Publish date:

1. Fantastic Result

Today, as per my earlier prediction, Lion Industries released a fantastic set of result.

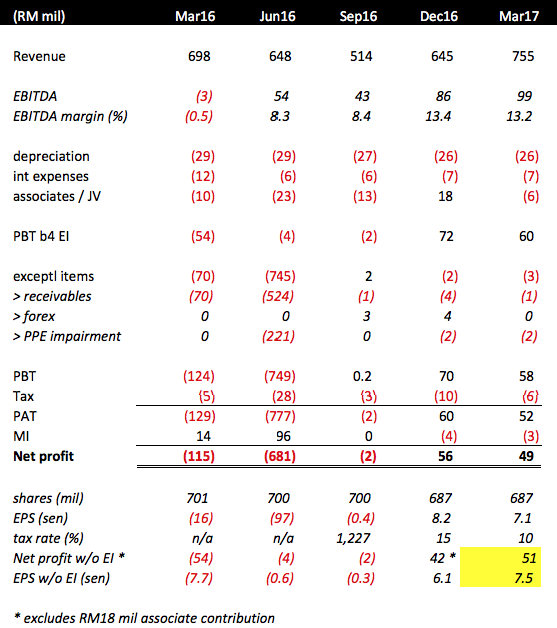

Key observations :-

(a) Core earning came in at RM51 mil, translates into EPS of 7.5 sen.

(b) Maintained previous quarter's strong EBITDA margin of more than 13%.

(c) Due to Parkson's RM33 mil losses, its 23% associate stake booked in RM6 mil losses.

The rest of the table is self explanatory. Please go through it yourself.

2. Conditions Are Ripe For Demerger

For many quarters, Parkson's losses has dragged down Lion Industries' performance. In my opinion, time is ripe for Lion Industries to rectify the situation through a demerger.

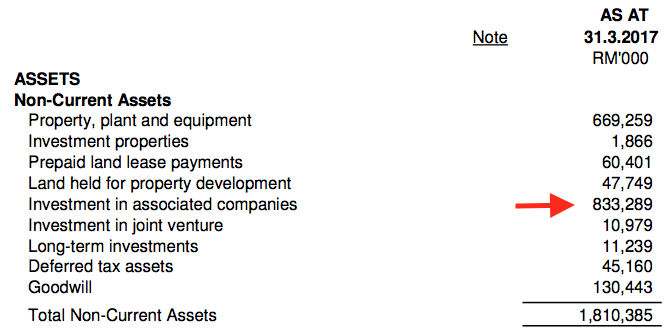

According to latest quarterly report, the book value of the Parkson stake is RM833 mil. Based on 23% equity interest, it implies Parkson valuation of RM3.6 billion. Based on 1,094 mil Parkson shares, that translates into price per share of RM3.29.

I believe that reflects Parkson price back in 2013. As at todate, Parkson's price is RM0.615, translates into market cap of RM673 mil. A 23% stake is equivalent to RM155 mil.

(Parkson share price)

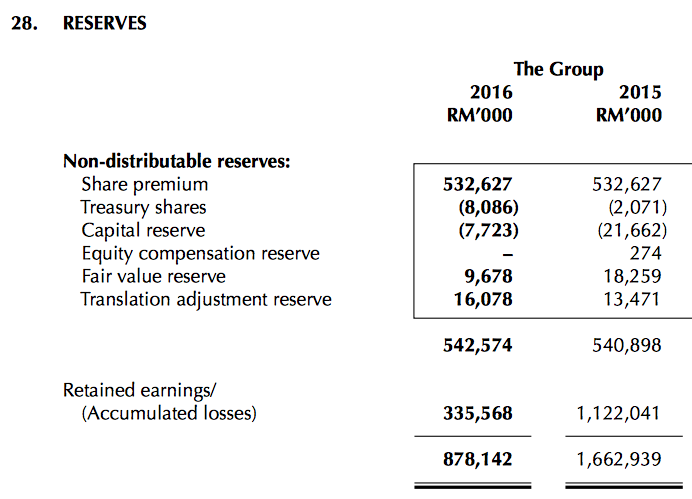

As shown below, Lion Industries only has RM336 mil retained profit. That is not sufficient to distribute the entire stake through dividend. To implement the demerger, it has to do it through capital repayment (which is non issue, just take a bit longer). Based on 687 mil Lion Industries shares, the distribution will be about 22 sen per share.

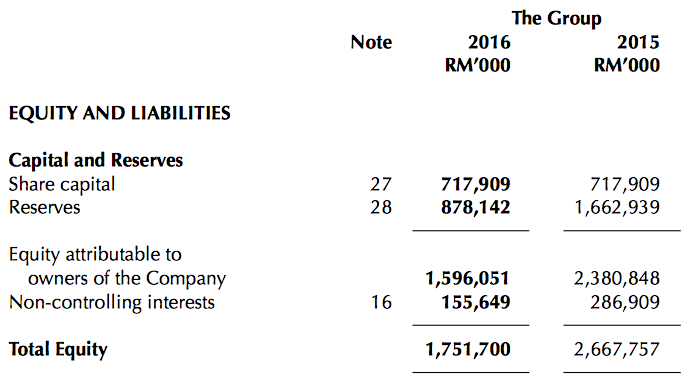

Pursuant to the distribution, net asset will drop from RM1.6 billion (please refer below) to RM767 mil. Net asset per share will become RM1.13 (down from existing RM2.51).

As the market is valuing Lion Industries based on earnings **, the drop in net assets should be shrugged off as a non event.

** RHB analyst's target price of RM1.46 is based on 0.6 times Book Value. However, I am not convinced that she genuinely believes that stock valuation should be based on book value. In my opinion, she was probably trying to protect herself just in case Lion Industries announces a disastrous set of result. Now that result is so good, let's see tomorrow whether she will try to wriggle herself out of the Book Value argument and adopt PE multiples as the prefered method of valuation.

Tan Sri William Cheng holds 38% equity interest in Lion Industries. As such, he will be entitled to distribution equivalent to 8.7% equity interest in Parkson. He also holds 28% direct equity interest in Parkson. To avoid triggering Mandatory General Offer (more than 33%), he can only accept up to 5% Parkson shares. The remaining 3.7% need to be placed out. I don't think that is a big problem.

In the event that Lion Industries does not have the appetite to distribute the entire 23% stake, it can consider distributing let's say 5% stake so as to bring equity interest down from 23% to 18%. That should allow them to cease equity accounting Parkson's losses.

(But that will likely force the auditors to demand impairment of Parkson stake. I am actually ok with that as it is just an accounting treatment, and Lion Industries can solve the Parkson problem once and for all)

No comments:

Post a Comment