1. Introduction

Supermax shocked the market by announcing a weak set of result on 29 August 2016 (EPS of 1 sen). As a result, share price nosedived the moment the stock started trading the next day.

Supermax used to trade as high as RM3.50 back in January 2016. At current price of RM2.10, the stock looked attractive. I am curious about its earning prospects.

For convenience sake, I relied on analyst reports extracted from klsei3investor.com. To my surprise, almost all analysts expect Supermax to register strong earning growth in the coming financial year.

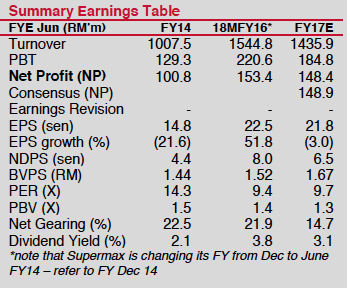

Even though their calls differ, ALL analysts forecast Supermax to report EPS of approximately 22 sen in coming financial year (which starts from September 2016 quarter onwards).

They differ only in the PER they apply to the forecast EPS. Some apply Supermax's traditional average PER of 13 to 14 times while some decided to be conservative by applying PER of 10 times.

I am sure the unanimous EPS forecast of 22 sen is no coincidence. They must have got it through Company's guidance.

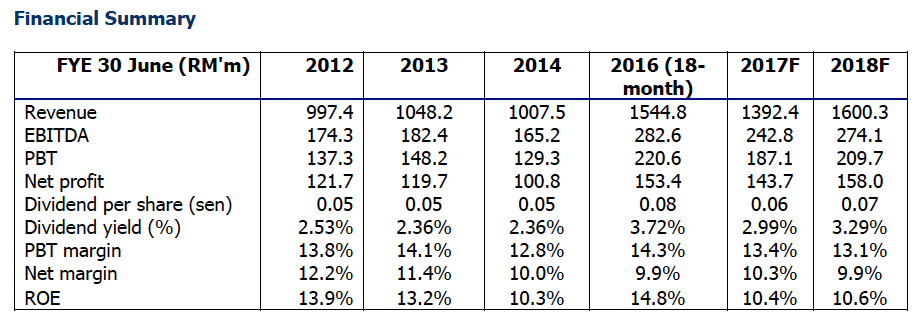

The expected jump in earning is primarily due to targeted full commissioning of Plant 10 and 11 in Meru, Klang by second half of 2016, which will result in 17% increase in production volume (from 19.8 billion gloves at end 2015 to 23.2 billion gloves).

(There are further plans to increase capacity to 55 billion gloves by 2020. Land has been acquired for that purpose and planning is in progress. However, I think for the moment, it suffices for us to just focus on the existing expansion plan and factor in the second phase only when there are proofs of more concrete development)

(Supermax share price declined from RM3.50 to RM2.10 within a period of 8 months. This kind of severely beaten down stocks are Icon's favorite hunting ground for recovery play)

2. Brokers' Recommendations

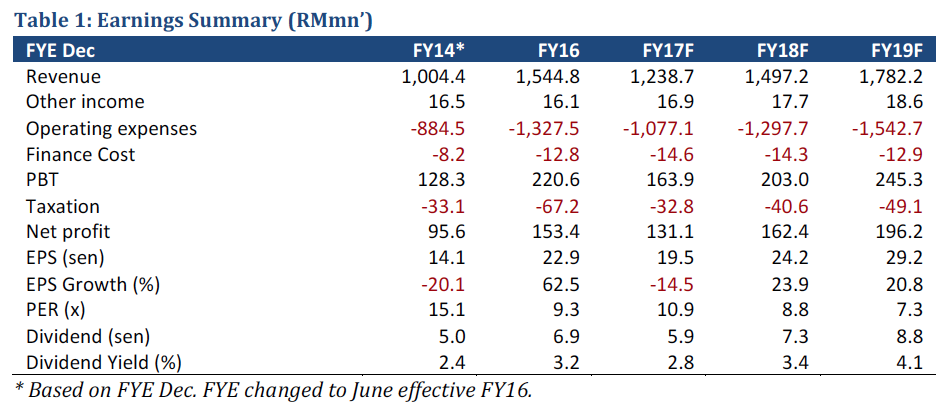

(TA Securities)

Recommendation : Sell

Target Price : RM2.20, based on FY2017 EPS of 22 sen and PER of 10 times

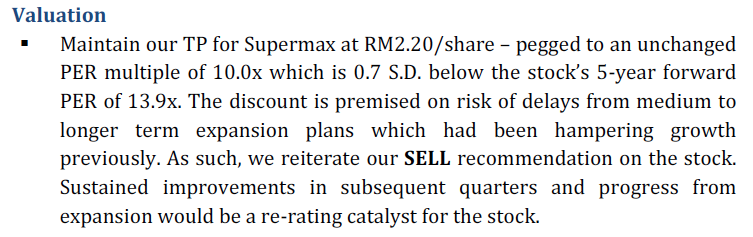

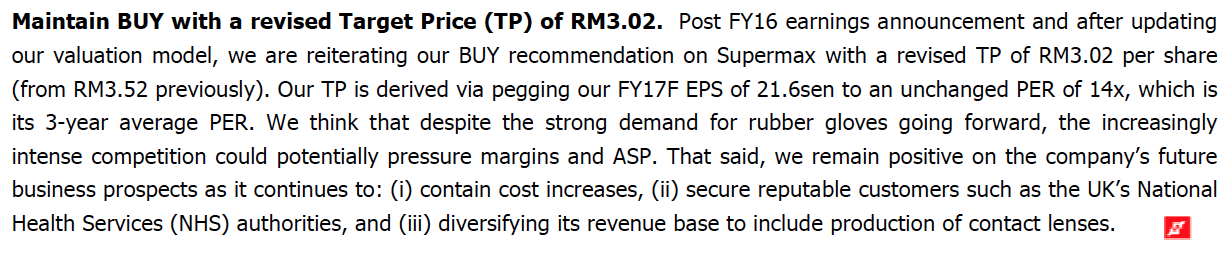

(MIDF Research)

Recommendation : Buy

Target Price : RM3.02, based on FY2017 EPS of 21.6 sen and PER of 14 times

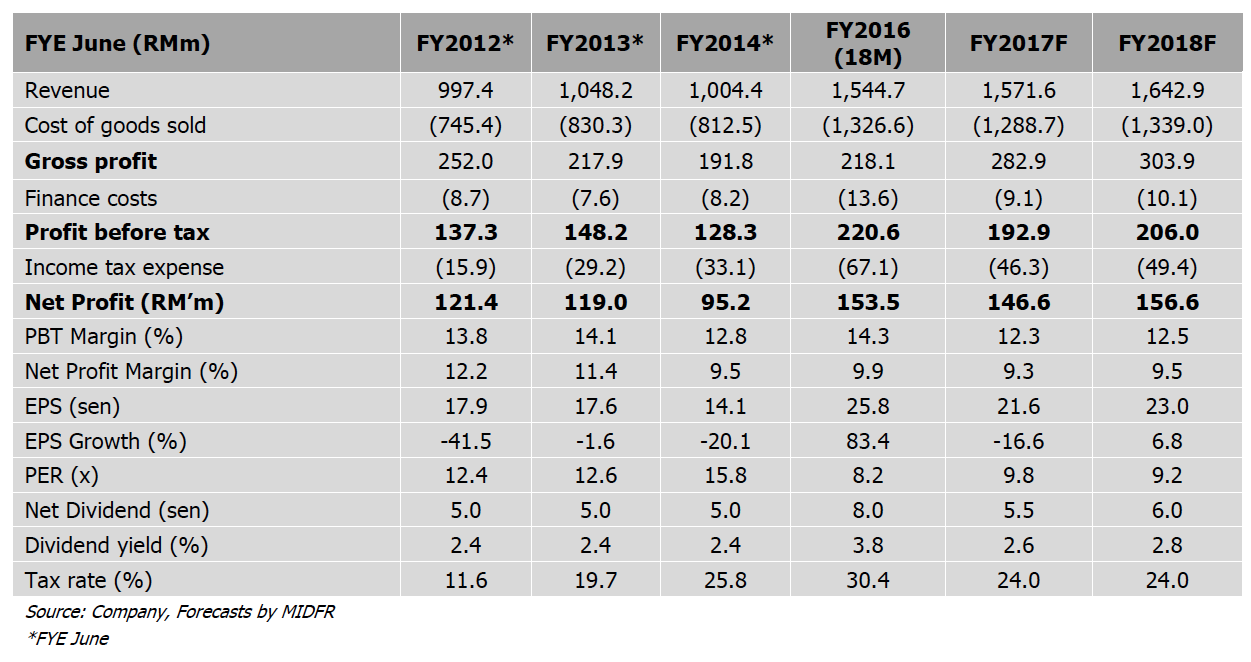

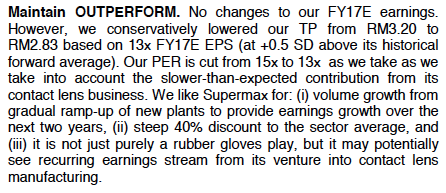

(K&N Kenanga)

Recommendation : Outperform

Target Price : RM2.83, based on FY2017 EPS of 21.8 sen and PER of 13 times.

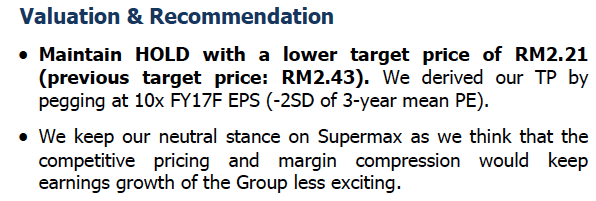

(JF Apex)

Recommendation : Hold

Target Price : RM2.21, based on FY2017 EPS of 22 sen and PER of 10 times

3. Concluding Remarks

As most of my readers would have noticed by now, I am a big fan of earnings growth and turnaround play. Supermax's recent correction from RM3.50 to RM2.10 was due to "A Series Of Unfortunate Events" - temporary shut down of existing plants, delay in commissioning of new production lines, exceptionally high taxation charges, etc.

At current price, the stock looked like it has reached rock bottom. If the Company really delivers the earnings growth going forward, I am sure that even those analysts that apply conservative valuation metrics will change their stance.

With such favorable risk and reward balance, I once again stick my neck out to call for...

BUY

No comments:

Post a Comment