Publish date:

1. Background Information

YKGI, previously known as Yung Kong Galvanizing Industries, is principally involved in the following business activities :-

(a) manufacturing of steel coils (Pickled and Oiled Hot Rolled Coil, Cold Rolled Coil, Galnanizd Steel and Pre-Painted Galvanized Steel)

(b) Steel Services Centre, which provides slitting services to customers (cutting big roll into narrow width).

YKGI has 348 mil shares outstanding. Based on latest price of 25 sen, market cap is RM87 mil.

As at 31 March 2017, the group has cash, borrowings and shareholders' funds of RM39 mil, RM166 mil and RM190 mil respectively. As such, net gearing is 0.67 times.

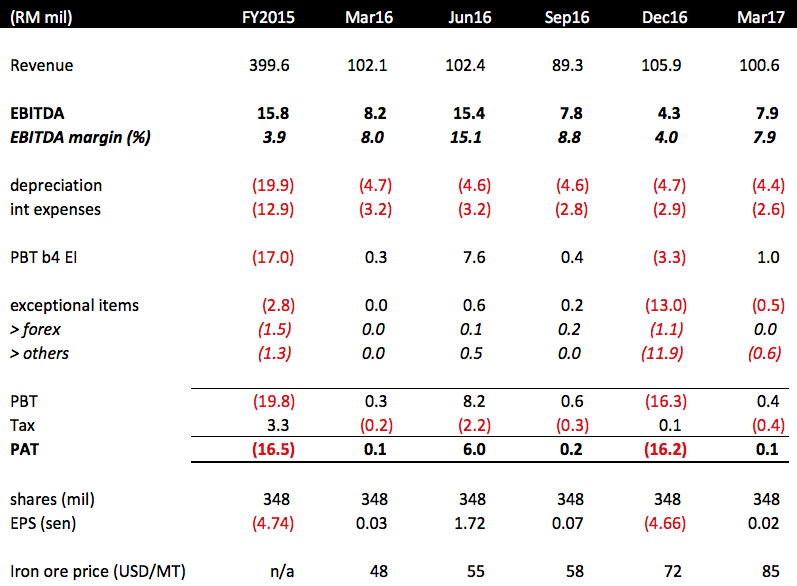

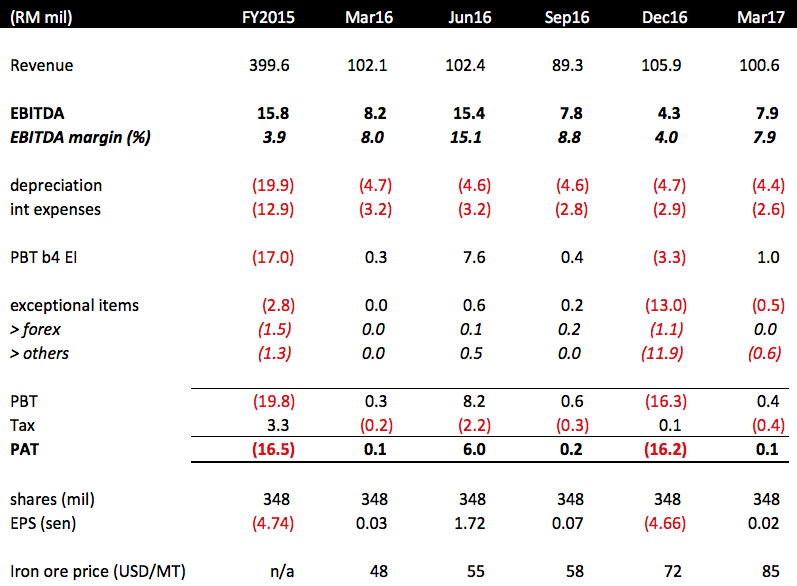

2. Historical Profitability

Key observations :

(a) FY2015 was a typical difficult year. Before 2016, Cold Rolled Coil manufacturers such as YKGI were forced to source Hot Rolled Coil from Megasteel. Megasteel was not an efficient producer. Its HRC was of poor quality and also more expensive than imported HRC.

At the same time, foreign players dumped CRC on Malaysia market, resulted in depressed selling price.

With high cost and low selling price, Malaysia CRC manufacturers were caught between a rock and a hard place.

This was reflected in FY2015 results. The group reported a loss of RM16.5 mil.

(b) Things started improving in second half of 2015, caused by Megasteel's curtailment of production (to minimise losses). As a result, CRC manufacturers started obtaining approval from government to source HRC from overseas. This changes showed up in March 2016 quarter's performance, which saw EBITDA margin improved from 3.9% in FY2015 to 8%.

(c) In May 2016, MITI imposed anti dumping duties on foreign import of CRC (will last until 2021). This has resulted in stronger CRC price domestically. Together with lower input cost pursuant to closing down of Megasteel, the group staged a decisive turnaround in June 2016 quarter.

(d) According to management's explanation, September 2016 quarter's drop in revenue was due to, inter-alia, disruption of galvanizing line due to revamping exercise. Profit margin was lower compared to June 2016 quarter due to increase in raw material cost by 23%.

(Note : my iron ore figure in the table above did not show such huge increase. Not sure what is the reason)

(e) December 2016 quarter result was adversely impacted by higher raw material cost, disposal loss of RM9.35 mil, inventories write off, etc. As shown in table above, average iron ore price was approximately USD72 per MT, USD14 higher than previous quarter.

(f) Iron ore price remained high in March 2017 quarter, went up to more than USD80 per MT at one point. As a result, the group only managed to break even.

(Note : The other three CRC producers : CSC Steel, Eonmetall and Mycron have yet to release their quarterly reports. I expect them to post weak result as well. Mycron might do better as its pipe division should be quite profitable).

3. Iron Ore Price Has Since Come Down

Since early April 2017, iron ore price has experienced a sharp decline. As at the date of this article (mid May 2017), it has declined from height of USD88 per MT to approximately USD60 per MT.

4. Why I Am Calling For Buy

(a) To be fair, YKGI is not a very strong company. I understand from articles written by other bloggers that it is less efficient than its more established peers CSC Steel and Mycron. Its balance sheet is also not that strong.

(Having said so, I have to give them credit for paring down borrowing from RM289 mil in 2012 to RM171 mil in 2016).

(b) What interests me is that its market cap is very small at RM87 mil. If things work out well, small cap stock has great potential for appreciation.

(c) In addition, unlike CSC Steel and Mycron, the stock has barely gone up.

(CSC Steel share price)

(Mycron Steel share price)

(YKGI share price)

(d) As mentioned above, iron ore price has declined substantially since early April 2017. Will that result in stronger profit in coming quarter ending June 2017 ? It is likely, but I can't tell for sure as I don't have insider information.

However, earning risk is mitigated by the fact that share price is now still closed to all time low. Even if coming quarter result disappoints, I believe downside risk is limited.

With such favorable risk reward ratio, the stock is a no brainer at current level.

BUY !

YKGI, previously known as Yung Kong Galvanizing Industries, is principally involved in the following business activities :-

(a) manufacturing of steel coils (Pickled and Oiled Hot Rolled Coil, Cold Rolled Coil, Galnanizd Steel and Pre-Painted Galvanized Steel)

(b) Steel Services Centre, which provides slitting services to customers (cutting big roll into narrow width).

YKGI has 348 mil shares outstanding. Based on latest price of 25 sen, market cap is RM87 mil.

As at 31 March 2017, the group has cash, borrowings and shareholders' funds of RM39 mil, RM166 mil and RM190 mil respectively. As such, net gearing is 0.67 times.

2. Historical Profitability

Key observations :

(a) FY2015 was a typical difficult year. Before 2016, Cold Rolled Coil manufacturers such as YKGI were forced to source Hot Rolled Coil from Megasteel. Megasteel was not an efficient producer. Its HRC was of poor quality and also more expensive than imported HRC.

At the same time, foreign players dumped CRC on Malaysia market, resulted in depressed selling price.

With high cost and low selling price, Malaysia CRC manufacturers were caught between a rock and a hard place.

This was reflected in FY2015 results. The group reported a loss of RM16.5 mil.

(b) Things started improving in second half of 2015, caused by Megasteel's curtailment of production (to minimise losses). As a result, CRC manufacturers started obtaining approval from government to source HRC from overseas. This changes showed up in March 2016 quarter's performance, which saw EBITDA margin improved from 3.9% in FY2015 to 8%.

(c) In May 2016, MITI imposed anti dumping duties on foreign import of CRC (will last until 2021). This has resulted in stronger CRC price domestically. Together with lower input cost pursuant to closing down of Megasteel, the group staged a decisive turnaround in June 2016 quarter.

(d) According to management's explanation, September 2016 quarter's drop in revenue was due to, inter-alia, disruption of galvanizing line due to revamping exercise. Profit margin was lower compared to June 2016 quarter due to increase in raw material cost by 23%.

(Note : my iron ore figure in the table above did not show such huge increase. Not sure what is the reason)

(e) December 2016 quarter result was adversely impacted by higher raw material cost, disposal loss of RM9.35 mil, inventories write off, etc. As shown in table above, average iron ore price was approximately USD72 per MT, USD14 higher than previous quarter.

(f) Iron ore price remained high in March 2017 quarter, went up to more than USD80 per MT at one point. As a result, the group only managed to break even.

(Note : The other three CRC producers : CSC Steel, Eonmetall and Mycron have yet to release their quarterly reports. I expect them to post weak result as well. Mycron might do better as its pipe division should be quite profitable).

3. Iron Ore Price Has Since Come Down

Since early April 2017, iron ore price has experienced a sharp decline. As at the date of this article (mid May 2017), it has declined from height of USD88 per MT to approximately USD60 per MT.

4. Why I Am Calling For Buy

(a) To be fair, YKGI is not a very strong company. I understand from articles written by other bloggers that it is less efficient than its more established peers CSC Steel and Mycron. Its balance sheet is also not that strong.

(Having said so, I have to give them credit for paring down borrowing from RM289 mil in 2012 to RM171 mil in 2016).

(b) What interests me is that its market cap is very small at RM87 mil. If things work out well, small cap stock has great potential for appreciation.

(c) In addition, unlike CSC Steel and Mycron, the stock has barely gone up.

(CSC Steel share price)

(Mycron Steel share price)

(YKGI share price)

(d) As mentioned above, iron ore price has declined substantially since early April 2017. Will that result in stronger profit in coming quarter ending June 2017 ? It is likely, but I can't tell for sure as I don't have insider information.

However, earning risk is mitigated by the fact that share price is now still closed to all time low. Even if coming quarter result disappoints, I believe downside risk is limited.

With such favorable risk reward ratio, the stock is a no brainer at current level.

BUY !

No comments:

Post a Comment