Publish date:

1. Teh Tarik With Deep Throat

Last week, I spoke to somebody ("Deep Throat") who is familiar with Priceworth. He generously answered all of the questions I posed to him. Some of the information I will disclose in this article while some I prefer to keep it confidential as those information has yet to be announced officially. I want to make sure Deep Throat does not get into trouble, even though he has never told me what to write, what not to write.

Please refer to details below.

2. Completion of Acquisition of Forest Concession

Deep Throat concurred with my analysis in earlier article that the ONLY condition for the proposed acquisition yet to be fulfilled is Shareholders' Approval. They are in the process of finalising the circular and will be calling for EGM soon. Target to implement the rights issue by March 2018.

The rights issue is confirmed to be two call rights with first call at 5 sen while the second call of 5 sen to be capitalised from retained profit, share premium, etc.

Post rights issue, the number of shares outstanding is estimated to be 3.6 billion.

3. Timber Extraction Volume

As mentioned in my previous article, in the month of November 2017, the group extracted 18,000 cubic meter from the concession (Compartment 57 and 58). The extraction volume (from the entire concession) will gradually go up until it reaches approximately 50,000 cubic meter per month (and stabilise there). This is targeted to be achieved within next 6 to 12 months.

4. Timber Market Condition

The timber market is relatively healthy. Demand is stable (not really growing in a big way), but supply is hard to come by. As such, timber price is stable and on steady upward trend. This is expected to continue over the long term.

Japan's 2020 Olympic should have material positive impact on demand.

5. The Concession

After I published Part 1, certain reader commented that the deal sounds fishy. He was of the opinion that if the concession is indeed so good, why would the owner wants to sell it ? There must be a trap.

I sought clarification with Deep Throat. Deep Throat explained that the concession was originally held by few Chambers of Commerce. They couldn't work together, so they sold it to the existing owners (West Malaysians) in 1997. The West Malaysians are not familiar with the industry, so they hired a contractor to do the extraction and replanting for them. The contractor also did not perform well (they were originally from palm oil industry). Until now, they have only logged a few thousand hectares.

This of course is met with dissatisfaction from the Sabah Forestry Department. If the concession is not logged properly, the State will not get tax revenue. Replanting also cannot be implemented effectively. As a result, the owners have to do something about it. Under this kind of circumstances, disposal to Priceworth is apparently a good option.

6. Timber Volume Determines Value of Concession

As mentioned in Part 1, Priceworth is acquiring the 80,000 hectares forest concession (FMU 5) for RM260 mil (discount of RM30 mil if payment is settled quickly). This translates into RM3,250 per hectare. However, in 2013, Priceworth acquired 20,000 hectares of forest concession (FMU 16) for consideration of RM25 mil. This translates into RM1,250 per hectare.

I asked Deep Throat why there is such huge discrepancy. Is Priceworth overpaying for FMU 5 ? Deep Throat explained that FMU 16 does not have much timber left. It only has salvageable value. FMU 5 on the other hand, is still full of timber as it has hardly been logged since 1997. As per announcement, the valuation is closed to RM500 mil (which they are getting at a discount at RM260 mil).

This also explained why the group still cannot turn around after acquiring FMU 16 in 2013. There is simply not much timber there. FMU 5 will be a different story, it will provide a steady supply of logs for Priceworth over many years to come.

7. A Volume Game

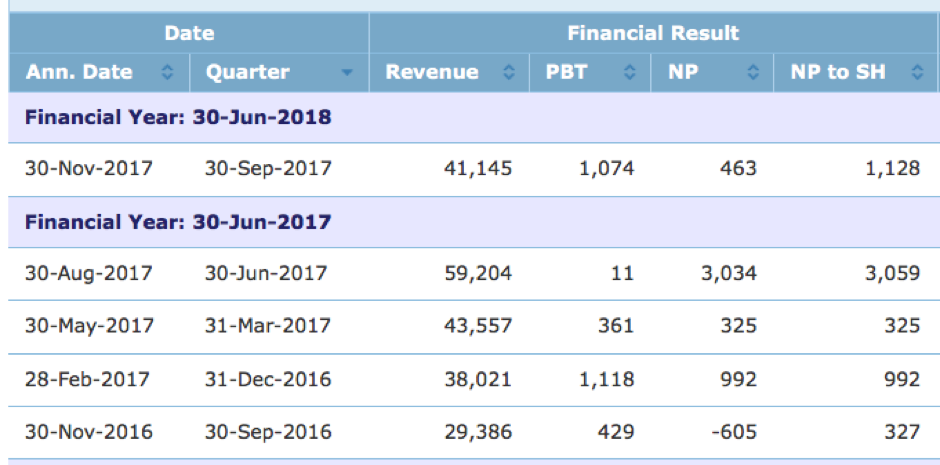

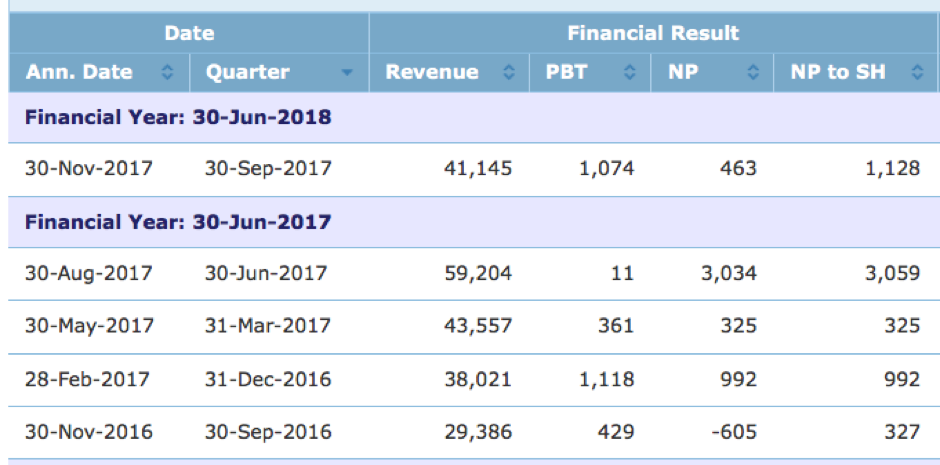

Deep Throat explained that what Priceworth needs most is not so much good price for its wood products, it needs volume. In FY2017, Priceworth only broke even. However, if you take a closer look, you will notice the huge Depreciation charges of RM25 mil. This means that the group has huge fixed cost. Due to lack of supply of logs, its plywood factory is now operating at low capacity (40% ? if I remember correctly). The acquisition of FMU 5 will address this structural issue. As volume comes in, profitability can be scaled up dramatically.

8. Operating Cost

One of the readers commented in Part 1 that profitability could be affected by hike in diesel and labour cost. According to him, diesel constitutes 30% of logging cost. Deep Throat commented that there might be some truth to that figure. However, Priceworth is not solely reliant on sale of logs. It also has a huge plywood operation. From entire group's perspective, diesel only constitutes 10% of operating cost. As such, recent rise in oil price will not have huge adverse impact on profitability.

As for labour cost, Priceworth has always faced this issue before. There might be some adverse impact, but not disastrous.

9. No Sarawak Style Black Swan Event

In July 2017, Sarawak State Government announced huge increase in timber logging premium (from 80 sen to RM50 per cu m). This shock therapy caused many timber stocks price to tumble. I asked Deep Throat whether we should worry about something similar happening to Sabah.

Deep Throat asked me to relax. He said that unlike Sarawak which kept rate unchanged for 30 years, Sabah has been increasing the rate gradually over the years. As such, there is no need for Sabah to undertake such drastic measure in the future.

(Note : I am not able to verify what Deep Throat said above. I don't have any figures to cross check. If you are familiar with Sabah timber industry and have the relevant info, please kindly share it with us).

10. Earning Forecast

Net profit unlikely to be RM100 mil in FY2018 as publicised by one of the company's director in May 2017. However, it is possible for FY2019.

Q4 of FY2018 (April to June 2018) should see full potential being unlocked.

11. Concluding Remarks

I initiated coverage on Priceworth on 30 December 2017. It was then trading at 25 sen. It is now trading at more than 30 sen. I don't recommend chasing the stock now. HOLD

Last week, I spoke to somebody ("Deep Throat") who is familiar with Priceworth. He generously answered all of the questions I posed to him. Some of the information I will disclose in this article while some I prefer to keep it confidential as those information has yet to be announced officially. I want to make sure Deep Throat does not get into trouble, even though he has never told me what to write, what not to write.

Please refer to details below.

2. Completion of Acquisition of Forest Concession

Deep Throat concurred with my analysis in earlier article that the ONLY condition for the proposed acquisition yet to be fulfilled is Shareholders' Approval. They are in the process of finalising the circular and will be calling for EGM soon. Target to implement the rights issue by March 2018.

The rights issue is confirmed to be two call rights with first call at 5 sen while the second call of 5 sen to be capitalised from retained profit, share premium, etc.

Post rights issue, the number of shares outstanding is estimated to be 3.6 billion.

3. Timber Extraction Volume

As mentioned in my previous article, in the month of November 2017, the group extracted 18,000 cubic meter from the concession (Compartment 57 and 58). The extraction volume (from the entire concession) will gradually go up until it reaches approximately 50,000 cubic meter per month (and stabilise there). This is targeted to be achieved within next 6 to 12 months.

4. Timber Market Condition

The timber market is relatively healthy. Demand is stable (not really growing in a big way), but supply is hard to come by. As such, timber price is stable and on steady upward trend. This is expected to continue over the long term.

5. The Concession

After I published Part 1, certain reader commented that the deal sounds fishy. He was of the opinion that if the concession is indeed so good, why would the owner wants to sell it ? There must be a trap.

I sought clarification with Deep Throat. Deep Throat explained that the concession was originally held by few Chambers of Commerce. They couldn't work together, so they sold it to the existing owners (West Malaysians) in 1997. The West Malaysians are not familiar with the industry, so they hired a contractor to do the extraction and replanting for them. The contractor also did not perform well (they were originally from palm oil industry). Until now, they have only logged a few thousand hectares.

This of course is met with dissatisfaction from the Sabah Forestry Department. If the concession is not logged properly, the State will not get tax revenue. Replanting also cannot be implemented effectively. As a result, the owners have to do something about it. Under this kind of circumstances, disposal to Priceworth is apparently a good option.

6. Timber Volume Determines Value of Concession

As mentioned in Part 1, Priceworth is acquiring the 80,000 hectares forest concession (FMU 5) for RM260 mil (discount of RM30 mil if payment is settled quickly). This translates into RM3,250 per hectare. However, in 2013, Priceworth acquired 20,000 hectares of forest concession (FMU 16) for consideration of RM25 mil. This translates into RM1,250 per hectare.

I asked Deep Throat why there is such huge discrepancy. Is Priceworth overpaying for FMU 5 ? Deep Throat explained that FMU 16 does not have much timber left. It only has salvageable value. FMU 5 on the other hand, is still full of timber as it has hardly been logged since 1997. As per announcement, the valuation is closed to RM500 mil (which they are getting at a discount at RM260 mil).

This also explained why the group still cannot turn around after acquiring FMU 16 in 2013. There is simply not much timber there. FMU 5 will be a different story, it will provide a steady supply of logs for Priceworth over many years to come.

7. A Volume Game

Deep Throat explained that what Priceworth needs most is not so much good price for its wood products, it needs volume. In FY2017, Priceworth only broke even. However, if you take a closer look, you will notice the huge Depreciation charges of RM25 mil. This means that the group has huge fixed cost. Due to lack of supply of logs, its plywood factory is now operating at low capacity (40% ? if I remember correctly). The acquisition of FMU 5 will address this structural issue. As volume comes in, profitability can be scaled up dramatically.

8. Operating Cost

One of the readers commented in Part 1 that profitability could be affected by hike in diesel and labour cost. According to him, diesel constitutes 30% of logging cost. Deep Throat commented that there might be some truth to that figure. However, Priceworth is not solely reliant on sale of logs. It also has a huge plywood operation. From entire group's perspective, diesel only constitutes 10% of operating cost. As such, recent rise in oil price will not have huge adverse impact on profitability.

As for labour cost, Priceworth has always faced this issue before. There might be some adverse impact, but not disastrous.

9. No Sarawak Style Black Swan Event

In July 2017, Sarawak State Government announced huge increase in timber logging premium (from 80 sen to RM50 per cu m). This shock therapy caused many timber stocks price to tumble. I asked Deep Throat whether we should worry about something similar happening to Sabah.

Deep Throat asked me to relax. He said that unlike Sarawak which kept rate unchanged for 30 years, Sabah has been increasing the rate gradually over the years. As such, there is no need for Sabah to undertake such drastic measure in the future.

(Note : I am not able to verify what Deep Throat said above. I don't have any figures to cross check. If you are familiar with Sabah timber industry and have the relevant info, please kindly share it with us).

10. Earning Forecast

Net profit unlikely to be RM100 mil in FY2018 as publicised by one of the company's director in May 2017. However, it is possible for FY2019.

Q4 of FY2018 (April to June 2018) should see full potential being unlocked.

11. Concluding Remarks

I initiated coverage on Priceworth on 30 December 2017. It was then trading at 25 sen. It is now trading at more than 30 sen. I don't recommend chasing the stock now. HOLD

No comments:

Post a Comment