Publish date:

Originally, I have set aside few hours this afternoon to write about Air Asia's latest quarter result. It turned out that all it took was 15 minutes of my time - the result is so normal, clean and straight forward that there isn't much to comment about.

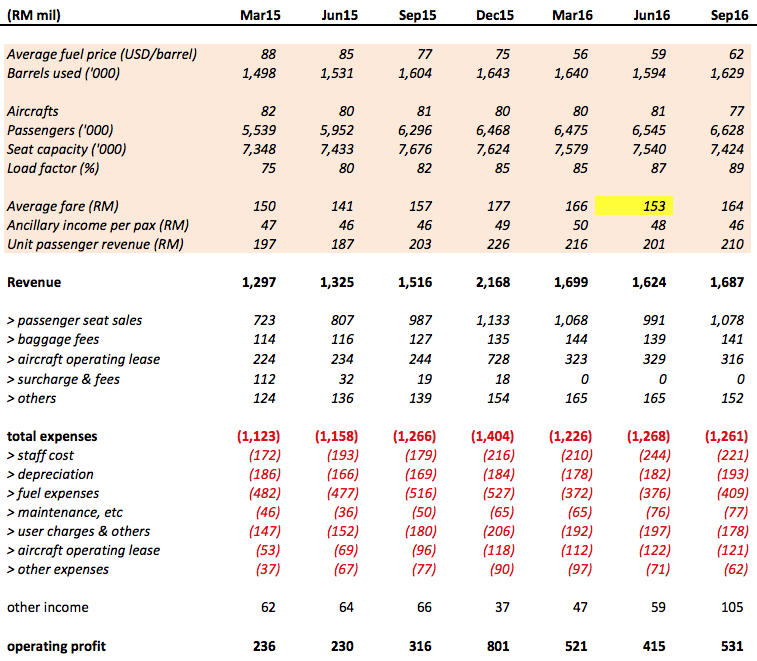

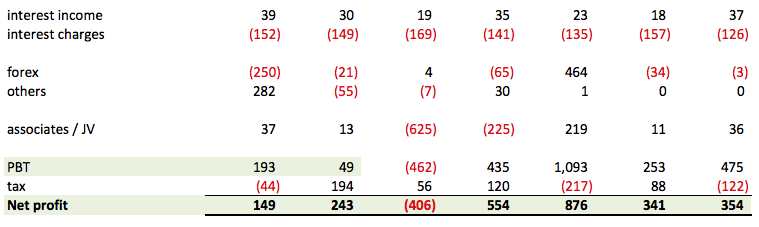

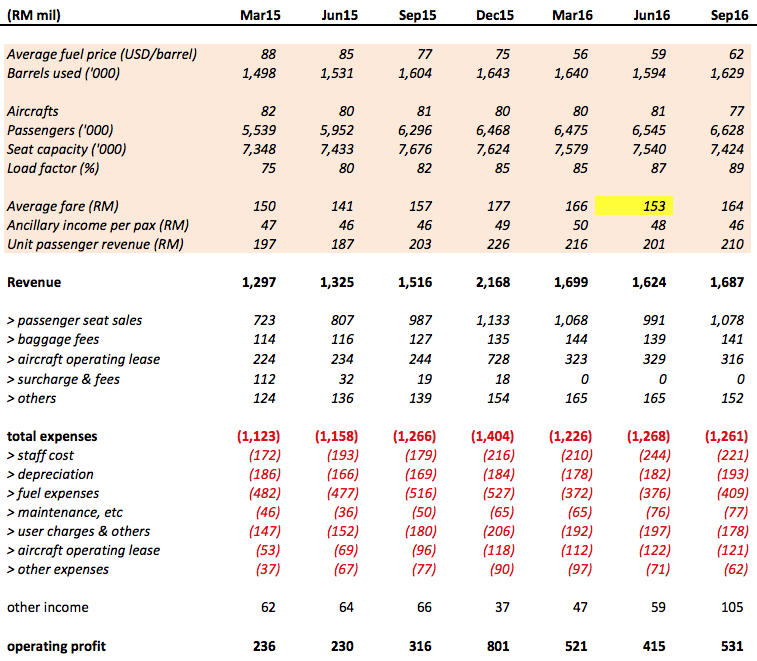

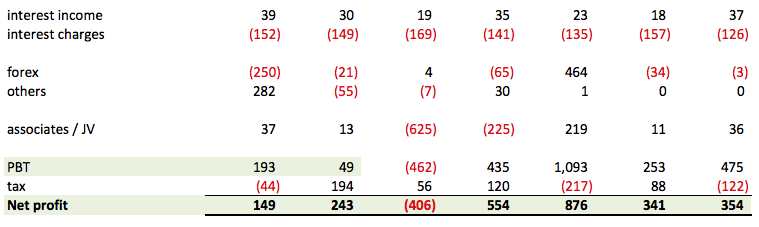

For me, one piece of information in the table that I paid most attention to is the average fare.

In the June 2016 quarter, average fare per passenger was only RM153, a big drop from RM166 and RM177 in previous two quarters. Coincidentally, my friends had also been telling me stories about how much freebies and discounts Malindo and MAS had been giving out recently to lure passengers. Putting all these information together, I was worried that a price war has developed and will drag everybody down.

Well, it turned out that my worry was unfounded. Yesterday's quarterly result showed that the June quarter's depressed average fare was due to low seasonal demand. The latest quarter's average fare per passenger has rebounced to RM164, an indication that the industry is still in good health.

I am pretty comfortable with next quarter's result. The final quarter is traditionally the strongest. There might be some margin pressure due to Ringgit depreciation, but I believe overall result should be not bad.

Tony Fernandes has also revealed that the offers for leasing unit Asia Aviation Capital is scheduled to come in in December (as many as 9 parties have shown interest). Positive new flows should provide support to share price in next one to two months.

In the June 2016 quarter, average fare per passenger was only RM153, a big drop from RM166 and RM177 in previous two quarters. Coincidentally, my friends had also been telling me stories about how much freebies and discounts Malindo and MAS had been giving out recently to lure passengers. Putting all these information together, I was worried that a price war has developed and will drag everybody down.

Well, it turned out that my worry was unfounded. Yesterday's quarterly result showed that the June quarter's depressed average fare was due to low seasonal demand. The latest quarter's average fare per passenger has rebounced to RM164, an indication that the industry is still in good health.

I am pretty comfortable with next quarter's result. The final quarter is traditionally the strongest. There might be some margin pressure due to Ringgit depreciation, but I believe overall result should be not bad.

Tony Fernandes has also revealed that the offers for leasing unit Asia Aviation Capital is scheduled to come in in December (as many as 9 parties have shown interest). Positive new flows should provide support to share price in next one to two months.

No comments:

Post a Comment