Publish date:

1. Introduction

Air Asia stock price has performed well. Since early 2016, it has gone up from approximately RM1.70 to as high as RM3.30 few weeks ago.

I believed many investors were tempted to take profit. However, Tony Fernandes pursuaded shareholders to hold on to their stocks. According to him, Air Asia is in the process of disposing its aircraft leasing unit, Asia Aviation Capital Limited, for closed to USD1 billion, and there is possibility of huge dividend payout.

While excited about the potential windfall, I am sure deep in our heart many of us are quietly asking whether he is exaggerating the potential upside. Is Asia Aviation Capital really worth that much ? How has it been perfoming ? What is it doing ? Why are potential buyers willing to pay so much for it ?

To answer the above questions, I decided to do a little bit of research. The findings turn out to be quite interesting. Please read on.

2. BOC Aviation Limited

Asia Aviation Capital is a relatively new entity (incorporated in 2014). There is not much information available from public sources. To better understand the business of aircraft leasing, I decided to take a look at BOC Aviation.

BOC Aviation was listed in Hong Kong Stock Exchange in mid 2016. It is majority owned by Bank of China and is the largest aircraft leasing company in Asia.

Same as Asia Aviation Capital, BOC Aviation's business model is as follows :-

(a) Buys and owns aircrafts (through appropriate use of debt funding);

(b) Leases the aircrafts to airlines for rental income. Typically, lease period lasts for 5 to 7 years; and

(c) When opportunities arise, disposes aircrafts to lock in capital gain.

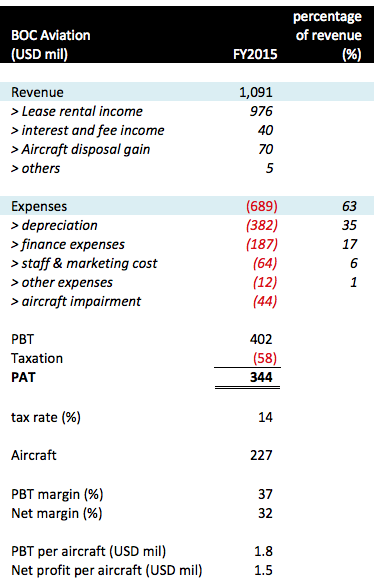

The following financial information is extracted from BOC Aviation's IPO Prospectus dated 19 May 2016. If you are interested, you can download it through the following link.

Key observations :-

(a) The business of aircraft leasing is surprisingly easy to understand. Basically, you let somebody make use of your aircrafts, and they pay you rental regularly. After deducting depreciation charges, interest expenses, staff cost, tax payment, etc, whatever left behind is your profit. Very straight forward.

(b) The bulk of BOC Aviation's FY2015 PAT of USD344 mil was operating profit. Exceptional items were very small at USD26 mil, being the difference between gain on disposal of USD70 mil and aircraft impairment of USD44 mil.

(c) Depreciation charges accounted for 35% of revenue. (Note : this piece of information will be useful in subsequent section for Asia Aviation Capital's financial modelling)

(d) Very high profit margin - net margin of 32%.

For comparison purpose, Public Bank, Gamuda, KLK, Tenaga (representing various industries in Malaysia) has net margin of 27%, 30%, 7% and 14% respectively.

(e) Based on average net assets of USD2.3 billion, FY2015 ROE was approximately 15%.

For comparison purpose, Public Bank, Gamuda, KLK, Tenaga (representing various industries in Malaysia) has ROE of 16%, 11%, 9% and 13% respectively.

(f) Based on 227 aircrafts, BOC Aviation generated PBT of USD402 mil. This translates into PBT of USD1.8 mil (RM7.2 mil) per aircraft in FY2015.

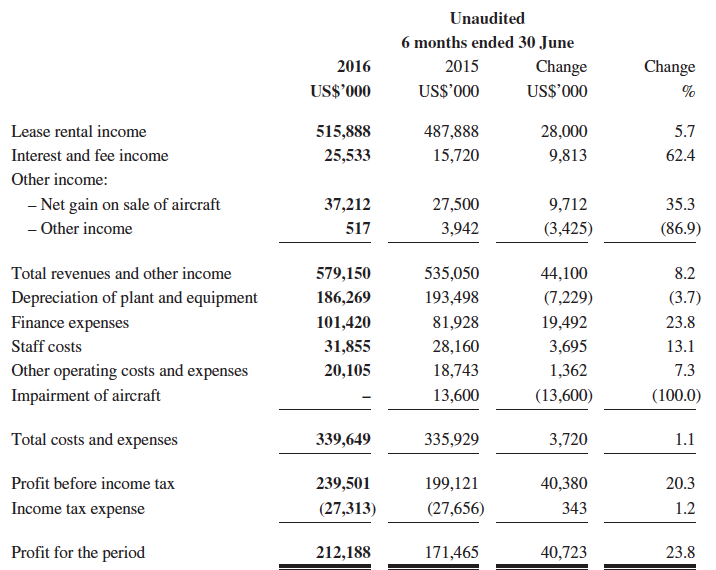

Note : BOC Aviation continued to do well post IPO. The company reccently announced 1H FY2016 net profit of USD212 mil, 23% higher than FY2015. Please refer to Appendix 1 for further details.

Summary Conclusion

The dramatic decline in oil prices recently has benefited many airline companies. Not only their profitability has increased, growth prospects has also improved as better affordability increases the appeal of air travelling.

Pursuant to this positive development, aircraft leasing business has also benefited substantially. Not only demand for aircrafts had increased (resulting in robust leasing rates), there is also substantial decline in credit risk.

My brief study of BOC Aviation shows that the industry is enjoying healthy economics. Both net profit margin and ROE is above average, an indication of strong profitability.

3. Asia Aviation Capital Limited

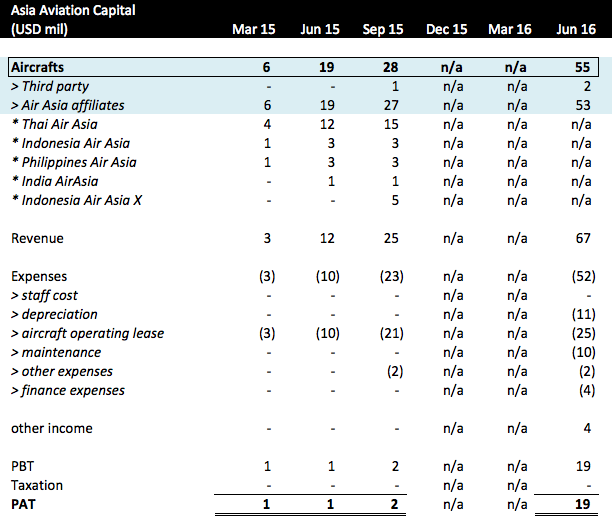

Asia Aviation Capital's financial information was obtained from Air Asia's quarterly reports. Air Asia sometime is sloppy when come to disclosure. Most quarterly reports contain information about Asia Aviation Capital. However, in December 2015 and March 2016 quarter, those information was missing.

Anyway, I have put whatever information I can get in the table below :-

Key observations :-

(a) Asia Aviation Capital has been leasing out aircrafts to Air Asia's affiliated companies since 2014 ("Affiliated Companies Leases"). However, back then, those aircrafts were apparently obtained by it through Operating Lease from leasing companies. It did not make much profit from the Affiliated Companies Leases.

For example, in September 2015 quarter, Asia Aviation Capital generated revenue of USD25 mil. However, it also incurred operating lease expense of USD21 mil. After deducting other expenses, it reported net profit of USD2 mil only, a very insignificant amount.

My guess is that those affiliated companies did not have the balance sheet strength to secure operating lease on their own. Asia Aviation Capital was thus set up by Air Asia to provide assistance to them.

(b) In June 2016 quarter, it seemed that there was a change in Asia Aviation Capital's business model.

During that quarter, Asia Aviation Capital generated net profit of USD19 mil. Based on exchange rate of let's say, 4.1, that amounted to RM78 mil per quarter. If annualised, we are looking at net profit of RM312 mil. This is not a small amount. Let's take a closer look at the figures.

(c) First of all, we need to establish how much of the revenue and profit was due to pass through mechanism (leased from external leasing companies and subsequently on lease to affiliated companies) and how much was actual leasing.

In the June 2016 quarter, Asia Aviation Capital generated revenue of USD67 mil. My guess is that USD25 mil was Pass Through Revenue (closely matching Operating Lease Expense of USD25 mil). This means that actual leasing revenue was USD67 mil less USD25 mil = USD42 mil.

(d) If that is the case, it means that Asia Aviation Capital generated net profit of USD19 mil based on revenue of USD42 mil. Is that reasonable ? One way to find out is to make comparison with BOC Aviation.

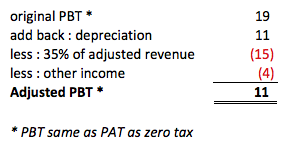

First of all, the depreciation figure does not look right. BOC Aviation's depreciation charges is approximately 35% of its revenue. In Asia Aviation Capital's case, it is 26% (being USD11 mil divided by USD42 mil). By bringing it in line with BOC Aviation, the adjusted depreciation charges should be USD15 mil.

(e) Secondly, there was an item called "other income" amounted to USD4 mil. BOC Aviation also has "other income", comprises of fee income from managing aircrafts leasing on behalf of third parties. I don't think Asia Aviation Capital has such expertise. As such, it is likely a one off item. We should exclude the USD4 mil from the financial model.

(f) After making the above adjustments, we arrived at adjusted net profit of USD11 mil (instead of USD19 mil). Please refer below :-

(g) Is the above figure reasonable ? Let's cross check by once again making comparison with BOC Aviation.

BOC Aviation generated PBT of USD402 mil based on 227 aircrafts. This translates into PBT per aircraft of USD1.8 mil. How about Asia Aviation Capital ?

First of all, we need to establish how many aircrafts are owned by Asia Aviation Capital. In September 2015 quarter, Asia Aviation Capital incurred USD21 mil Operating Lease Expense for 28 aircrafts leased from third parties. In June 2016 quarter, Operating Lease Expense has increased to USD25 mil.

Based on these information, my guess is that aircrafts leased from third parties was 25 / 21 x 28 = 33 units. This means that aircrafts owned by Asia Aviation Capital in June 2016 quarter was 55 - 33 = 22 units.

Based on 22 aircrafts and annualised PBT of USD44 mil (being USD11 mil x 4), it seemed that Asia Aviation Capital generated PBT of USD2 mil per aircraft. This figure is closed to BOC Aviation's USD1.8 mil per aircraft. In this regard, the financial model seemed to pass the test.

Summary Conclusion

First of all, I would like to apologise for overwhelming you with figures. I believe at this stage, most of my readers are lost and have no idea what to feel about Asia Aviation Capital. Well, the following are the salient points :-

(i) In the past, Asia Aviation Capital was used as a vehicle by Air Asia to facilitate leasing of aircrafts by affiliated companies. It did not generate much profit.

(ii) However, in June 2016 quarter, Asia Aviation Capital started generating huge profit. My guess is that this happened because it started taking delivery of new aircrafts, which allowed it to operate as an actual Leasing Company.

(iii) Asia Aviation Capital generated net profit of USD19 mil in June 2016 quarter. However, my calculation showed that that level of profitability might not be sustainable. After making various adjustments, I arrived at a more conservative figure of USD11 mil per quarter (USD44 mil per annum).

That works out to be PBT of USD2 mil per aircraft per annum, closed to BOC Aviation's USD1.8 mil per aircraft.

(iv) The figure of USD2 mil PBT per aircraft per annum is useful because by simply multiplying it with the number of aircrafts to be owned, you can arrive at an estimate of Asia Aviation Capital's future net profit (up to you to assume whether zero tax or 25%).

4. Concluding Remarks

(a) My study showed that at current low oil price environment, aircraft leasing has become a high quality business. It commands high profit margin and strong ROE. As most of the leases typically last for several years, Lessor Companies also enjoy strong earning visibility from recurrent income. Bad debt risk is minimal - the moment the clients stop paying rental, you can pull back the planes and deploy them else where. There are plenty of demand for aircrafts nowadays.

After taking into consideration the abovementioned factors, it seemed that Tony Fernandes' claim of USD1 billion valuation is not that far fetched afterall. Based on assumption of net profit of USD44 mil (we have been through this in Section 3 above) and exchange rate of 4.1, Asia Aviation Capital can potentially generate net profit of RM180 mil in FY2016/17. A RM4.1 billion (USD1 billion) valuation translates into PE multiple of 22 times, not an unreasonable figure when come to take over.

The valuation looked even more undemanding if you factor in the growth potential. Asia Aviation Capital has justed started its operation. With its backlog of aircrafts pending delivery, the group is well positioned to grow its profit by leaps and bounds. Just look at how BOC Aviation effortlessly grew its earnings by 23% in 1H FY2016.

(b) One thing that sets Asia Aviation Capital apart from other leasing companies is its relationship with Air Asia. Did you notice that Asia Aviation Capital's staff cost is zero whereas BOC Aviation incurred staff and marketing expenses of USD64 mil (that is approximately RM256 mil, dude), equivalent to 6% of its revenue ? That is because Asia Aviation Capital does not need to solicit for businesses. Air Asia's affiliated companies (Air Asia X, Air Asia Thai, Indonesia, Philippines, India and Japan) provide it with a ready supply of clientele. If the buyer is smart, he would request for first right of refusal to lease aricrafts to those companies in the future. Of course, our Tony Fernandes is not dumb either. He will leverage on that to extract even better pricing. Don't rule out the possibility of more than USD1 billion valuation (Tony Fernandes gave me the impression that he is shopping around for best deal).

(c) How do I feel about the proposed disposal ? Well, if Tony Fernandes really pulls off the deal and rewards me with a huge dividend, I will happily pocket it. However, if the proposed disposal falls through, I will not be unduly upset either. If my understanding is correct, Asia Aviation Capital is a very valuable asset. It has the potential to add significant value to Air Asia by delivering huge earning growth. I am more than happy to see it remains in the group.

Appendix 1 - BOC Aviation Latest Half Year Results

Appendix 2 - Billionaire Li Ka Shing Ventured Into Aircraft Leasing

(Source : Bloomberg, 5 November 2014)

No comments:

Post a Comment