Publish date:

1. Excellent Result

Crest Builder released a strong set of result this evening.

Key observations :

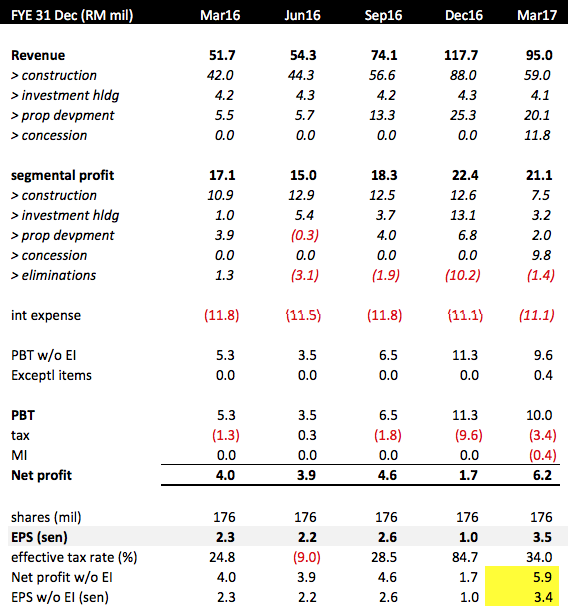

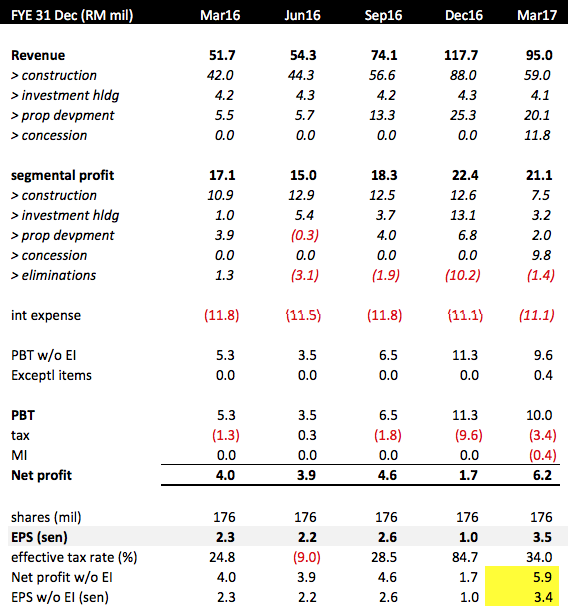

(a) Very little exceptional items. Almost the entire profit is operation related. Core EPS of 3.4 sen.

(b) Actually, the group has already turned around in previous quarter (PBT of RM11.3 mil). However, high tax rate of 85% pressed down its net profit (EPS of 1 sen only). With tax rate normailizing to 34% this quarter, EPS finally shines through.

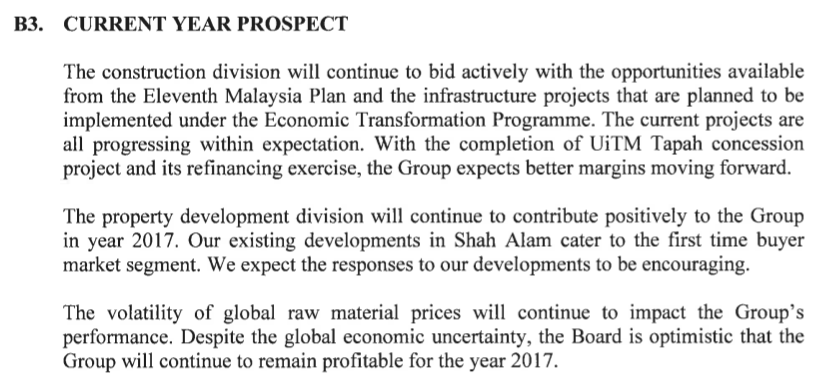

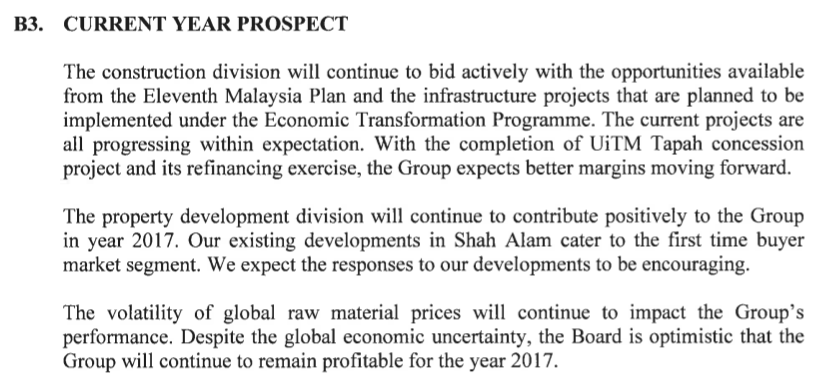

(c) The company is positive about coming quarter prospects :-

2. BUY Recommendation

(a) Since the beginning of this year, almost all construction stocks had been re-rated. Crest Builder is the last one. Its price has hardly gone up.

(b) Many of the construction stocks that have gone up had fundamentals worse than Crest Builder. Many are still incurring losses and / or saddled with legacy issues. Crest Builder has proper profit track record and is relatively clean (no ticking time bomb).

(c) Crest Builder has RM800 mil order book. Enough to last more than three years based on assumed annual revenue of RM240 mil (based on latest quarter construction revenue of RM59 mil x 4). There is potential to secure more contracts.

(d) Very small market cap of RM167 mil. This is a very good point. It means that the Group only needs a relatively small amount of profit to propel share price upwards. Compare to other bigger construction companies, lower risk of earning disappointment (backed by order book and property division).

Crest Builder released a strong set of result this evening.

Key observations :

(a) Very little exceptional items. Almost the entire profit is operation related. Core EPS of 3.4 sen.

(b) Actually, the group has already turned around in previous quarter (PBT of RM11.3 mil). However, high tax rate of 85% pressed down its net profit (EPS of 1 sen only). With tax rate normailizing to 34% this quarter, EPS finally shines through.

(c) The company is positive about coming quarter prospects :-

2. BUY Recommendation

(a) Since the beginning of this year, almost all construction stocks had been re-rated. Crest Builder is the last one. Its price has hardly gone up.

(b) Many of the construction stocks that have gone up had fundamentals worse than Crest Builder. Many are still incurring losses and / or saddled with legacy issues. Crest Builder has proper profit track record and is relatively clean (no ticking time bomb).

(c) Crest Builder has RM800 mil order book. Enough to last more than three years based on assumed annual revenue of RM240 mil (based on latest quarter construction revenue of RM59 mil x 4). There is potential to secure more contracts.

(d) Very small market cap of RM167 mil. This is a very good point. It means that the Group only needs a relatively small amount of profit to propel share price upwards. Compare to other bigger construction companies, lower risk of earning disappointment (backed by order book and property division).

(e) Its gearing looked high. But please don't worry. The bulk of the borrowings are related to the UiTM concession. They are backed by long term revenue stream from government and has no recourse to holding company.

(f) Everything I mentioned above has not factored in huge Transit Oriented property development pipeline. You might be pessimistic about property. I don't disagree. But Crest Builder's major future projects are all located closed to LRT stations. That put them in a different league and better position to pull things off. Please refer to my previous article for details.

(g) The Company has declared 4 sen dividend few months ago. It has yet to go ex. That means the effective price now is only 94 sen (instead of 98 sen).

(h) Based on annualised EPS of 13.6 sen, existing PER is 7.2 times. I believe a PER of 10 times is reasonable.

No comments:

Post a Comment