1. Introduction

Since I bought Air Asia in March 2016, the stock has performed well. At one point, it made up closed to 40% of my portfolio. For risk management purpose, last week I disposed of some to reduce exposure.

I noticed that Affin reported EPS of 7.1 sen in latest quarter. I don't know whether the group can repeat the same performance going forward. However, the stock has come down by quite a lot and past few quarters' EPS was quite stable. I decided to park my Air Asia sale proceeds with this stock.

Hopefully the group can continue to do well in coming quarters, with quarterly EPS of at least 5 to 6 sen (my expectation for 2016 and 2017, plucked from the air).

In 2018, I will set higher expectation as hopefully economy can gather strength, benefitting all banking stocks.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2016-12-31 | 2016-06-30 | 476,715 | 182,613 | 137,396 | 7.07 | - | 4.4200 |

| 2016-12-31 | 2016-03-31 | 426,921 | 152,727 | 115,566 | 5.95 | - | 4.3800 |

| 2015-12-31 | 2015-12-31 | 464,834 | 139,160 | 97,407 | 5.01 | 5.00 | 4.2600 |

| 2015-12-31 | 2015-09-30 | 459,786 | 149,054 | 102,389 | 5.27 | 2.99 | 4.1600 |

| 2015-12-31 | 2015-06-30 | 447,057 | 177,648 | 139,388 | 7.17 | - | 4.1800 |

| 2015-12-31 | 2015-03-31 | 448,933 | 48,547 | 30,085 | 1.55 | - | 4.1400 |

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| 2015-12-31 | 1,802,492 | 369,269 | 19.01 | 12.31 | 7.99 | 3.41 | 4.2600 | 4.46 |

| 2014-12-31 | 1,819,813 | 592,677 | 34.52 | 8.41 | 15.00 | 5.17 | 4.0800 | 8.46 |

| 2013-12-31 | 1,525,749 | 650,021 | 43.49 | 9.55 | 15.00 | 3.61 | 4.2700 | 10.19 |

| 2012-12-31 | 2,971,723 | 628,942 | 42.08 | 8.18 | 15.00 | 4.36 | 4.0400 | 10.42 |

| 2011-12-31 | 2,655,610 | 507,995 | 33.99 | 9.07 | 12.00 | 3.90 | 3.7400 | 9.09 |

| 2010-12-31 | 2,272,995 | 488,625 | 32.70 | 9.45 | 9.00 | 2.91 | 3.4800 | 9.40 |

2. Rare Opportunity To Own Bank Stocks At Trough Valuation

I always have a soft spot for banking stocks. They are tightly supervised by Bank Negara (stringent disclosure requirement), allowed by the government to have healthy profit margin (to nurture a strong banking system), and as a proxy to the economy, have excellent growth prospects.

However, in the past few years, I did not have opportunity to own any bank stocks. Banks were not cheap. Many traded at PER of closed to 15 times. In addition, most banks' earnings have grown tremendously. For example, CIMB's net profit was RM782 mil in FY2003. Ten years later (2013), it has ballooned to RM4.5 billion. In my opinion, prospect for further growth was not exciting.

Things took a dramatic turn by end of 2014. Due to collapse of oil price and the ensuing economic downturn, many banks were adversely affected. Affin has not been spared. Its net profit declined from RM593 mil in FY2014 to RM369 mil in FY2015. Share price also took a massive beating. The stock used to trade as high as RM4.50. It is now trading at RM2.15.

For me, this is a golden opportunity to gain exposure in banking stocks.

3. Corporate Governance

Before you invest in a bank, you must be comfortable with its corporate governance standard.

During Tan Sri Zeti's tenure as Governor, she put in place various measures to strengthen corporate governance of financial insititutions. Among them are requirement that individual and corporate shareholders' equity interest cannot exceed certain level. Bank Negara also encouraged local banks to bring in foreign shareholders as minority partners.

Affin's foreign partner is Hong Kong based Bank of East Asia, which holds 23.5% equity interest in the company. It has two representaives, Ignatius Chan and Joseph Yuk on the Board of Directors. I believe the practice of bringing in minority partners with substantial equity interest should provide effective check and balance to safeguard the interest of all stakeholders. This is not only true for Affin, but also for all other banks.

4. Historical Profitability

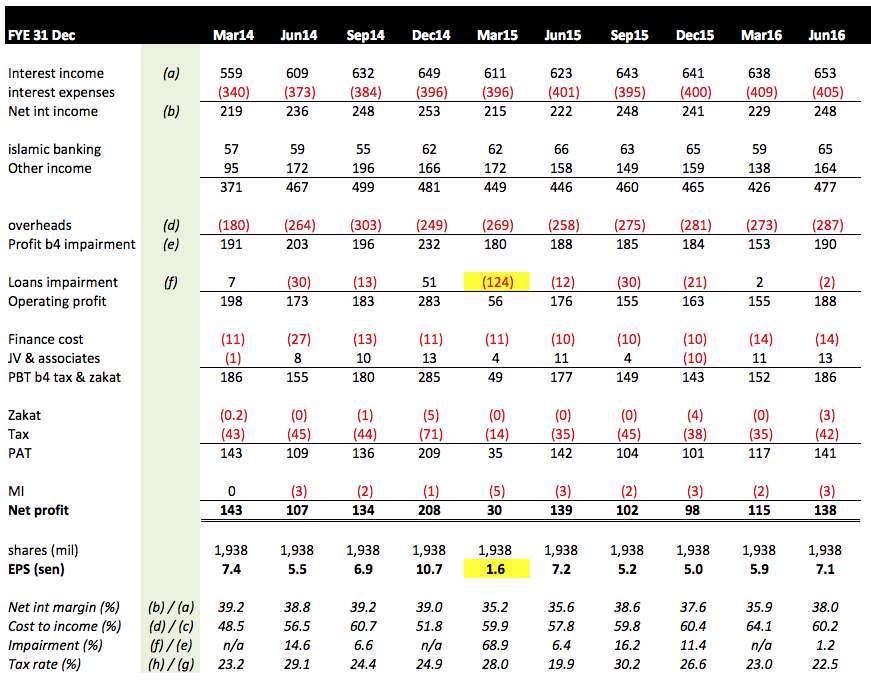

Key observations :-

(a) Once I laid out all the figures in a spreadsheet, it becomes very easy to understand a company's past performance.

(b) As pointed out by many analysts, Affin's cost to income ratio is a bit high. I have to admit that there is room for improvement. However, this would have already been reflected in its share price, what is there for me to complain ?

However, I do hope that they can try harder to bring it down. No matter what we do, it is always good to be more efficient, right ?

(c) I found their asset quality acceptable. Of course they are not in the same class as Public Bank. But it seemed that they have been able to come out of the tumultous 2015 relatively unscatched. Certain banks (for example, CIMB) has performed even worse.

5. Dividend Policy

The company mentioned in its 2015 annual report that it is committed to pay out at least 50% of its Company level PAT as dividend.

Based on latest DPS of 8 sen and market price of RM2.15, dividend yield is 3.7%.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | DY |

|---|---|---|---|---|---|

| 2015-12-31 | 1,802,492 | 369,269 | 19.01 | 7.99 | 3.41 |

| 2014-12-31 | 1,819,813 | 592,677 | 34.52 | 15.00 | 5.17 |

| 2013-12-31 | 1,525,749 | 650,021 | 43.49 | 15.00 | 3.61 |

| 2012-12-31 | 2,971,723 | 628,942 | 42.08 | 15.00 | 4.36 |

| 2011-12-31 | 2,655,610 | 507,995 | 33.99 | 12.00 | 3.90 |

| 2010-12-31 | 2,272,995 | 488,625 | 32.70 | 9.00 | 2.91 |

In the longer run, I expect Affin to generate higher EPS. During the period from 2010 to 2014, EPS ranged from 32 sen to 43 sen. It used to distribute dividend as high as 15 sen. If that happens again (several years down the road), dividend yield based on current price will be closed to 7%.

(Note : If you are not prepared to hold long term, all the above mentioned vision, hope and expectation are meaningless to you. If that is the case, you should give this stock a pass and move on to something more exciting)

6. Take Care of The Downside, And The Upside Will Take Care of Itself

The main decision I invest in Affin is because I think it is defensive at current level. I am not saying that it has reached rock bottom. There is a possibility that it can go down further as EPF has been consistently selling in the past few weeks (after the fantastic EPS of 7 sen was announced).

The reason I said that it is defensive is because when I look at the chart and ask myself the question :

"By buying now at RM2.15 at closed to bottom of earning cycle and at PBR of 0.5 times, what is the chance that I am buying at the peak ? What is the chance that Affin will forever stay below RM2.15 and never go above that level again ?"

The answer is "closed to zero chance".

NO WAY I WILL SUFFER PERMANENT LOSS OF CAPITAL IN THIS STOCK, IF I AM WILLING TO HOLD IT FOR LONG TERM

When I look at things from this perspective, then the decision to invest in Affin becomes very easy to make. If you put money in fixed deposit, you get 3% return. Affin at current level is as safe as fixed deposit (for long term investors), and the return is likely to be much higher than 3% (as mentioned above, Affin has committed to pay out at least 50% of its profit as dividend).

It is a no brainer.

7. Disposals By EPF

During the past few weeks, EPF disposed more than 7 mil shares, paring down its holdings from 147 mil shares to 140 mil shares.

I don't know why EPF is so busy selling. Does EPF know something everybody else doesn't know ? Is it selling because the coming quarter result will be horrible ?

Deep in my heart, I think that is very unlikely :-

(a) Next financial quarter will end on 30 September 2016. We are now only in August. As such, nobody knows exactly how much Affin will make in the coming quarter. Not even the CFO and CEO; and

(b) If EPF is indeed selling ahead of bad results, it has full three months ahead of it to sell. There is no need to sell so aggressively as though there will be no tomorrow.

EPF must be selling because of some other reasons. If that is the case, I shouldn't give too much weightage to their action. I buy stocks based on earnings and valuation.

In any event, I am more than happy to increase exposure if result continues to be good and price keeps dropping. I hope EPF will continue to sell more.

8. Proxy To Oil Price Recovery (If It Happens)

2016 has been a good year for Airline stocks as oil price has been low. However, going into 2017, nobody can tell for sure how oil will perform. Certain people invest in oil and gas stocks in preparation for that possibility.

However, I prefer Banking stocks as proxy to potential oil price recovery. Malaysia is a net oil exporter. Increase in oil price will increase government revenue, has positive effect on consumer sentiment as well as make Bursa attractive to foreign funds. All the positive factors mentioned above will spill over to benefit banking stocks.

I think this is more superior than gaining direct exposure to oil and gas stocks. If oil price does not perform, oil and gas stocks will be stuck at the doldrum, but Banking stocks can still chuck along nicely.

Limited downside but possibility of decent upside. That is what l like.

No comments:

Post a Comment