Publish date:

1. Introduction

Comcorp is a controversial stock.

There is nothing controversial about the company at all. If you look at their past few quarters performance (in Section 2 below), you really can't find much fault about it. I said that the stock is controversial because of two things :-

(a) it attracted a lot of animosity from certain forum members. They found faults in everything related to the company. However, upon closer examination, all those accusations are mostly untrue.

(b) I believe certain syndicates like to manipulate this stock. In several occasions, many forum members got burnt because they chased the stocks for quick profit.

I have got nothing to do with the syndicates. I don't want you to get burned. If you want to profit from this stock, you should adopt a buy and hold strategy. Based on past experience, those that try to make quick money by jumping in whenever volume picks up will usually end in tears.

Handle this stock with care. This is my advice to you.

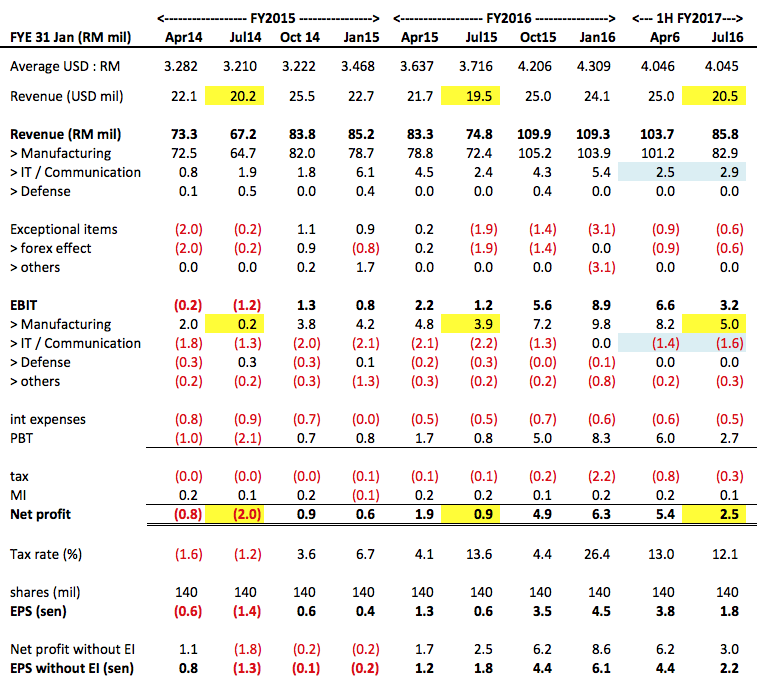

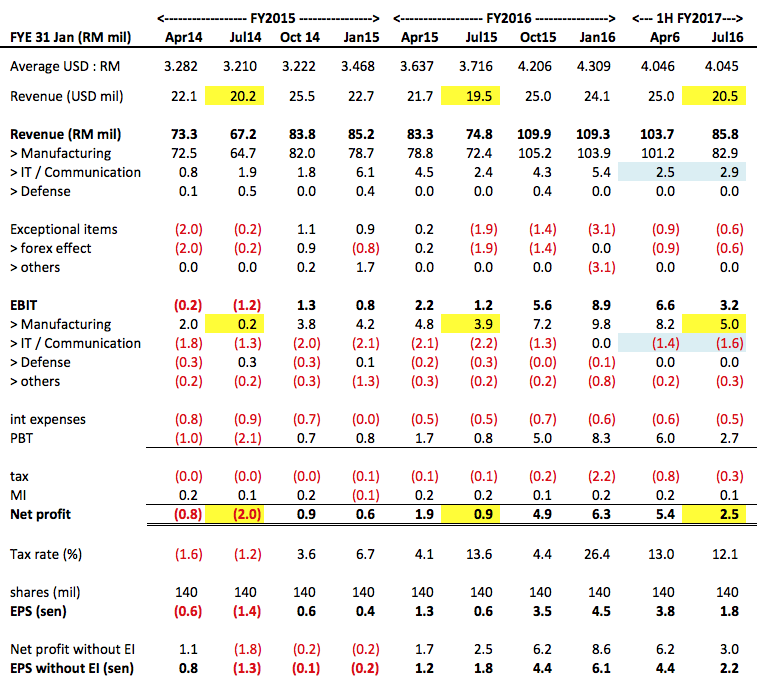

2. Historical Profitability

Even though the table above contains information starting from April 2014 onwards, I will not go into details on those old figures. This is because I have covered them before in my first few articles. If you want to get to know Comcorp in depth, please refer to those articles.

In this article, I will only discuss the latest 2 quarters.

Key observations :-

(a) Comcorp's July 2016 quarter result seemed to catch many people by surprise. Share price plunged after it announced net profit of RM2.5 mil, 55% lower than preceding quarter's RM5.4 mil.

However, I will say that there is no surprise at all. If you look at past few years P&Ls, you will notice that JULY QUARTER IS SEASONALLY WEAK. This is true for FY2014, 2015 and 2016. (Please refer to the yellow highlighted).

(b) One thing that upset me in the latest two quarters is that the IT / Communication division has resumed losing money. When I last wrote about Comcorp (covering the January 2016 quarter), the IT / Communication division broke even.

The reason I complained about their losses is because they dragged down Comcorp's performance. Comcorp reported net profit of RM19 mil in the past 12 months. If not because of the RM4.3 mil losses of the IT / Communication division, earnings could have been much stronger.

The IT / Communication division obtained most of its contracts from the government. With weak finances following the plunge of oil price, I don't think the government will spend much on IT. I just hope that the division can manage its losses so that it does not spin out of control.

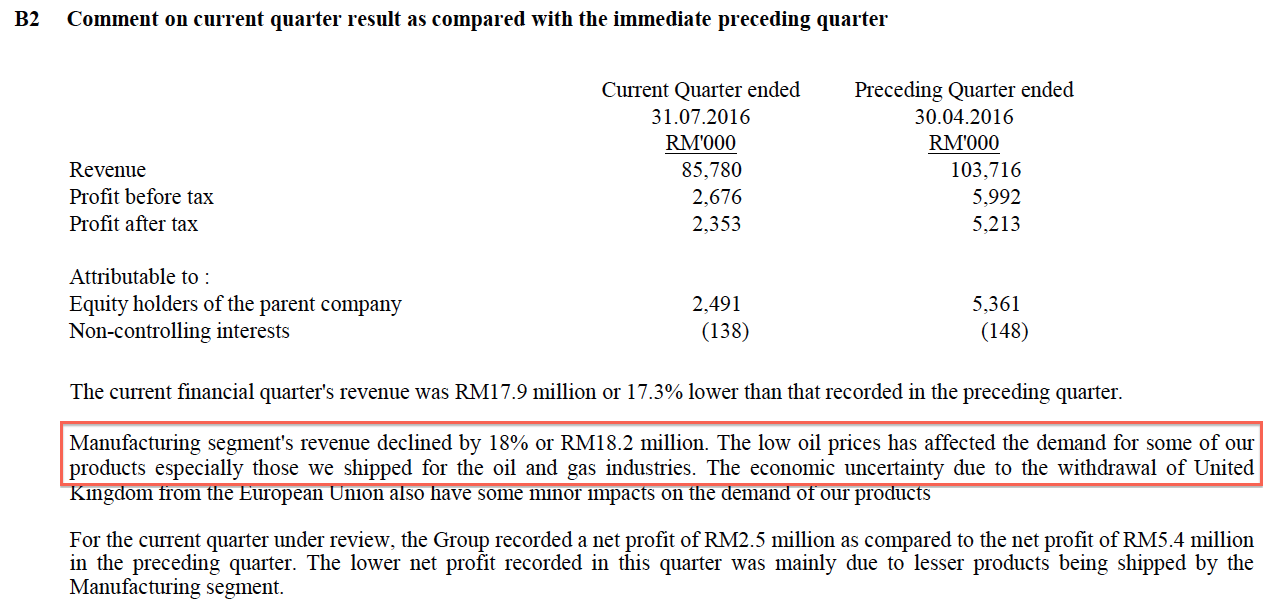

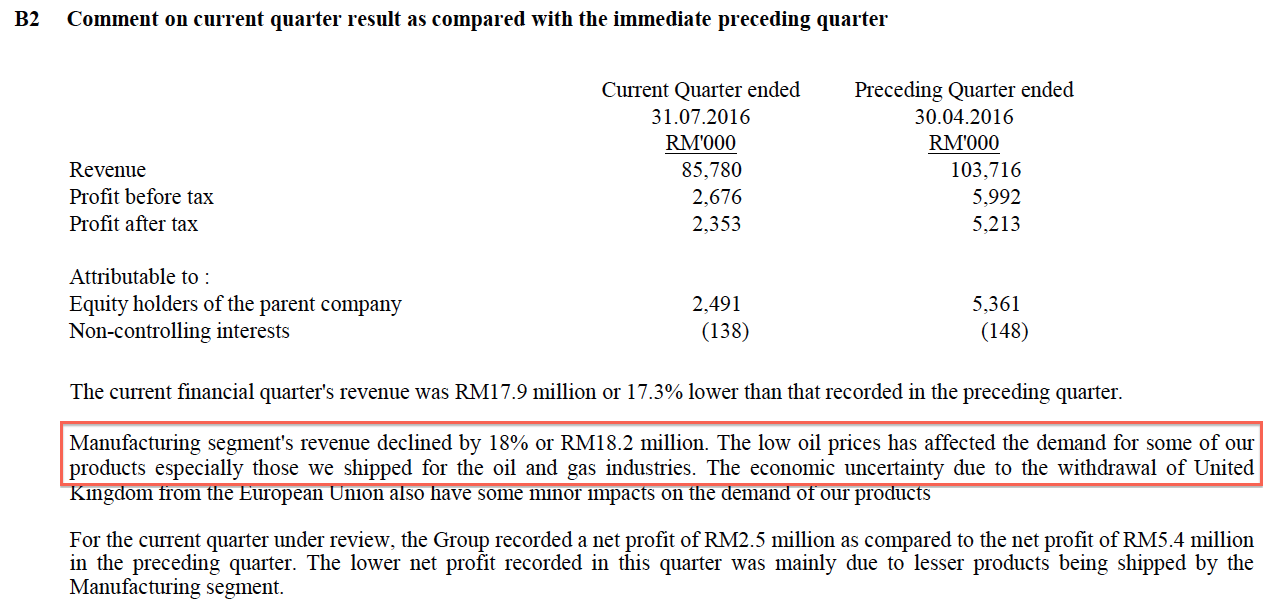

(c) In (a) above, I argued that July 2016's lousy result was due to seasonality. But in the quarterly report, management attributed that to weak demand from oil and gas clients :-

For me, this is something new. In all previous quarterly reports, the Company has never cited this reason. So, what is the actual cause ? Seasonality or weak demand from oil and gas clients ? We can only find out when the company releases its October 2016 quarterly report by end December.

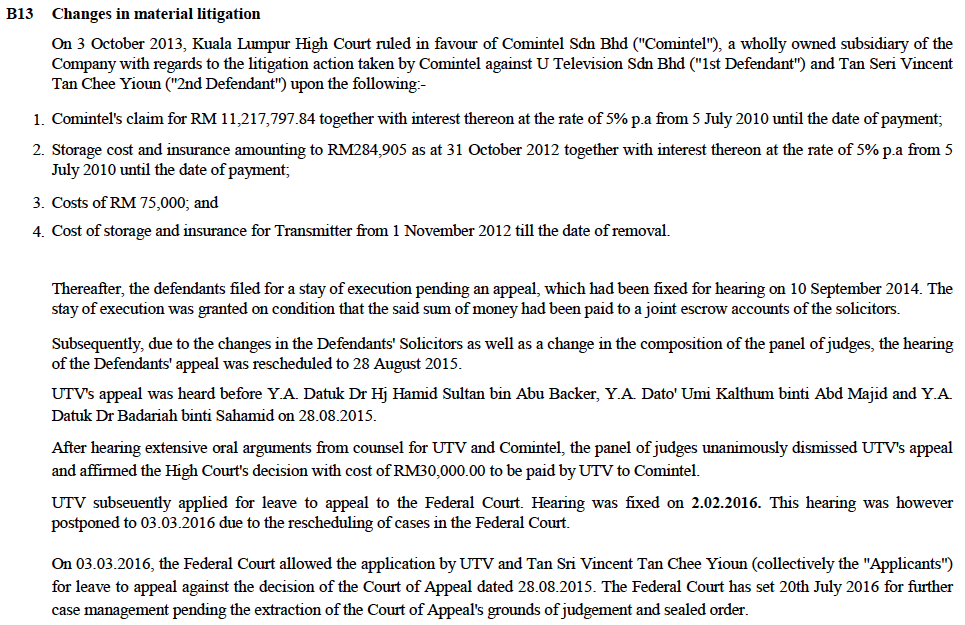

3. Court Case

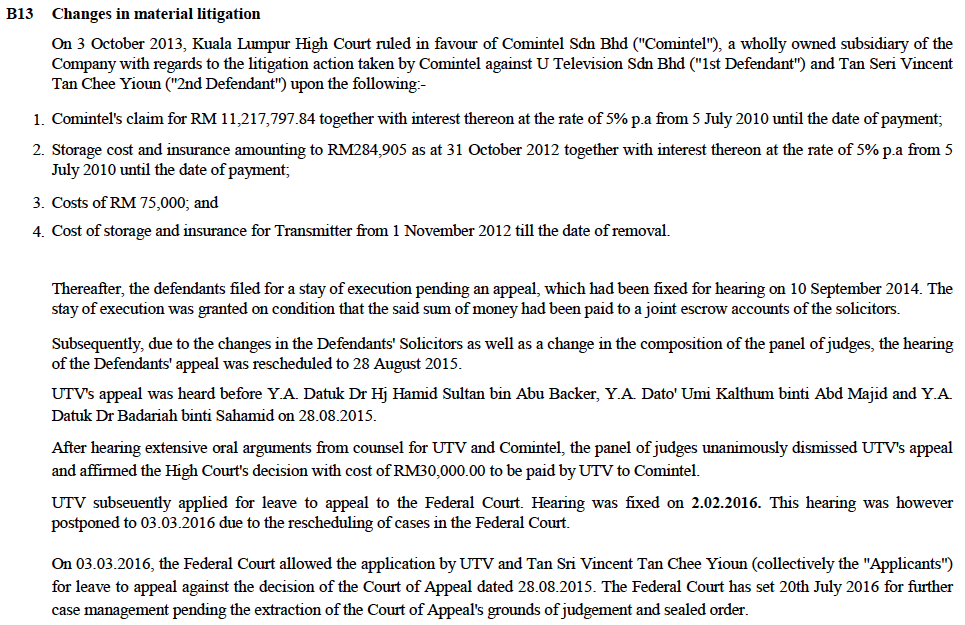

Latest update on the much awaited U-Mobile Court Case. 30 November 2016 is only few days away.

4. Concluding Remarks

Not every stock that I write about means that I think it is a Buy. Sometime I cover a stock because I find the macro environment conducive and as such, warrants a closer look. Due to lack of insider information, I am as blur as everybody else when come to the prospect of the company.

Comcorp is a controversial stock.

There is nothing controversial about the company at all. If you look at their past few quarters performance (in Section 2 below), you really can't find much fault about it. I said that the stock is controversial because of two things :-

(a) it attracted a lot of animosity from certain forum members. They found faults in everything related to the company. However, upon closer examination, all those accusations are mostly untrue.

(b) I believe certain syndicates like to manipulate this stock. In several occasions, many forum members got burnt because they chased the stocks for quick profit.

I have got nothing to do with the syndicates. I don't want you to get burned. If you want to profit from this stock, you should adopt a buy and hold strategy. Based on past experience, those that try to make quick money by jumping in whenever volume picks up will usually end in tears.

Handle this stock with care. This is my advice to you.

Even though the table above contains information starting from April 2014 onwards, I will not go into details on those old figures. This is because I have covered them before in my first few articles. If you want to get to know Comcorp in depth, please refer to those articles.

In this article, I will only discuss the latest 2 quarters.

Key observations :-

(a) Comcorp's July 2016 quarter result seemed to catch many people by surprise. Share price plunged after it announced net profit of RM2.5 mil, 55% lower than preceding quarter's RM5.4 mil.

However, I will say that there is no surprise at all. If you look at past few years P&Ls, you will notice that JULY QUARTER IS SEASONALLY WEAK. This is true for FY2014, 2015 and 2016. (Please refer to the yellow highlighted).

(b) One thing that upset me in the latest two quarters is that the IT / Communication division has resumed losing money. When I last wrote about Comcorp (covering the January 2016 quarter), the IT / Communication division broke even.

The reason I complained about their losses is because they dragged down Comcorp's performance. Comcorp reported net profit of RM19 mil in the past 12 months. If not because of the RM4.3 mil losses of the IT / Communication division, earnings could have been much stronger.

The IT / Communication division obtained most of its contracts from the government. With weak finances following the plunge of oil price, I don't think the government will spend much on IT. I just hope that the division can manage its losses so that it does not spin out of control.

(c) In (a) above, I argued that July 2016's lousy result was due to seasonality. But in the quarterly report, management attributed that to weak demand from oil and gas clients :-

For me, this is something new. In all previous quarterly reports, the Company has never cited this reason. So, what is the actual cause ? Seasonality or weak demand from oil and gas clients ? We can only find out when the company releases its October 2016 quarterly report by end December.

3. Court Case

Latest update on the much awaited U-Mobile Court Case. 30 November 2016 is only few days away.

4. Concluding Remarks

Not every stock that I write about means that I think it is a Buy. Sometime I cover a stock because I find the macro environment conducive and as such, warrants a closer look. Due to lack of insider information, I am as blur as everybody else when come to the prospect of the company.

Comcorp is one such stock. I am studying it now because the USD has strengthened. Ultimately whether it will do well is dependent on many other factors. So please don't blame me if things turn sour. I am not asking you to buy. This article is for reference purpose only.

No comments:

Post a Comment