1. Introduction

DKSH released its June 2016 quarterly report yesterday. Net profit grew by 80% Q-o-Q.

The group used to do well in the past but suffered decline in profitability in FY2015 due to restructuring of its operation (which incurred additional costs). With the new platform in place, it seemed that the Group is now in a position to deliver stronger earnings going forward.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) |

|---|---|---|---|---|---|---|

| 2016-12-31 | 2016-06-30 | 1,354,890 | 27,368 | 20,417 | 12.95 | 9.50 |

| 2016-12-31 | 2016-03-31 | 1,332,797 | 15,679 | 11,270 | 7.15 | - |

| 2015-12-31 | 2015-12-31 | 1,355,905 | 13,799 | 10,081 | 6.39 | - |

| 2015-12-31 | 2015-09-30 | 1,425,143 | 6,612 | 4,513 | 2.86 | - |

| 2015-12-31 | 2015-06-30 | 1,372,006 | 13,787 | 10,017 | 6.35 | - |

| 2015-12-31 | 2015-03-31 | 1,419,132 | 16,811 | 12,225 | 7.75 | - |

| 2014-12-31 | 2014-12-31 | 1,380,295 | 23,208 | 17,277 | 10.96 | - |

| 2014-12-31 | 2014-09-30 | 1,311,159 | 19,520 | 14,678 | 9.31 | - |

| 2014-12-31 | 2014-06-30 | 1,361,014 | 19,753 | 14,457 | 9.17 | 22.50 |

| 2014-12-31 | 2014-03-31 | 1,287,013 | 17,934 | 13,499 | 8.56 | - |

2. Principal Business Activities

DKSH is previously known as Diethelm. It is 74% owned by Swiss company DKSH International Ltd.

The DKSH Group has a long history operating in Asia. The company has its origin in the business activities of three Swiss entrepreneurs (Diethelm, Keller and Siber) who sailed to Asia in the 1860s. It later grew into a giant group with business operation in Malaysia, Thailand, China and other Asian countries.

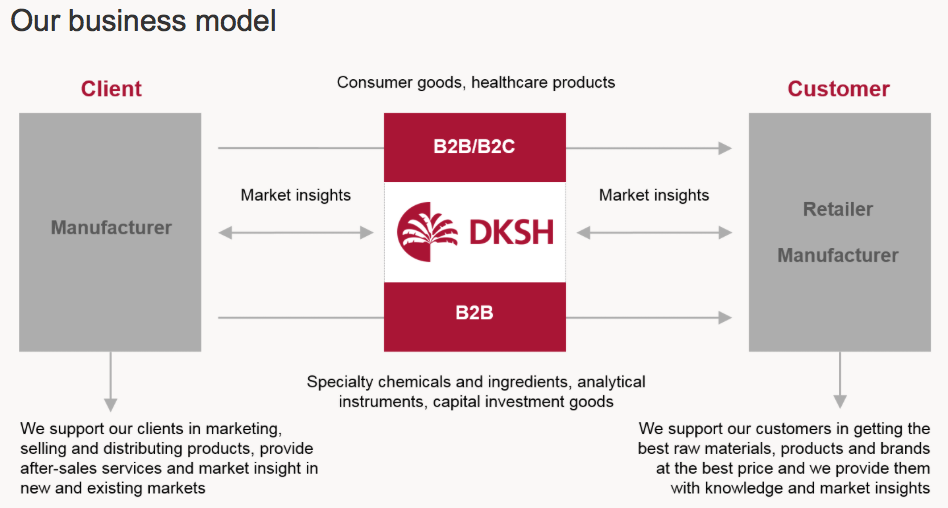

DKSH is basically a trading company. It describes its core business activity as "Market Expansion Service". It helps manufacturers to expand into new market.

However, unlike ordinary trading company, DKSH not only distributes the clients' goods, it also manages their marketing, repackaging, cash collection, supply chain management, etc. In other words, if you are a client of DKSH, you can outsource the entire marketing and sales to DKSH and focus on product development and manufacturing.

3. Background Financials

Based on 158 mil shares and price of RM5.20, DKSH has market cap of RM822 mil.

It reported aggregate net profit of RM46 mil in the past 12 months. As such, historical PER is 18 times.

The group has net assets of RM512 mil, loans of RM67 mil and cash of RM100 mil. As such, it is in net cash position.

DKSH used to trade as high as RM9.00 in March 2014. However, as earning declined, share price gradually retraced to below RM4.00 in 2015.

It seemed that investors has high regard for the company as it attracted PER of more than 15 times in the past.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE |

|---|---|---|---|---|

| 2015-12-31 | 5,572,186 | 36,836 | 23.36 | 17.13 |

| 2014-12-31 | 5,339,481 | 59,911 | 38.00 | 14.16 |

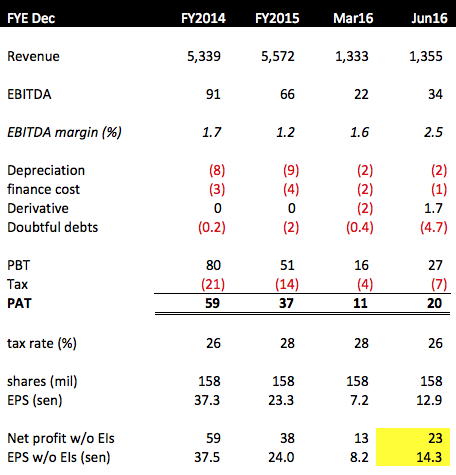

4. Historical Profitability

Key observations :-

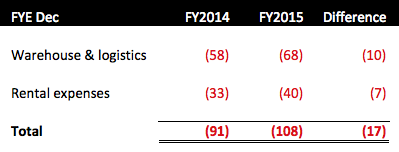

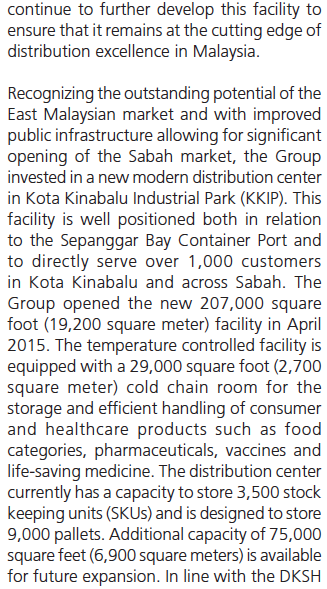

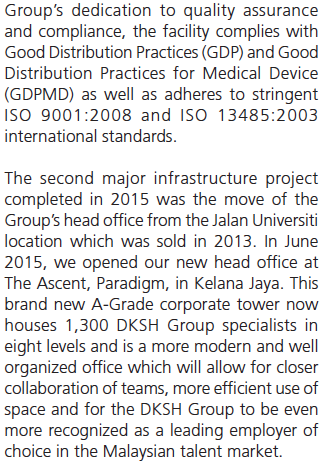

(a) EBITDA margin declined substantially in FY2015 due to relocation cost. The group moved its head office from Jalan University to The Ascent at Paradigm, PJ. It also opened a new distribution centre in Kota Kinabalu, Sabah. All these activities incurred additional cost in the form of double rental, warehousing, etc. The breakdown of the additional cost are as set out below :-

(Source : FY2015 annual report)

In the FY2015 annual report, the company explained that investment in these new facilities lays the platform for future growth :-

(b) EBITDA margin rebounced strongly in June 2016 quarter to 2.5% (from FY2015's 1.2%). As a result, net profit increased by more than 80% Q-o-Q to RM20 mil.

The latest quarter profit includes provision for doubtful debts of RM4.7 mil and derivative gain of RM1.7 mil. Excluding those exceptional items, net profit would have been higher at RM23 mil. Based on 158 mil shares, Core EPS in this latest quarter is actually 14.3 sen.

5 Concluding Remarks

(a) I first noticed DKSH in 2011 when it was trading at RM2.00. I did a quick check and found out that the stock was trading at approximately 10 times PER then. I brushed it aside as I felt that it would have been fully valued.

How wrong have I been !!! In the subsequent few years, I watched haplessly as DKSH was re-rated all the way to RM9.00. Fair enough, earnings had grown by quite a fair bit, but there was also massive expansion in PE multiples. It turned out that investors (mostly funds, as per annual reports) have high regard for the group and its business model and hence were willing to pay a premium.

(b) This round when DKSH showed an improvement in earning, I decided to jump on the opportunity.

Can I make money from this investment ? I guess it all boils down to future earnings. The stock’s adjusted EPS in latest quarter is 14.3 sen. If they managed to repeat the performance and deliver full year EPS of 57.2 sen (being 14.3 sen x 4), the stock is still cheap at current level. Based on 15 times PER, it should trade at RM8.50.

(c) Having said so, even if future quarters’ EPS are lower, I will still be comfortable to hold on for long term. In my opinion, DKSH is a company with moat. Its extensive network of suppliers and distribution channels, in-depth knowledge of domestic market, international exposure, super efficient Swiss management team and economy of scale sets it apart from its competitors, most of which are local trading companies or logistic operators.

The Group should be able to thrive.

(d) I also like its growth potential. There is no limit to the number of products that can be distributed by the Group. In the past few months alone, the group has added one client after another.

No comments:

Post a Comment