Publish date:

Yesterday, North Korea tested fire an Intercontinental Ballistic Missile. Most of Bursa was in red colour. But Crest Builder was strong. Somebody was consistently buying, and it closed by 3 sen higher. Today, market remains subdued. But early in the morning, Crest Builder was actively bidded up 3 sen. The buying was not caused by me or my friends, relatives, etc. I am a lone wolf. Most of the time, I do not inform anybody when I write articles (unless the stock is super duper good).

Strong buying when market is bearish - For me, that is very Bullish Technical Indicator.

I have experienced this before with Johore Tin. Last year, when market was very bearish, somebody was busy accumulating Johore Tin. It was one of the very few stocks that went up despite the weak market sentiment. Shortly after that, Johore Tin anounced share split, bonus, etc.

Why am I so bulish about Crest Builder ? I am bullish because the MD of Crest Builder is bullish. On 7 June 2017, Crest Builder's MD spoke to the press at the end of the Company's AGM. And this was what he said :-

"We are looking to post very good numbers for FY2017"

Let's not blindly believe what people told us. Let's look at recent quarters figures.

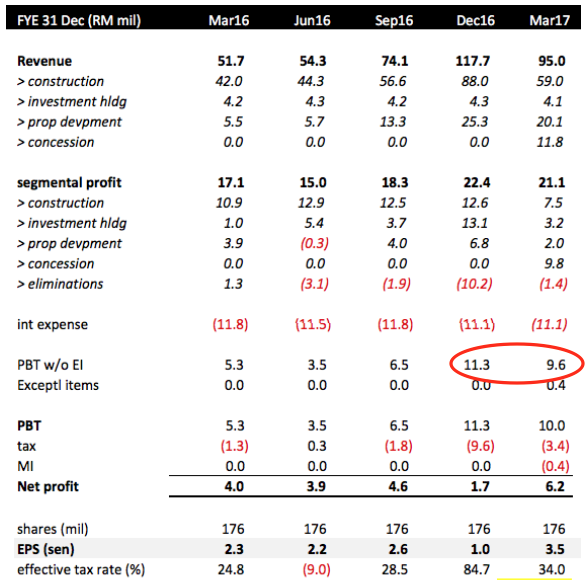

(Source : Icon8888's 25 May 2017 Crest Builder article)

As shown in table above, in the first half ended March 2017, Crest Builder reported PBT of RM20.9 mil (being RM11.3 mil + RM9.6 mil). However, due to unusually high tax rate of 62% (being RM9.6 mil + RM3.4 mil = RM13 mil), net profit was only RM7.9 mil.

If we normalise the tax rate to 25%, Crest Builder's past six months net profit will increase to RM15.7 mil. Based on 176 mil shares, 1H FY2017 EPS will be 8.9 sen. If annualised, full year EPS will be 17.8 sen.

EPS is likely to grow in coming quarters as construction works go into full swing and progress billing further increase. I believe EPS of 20 sen this year is not impossible.

Based on existing price of RM1.16, prospective PER could be as low as 5.8 times.

Can Crest Builder deliver as I predicted ? Only time can tell.

Strong buying when market is bearish - For me, that is very Bullish Technical Indicator.

I have experienced this before with Johore Tin. Last year, when market was very bearish, somebody was busy accumulating Johore Tin. It was one of the very few stocks that went up despite the weak market sentiment. Shortly after that, Johore Tin anounced share split, bonus, etc.

Why am I so bulish about Crest Builder ? I am bullish because the MD of Crest Builder is bullish. On 7 June 2017, Crest Builder's MD spoke to the press at the end of the Company's AGM. And this was what he said :-

Let's not blindly believe what people told us. Let's look at recent quarters figures.

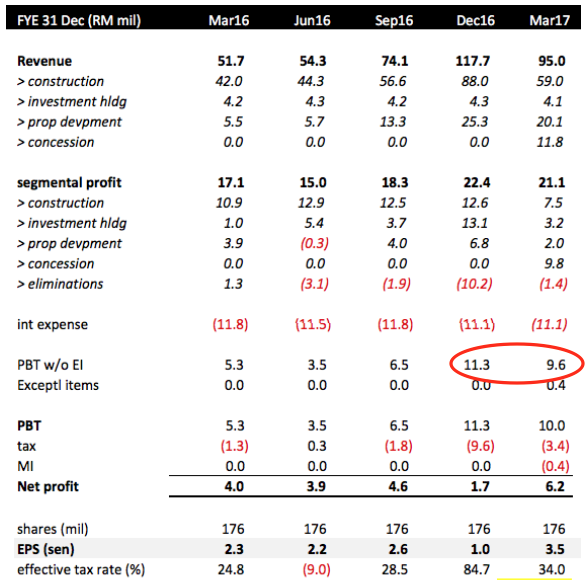

(Source : Icon8888's 25 May 2017 Crest Builder article)

As shown in table above, in the first half ended March 2017, Crest Builder reported PBT of RM20.9 mil (being RM11.3 mil + RM9.6 mil). However, due to unusually high tax rate of 62% (being RM9.6 mil + RM3.4 mil = RM13 mil), net profit was only RM7.9 mil.

If we normalise the tax rate to 25%, Crest Builder's past six months net profit will increase to RM15.7 mil. Based on 176 mil shares, 1H FY2017 EPS will be 8.9 sen. If annualised, full year EPS will be 17.8 sen.

EPS is likely to grow in coming quarters as construction works go into full swing and progress billing further increase. I believe EPS of 20 sen this year is not impossible.

Based on existing price of RM1.16, prospective PER could be as low as 5.8 times.

Can Crest Builder deliver as I predicted ? Only time can tell.

No comments:

Post a Comment