Publish date:

1. Angler, Drift Wood and Surf Rider

On 1 December 2015, I wrote the article "Three Ways You Can Punt The Market".

https://klse.i3investor.com/blogs/icon8888/87192.jsp

In that article, I explained that there are three ways you can pick stocks :-

(a) Angler

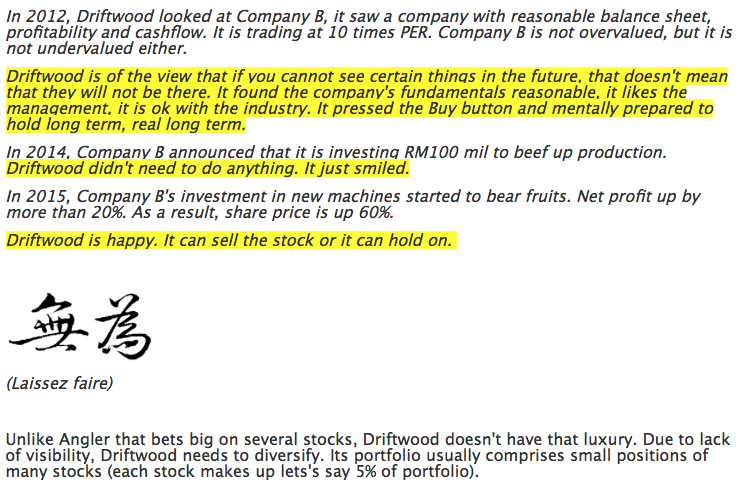

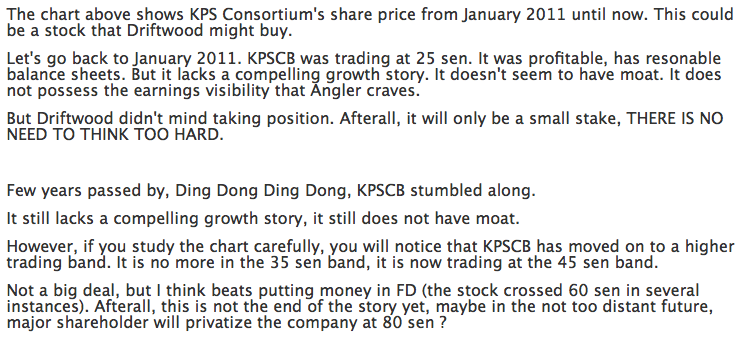

2. Drift Wood

(c) Surf Rider

2. How I Manage My Portfolio In Real Life

The above information is more than just theory, I actually manage my portfolio based on a combination of the 3 methods.

My portfolio comprises of stocks with 3 different investment horizon :-

(a) Immediate Term

For immediate term play, I am basically a Surf Rider. I go through newspapers, forums, analysts reports, etc regularly to identify stocks that can perform in the near future.

Some examples of Immediate Term Play are Hengyuan, Careplus (wrong pick), Crest Builder, Lion Industries, etc.

Some of the stocks perform, some don't. I am afterall just an armchair analyst and do not have insider information. Only God is perfect. I am not God.

Despite the imperfection, the performance of my Immediate Term Portfolio is usally quite good. I give credit to my participation in investing forums such as klsei3investor.com. The forum has so much useful information (blog articles, comments, analysis, etc) that I am able to have abundant good candidate stocks to pick from.

Having said so, one must have strong stomach. No matter how good a company is, its profitability might go up and down over different quarters. Sometime it takes as much as 6 months to 1 year for the stock to start performing. Downside potential can also be sizeable. This is natural because so many investors are chasing these hot stocks. Once the earning disappoints, there is tendency to rush for the exit.

(b) Medium Term

For medium term play, I see myself as an Angler.

There are many stocks that have good potential over the next 12 to 18 months. However, as Malaysian investors are short term focused, these stocks are usually ignored.

For example : WCE Holdings (highway under construction and will only be completed by end of 2018), HSL (RM2.8 billion order book expected to start contributing strong profit only by second half 2018), Supermax (contact lense business will drag down earning until probably second half 2018).

If you are lucky, the price of these stocks will stagnate until closed to the catalytic event (and then go up). If you are not lucky, negative events or negative sentiment might occur during the holding period and cause price to trend downwards. Due to absence of strong earning, the latter is very likely to happen. Most of the stocks in my Medium Term Portfolio is now experiencing losses (price has come down).

For these stocks, you probably need to adopt a different book keeping method : Stop reflecting the latest market price when computing portfolio return. Instead, freeze the stocks' value at your cost of investment. Only make provision for permanent impairment when a negative event happens and adversely impact fundamentals.

For illustration purpose : I bought WCE at RM1.50 few months ago. It has now declined to RM1.28. If I reflect this in my portfolio, my portfolio gain this year will decline by 7% from 30% to 23% (lets' say). That will make me nervous. However, if I ignore the price change (as I know WCE fundamental has not deteriorated), then my portfolio return will not be affected. Then I feel better and continue to hold on.

Am I manipulating figures to make myself feel better ? Not really. This is actually how accountants do things in real life. If PLC A holds stake in PLC B, daily fluctuation of share price of B does not have impact on the P&L of A. Only if something bad happens to B only then the accontants will step in to review and see whether there is a need to provide for impairment. We should practise the same. By eliminating the noises from daily share price fluctuation, it makes our task of managing portfolio less stressful. And because of that, it gives us the courage and confidence to make longer term investment, instead of purely involved in short term plays (short term is not necessarly a bad thing, but comes with pros and cons as explained above).

(c) Long Term

Long Term Portfolio is bascially stocks that I hold for let's say 3, 4 or 5 years. Unlike Surf Rider and Angler, I don't have insights of catalytic events that might happen in the future to re rate those stocks. Basically, it is a Drift Wood strategy of dumb dumb hold.

One of the myths in the market is that "if you hold long term, you can make money". Is that true ? Yes or no. If you hold Public Bank long term, you are cool. But if you hold BJ Corp for long term, you are fool.

If that is the case, how do I pick long term plays ? I actually get them from my short term and medium term portfolios. As mentioned in (a) and (b) above, I behave as Surf Rider and Angler to identify stocks that can do well in the not too distant future. These stocks usually will deliver result in 6 to 12 months time. Once it reaches my target price, I will sell lets's say 70% of my holdings and keep the remaining 30% for long term exposure. These stocks are usually good quality stocks (as proven by their ability to go up and reached target price). This is better than picking stocks blindly and hold them for long term without good reasons and hoping that one day miracles will happen.

In other words, be a smart Drift Wood. Don't dumb dumb hold for the sake of dumb dumb hold. Only long term hold those stocks that have proven themselves.

3. Concluding Remarks

In this article, I propose that we should have a combination of stocks that spread out over different investment horizons. It will allow us to reduce our risk as well as stress level.

Short term plays yield faster return, but is usually crowded space and is more volatile. It can also be stressful.

Channeling some money to buy stocks that nobody pays attention (Medium Term Play) is one good way to mitigate the abovementioned negative points. But be careful not to buy stocks that need very long gestation period (the longer the holding period the more chance of black swan events). Preferably the stocks should have potential to be re-rated within 12 months. Once you bought them, ignore the short term price fluctuation so as not to give you unnecessary stress.

When a company is doing well, it can potentially last for multiple years (such as Air Asia). Long term plays hence allows us to capture maximum benefit from good quality stocks. By selling 70% (lets' say) of the initial holding at target price, original cost of investment will be reduced to very low level. This creates a conducive environment to hold long term and potentially benefit from multibaggers.

Making money in stock market is easy. The difficult part is how to do it year after year. A good portfolio management strategy not only reduces your risk but also helps you to manage your emotion, making investing less stressful and also sustainable over the longer term.

Have a nice day.

On 1 December 2015, I wrote the article "Three Ways You Can Punt The Market".

https://klse.i3investor.com/blogs/icon8888/87192.jsp

In that article, I explained that there are three ways you can pick stocks :-

(a) Angler

2. Drift Wood

(c) Surf Rider

2. How I Manage My Portfolio In Real Life

The above information is more than just theory, I actually manage my portfolio based on a combination of the 3 methods.

My portfolio comprises of stocks with 3 different investment horizon :-

(a) Immediate Term

For immediate term play, I am basically a Surf Rider. I go through newspapers, forums, analysts reports, etc regularly to identify stocks that can perform in the near future.

Some examples of Immediate Term Play are Hengyuan, Careplus (wrong pick), Crest Builder, Lion Industries, etc.

Some of the stocks perform, some don't. I am afterall just an armchair analyst and do not have insider information. Only God is perfect. I am not God.

Despite the imperfection, the performance of my Immediate Term Portfolio is usally quite good. I give credit to my participation in investing forums such as klsei3investor.com. The forum has so much useful information (blog articles, comments, analysis, etc) that I am able to have abundant good candidate stocks to pick from.

Having said so, one must have strong stomach. No matter how good a company is, its profitability might go up and down over different quarters. Sometime it takes as much as 6 months to 1 year for the stock to start performing. Downside potential can also be sizeable. This is natural because so many investors are chasing these hot stocks. Once the earning disappoints, there is tendency to rush for the exit.

(b) Medium Term

For medium term play, I see myself as an Angler.

There are many stocks that have good potential over the next 12 to 18 months. However, as Malaysian investors are short term focused, these stocks are usually ignored.

For example : WCE Holdings (highway under construction and will only be completed by end of 2018), HSL (RM2.8 billion order book expected to start contributing strong profit only by second half 2018), Supermax (contact lense business will drag down earning until probably second half 2018).

If you are lucky, the price of these stocks will stagnate until closed to the catalytic event (and then go up). If you are not lucky, negative events or negative sentiment might occur during the holding period and cause price to trend downwards. Due to absence of strong earning, the latter is very likely to happen. Most of the stocks in my Medium Term Portfolio is now experiencing losses (price has come down).

For these stocks, you probably need to adopt a different book keeping method : Stop reflecting the latest market price when computing portfolio return. Instead, freeze the stocks' value at your cost of investment. Only make provision for permanent impairment when a negative event happens and adversely impact fundamentals.

For illustration purpose : I bought WCE at RM1.50 few months ago. It has now declined to RM1.28. If I reflect this in my portfolio, my portfolio gain this year will decline by 7% from 30% to 23% (lets' say). That will make me nervous. However, if I ignore the price change (as I know WCE fundamental has not deteriorated), then my portfolio return will not be affected. Then I feel better and continue to hold on.

Am I manipulating figures to make myself feel better ? Not really. This is actually how accountants do things in real life. If PLC A holds stake in PLC B, daily fluctuation of share price of B does not have impact on the P&L of A. Only if something bad happens to B only then the accontants will step in to review and see whether there is a need to provide for impairment. We should practise the same. By eliminating the noises from daily share price fluctuation, it makes our task of managing portfolio less stressful. And because of that, it gives us the courage and confidence to make longer term investment, instead of purely involved in short term plays (short term is not necessarly a bad thing, but comes with pros and cons as explained above).

(c) Long Term

Long Term Portfolio is bascially stocks that I hold for let's say 3, 4 or 5 years. Unlike Surf Rider and Angler, I don't have insights of catalytic events that might happen in the future to re rate those stocks. Basically, it is a Drift Wood strategy of dumb dumb hold.

One of the myths in the market is that "if you hold long term, you can make money". Is that true ? Yes or no. If you hold Public Bank long term, you are cool. But if you hold BJ Corp for long term, you are fool.

If that is the case, how do I pick long term plays ? I actually get them from my short term and medium term portfolios. As mentioned in (a) and (b) above, I behave as Surf Rider and Angler to identify stocks that can do well in the not too distant future. These stocks usually will deliver result in 6 to 12 months time. Once it reaches my target price, I will sell lets's say 70% of my holdings and keep the remaining 30% for long term exposure. These stocks are usually good quality stocks (as proven by their ability to go up and reached target price). This is better than picking stocks blindly and hold them for long term without good reasons and hoping that one day miracles will happen.

In other words, be a smart Drift Wood. Don't dumb dumb hold for the sake of dumb dumb hold. Only long term hold those stocks that have proven themselves.

3. Concluding Remarks

In this article, I propose that we should have a combination of stocks that spread out over different investment horizons. It will allow us to reduce our risk as well as stress level.

Short term plays yield faster return, but is usually crowded space and is more volatile. It can also be stressful.

Channeling some money to buy stocks that nobody pays attention (Medium Term Play) is one good way to mitigate the abovementioned negative points. But be careful not to buy stocks that need very long gestation period (the longer the holding period the more chance of black swan events). Preferably the stocks should have potential to be re-rated within 12 months. Once you bought them, ignore the short term price fluctuation so as not to give you unnecessary stress.

When a company is doing well, it can potentially last for multiple years (such as Air Asia). Long term plays hence allows us to capture maximum benefit from good quality stocks. By selling 70% (lets' say) of the initial holding at target price, original cost of investment will be reduced to very low level. This creates a conducive environment to hold long term and potentially benefit from multibaggers.

Making money in stock market is easy. The difficult part is how to do it year after year. A good portfolio management strategy not only reduces your risk but also helps you to manage your emotion, making investing less stressful and also sustainable over the longer term.

Have a nice day.

Today skin care is taken to a new level, and many people consider herbal skin care to be the best choice when considering natural skin care. These natural skin care products provide revitalizing nutrients and anti-oxidants that help keep your skin beautiful and ageless.portfolio Management tampa

ReplyDelete