1. Introduction

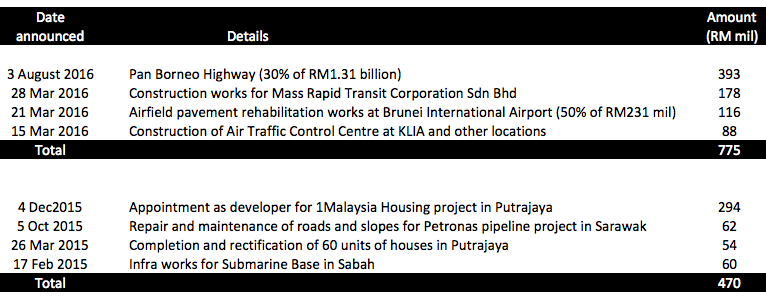

TRC is principally involved in construction and property development. It attracted my attention because recently its 30% owned JV vehicle secured a RM1.31 billion construction contract for Pan Borneo Highway (effective interest of RM393 mil).

2. Background Financials

Based on 480 mil shares and market price of 46 sen, market cap is RM221 mil.

The group reported aggregate net profit of RM27 mil in past twelve months. As such, historical PER is approximately 8.2 times.

The group has net assets of RM357 mil, borrowings of RM193 mil and cash of RM198 mil. As such, it is in net cash position of RM5 mil.

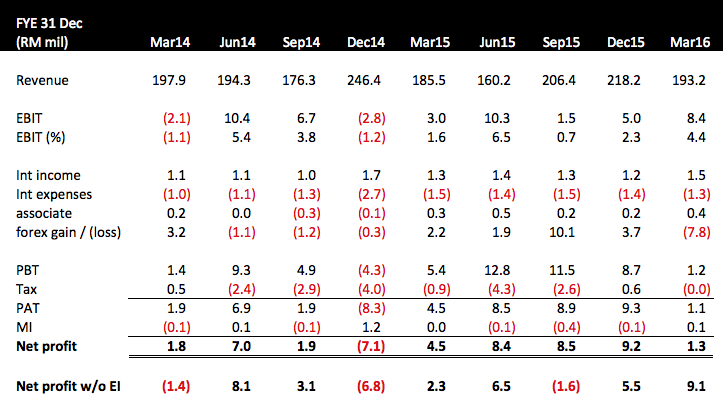

3. Historical Profitability

Key observations :-

(a) At first look, the group has done well in past few quarters. However, upon closer examination, the bulk of the profit (RM18 mil out of RM31 mil in FY2015) was due to forex gain.

(b) In the March 2016 quarter, the group's net profit declined to RM1.3 mil. However, that was due to forex loss of RM7.8 mil. Without that, the group has actually done well with core earning of RM9.1 mil, translating into EPS of 1.9 sen.

4. Flushed With New Contracts

2016 is a bumper year for the group. It secured one contract after another. Please refer to table below for details.

5. Transit Oriented Development Project At Ara Damansara

In 2013, TRC entered into JV agreement with Prasarana for the mixed development project at LRT Station 2 at Ara Damansara, PJ. GDV is estimated to be RM1 billion. After finally resolving land transfer issue, the group targets to launch the project in first quarter 2017.

6. Concluding Remarks

TRC is very good at replenishing its order book. However, I have a bit of reservation about the stock as its past profit has been erratic.

I have bought a little bit and will only buy more if coming quarter result is good.

No comments:

Post a Comment