Publish date:

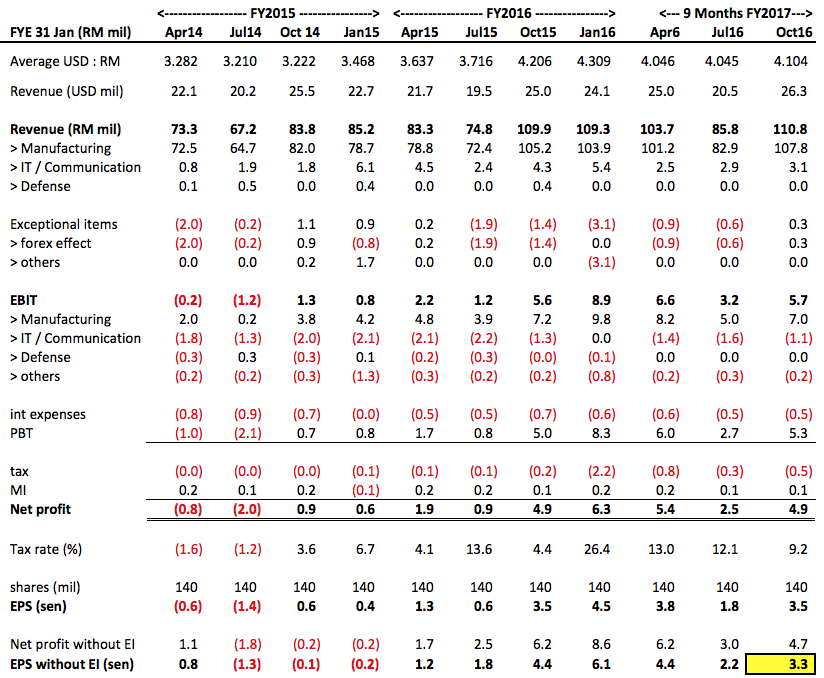

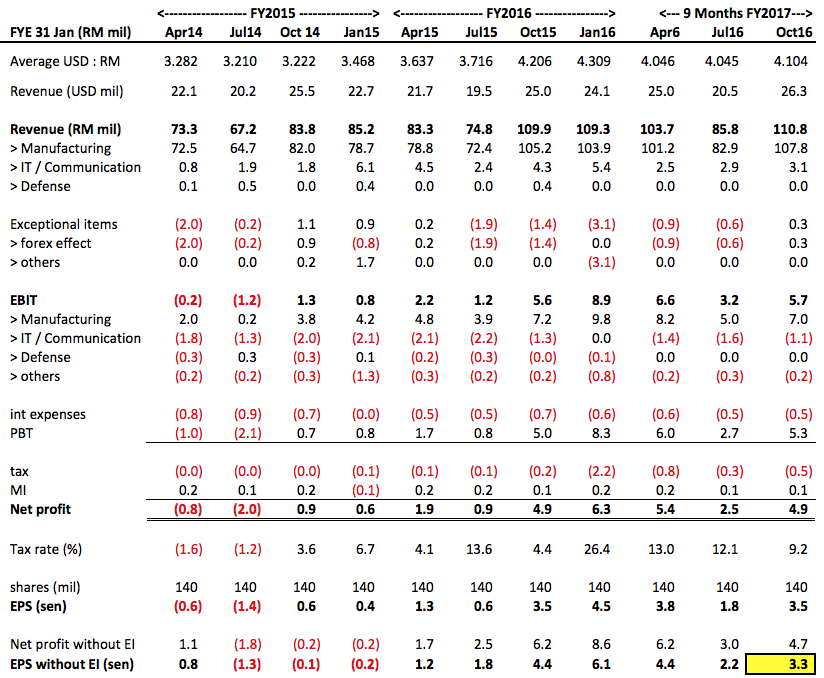

In my previous article dated 21 November 2016, I stick my neck out by doubting Comcorp management's claim that the weak July quarter result was due to industry slow down (weak demand from oil and gas clients). I pointed out that it was more likely due to seasonal factor.

Today, I feel vindicated. Comcorp released its financial result for the quarter ended 30 October 2016. The result is very satisfactory. Actual EPS was 3.5 sen. After excluding forex gain of RM0.3 mil, core EPS would be 3.3 sen.

Based on annualised EPS of 13.2 sen (being 3.3 sen x 4) and latest share price of 76 sen, the stock is trading at prospective PER of 5.8 times. In my opinion, the stock is undervalued at current level. The latest quarter EPS was arrived at based on USD : RM exchange rate of 4.10. However, USD has recently strengthened to 4.46. With almost its entire revenue denominated in USD, coming quarter results will likely be even stronger.

Based on conservative prospective PER of 8 times, I believe Comcorp is potentially worth RM1.05. If you are looking for export exposure, this stock is not a bad choice.

I did a quick check of its balance sheet. The group has cash of RM34 mil and total borrowings of RM57 mil. As such, net borrowing is RM23 mil. Based on net assets of RM126 mil, net gearing is 0.18 times only.

Definitely better than DRB Hicom, Perisai, MP Corp, or Binapuri...

Today, I feel vindicated. Comcorp released its financial result for the quarter ended 30 October 2016. The result is very satisfactory. Actual EPS was 3.5 sen. After excluding forex gain of RM0.3 mil, core EPS would be 3.3 sen.

Based on annualised EPS of 13.2 sen (being 3.3 sen x 4) and latest share price of 76 sen, the stock is trading at prospective PER of 5.8 times. In my opinion, the stock is undervalued at current level. The latest quarter EPS was arrived at based on USD : RM exchange rate of 4.10. However, USD has recently strengthened to 4.46. With almost its entire revenue denominated in USD, coming quarter results will likely be even stronger.

Based on conservative prospective PER of 8 times, I believe Comcorp is potentially worth RM1.05. If you are looking for export exposure, this stock is not a bad choice.

I did a quick check of its balance sheet. The group has cash of RM34 mil and total borrowings of RM57 mil. As such, net borrowing is RM23 mil. Based on net assets of RM126 mil, net gearing is 0.18 times only.

Definitely better than DRB Hicom, Perisai, MP Corp, or Binapuri...

No comments:

Post a Comment