Publish date:

1. Special Mention

Thank you koko888 for introducing this stock to us through his earlier artcle.

https://klse.i3investor.com/blogs/koko888/124155.jsp

You can say that koko888 lit the fire, and I am now trying to fan the flame.

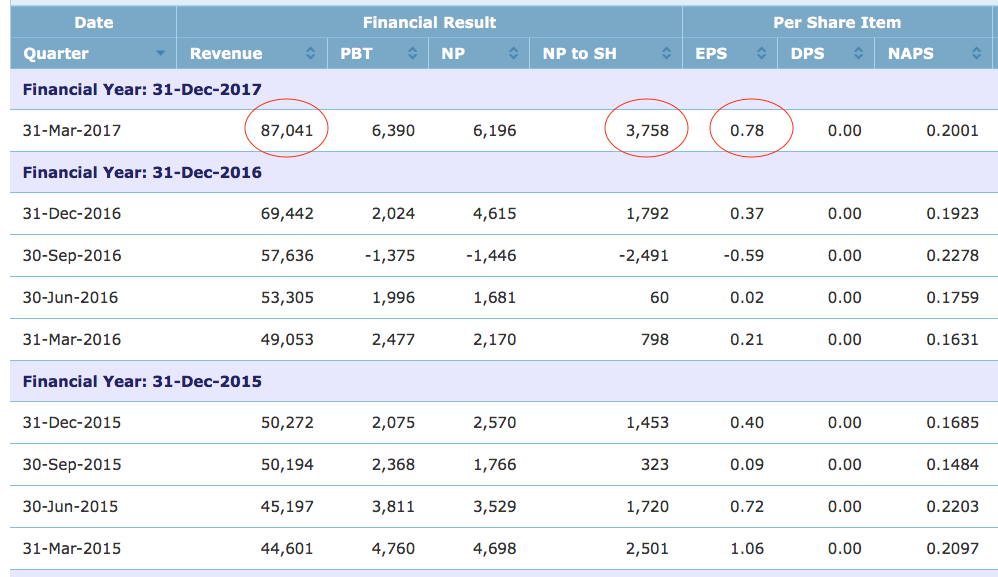

2. Spike In Revenue and Earning

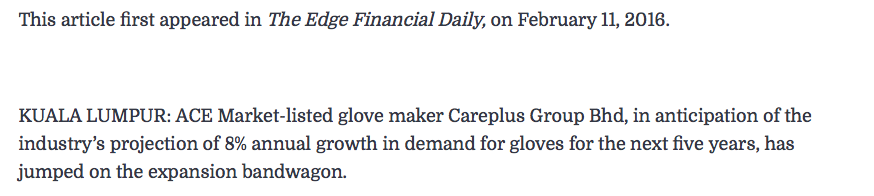

Careplus is a glove manufacturer listed on ACE, industry peers of Top Glove, Kossan, Supermax, etc. Since IPO in 2010, it has been growing by leaps and bounds. In 2016, it undertook further expansion by adding 6 more lines. In the quarter ended March 2017, its revenue and profit grew significantly as positive impact from the additional capacity started trickling in. Please refer to table below.

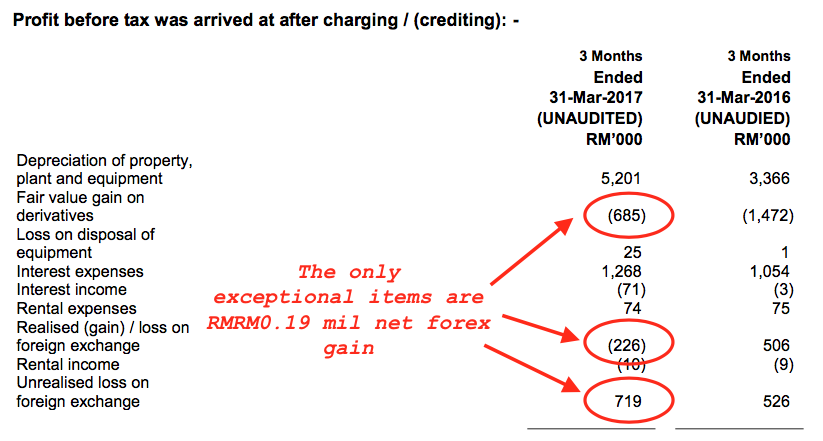

The March 2017 quarter was purely operational, with very little exceptional items.

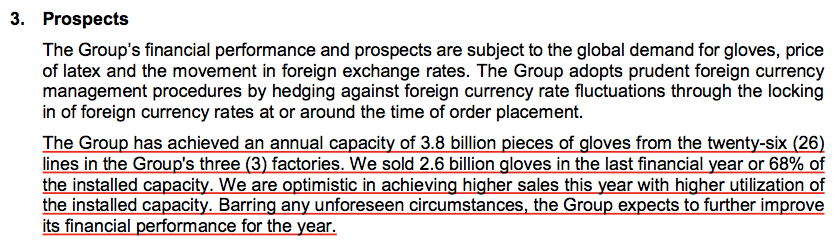

The company is positive about coming quarters' earnings.

3. Further Expansion Ahead, All The Way Until 2020

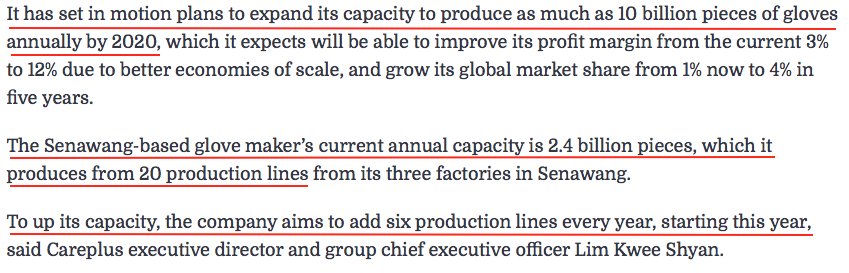

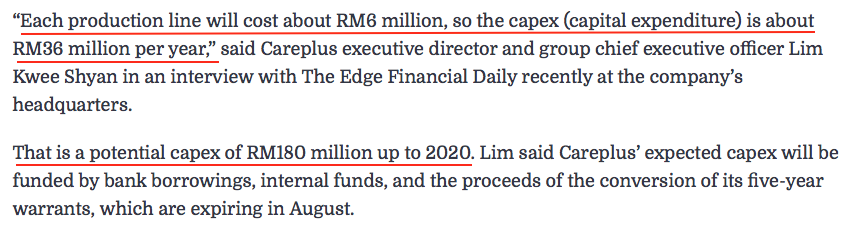

In an interview dated February 2016, Group CEO told The Edge that from 2016 until 2020, they plan to add six production lines every year. At the end of the expansion program, capacity will increase from 2.4 billion pieces to 10 billion pieces (note : as at end 2016, capacity is 3.8 billion pieces). Please refer to article below.

http://www.theedgemarkets.com/article/careplus-ups-capacity-boost-profit-margin

4. Balance Sheet Not Strong, But Not Really A Problem

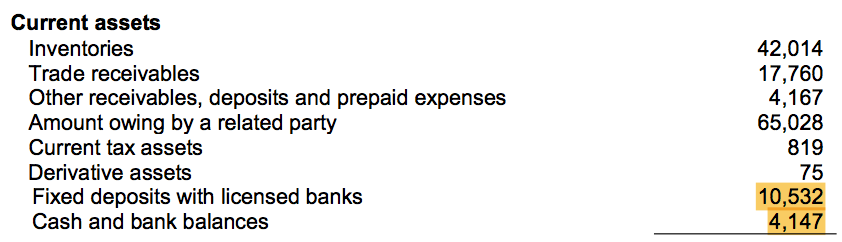

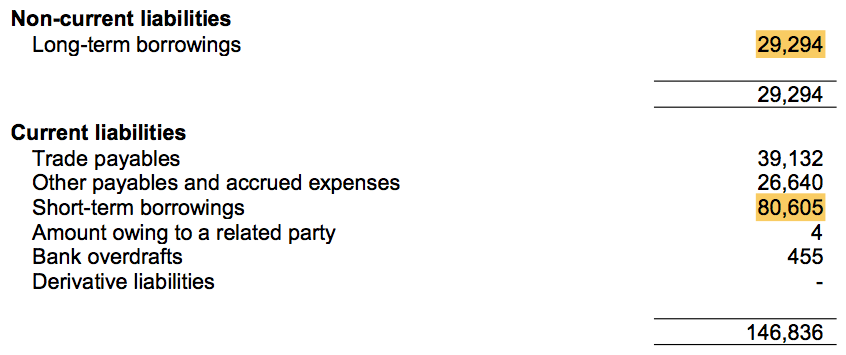

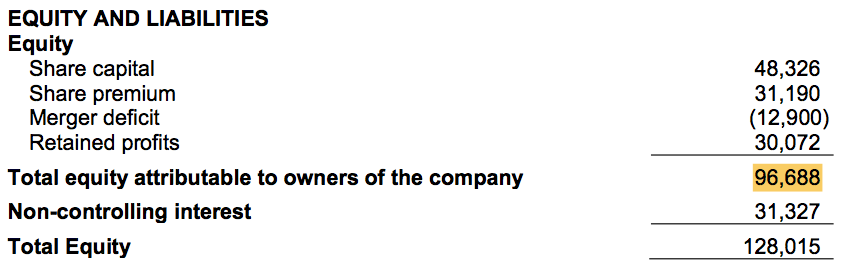

As at March 2017, Careplus has net gearing of approximately 1 time. To be honest, its balance sheet is not considered strong.

However, Malaysia has certain competitive advantages when come to glove manufacturing. Many of our glove companies are world leaders in the industry. As such, I am not particularly worried about Careplus' financial strength, especially now that it is showing signs of thriving.

Having said so, according to the February 2016 interview, the capacity expansion porgramme required total funding of RM180 mil. Can Careplus afford it ?

It is actually not as intimidating as it looked. First of all, Careplus' March 2017 figures had already factored in RM36 mil capex (incurred in 2016). The remaining amount would be RM144 mil.

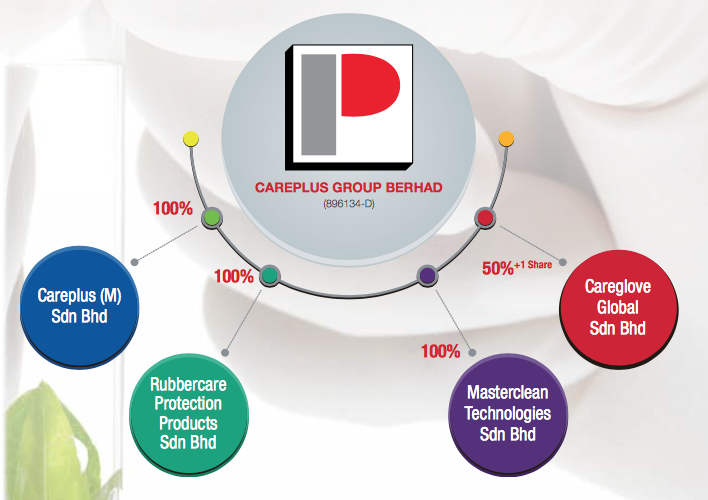

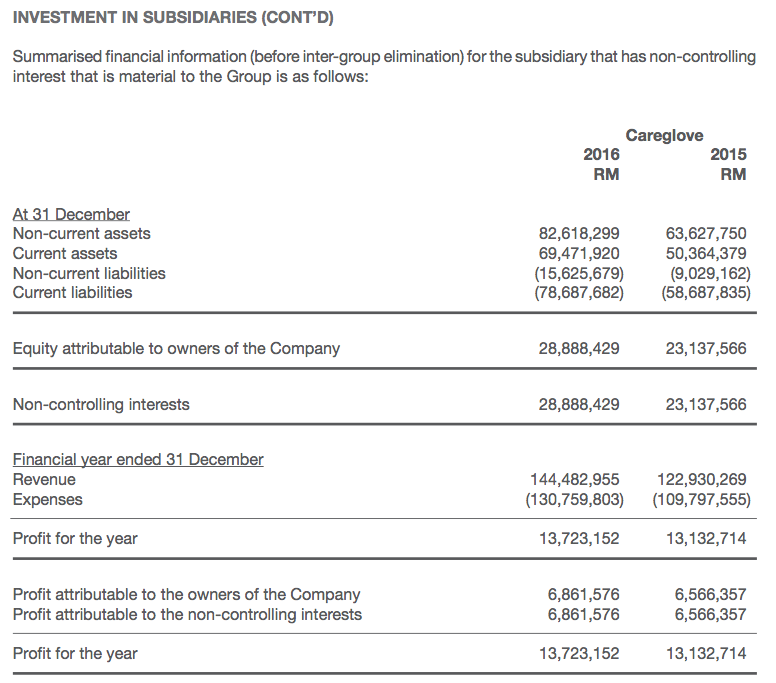

Secondly, if I am not wrong, a substantial portion of the funding might be borne by its 50% owned subsidiary, Careglove Global Sdn Bhd. According to FY2016 annual report, Careglove's assets and liabilities accounted for a substantial portion of Careplus group's balance sheets. It was also a major earning contributor to the Group. As such, Careplus could end up funding only 50% of the capex, while the remaining 50% by Careglove minority shareholders.

Lastly, there is also a likelihood that Careplus will undertake a private placement in the future to raise equity funding. The company's major shareholders collectively hold closed to 50% stake. As such, they are in a position to tolerate placement related dilution.

(Speculative angle : will Careplus capitalise on its strong earning to ramp up share price to facilitate private placement ? Let's wait and see)

Anyway, let's not worry too far ahead. Careplus' management has been in this industry for a long time. They should know how to assess and manage the financial risk associated with the expansion.

Careplus' recent quarter strong earning attracted our attention. We also think that it is likely sustainable as it was driven by capacity expansion, which will last until 2020.

The capacity expansion not only increases revenue, it also improves profit margin due to economy of scale.

If we are lucky, Careplus will enter a virtue cycle over the next few years :-

(a) capacity expansion increases revenue and profit margin;

(b) higher profitability attracts investors' attention. Re-rating leads to PE mulltiple expansion;

(c) the company leverages on strong share price to undertake placement to raise equity funding;

(d) cheap equity funding facilitates further expansion (through a combination of equity and borrowing), which will further increase earnings. And the cycle repeats itself.

We are currently at early stage of breakout growth. Will the above blue sky scenario materialise ? Nobody knows. Investing is challenging because we need to make decision based on incomplete information. There is no assurance that Careplus will indeed evolve into another Top Glove, Supermax, or Hartalega. You have to try your luck. In stock market, no risk no return.

Appendix - The Edge Interview Dated February 2016

No comments:

Post a Comment