Publish date:

(Ekovest share price)

Ekovest has a good run earlier this year. Between February and March 2017, the stock went up from RM1.10 to RM1.50, a 36% return within a peirod of one month. Investors were euphoric about the stock. It looked unstoppable.

However, as we all know, the Bandar Malaysia deal was terminated in early May 2017 and Iskandar Waterfront City Bhd ("IWC") took a big hit. Even though Ekovest was not a party to the deal, it is the sister company of IWC. Fearing that the relationship between Tan Sri Lim Kang Hoo (the controlling shareholder of IWC and Ekovest) and the Malaysian government has broken down, investors pulled out of both stocks, causing share price to tumble.

Since then, Ekovest has been trading at around RM1.20, 25% off its peak. The market uneasily waited for fresh leads. Will IWC take legal action to protect its interest ? Is Ekovest still in the good book of the government ?

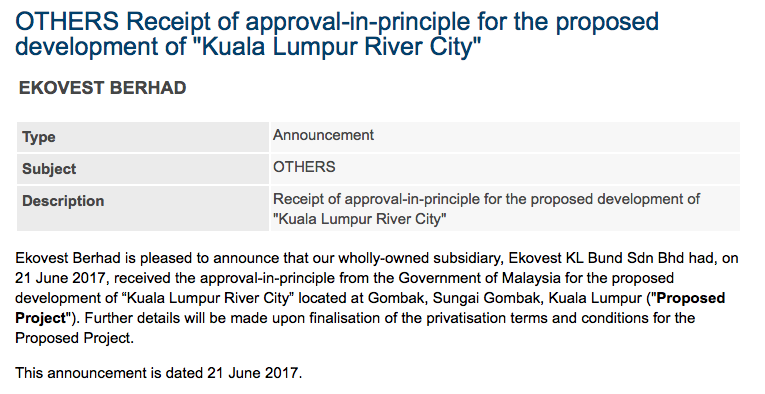

Yesterday, answer for the above questions finally arrived (in my opinion), and it was positive. Ekovest announced that it has secured approval in principle from the Malaysian government for the proposed development of "Kuala Lumpur River City".

To be honest, I do not know much about the River City project, and neither am I very excited about it (even though it could be quite lucrative, albeit over the longer term). What excited me was the POSITIVE SIGNAL - it seemed that the Bandar Malaysia issue is now water under the bridge, all the parties involved had decided to move on.

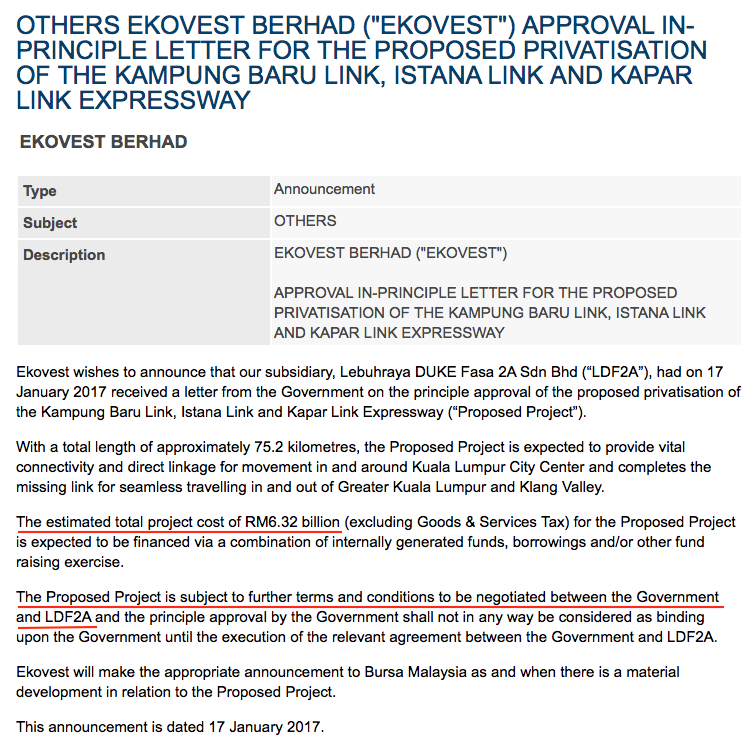

This augurs well for Ekovest's next mega project - privatisation of the Kampung Baru Link, Istana Link and Kapar Link Expressway, which was first announced on 17 January 2017.

As per the announcement above, the construction cost for the project is RM6.32 billion (usually will be undertaken by the concessionaire, which is Ekovest). Ekovest is still in negotiation with the government to finalise the details.

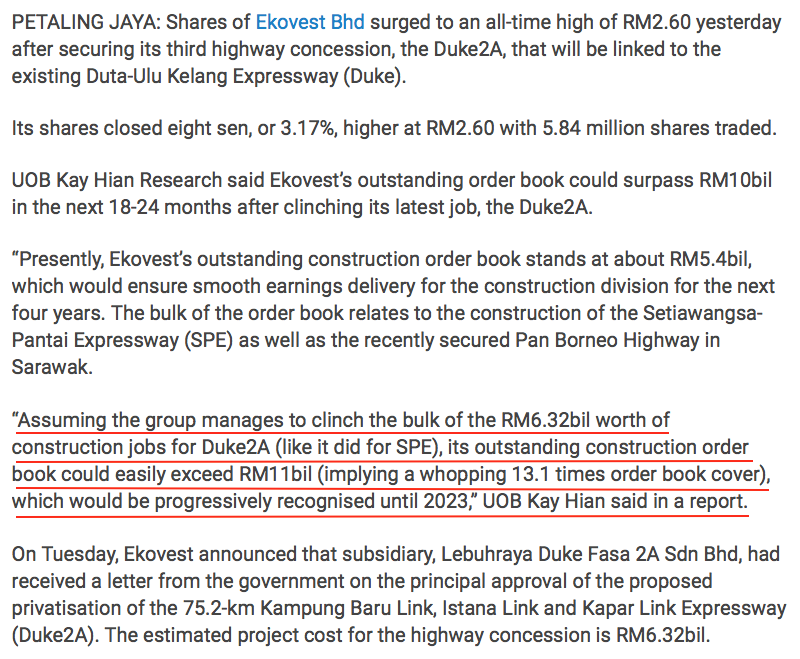

If this new project is successfully secured, Ekovest's order book will balloon to mouth watering RM11 billion.

For those with strong risk appetite (which I am one), maybe it is time to jump in.

No comments:

Post a Comment