurance claim). PBT margin increased from 6.8% to 14.6%.

(c) In the quarterly report, management explained that Y-o-Y higher revenue in Vietnam was due to stronger demand from customers while profit margin was boosted by, inter-alia, the new spray line facilities completed in August 2016 (after the fire) as well as more favorable exchange rate.

(Note : I am surprised by the favorable forex effect. I was expecting the opposite. My figures showed that October 2015 quarter's average USD exchange rate was 4.2, higher than the 4.1 for the latest quarter. The group must have managed its exchange rate differently from the market average. Whatever it is, I believe the impact of exchange rate was not big)

3. Increase In Net Cash

As at 30 October 2016, the group has cash and borrowings of RM72 mil and RM29 mil respectively. The net cash of 43 mil was RM18 mil higher than previous quarter's RM25 mil.

4. Prospect

5. Concluding Remarks

Poh Huat's latest quarter result far exceeded my expectation. The main contributing factors were higher revenue and profit margin of its Vietnam operation. What excited me most is that this was achieved against the backdrop of a relatively weak USD exchange rate of 4.10. Well done.

Next quarter result is expected to continue to be good as it will still be a strong season (as a matter of fact, traditionally its sale was stronger than October quarter). Furthermore, USD has strengthened substantially. Instead of 4.10, average USD should be more than 4.30 for the coming January 2017 quarter.

Everything looked good for Poh Huat. It is undoutedly a Strong BUY at current price. The only risk and uncertainty is potential US protectionism. I have analysed and discussed this issue in my previous few articles and concluded that it is not easy to be implemented. However, the risk is there and it is up to you to decide your next course of action.

Your money, your risk, your reward.

In my previous article dated 27 November 2016, I predicted EPS of 4.6 sen for Poh Huat's October quarter result.

Poh Huat released its result today. EPS was 8.9 sen (!!!). After excluding insurance claim of RM2.2 mil, core EPS was still an extremely impressive 8.0 sen. This is 74% higher than the 4.6 sen I expected.

2. Earning Review

Key observations :-

(a) Malaysia operation's performance was reasonable. Its revenue, PBT and profit margin were more or less the same as previous quarters.

(b) Vietname operation sprang a HUGE positive surprise. Revenue increased by more than 17% Y-o-Y, while PBT increased by 153% from RM6.4 mil to RM16.2 mil (after excluding RM2.2 mil insurance claim). PBT margin increased from 6.8% to 14.6%.

(c) In the quarterly report, management explained that Y-o-Y higher revenue in Vietnam was due to stronger demand from customers while profit margin was boosted by, inter-alia, the new spray line facilities completed in August 2016 (after the fire) as well as more favorable exchange rate.

(Note : I am surprised by the favorable forex effect. I was expecting the opposite. My figures showed that October 2015 quarter's average USD exchange rate was 4.2, higher than the 4.1 for the latest quarter. The group must have managed its exchange rate differently from the market average. Whatever it is, I believe the impact of exchange rate was not big)

3. Increase In Net Cash

As at 30 October 2016, the group has cash and borrowings of RM72 mil and RM29 mil respectively. The net cash of 43 mil was RM18 mil higher than previous quarter's RM25 mil.

4. Prospect

5. Concluding Remarks

Poh Huat's latest quarter result far exceeded my expectation. The main contributing factors were higher revenue and profit margin of its Vietnam operation. What excited me most is that this was achieved against the backdrop of a relatively weak USD exchange rate of 4.10. Well done.

Next quarter result is expected to continue to be good as it will still be a strong season (as a matter of fact, traditionally its sale was stronger than October quarter). Furthermore, USD has strengthened substantially. Instead of 4.10, average USD should be more than 4.30 for the coming January 2017 quarter.

Everything looked good for Poh Huat. It is undoutedly a Strong BUY at current price. The only risk and uncertainty is potential US protectionism. I have analysed and discussed this issue in my previous few articles and concluded that it is not easy to be implemented. However, the risk is there and it is up to you to decide your next course of action.

Your money, your risk, your reward.

GPS robot tripled the $100k deposit [live proof authenticated]

ReplyDeleteI just completed a webinar with Mark and his partner, Antony, two days ago and it was AMAZING.

During the webinar MARK and ANTONY shared their secrets to success and answered questions about their new version of the GPS Forex Robot that CAME OUT TODAY!